Questions

Calculate the following

Sales budget

purchase budget

Cost of goods Sold

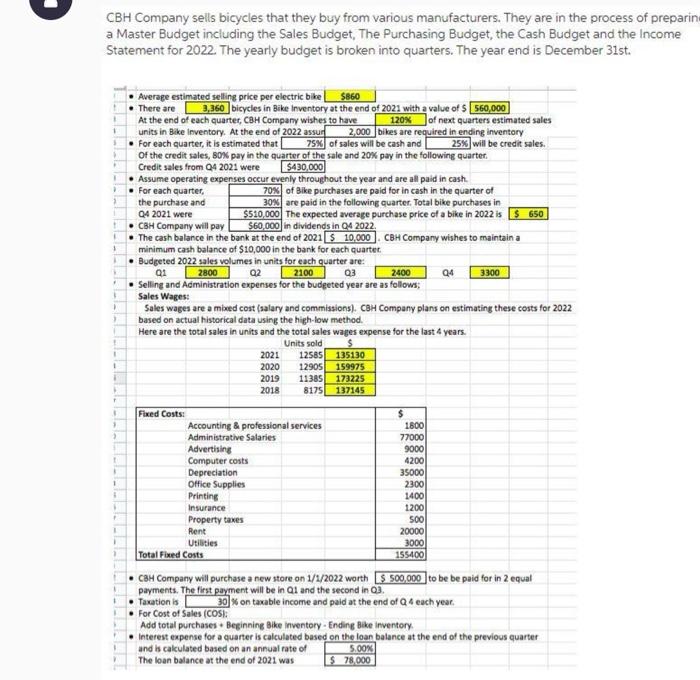

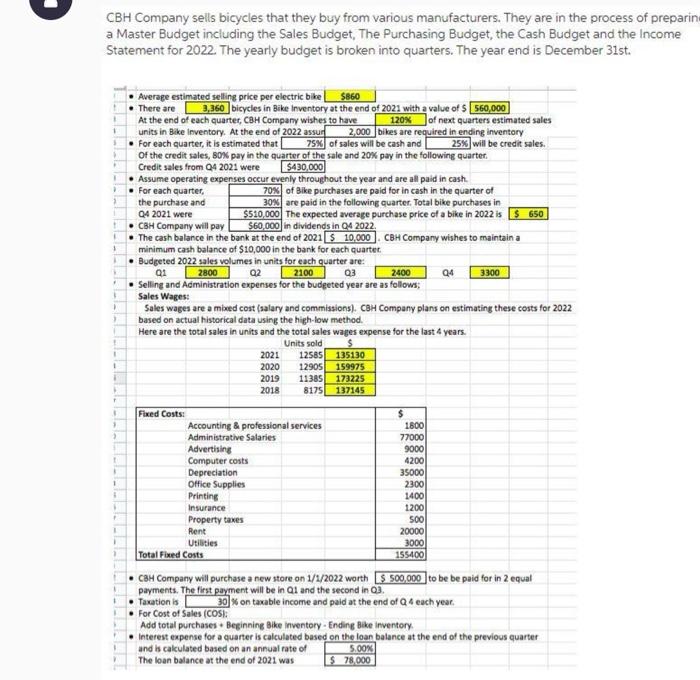

CBH Company sells bicycles that they buy from various manufacturers. They are in the process of preparin a Master Budget including the Sales Budget, The Purchasing Budget, the Cash Budget and the Income Statement for 2022. The yearly budget is broken into quarters. The year end is December 31st. - Average estimated selling price per electric bike - There are bicycles in Bike inventory at the end of 2021 with a value of $ At the end of each quarter, CaH Company wishes to have_ of next quarters estimated sales units in Bike inventory. At the end of 2022 assul |bikes are reouired in ending inventory - For each quarter, it is estimated that of sales will be cash and will be credit sales. Of the credit sales, 80% pay in the quarter of the sale and 20% pay in the following quarter: Credit sales from Q4 2021 were - Assume operating expenses occur evenly throughout the year and are all paid in cash. - For each quarter, the purchase and Q4 2021 were - CBH Company will pay of Bike purchases are paid for in cash in the quarter of are paid in the following quarter. Total bike purchases in The expected average purchase price of a bike in 2022 is in dividends in 042022. - The cash balance in the bank at the end of 2021 CBH Company wishes to maintain a minimum cash balance of $10,000 in the bank for each quartet. - Budgeted 2022 sales volumes in units for each quarter are: Q1 Q2 Q3 Q4 - Selling and Administration expenses for the budpeted year are as follows; Sales Wages: Sales wages are a mixed cost (salary and commissions). CBH Company plans on estimating these costs for 2022 based on actual historical data using the high-low method. Here are the total sales in units and the total sales wages expense for the last 4 vears. \begin{tabular}{|c|c|c|} \hline & Units sold & 5 \\ \hline 2021 & 12585 & 135130 \\ \hline 2020 & 12905 & 159975 \\ \hline 2019 & 11385 & 173225 \\ \hline 2018 & 8175 & 137145 \\ \hline \end{tabular} - CaH Company will purchase a new store on 1/1/2022 worth $00,000 to be be paid for in 2 equal payments. The first pavment will be in Q1 and the second in Q3. - Taxation is \% on taxable income and paid at the end of Q 4 each year. - For Cost of Sales (COS): Add total purchases + Beginning Bike inventory - Endirng Bike inventory. - Interest expense for a quarter is calculated based on the loan balance at the end of the previous quarter and is calculated based on an annual rate of The loan balance at the end of 2021 was 5 78,000 J