Question

QUESTIONS: CASE BARRICK GOLD INTEGRATING ESG INTO THE (POST-MERGER) EXECUTIVE PERFORMANCE SCORECARDPlease, give recommendations to the balance scorecard. The proposed metrics for a revised executive

QUESTIONS: CASE BARRICK GOLD INTEGRATING ESG INTO THE (POST-MERGER) EXECUTIVE PERFORMANCE SCORECARDPlease, give recommendations to the balance scorecard.

- The proposed metrics for a revised executive scorecard would need to reflect Barrick Gold's post-merger strategic vision. Should the proposal emphasize the short-term or long-term incentive plan?

- Further to this, which metrics and weightings should be changed?

- Were the financial measures still appropriate, given the changes to Barrick's financial strategy?

- Were the non-financial measures adequately reflecting Barrick's sustainability goals and its vision for leaving a legacy in the communities in which it operated?

- Was Barrick doing enough to satisfy regulators and institutional investors?

- Numerous guidelines and standards had been released in recent years, which of these guidelines and standards should be incorporated into the scorecard, if any?

INFORMATION

Barrick gold

Maria Nunes had 24 hours before her final-round interview with Toronto's leading human resources consulting firm. For her interview, Nunes had been tasked with creating a new executive scorecard for Barrick Gold Corporation (Barrick). Both Barrick and the mining industry more broadly had been marked by momentous change in 2019. On January 2, 2019, Barrick and Randgold Resources (Randgold) had merged to become the largest gold mining company in the world. Following this merger, Barrick's new executive team had communicated a financial strategy that emphasized a long-term view, with a higher priority on sustainability. The newly merged companies had appointed an Environmental & Social Oversight Committee2 and a group-level sustainability executive to support the delivery of its environmental and social goals. While both companies had previously included environmental, social, and governance metrics in executive incentive plans, different approaches had been taken. Streamlining these approaches, as well as incorporating the central tenets of Barrick's financial strategy, was essential to designing the new executive scorecard for fiscal 2020. Drawing on media articles, investor and regulatory reports, and data on Barrick's history, strategy, and financials, Nunes got to work.

MINING INDUSTRY

The mining and minerals processing industries were critical to the Canadian economy. According to the Mining Association of Canada (MAC), the minerals sector directly and indirectly contributed CA$97 million3 (or 5 per cent) to Canada's total nominal gross domestic product (GDP). The industry directly employed 426,000 people and indirectly employed an additional 208,000 people across Canada. These figures included over 16,500 Indigenous people, making the mining industry the largest private-sector employer of Indigenous people in Canada.

Toronto was considered the mining finance capital of the world: the Toronto Stock Exchange (TSX) and the TSX Venture Exchange (TSXV) listed more mining companies than any other exchange and were home to almost 50 per cent of the world's public mining companies.5 Canada was also seen to be a mining leader at a global level. However, the MAC believed that the country had lost more ground in recent years than it had gained due to the steady outflow of innovation dollars to countries such as Australia, Germany and South Africa.

At the same time, "the global transition to a lower-carbon future represented a significant growth opportunity for Canada's mining sector. Minerals and metals were the building blocks of lower-carbon technologies, and a 2017 World Bank Group report concluded that the increased use of wind, solar, and energy storage technologies would heighten the demand for many mining products."

The mining industry also faced environmental, political, and social risks. Although Ontario was seen to be one of the safest mining jurisdictions in the world, Canadian mining companies operated globally?often in countries where the political and environmental risks had sizable financial and social implications. For example, Barrick's Pascua-Lama project had been fined $16 million by the Chilean government in May 2013?and its appeal of the fine rejected by the Supreme Court of Chile in 2015?and its operations had been halted by the government in October 2013.8 Protesters from the Indigenous community living in surrounding areas had called for Barrick's license to be revoked due to a risk of glacial water contamination.9 While the government did not revoke the company's license to operate, it did require Barrick to honour its environmental commitments and work to protect the water systems. Also in 2013, week-long protests across Romania resulted in the local government's rejection of plans by the Canadian mining firm Gabriel Resources Ltd. to create Europe's largest open-pit gold mine in the small town of Ros?ia Montana?.10 These incidents were part of a growing trend that saw local community demands intensifying and the relationships between governments and mining companies marked by rising hostility and zero- tolerance regulatory environments.11 Alongside the social risks were the economic risks of volatility in gold prices year over year.

GOLD PRICES

Although most of the gold mined or recycled was used to manufacture jewellery, gold was also used in manufacturing many everyday products, especially electronics. Gold was a highly efficient conductor of electricity and resistant to corrosion; consequently, it was used in connectors, switch and relay contacts, soldered joints, connecting wires, and connection strips and thus could be found in items such as televisions, cell phones, calculators, global positioning system (GPS) devices, laptops, and desktop computers. Gold was widely used in other areas as well, including the dental, medical, aerospace, and glass-making industries.

Gold prices were affected by a plethora of factors. Because fiscal and monetary policies and the commodity and stock markets were interrelated, shifts in interest rates, the US dollar, and stock markets all affected the price of gold. Also, investors and central banks stockpiled gold in periods of economic disruption and uncertainty because gold was highly liquid and redeemable.12 As Federal Reserve Chair Ben Bernanke noted, "The reason people hold gold is as a protection against what we call tail risk, really, really bad outcomes."The global financial crisis and the ensuing great recession was considered to be one such "really, really bad outcome."

From 2008 to 2012, the value of gold increased dramatically. While it initially rose modestly (2.6 per cent in 2008 and 12.8 per cent in 2009), as uncertainty regarding the US economic recovery persisted, gold prices jumped 50.6 per cent from September 2010 to September 2011. By 2012, the price increase had slowed once more and by 2013, came tumbling down to decade lows. From a peak of US$1,900 in 2011, gold fell to around US$1,200 in 2013.14 This downturn continued throughout 2014, as geopolitical tensions played a role in price fluctuations. Russia's annexation of Crimea and rising tensions in the region, for example, contributed to a rise in gold prices in early 2014 as investors anticipated US sanctions against Russia and consequent stock market volatility. The increase, however, was short-lived. Macro trends? including rising interest rates, a stronger US dollar relative to other major currencies, and positive stockmarket returns?resulted in gold being dumped in favour of stocks and interest-bearing bonds. Ultimately, gold closed at US$1,199 in 2014.

Because of the continuing increased strength of the US dollar and a widely held belief that interest rates would increase, making other investments more attractive, gold prices hit new lows, closing at US$1,060 by the end of 2015.17 In 2016, uncertainty in the financial markets resulted in the price of gold increasing to US$1,150 in 2016.18 Geopolitical tensions focused on North Korea and uncertainty surrounding Brexit influenced a modest increase in prices to US$1,392 by the end of 2017.19 In 2018, gold prices fluctuated around this price point and closed at US$1,282 in December. After a six-year slump, gold prices began to rise in 2019, mainly due to the US Federal Reserve's planned interest-rate cut

HISTORICAL OVERVIEW

Barrick Gold Corporation was founded as Barrick Resources Corporation in 1980 by Peter Munk, an immigrant to Canada who became one of the nation's most successful entrepreneurs and philanthropists. Munk established both the Peter Munk Cardiac Centre at Toronto General Hospital and the Munk School of Global Affairs at the University of Toronto; and founded the Munk Debates. He also earned numerous awards and honours, including becoming a Companion of the Order of Canada?the nation's highest civilian honour.The company initially focused on oil and gas exploration, but repeated financial losses during its early years prompted Munk to pivot to mining precious metals, in particular, gold. By 1983, Barrick's mission was to "dominate the gold industry by becoming North America's largest producer, acquire established properties with sound futures, be fiscally conservative, and protect the bottom line through an aggressive hedging program."

The company's decision to expand its operations through acquisitions proved successful, while its hedging program ensured financial stability. By using complex financial contracts to arrange future sales at fixed prices, Barrick was protected if prices went down and was able to sell additional reserves on the open market if prices went up. Nonetheless, even the best of strategies had little chance of weathering a market crash. Thus, when gold prices crashed in 1997, Barrick was forced to close four mines, and the company suffered a $6.8 billion fall in market value. Almost immediately, the company started navigating its recovery, delivering a record $300 million in earnings for fiscal year (FY) 1998.23

Barrick entered the 21st century as an industry leader, with Munk championing growth. On December 21, 2001, Barrick grew to be the second-largest producer in the world after it merged with Homestake.24 Barrick's executive team also announced a shift in its mission, aiming to be the most profitable rather than the largest producer. This changed emphasis was believed to drive greater value for the company's shareholders.

On March 16, 2006, Barrick completed the acquisition of Placer Dome Inc. (Placer Dome) for $12.1 billion, a deal with expected synergies of $200 million a year26 that earned Barrick the rank of largest gold company in the world.27 In the years following the Placer Dome acquisition, Barrick suffered several setbacks. In 2011, seeking new strategies to improve company performance, Barrick acquired copper producer Equinox Minerals Limited (Equinox) for US$7.3 billion in order to diversify into copper.28 Some investors and market pundits felt this move failed to align with Barrick's strategy. This belief was validated in 2013, when Barrick wrote down US$4.2 billion, suggesting that the company had significantly overpaid for Equinox.29 The year was also marred by the largest gold price crash since the late 1990s.30 The crash in turn precipitated a decline in Barrick's share price to its lowest level since 1993.

In 2013, Barrick made strides to slash overall costs, reducing its per-ounce cost by $100. Around 75 per cent of total production was planned to be mined at under $800, a lean expenditure considering the industry average was at $1,200 to $1,300 per ounce. Barrick then sold several of its non-core mines to shift its focus to five key mines in the Americas. These five mines were expected to generate 60 per cent of output at a cost of under $700 per ounce.

As noted earlier, the Chilean government had tasked Barrick with completing its environmental commitments for the Pascua-Lama project. Even with challenging market conditions and materially lower metal prices, Barrick planned to reduce capital expenditures for the Pascua-Lama project in Chile and Argentina by $1.5 billion to US$1.8 billion by 2014. The company also planned to drop its debt by US$3.5 billion, to around US$7.0 billion. In order to achieve this, Barrick launched a US$3.0 billion public equity offering in October 2013, with the intention of using US$2.6 billion in net proceeds to redeem or repurchase outstanding debt.

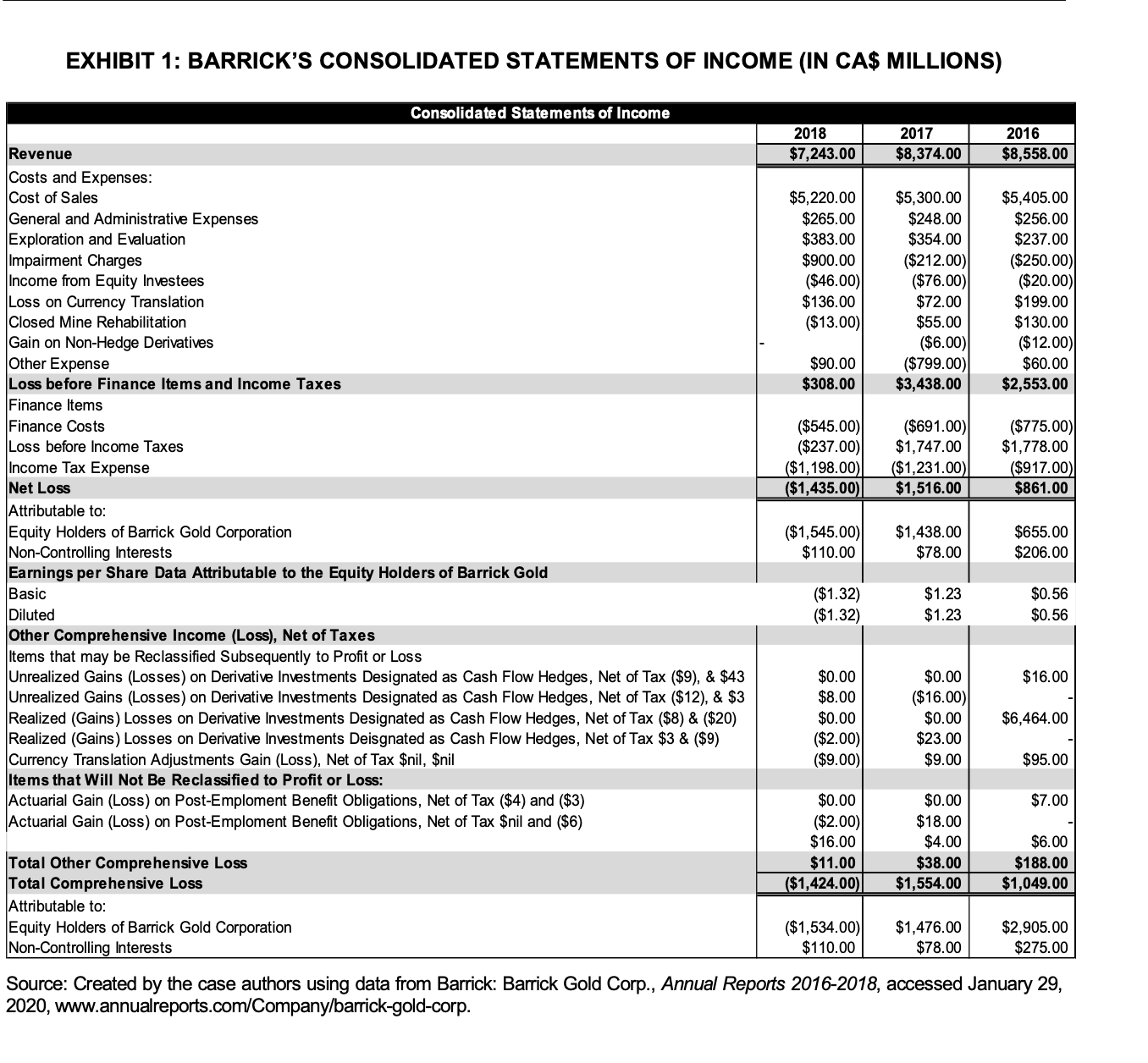

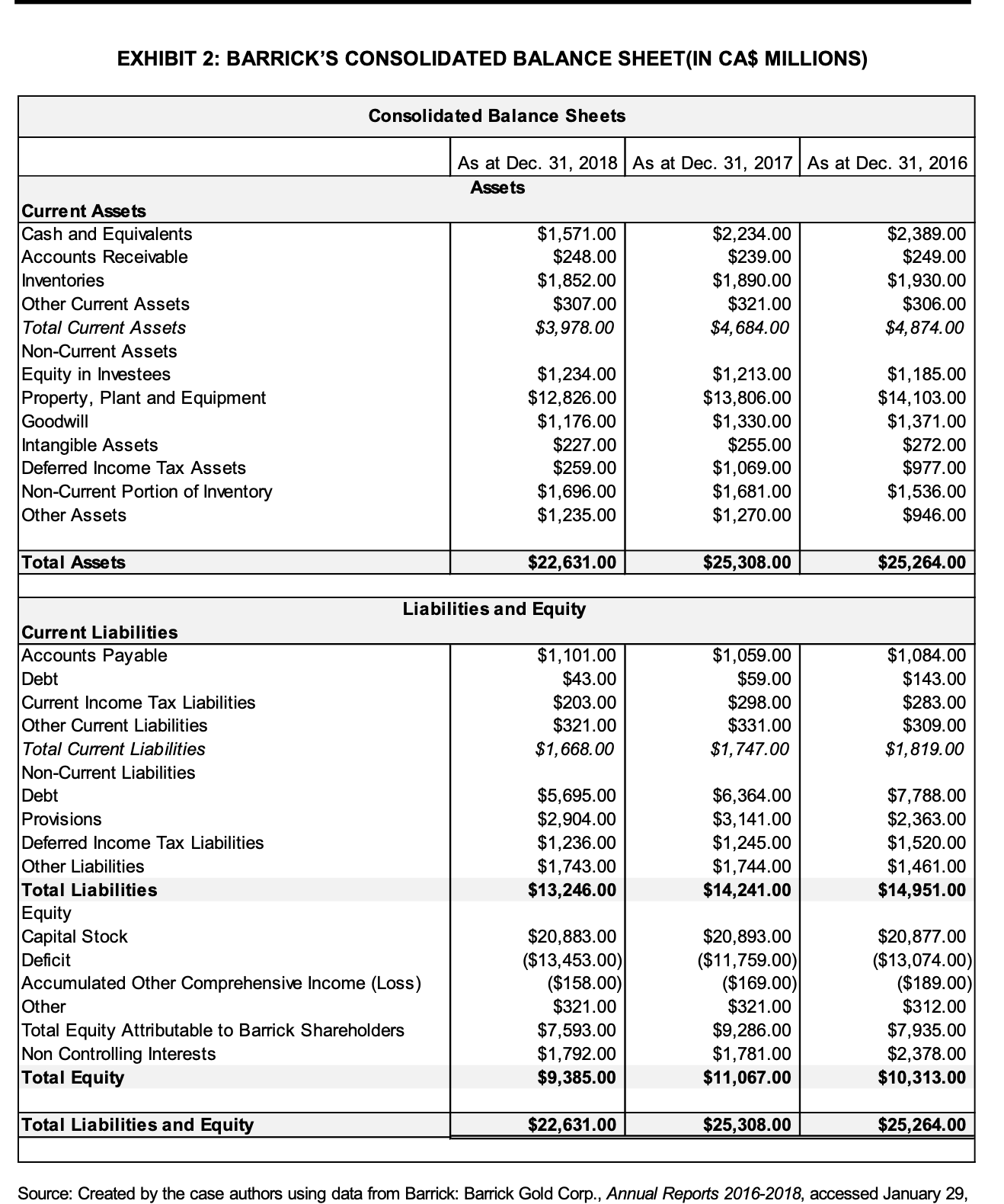

The significant cuts in spending and reductions in debt did not take effect in the short term, and the company reported a significant net loss (around US$2.8 billion), which was largely driven by a US$778 million impairment on Cerro Casale and a US$930 million writedown on the Lumwana mine and other assets.34 By the end of 2015, Barrick had recovered considerably, recording positive free cash flow for the first time in four years. This cash influx further enabled Barrick to reduce its overall debt burden by 24 per cent.35 Overall company performance continued to improve in 2016 due to effective cost control and improved operational efficiency and productivity.36 By 2017, Barrick was able to increase dividends by 50 per cent to $0.03 per share and also established a strategic partnership in the Veladero mine in Argentina with Shandong Gold Group, despite the suspended operation that year. Barrick paid down 19 per cent of its debt and focused its portfolio on "high margin, long life gold operations"37 (see Exhibits 1 and 2).

In September 2018, Barrick announced plans to merge with Randgold in a US$18.3 billion deal. The stock market responded positively to the news,38 and in November 2018, shareholders voted overwhelmingly in favour of the merger. By December 2018, Randgold had stopped trading on the London Stock Exchange and the NASDAQ, in preparation for a new Barrick listing on the TSX and New York Stock Exchange in January 2019.39

Completing its nil-premium merger with Randgold on January 1, 2019, Barrick opened for trading on January 2 with a market capitalization in excess of $23.75 billion and the largest reserve base among its gold peers. Barrick now owned five of the industry's top 10 tier-one gold assets.40 In a joint letter to stakeholders, Executive Chairman John Thornton, and President and Chief Executive Officer (CEO) Mark Bristow (formerly CEO of Randgold), stated:

With the best asset base and the strongest management team in the sector, we are well placed to be the world's most valued gold mining business. We will do so by optimising our existing operations, pursuing new opportunities that meet strict investment criteria and developing them with disciplined efficiency. In all that we do we will be guided by a long-term strategy and clear implementation plans designed to deliver sustainable returns to our owners and real benefits to our partners, host countries, and communities.

BARRICK'S LEADERSHIP

Barrick was known for its lean management structure and highly entrepreneurial culture. Munk had created an ownership culture with Barrick's early leaders, enabling them to share in and take accountability for thecompany's successes and failures. Their ownership stake was such that their personal wealth was tied to the company's success.

Aaron Regent, who served as CEO from January 2009 to June 2012, marked the beginning of his term by ending the hedging program, leading to a $6 billion write-off. To control operating costs, he cut 80 executive jobs and separated Barrick's African assets into a separate company, publicly traded on the London Stock Exchange.43 Regent also acquired Equinox, an ill-fated move, which Munk later regretted. These major changes did not slow the decline in share price, despite a jump in gold prices.44 In a move that caught investors by surprise, Regent was replaced in June 2012 by the company's long-time chief financial officer (CFO), Jamie Sokalsky. During the next two years, Sokalsky sold almost $1 billion worth of money-losing and non-core assets, shrinking Barrick from 27 to 19 mines globally. He was well regarded by investors for his role in steering the company through two of the most tumultuous years in its history. 45

In 2012, Munk recruited former-Golman Sachs President John Thornton to join Barrick as co-chairman, offering a $11.9 million signing bonus in addition to $9.5 million in salary. The signing bonus proved controversial due to its magnitude, yet Munk strongly defended the offer, stating, "we had to secure him" and " secure the kind of access he could give us and the credibility he could provide us with in securing major capital."46 Thornton, who had degrees in management, jurisprudence, and history from Yale and Oxford universities and Harvard College, respectively, and had developed the mergers and acquisitions business at Goldman Sachs International, was a professor at Beijing's Tsinghua University?a role that gave him access to Tsinghua University graduates, including President Xi Jinping.

Thornton co-chaired the board with Munk for two years. Upon Munk's retirement in 2014, Thornton became the sole chairman significantly overhauling the senior executive team and discontinuing the CEO role when Sokalsky stepped down in 2014. In Sokalsky's place, James Gowans and Kelvin Dushnisky were appointed as co-presidents. Gowans had previously served as the company's chief operating officer, while Dushnisky had been head of corporate and government affairs.49 In August 2015, Gowans retired, and Dushinsky was appointed President. He held this role until 2018 when he retired. In anticipation of the merger, the company did not appoint a new president.

Following the merger, Barrick's executive committee comprised the following roles: executive chairman (John Thornton); chief executive officer (Mark Bristow); senior executive vice-president-chief financial officer;50 senior executive vice-president?Strategic Matters; chief orating officer?North America; chief operating officer?Latin America and Asia Pacific; and chief operating officer?Africa and Middle East. The three latter roles reflected the company's decision to establish regional executive teams in each of its three geographical zones: North America; Latin America and Australia Pacific; and Africa and the Middle East.

the committee was governed by Barrick's board which had been reconstituted with nine directors, six of whom were appointed by Barrick and three by Randgold. Ensuring that the executive committee's attention was focused on the company's strategic goals relied on Barrick's executive compensation systems and structures.

SAY ON PAY

Shareholders had the right to vote either for or against a company's proposed executive compensation package at the annual general meeting. This "say on pay" was one of many corporate governance remedies afforded to shareholders. Although "say-on-pay" votes were non-binding in Canada, the votes were seen as important signals of the health of a company' governance system as well as the alignment between pay and performance. Executive compensation packages typically comprised base salary, short-term incentives,and long-term incentives. Shareholders were often most concerned with long-term performance-based pay as the magnitude of these payouts was significant.

In 2013, however, John Thornton's signing bonus triggered condemnation from the Canada Pension Plan, six other pension plans, and Barrick's other large institutional investors.53 At the time of Thornton's signing, Barrick's stock price was at a 20-year low.54

Capturing the shareholder discontent, 85 per cent of Barrick's shareholders voted against the company's proposed compensation plans at the April 24, 2013 annual general meeting. This "no" vote was only the second time that a TSX-traded company had received a majority vote against its proposed executive compensation plan. In its wake, Barrick engaged with shareholders representing 30 per cent of the company's outstanding common shares.55 The engagement process shaped the redesign of Barrick's executive incentive system. In a March 31, 2014 company statement, the chair of the compensation committee stated:

We believe our new system features the most shareholder-friendly, long-term compensation program of any Canadian company today, as well as among our peers in the global mining industry. . . . Put simply, our management team will now be owners, receiving a significant portion of the compensation they earn in the form of common shares that cannot be sold, fully aligning the long- term interests of executives and shareholders.56

The statement went on to describe the compensation plans in greater detail:

As part of Barrick's new compensation approach, participating executives will be assessed on their collective performance, as measured against a transparent scorecard disclosed to shareholders in advance. The company's long-term scorecard will assess participating executives on eight performance measures...Scores will be published to shareholders at the end of each year, ensuring transparency of the process. A majority of compensation awarded will be long-term in nature, in units that ultimately convert into Barrick common shares. These shares cannot be sold until a participating executive retires or leaves the company. Shares will be purchased on behalf of participating executives on the open market, resulting in no dilution to shareholders.

If earned, a smaller portion of total compensation will be awarded in the form of an annual bonus. Annual bonuses will be determined by the compensation committee based on its assessment of each executive's individual performance in achieving short-term operating priorities and specific initiatives that fall within the executive's sphere of accountability.

The company has also adopted new minimum share ownership requirements that are among the highest of any Canadian public company, including 10 times base salary for the chief executive officer.

Additionally, Barrick has implemented a new Clawback Policy for incentive compensation that goes beyond the yet-to-be implemented requirements of the US Dodd-Frank Act.57

In 2014, the named partners or participating executives, included the president, the senior executive vice- president?Strategic Matters, executive vice-president-chief financial officer, and the investment officer. The eight performance measures included five financial and three non-financial measures:

? return on invested capital (20%)

- ?dividends to shareholders (10%)

- ?free cash flow (10%)

- ?strong capital structure (10%)

- ?capital project performance (10%)

- ?strategic execution (15%)

- ?reputation and license to operate (15%)

- ?people development (10%)

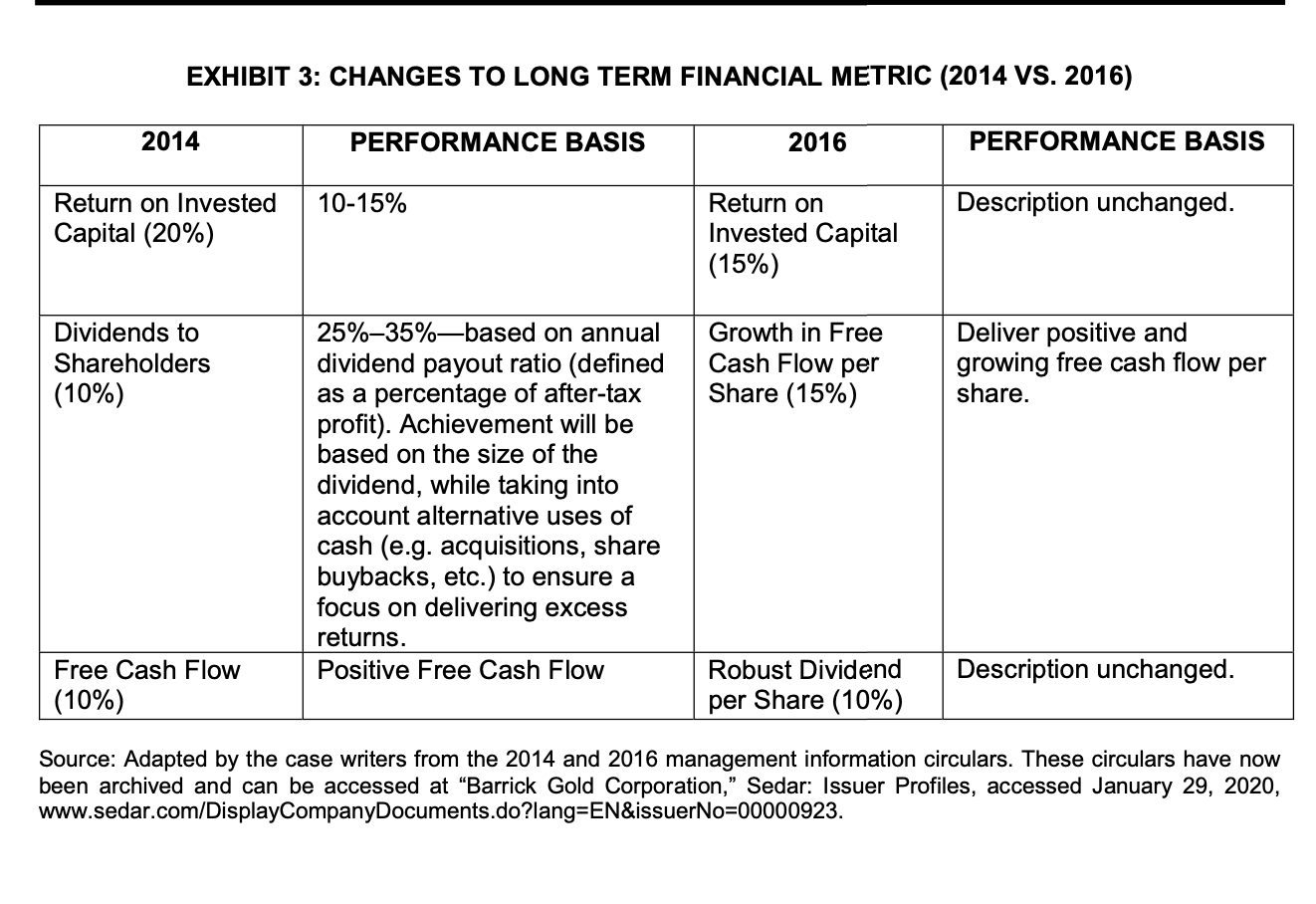

The proposed compensation plan was approved by 80 per cent of shareholders at the 2014 annual general meeting.59 Despite the positive reception to Barrick's compensation plans in 2014, the tide swiftly changed in reaction to the company announcing a 35 per cent increase in Thornton's salary in 2015. To shareholders, the $13 million salary was in stark contrast to Barrick's share price which had lost a third of its value during fiscal 2014,60 in addition to suffering annual declines in four consecutive years on the TSX.61 The Canada Pension Plan Investment Board (CPPIB) was notably outspoken, stating, "We continue to be concerned with the company's practice of granting outsized awards on a largely discretionary basis, which we believe is inconsistent with the governance principle of pay-for-performance." Although CPPIB owned a small percentage of Barrick stock, the comment drew considerable market attention. Unsurprisingly, at Barrick's April 27, 2015 annual general meeting, 75 per cent of shareholders voted against the proposed compensation plan.

- In a move to placate shareholders, Thornton forfeited his year-end bonus, reducing his pay package by 76 per cent to $3.1 million. The company again engaged its shareholders, and updated three of its financial measures and weightings (see Exhibit 3). These proposed compensation changes were approved by 90.9 per cent of shareholder votes.63

- In November 2016, Barrick also launched its Global Employee Share Plan which granted over 10,000 employees 25 Barrick common shares, which were to be held for the duration of their employment.64 Thornton's philosophy on compensation and ownership were captured in the company's official statement announcing the plan:

- ...this Company's authentic, original DNA was created by Peter Munk, and a small number of his friends and colleagues. They were all owners. They all trusted each other completely, and they built a partnership culture that was ahead of its time. That is who Barrick is?and we believe that in the twenty-first century, being a partnership organization is distinctive, commercially compelling, and likely to lead to greater success.

- By a partnership culture, we mean a trust-based culture, and the currency of trust is transparency. So it is a transparent culture. It is a culture of peers. There is mutual respect among individuals and between Barrick and external parties. Those who are part of Barrick recognize that in general the collective is stronger than the aggregation of individuals, and more importantly they prefer to work in that kind of culture.

- We thought that the best way to replicate that original culture and update it for the twenty-first century was literally to make everyone at Barrick an owner. We want people who are all in. They are all in emotionally, and they are all in financially. In engaging with external parties, particularly with shareholders, we want to say: "Listen, it's not that we're aligned with your interests?we literally have the same interests, because we're all owners here."

Shareholder discontent over executive compensation plans largely fell away in the years which ensued; the compensation plans were approved in 2017 (91.2 per cent),66 2018 (94.25 per cent),67 and 2019 (92.07 per cent).68 Even with this high shareholder approval, the company continued to respond to key concerns raised in shareholder feedback. For example, shareholders had asked for "active, year-round shareholder engagement, with a particular focus on sustainability and governance issues."

In 2017, Barrick released eight key reports for environmental, social, and governance (ESG) analysts and 11 documents pertaining to the company's policies and standards on issues ranging from conflict-free gold to anti-corruption, human rights, and a supplier code of ethics. The magnitude of this reporting reflected the growing demands being made by investors, regulators, and standard setters with respect to ESG accountability and reporting.

In its 2018 Information Circular, the company stated that it held 485 shareholder engagement meetings, the majority of which had occurred during off-proxy season and approximately 106 of which were related to sustainability and governance issues.70 Barrick also hosted its first sustainability briefing for investors, reviewed company shareholder engagement strategy on sustainability and governance issues, and included further disclosure on incentive plan goals and the rationale for each measure selected.

Prior to the merger, Barrick and Randgold had taken different approaches to disclosing their incentive plans. Barrick's short-term incentive program, based on performance against strategic priorities, was called the Annual Performance Incentive (API) scorecard. While Barrick had created a detailed scorecard with specific measures of success (i.e., targets) for its long-term incentive plan, the short-term incentive plan did not provide the same level of detail. In contrast, Randgold created a detailed scorecard for its short-term incentive plan and less specific long-term incentive structures.72

Randgold's short-term executive scorecard, which applied to the CEO and CFO, was broken down into five categories: financial, operational, safety, environment, and strategic. Randgold used a restricted share plan for its long-term incentive program. Under such plans, employees received restricted stock units (RSUs) through a vesting plan and distribution schedule after they had achieved required performance milestones or had been with the employer for a set period.73 In the Randgold plan, 30 per cent of the shares were vested if a threshold was met, and 100 per cent of shares were vested for maximum performance. Long-term incentive payouts were based on three measures: (1) reserve replacement ratio of reserves added compared to reserves mined, (2) total cash cost per ounce, and (3) total shareholder return performance relative to peers. Each measure was assessed over a four-year period.

In light of the merger, choices would have to be made with respect to the measures and weightings assigned to the long-term executive scorecard. The commitment to a partnership culture remained, as well as significant shareholding among the company's senior leadership. By April 2019, both Thornton and Bristow held in excess of 5 million Barrick shares.75 Board Chair Brett Harvey also shed light on the company's strategic and compensation goals:

The goal of our compensation system is to drive the highest possible emotional and financial ownership among the company's senior executives, now and over the long-term, while linking compensation to the company's performance and the experience of our shareholders. A significant portion of our leaders' compensation is in the form of Barrick shares that must be held until they retire or leave the company.

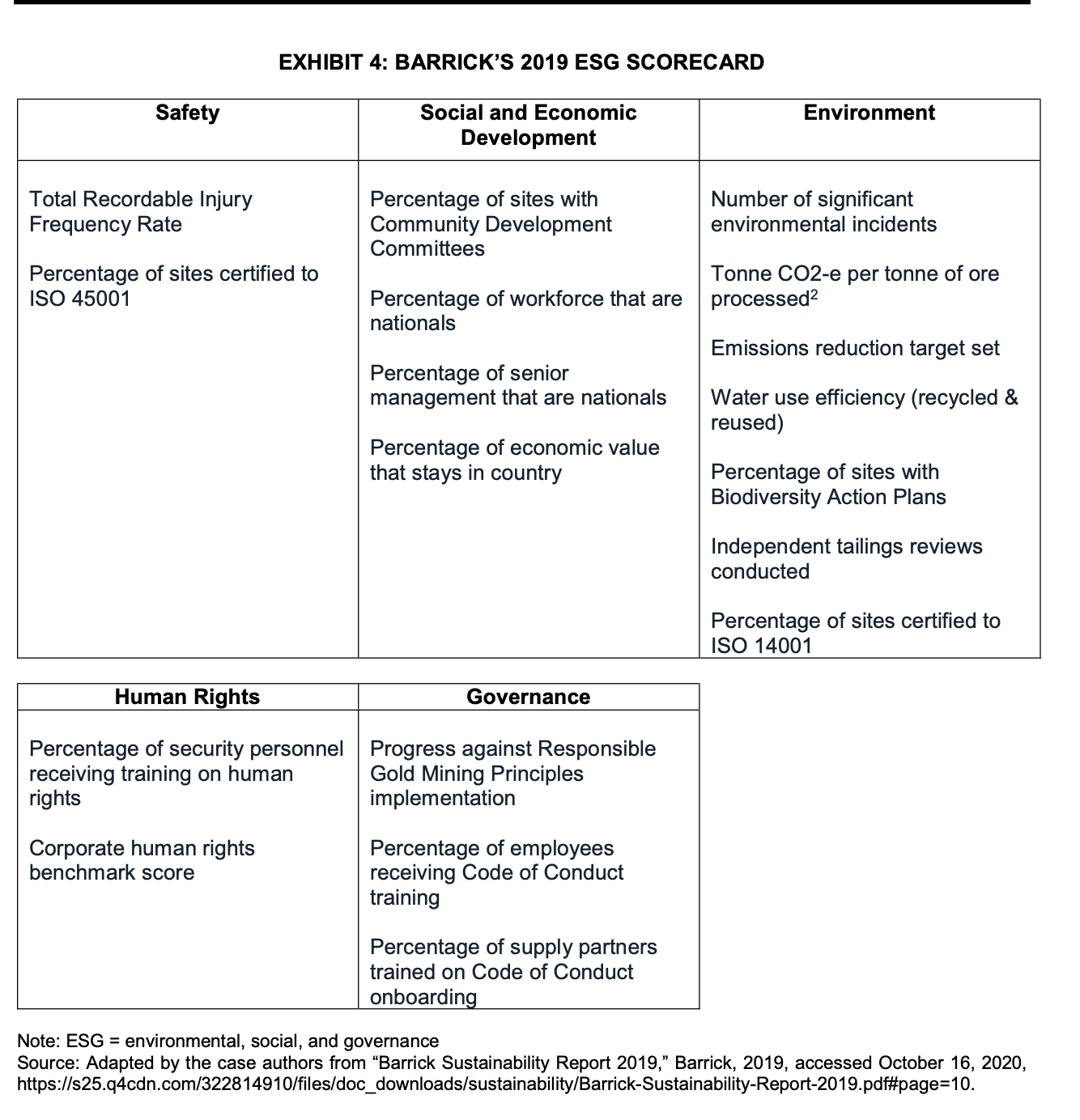

The newly merged company had also assigned sustainability a higher priority. The company appointed a group sustainability executive dedicated to "executive oversight of health, safety, community relations, andenvironmental matters to further our sustainability vision."78 From late 2019 into early 2020, Barrick developed an ESG scorecard with the help of independent external sustainability experts. With the intention of using the scorecard as a tool for continuous improvement in ESG, Barrick benchmarked 18 indicators against its peers. For the first year of the benchmarking exercise, these peers included Barrick's 2019 Mining Peers as listed in the 2019 Annual Information Circular.79 The 18 indicators were organized under five sub-categories entitled safety, social and economic development, human rights, environment and governance (see Exhibit 4).

GLOBAL INITIATIVES: ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) INCENTIVES

ESG metrics are used as tools to measure the sustainability and societal impact of a given investment or organization. With recent, transformative shifts in the expectations of corporations in society?from the Business Roundtable redefining the purpose of a business,81 to Larry Fink, the CEO of BlackRock (the largest asset manager in the world) stating that all companies must prove how they make positive contributions to society82?several stakeholders are turning to ESG metrics as a tool to identify which companies are committed to tackling social and environmental issues. Through the rising prominence of ESG metrics, shareholders, impact investors, foundations, and other stakeholders seek to shift the historically short-term, quarterly report-driven approach to conducting business to one that achieves lasting, sustainable change.

In 2015, the Financial Stability Board (FSB), an international body that monitored and made recommendations about the global financial system, convened a private-sector task force chaired by business tycoon and former New York City Mayor Michael Bloomberg. The Task Force on Climate- Related Financial Disclosures (TCFD) released its final report in June 2017. The report's recommendations were structured around four themes: governance, strategy, risk management, and metrics and targets. Following this publication, the task force released two additional status reports in June 2018 and 2019. These reports acknowledged the difficulty of measuring and therefore disclosing climate-change risks. However, making this disclosure a part of annual financial reporting instead of including it solely in sustainability reports was important as this would force companies to quantify the financial impacts of climate risks, which were the concerns of most investors. The TCFD 2019 status report specifically outlined an urgent call to action to reduce the global average temperature by reducing global emissions. Ultimately, companies would not only have to make decisions that were in line with the transition to a "lower-carbon economy" but would also have to disclose the decisions they made so that investors could make informed investment decisions based on which companies they believed would have a long-term sustainable focus.83

In October 2016, the Global Reporting Initiative (GRI) published new sustainability reporting standards. The GRI, which started in 1997 as an independent, international not-for-profit organization, boasted that its standards were the "first and most widely adopted global standards for sustainability reporting."84 It promoted economic sustainability and produced one of the world's most prevalent standards for sustainability reporting, also known as ecological footprint reporting. Its reporting principles focused on both content and quality. In terms of content, the GRI aimed to ensure that all stakeholders were considered, that information was material, and that information was completeand included not only the direct effects of decisions but also boundary effects (i.e., the outcomes or effects the decisions contributed to). In terms of quality, it focused on making sure that information was accurate, balanced, clear, comparable, reliable, and timely. The GRI also outlined topic-specific standards for reporting on economic, environmental, and social issues.

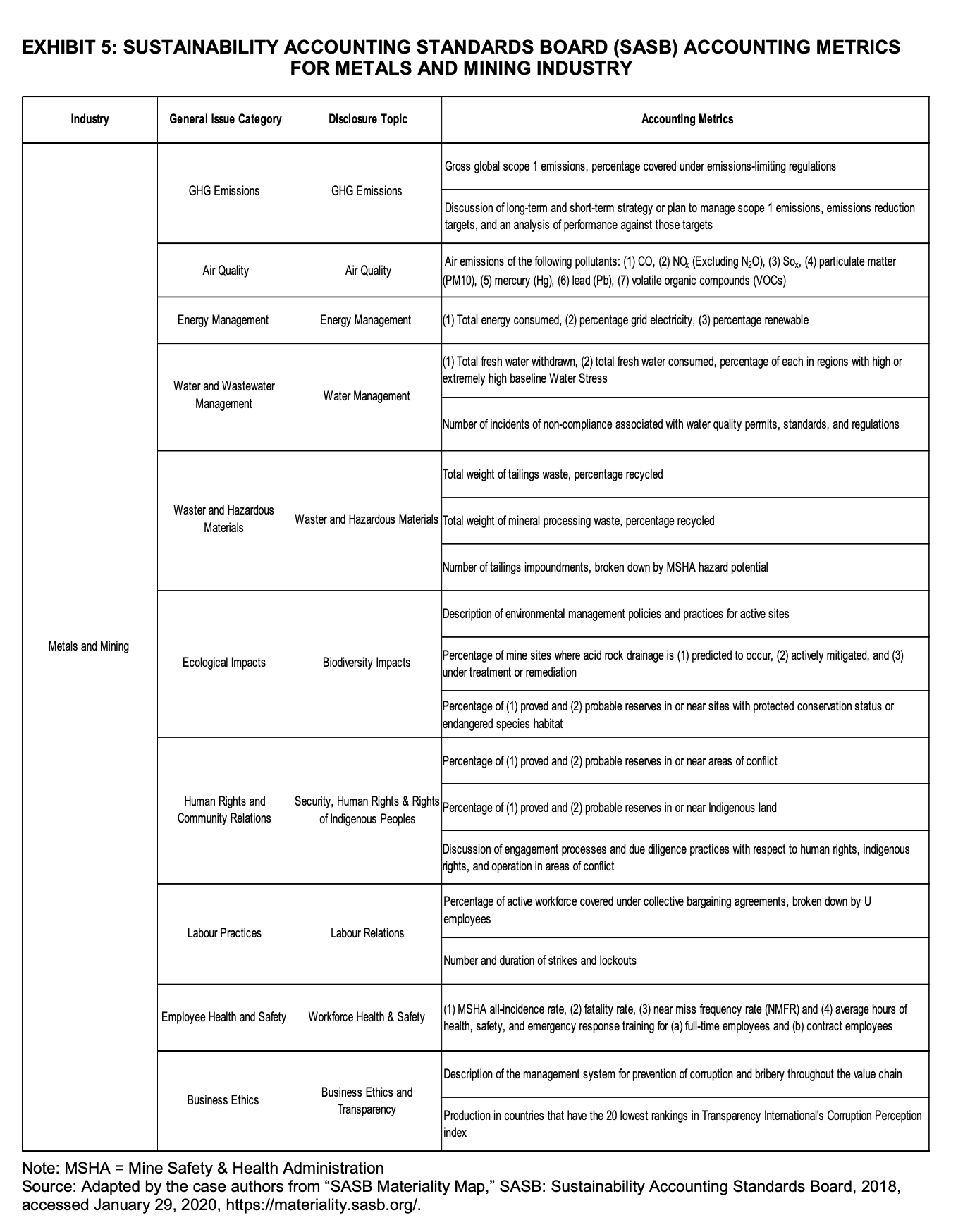

In November 2018, the Sustainability Accounting Standards Board (SASB) published 77 industry standards, which it described as a "complete set of globally applicable industry-specific standards which identify the minimal set of financially material sustainability topics and their associated metrics for the typical company in an industry."86 While the Financial Accounting Standard Board (FASB) defined materiality as "information which would be considered decision-relevant to an investor,"87 the SASB approached the issue of materiality at an industry level. Drawing on tens of thousands of source documents such as 10-K forms, legal news, corporate social responsibility (CSR) reports, and shareholder resolutions, the board identified the intensity with which issues arose in each industry and then ascertained the economic impact of these issues. It gauged the economic impact of issues by evaluating anecdotal reports and quantitative studies and exploring the effect on parameters such as revenue growth, return on capital, risk management, and management quality.88 The SASB also considered forward-looking adjustments to capture positive and negative externalities only in those instances where the effects of (mis)management of ESGs issue were reasonably likely to occur and significant enough to be deemed material. Its materiality map included accounting metrics designed for the metals and mining industry (see Exhibit 5).

The Canadian Securities Administrators (CSA) published a report on its climate change-related disclosure project in April 2018. The report detailed the CSA's review of the reporting disclosure of risks and financial impacts associated with climate change and related governance processes. The CSA required each company to disclose, in its annual information forms, risk factors relating to the company and its business that would be most likely to influence an investor's investing decisions. Furthermore, the CSA required companies to discuss, in their management discussion and analysis (MD&A) reports, their analyses of their operations for the most recent fiscal year, including commitments, events, risks, or uncertainties that they reasonably believed would materially affect their future performance. Ultimately, the CSA reviewed the disclosures of 78 companies from the S&P/TSX Composite Index whose market capitalization ranged from $650 million to approximately $140 billion. The CSA found that 56 per cent of issuers' disclosures provided specific climate change-related disclosures in their MD&As or annual information forms (AIFs). The CSA's view was that 22 per cent of the issuers provided boilerplate disclosures, while 22 per cent of issuers provided no disclosures at all. Overwhelmingly, issuers published climate-related disclosures via voluntary reporting.

The Principles for Responsible Investment (PRI) network described itself as the world's leading proponent of responsible investing; the network created principles for its investor signatories that would aid them in making investment and ownership decisions that incorporated ESG factors and risks. Unlike the initiatives described above, the PRI was also interested in linking ESG performance to executive pay. As such, it released reports in 2012 and 2016 pertaining to the integration of ESG issues into executive pay design. Based on the PRI's research, even when ESG metrics were used, they often did not reflect the issues most material to performance. For example, despite carbon emissions being a significant concern for extractive companies, only three out of 70 companies in the PRI's sample listed climate-change metrics in their reporting. The PRI found that companies often argued that their operational complexity made it challenging to identify either common sets of ESG issues at the sector level or metrics across entire companies that could be standardized in order to measure executives.

THE TASK

The proposed metrics for a revised executive scorecard would need to reflect Barrick Gold's post-merger strategic vision. Should the proposal emphasize the short-term or long-term incentive plan? Further to this, which metrics and weightings should be changed? Were the financial measures still appropriate, given the changes to Barrick's financial strategy? Were the non-financial measures adequately reflecting Barrick's sustainability goals and its vision for leaving a legacy in the communities in which it operated? Was Barrick doing enough to satisfy regulators and institutional investors? Numerous guidelines and standards had been released in recent years, which of these guidelines and standards should be incorporated into the scorecard, if any? If the standards and guidelines were not incorporated, how would the company prepare for potential shareholder backlash at the next annual general meeting?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started