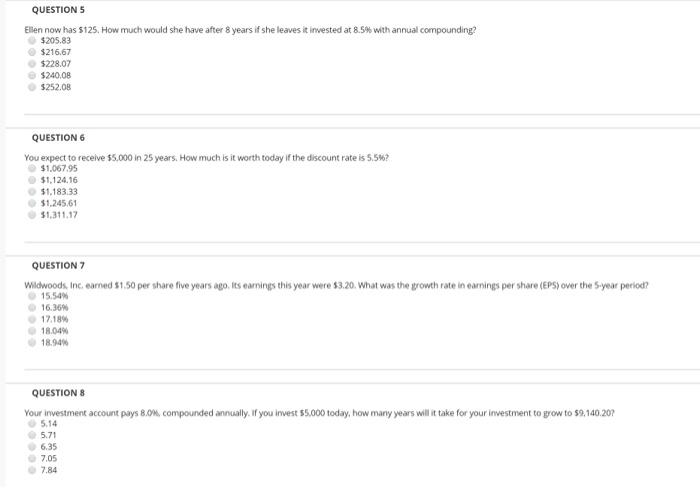

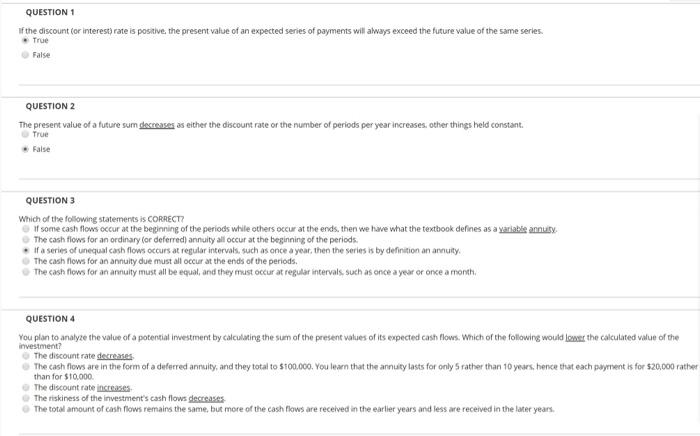

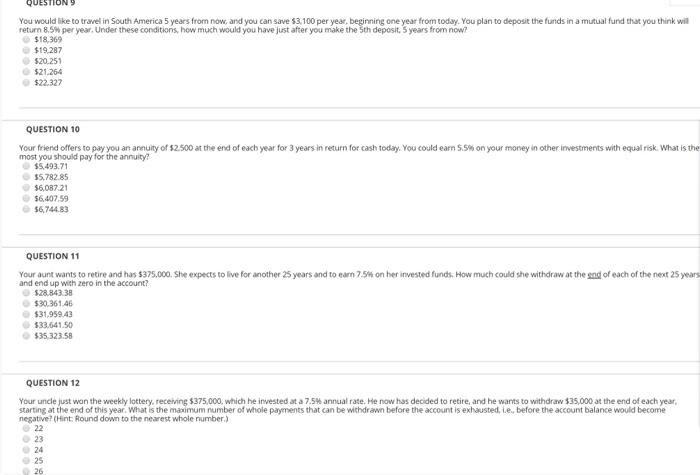

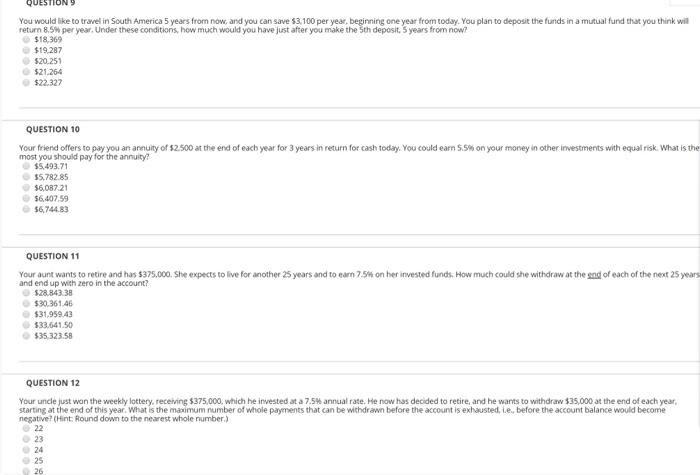

QUESTIONS Ellen now has $125. How much would she have after 8 years if she leaves it invested at 8.5% with annual compounding? $205.83 $216.67 $228.07 $240,00 5252.08 QUESTION 6 You expect to receive 55.000 in 25 years. How much is it worth today If the discount rate is 5.5%? $1.067.95 $1.124.16 $1.183.33 $1,245,61 $1,311.12 QUESTION 7 Wicwoods Inc earned 51.50 per share five years ago. Its earnings this year were $3.20. What was the growth rate in earnings per share (EPS) over the 5-year period? 15.54% 16,369 17.18% 18.04% 18.94% QUESTIONS Your investment account pays 8.m.compounded annually. If you inwest 55.000 today, how many years will it take for your investment to grow to $9,140.207 5.14 571 6.35 7.05 7.84 QUESTION 1 If the discount for interest rate is positive, the present value of an expected series of payments will always exceed the future value of the same series. True False QUESTION 2 The present value of a future sum decreases as either the discount rate or the number of periods per year increases, other things held constant. True False QUESTION 3 Which of the following statements is CORRECT? If some cash flows occur at the beginning of the periods while others occur at the ends. then we have what the textbook defines as a variatie annuity The cash flows for an ordinary for deferred) annuity all occur at the beginning of the periods. If a series of unequal cash flows occurs at regular intervals such as once a year, then the series is by definition an annuity The cash flows for an annuity due must all occur at the ends of the periods. The cash flows for an annuity must all be equat, and they must occur at regular intervals such as once a year or once a month, QUESTION 4 You plan to analyze the value of a potential restment by calculating the sum of the present values of its expected cash powes. Which of the following would lower the calculated value of the ? The discount rate decreases The cash flows are in the form of a deferred annuity, and they total to $100,000. You learn that the annuty lasts for only 5 rather than 10 years, hence that each payment is for $20,000 rather than for $10.000 The discount rate increases The riskiness of the investment's cash flows decreases The total amount of cash flows remains the same, but more of the cash flows are received in the earlier years and less are received in the later ye years. QUESTION You would like to travel in South America 5 years from now, and you can save $3,100 per year, beginning one year from today. You plan to deposit the funds in a mutual fund that you think wil return 8.5% per year. Under these conditions, how much would you have just after you make the 5th deposit. 5 years from now? $18,369 $19.287 $20.251 $21.264 $22.327 QUESTION 10 Your friend offers to pay you an annuity of $2.500 at the end of each year for 3 years in return for cash today. You could earn 55% on your money in other investments with equal risk. What is the most you should pay for the annuity? $5.493.71 55.782.85 $6,087.21 $6.407.59 56.744.83 QUESTION 11 Your aunt wants to retire and has $375,000. She expects to live for another 25 years and to earn 7.5on her invested funds. How much could she withdraw at the end of each of the next 25 years $28.843 38 $30,361 46 $31.959.43 $33.641.50 $35,323.58 QUESTION 12 Your uncle just won the weekly lottery receiving $375,000, which he invested at a 7.5% annual rate. He now has decided to retire and he wants to withdraw $35.000 at the end of each year, starting at the end of this year. What is the maximum number of whole payments that can be withdrawn before the account is exhausted, ie, before the account balance would become negative (Hint Round down to the nearest whole number) 22 23 24 25 26