Questions on microeconomics, try and provide solutions for these.

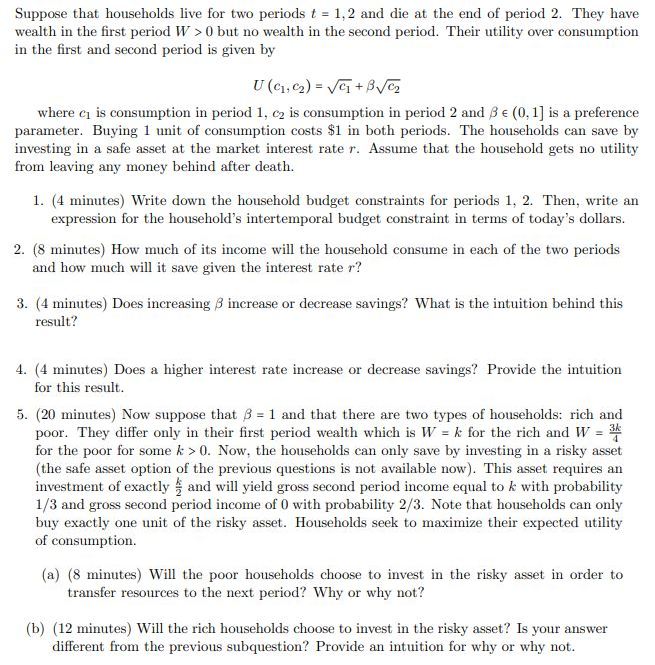

Suppose that households live for two periods t = 1,2 and die at the end of period 2. They have wealth in the rst period W 2- [l but no wealth in the second period. Their utility over consumption in the first and semnd period is given by Ui1521= EE'I-v where c1 is consumption in period 1, cg is consumption in period 2 and 13 E [i]. l] is a preference parameter. Buying 1 unit of consumption costs $1 in both periods. The households can save by investing in a safe asset at the market interest rate 1*. Assume that the household gets no utility from leaving any money behind after death. 1. {4 minutes) Write down the household budget constraints for periods 1. 2. Then, write an expression for the household's intertemporal budget constraint in terms of today's dollars. 2. {3 minutm} How much of its immme will the household consume in each of the two periods and how much will it save given the interest rate r? 3. (4 rninutm} Does increasing ,5 increase or decrease savings? What is the intuition behind this result? cl. {4 minutes} Does a higher interest rate increase or decrease savings? Provide the intuition for this result. 5. {20 minutes} Now suppose that 13 = 1 and that there are two types of households: rich and poor. They differ only in their rst period wealth which is W = Jr for the rich and W = for the poor for some It 2: [1. Now. the households can only save by investing in a risky asset {the safe asset option of the previous questions is not available now]. This asset requires an investment of exactly '3' and will yield gross second period income equal to l: with probability US and gross second period income oil] with probability 2H. Note that households can only buy exactly one unit of the risky asset. Households seek to maximise their expected utility of consumption. {a} {3 minutes] Will the poor households choose to invest in the risky asset in order to transfer resources to the next period? Why or why not? (b) {12 minutes] 1Will the rich households choose to invat in the risky asset? Is your answer different from the previous subqution? Provide an intuition for why or why not. 3. Bergson becomes a benevolent dictator. He has a subjects i = 1,... .n with CARA utilities w1...., un, respectively. (Write o, for the absolute risk aversion of i.) The total wealth in the society, Y, is a function of an unknown state w and is normally distributed with mean / and variance of. Bergson can choose any allocation r = (21, ... .2,) such that an (@) + ... +2, (w) I from her savings so that her wealth at t + 1 is my+1 = " (wt - 2,) if her wealth at t is wy and she consumes r, at t. (b) Find a sophisticated-optimal consumption strategy for her in which the self at any given date s consumes yes. Compute the constant y and briefly verify that this is indeed a subgame-perfect equilibrium of the multi-agent game. (c) For 8