Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions Problem 1 8 - 0 2 ( Underwriting and Flotation Expenses ) Question 2 of 5 Check My Work 3 . 4 . Underwriting

Questions

Problem Underwriting and Flotation Expenses

Question of

Check My Work

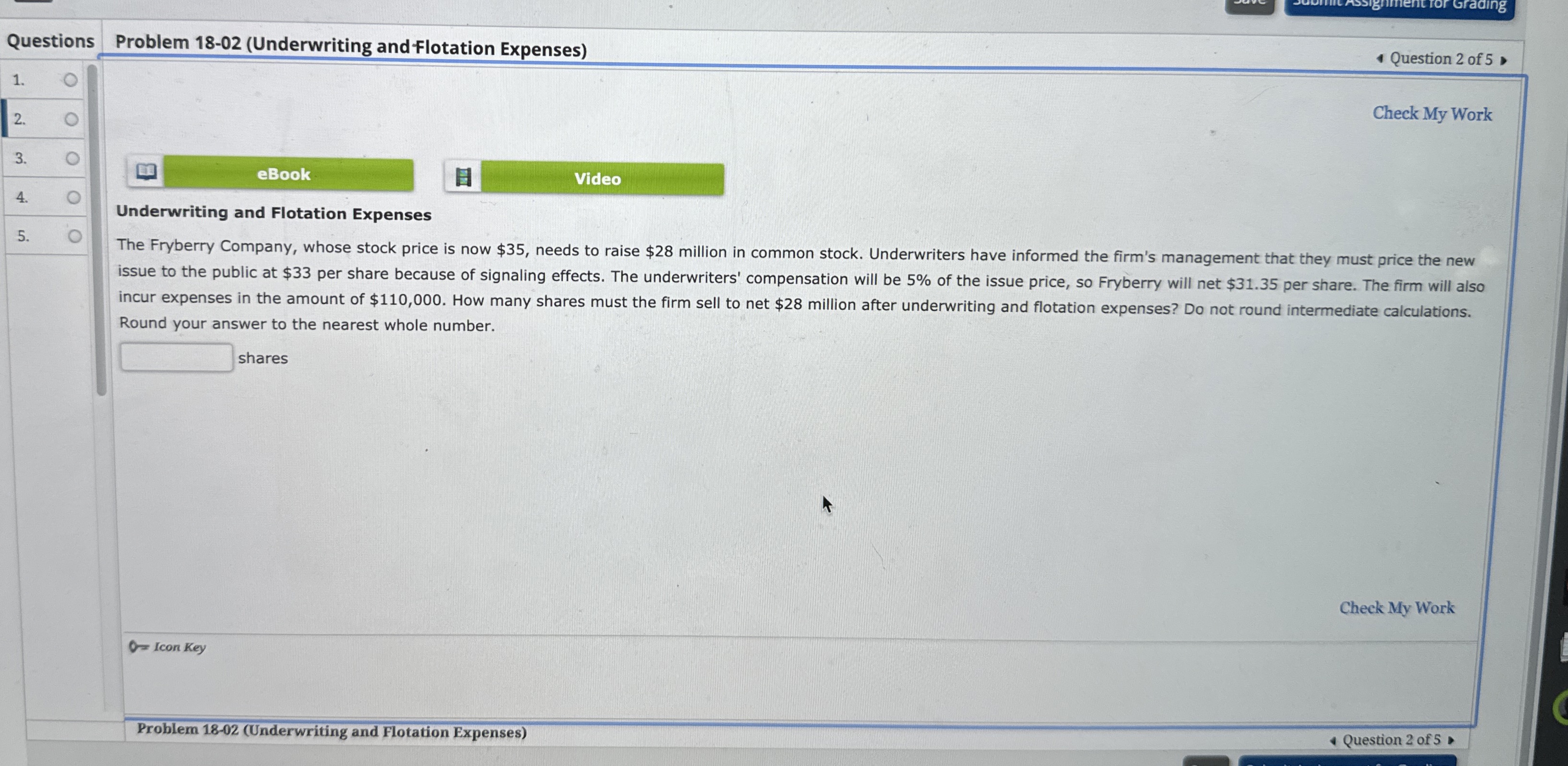

Underwriting and Flotation Expenses

The Fryberry Company, whose stock price is now $ needs to raise $ million in common stock. Underwriters have informed the firm's management that they must price the new issue to the public at $ per share because of signaling effects. The underwriters' compensation will be of the issue price, so Fryberry will net $ per share. The firm will also incur expenses in the amount of $ How many shares must the firm sell to net $ million after underwriting and flotation expenses? Do not round intermediate calculations. Round your answer to the nearest whole number.

shares

Check My Work

Icon Key

Problem Underwriting and Flotation Expenses

Question of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started