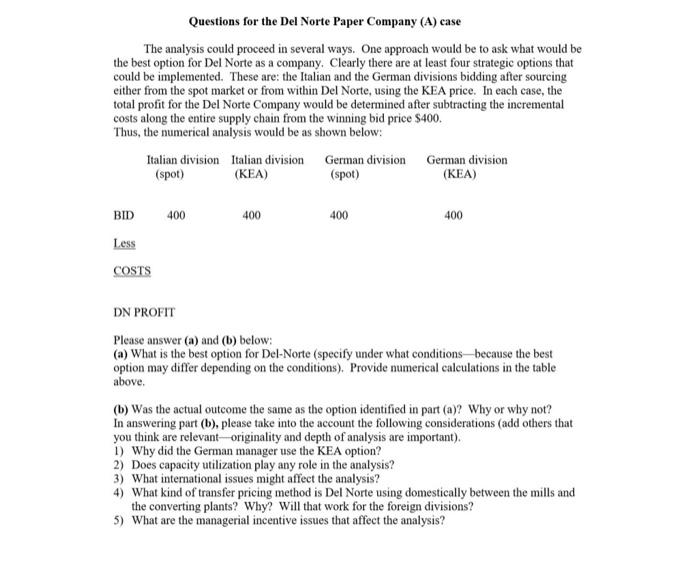

Questions for the Del Norte Paper Company (A) case The analysis could proceed in several ways. One approach would be to ask what would be the best option for Del Norte as a company. Clearly there are at least four strategic options that could be implemented. These are the Italian and the German divisions bidding after sourcing either from the spot market or from within Del Norte, using the KEA price. In each case, the total profit for the Del Norte Company would be determined after subtracting the incremental costs along the entire supply chain from the winning bid price $400. Thus, the numerical analysis would be as shown below: Italian division Italian division German division German division (spot) (KEA) (spot) (KEA) BID 400 400 400 400 Less COSTS DN PROFIT Please answer (a) and (b) below: (a) What is the best option for Del Norte (specify under what conditions because the best option may differ depending on the conditions). Provide numerical calculations in the table above. (b) Was the actual outcome the same as the option identified in part (a)? Why or why not? In answering part (b), please take into the account the following considerations (add others that you think are relevant-originality and depth of analysis are important). 1) Why did the German manager use the KEA option? 2) Does capacity utilization play any role in the analysis? 3) What international issues might affect the analysis? 4) What kind of transfer pricing method is Del Norte using domestically between the mills and the converting plants? Why? Will that work for the foreign divisions? 5) What are the managerial incentive issues that affect the analysis? Questions for the Del Norte Paper Company (A) case The analysis could proceed in several ways. One approach would be to ask what would be the best option for Del Norte as a company. Clearly there are at least four strategic options that could be implemented. These are the Italian and the German divisions bidding after sourcing either from the spot market or from within Del Norte, using the KEA price. In each case, the total profit for the Del Norte Company would be determined after subtracting the incremental costs along the entire supply chain from the winning bid price $400. Thus, the numerical analysis would be as shown below: Italian division Italian division German division German division (spot) (KEA) (spot) (KEA) BID 400 400 400 400 Less COSTS DN PROFIT Please answer (a) and (b) below: (a) What is the best option for Del Norte (specify under what conditions because the best option may differ depending on the conditions). Provide numerical calculations in the table above. (b) Was the actual outcome the same as the option identified in part (a)? Why or why not? In answering part (b), please take into the account the following considerations (add others that you think are relevant-originality and depth of analysis are important). 1) Why did the German manager use the KEA option? 2) Does capacity utilization play any role in the analysis? 3) What international issues might affect the analysis? 4) What kind of transfer pricing method is Del Norte using domestically between the mills and the converting plants? Why? Will that work for the foreign divisions? 5) What are the managerial incentive issues that affect the analysis