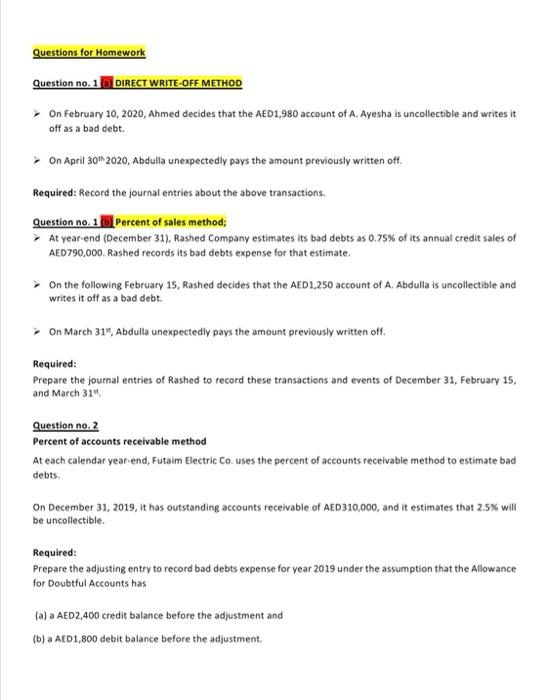

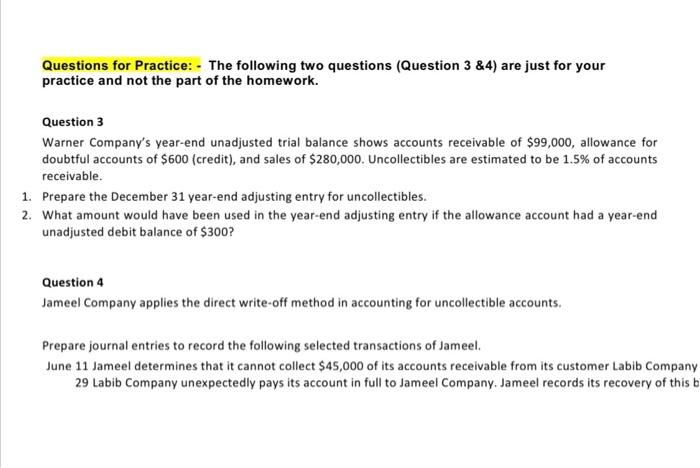

Questions for Homework Question no. 1 DIRECT WRITE-OFF METHOD On February 10, 2020, Ahmed decides that the AED1,980 account of A. Ayesha is uncollectible and writes it off as a bad debt. On April 30*2020, Abdulla unexpectedly pays the amount previously written off. Required: Record the journal entries about the above transactions. Question no. 1 Percent of sales method; At year-end (December 31), Rashed Company estimates its bad debts as 0.75% of its annual credit sales of AED 790,000. Rashed records its bad debts expense for that estimate. On the following February 15, Rashed decides that the AED 1,250 account of A. Abdulla is uncollectible and writes it off as a bad debt. On March 31", Abdulla unexpectedly pays the amount previously written off. Required: Prepare the journal entries of Rashed to record these transactions and events of December 31, February 15, and March 314 Question no. 2 Percent of accounts receivable method At each calendar year-end, Futaim Electric Co uses the percent of accounts receivable method to estimate bad debts. On December 31, 2019, it has outstanding accounts receivable of AED310,000, and it estimates that 2.5% will be uncollectible Required: Prepare the adjusting entry to record bad debts expense for year 2019 under the assumption that the Allowance for Doubtful Accounts has (a) a AED 2,400 credit balance before the adjustment and (b) a AED 1,800 debit balance before the adjustment. a Questions for Practice: - The following two questions (Question 3 &4) are just for your practice and not the part of the homework. Question 3 Warner Company's year-end unadjusted trial balance shows accounts receivable of $99,000, allowance for doubtful accounts of $600 (credit), and sales of $280,000. Uncollectibles are estimated to be 1.5% of accounts receivable. 1. Prepare the December 31 year-end adjusting entry for uncollectibles. 2. What amount would have been used in the year-end adjusting entry if the allowance account had a year-end unadjusted debit balance of $300? Question 4 Jameel Company applies the direct write-off method in accounting for uncollectible accounts. Prepare journal entries to record the following selected transactions of Jameel. June 11 Jameel determines that it cannot collect $45,000 of its accounts receivable from its customer Labib Company 29 Labib Company unexpectedly pays its account in full to Jameel Company, Jameel records its recovery of this b