Answered step by step

Verified Expert Solution

Question

1 Approved Answer

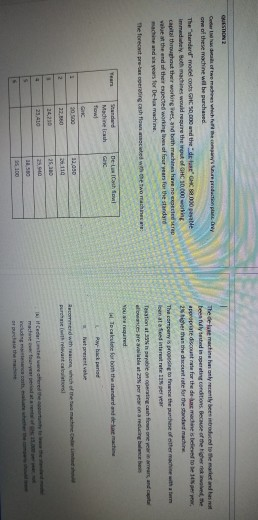

QUESTIONS olar is a para pradattanpura Uny of these machine will be purchased The standard model cos 50,000 and the datase H 84.000 patte immediately.

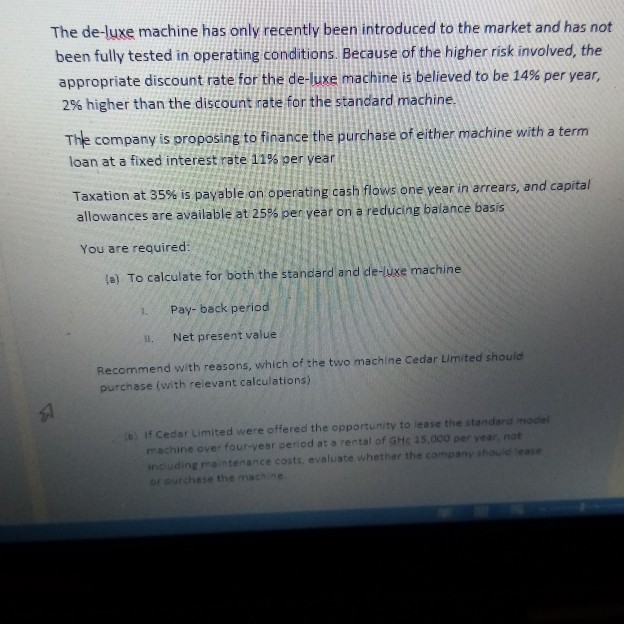

QUESTIONS olar is a para pradattanpura Uny of these machine will be purchased The standard model cos 50,000 and the datase H 84.000 patte immediately. Both machines would require the mouto GHC 10,000 capital through the worloges, and both machine step value at the end of the expected working of four years for the standard machine and years for De la machine the forect preperating cash flow rated with new machine The de luxe machine only by betroduced to the market and has beefully tested in pering conditions. Because of the higher in the appropriate discount for the dele medie is believed to be 2 her then the contrate for the stand machine The company is proing to finance the purchase of the machine with loen at first rete 11 per year Tassinable on ting cash flowers and ances are available at per on reducing No required To celulete for both the standard de machine De La Cathol Madinah Tow! Rhaper het presente 1 Recommend with which of the ta macho 2 22.000 12.050 2110 25. 23 AC 20 The de luxe machine has only recently been introduced to the market and has not been fully tested in operating conditions. Because of the higher risk involved, the appropriate discount rate for the de-luxe machine is believed to be 14% per year, 2% higher than the discount rate for the standard machine. The company is proposing to finance the purchase of either machine with a term loan at a fixed interest rate 11% per year Taxation at 35% is payable on operating cash flows one year in arrears, and capital allowances are available at 25% per year on a reducing balance basis You are required: la) To calculate for both the standard and de-luxe machine 1. Pay-back period Net present value Recommend with reasons, which of the two machine Cedar Limited should purchase (with relevant calculations) b) If Cedar Limited were offered the opportunity to lease the standard model machine over four-year period at a rental of GHS 15,000 per year not including maintenance costs evaluate whether the company should lease of purchase the machine QUESTIONS olar is a para pradattanpura Uny of these machine will be purchased The standard model cos 50,000 and the datase H 84.000 patte immediately. Both machines would require the mouto GHC 10,000 capital through the worloges, and both machine step value at the end of the expected working of four years for the standard machine and years for De la machine the forect preperating cash flow rated with new machine The de luxe machine only by betroduced to the market and has beefully tested in pering conditions. Because of the higher in the appropriate discount for the dele medie is believed to be 2 her then the contrate for the stand machine The company is proing to finance the purchase of the machine with loen at first rete 11 per year Tassinable on ting cash flowers and ances are available at per on reducing No required To celulete for both the standard de machine De La Cathol Madinah Tow! Rhaper het presente 1 Recommend with which of the ta macho 2 22.000 12.050 2110 25. 23 AC 20 The de luxe machine has only recently been introduced to the market and has not been fully tested in operating conditions. Because of the higher risk involved, the appropriate discount rate for the de-luxe machine is believed to be 14% per year, 2% higher than the discount rate for the standard machine. The company is proposing to finance the purchase of either machine with a term loan at a fixed interest rate 11% per year Taxation at 35% is payable on operating cash flows one year in arrears, and capital allowances are available at 25% per year on a reducing balance basis You are required: la) To calculate for both the standard and de-luxe machine 1. Pay-back period Net present value Recommend with reasons, which of the two machine Cedar Limited should purchase (with relevant calculations) b) If Cedar Limited were offered the opportunity to lease the standard model machine over four-year period at a rental of GHS 15,000 per year not including maintenance costs evaluate whether the company should lease of purchase the machine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started