Questions are related to investment calculation.

i would like a full calculation with brief explantion. The bottom part is a excel example for reference.

thanks.

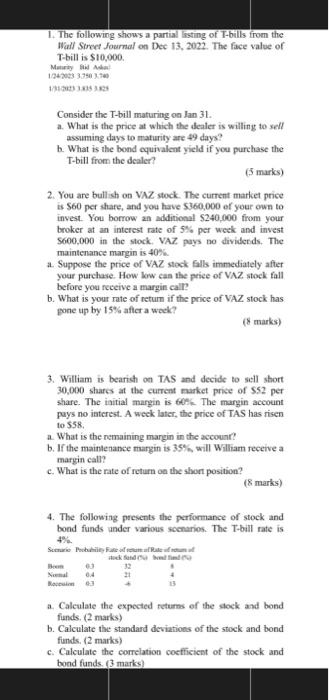

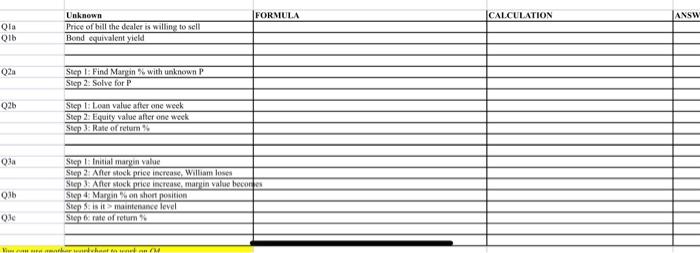

1. The following shows a partial listing of T-bills from the Wail Sireet fournal on Dec 13, 2022. The face value of T-bill is $10,000. Matiriy hiel Adman 1/24704339401740 13ats 3834329 Consider the T-bill maturing on Jan 31. a. What is the price at which the alealer is willing to sell assuming days to maturity are 49 days? b. What is the bond equivalent yield if you purchase the T-bill from the dealer? ( ( marks) 2. You are bullish on VAZ stock. The current market price is $60 per share, and you have $360,000 of your own to invest. You borrow an additional $240,000 from your broker at an interest rate of 5% per week and invest 5600,000 in the stock. VAZ, pays no dividends. The maintenance margin is 40F. a. Suppose the price of VAZ stock falls immediately after your purchase. How kow caa the price of VAZ stock fall before you feceive a margin call? b. What is your rate of return if the price of VAZ stock has gone up by 15% after a wock? 3. William is bearish on TAS and decide to sctl stort 30,000 shares at the current market price of $52 per share. The iaitial margin is tote the margin account pays no isterest. A week later, the price of TAS has risen to 558 , a. What is the nemaining margin in the account? b. If the maintenance margin is 35%, will William receive a maryin call? c. What is the rate of return on the shon position? ( 8 marks) 4. The following presents the performance of stock and bond funds under various scenarios. The T-bill rate is 47 a. Calculate the expected rcturns of the slock and bond funds. (2 marks) b. Calculate the standard deviations of the stock and bond funds. (2 marks) c. Calculate the correlation coefficicnt of the stock and bond funds. ( 3 marks) 1. The following shows a partial listing of T-bills from the Wail Sireet fournal on Dec 13, 2022. The face value of T-bill is $10,000. Matiriy hiel Adman 1/24704339401740 13ats 3834329 Consider the T-bill maturing on Jan 31. a. What is the price at which the alealer is willing to sell assuming days to maturity are 49 days? b. What is the bond equivalent yield if you purchase the T-bill from the dealer? ( ( marks) 2. You are bullish on VAZ stock. The current market price is $60 per share, and you have $360,000 of your own to invest. You borrow an additional $240,000 from your broker at an interest rate of 5% per week and invest 5600,000 in the stock. VAZ, pays no dividends. The maintenance margin is 40F. a. Suppose the price of VAZ stock falls immediately after your purchase. How kow caa the price of VAZ stock fall before you feceive a margin call? b. What is your rate of return if the price of VAZ stock has gone up by 15% after a wock? 3. William is bearish on TAS and decide to sctl stort 30,000 shares at the current market price of $52 per share. The iaitial margin is tote the margin account pays no isterest. A week later, the price of TAS has risen to 558 , a. What is the nemaining margin in the account? b. If the maintenance margin is 35%, will William receive a maryin call? c. What is the rate of return on the shon position? ( 8 marks) 4. The following presents the performance of stock and bond funds under various scenarios. The T-bill rate is 47 a. Calculate the expected rcturns of the slock and bond funds. (2 marks) b. Calculate the standard deviations of the stock and bond funds. (2 marks) c. Calculate the correlation coefficicnt of the stock and bond funds. ( 3 marks)