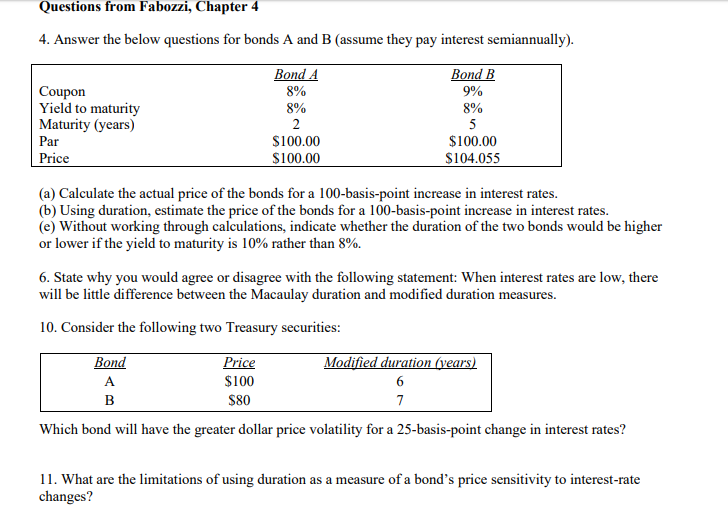

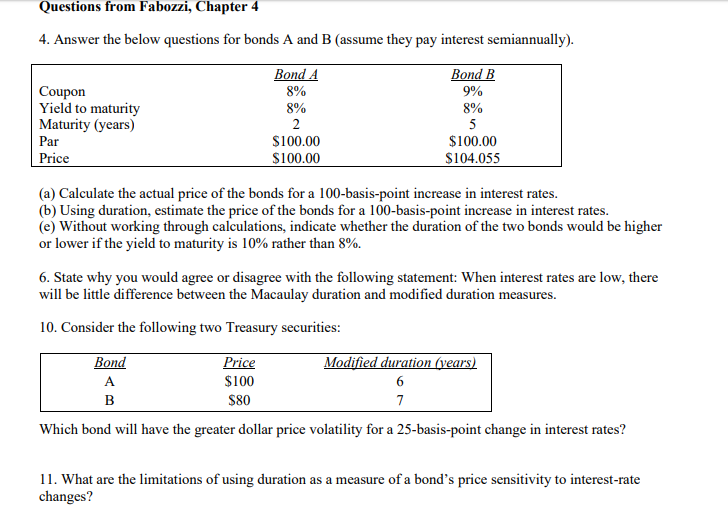

Questions from Fabozzi, Chapter 4 4. Answer the below questions for bonds A and B (assume they pay interest semiannually). Bond A 8% 8% Bond B 9% 8% Coupon Yield to maturity Maturity (years) Par Price $100.00 $100.00 $100.00 $104.055 (a) Calculate the actual price of the bonds for a 100-basis-point increase in interest rates. (b) Using duration, estimate the price of the bonds for a 100-basis-point increase in interest rates. (e) Without working through calculations, indicate whether the duration of the two bonds would be higher or lower if the yield to maturity is 10% rather than 8%. 6. State why you would agree or disagree with the following statement: When interest rates are low, there will be little difference between the Macaulay duration and modified duration measures. 10. Consider the following two Treasury securities: Bond Modified duration (years) Price $100 $80 Which bond will have the greater dollar price volatility for a 25-basis-point change in interest rates? 11. What are the limitations of using duration as a measure of a bond's price sensitivity to interest-rate changes? Questions from Fabozzi, Chapter 4 4. Answer the below questions for bonds A and B (assume they pay interest semiannually). Bond A 8% 8% Bond B 9% 8% Coupon Yield to maturity Maturity (years) Par Price $100.00 $100.00 $100.00 $104.055 (a) Calculate the actual price of the bonds for a 100-basis-point increase in interest rates. (b) Using duration, estimate the price of the bonds for a 100-basis-point increase in interest rates. (e) Without working through calculations, indicate whether the duration of the two bonds would be higher or lower if the yield to maturity is 10% rather than 8%. 6. State why you would agree or disagree with the following statement: When interest rates are low, there will be little difference between the Macaulay duration and modified duration measures. 10. Consider the following two Treasury securities: Bond Modified duration (years) Price $100 $80 Which bond will have the greater dollar price volatility for a 25-basis-point change in interest rates? 11. What are the limitations of using duration as a measure of a bond's price sensitivity to interest-rate changes