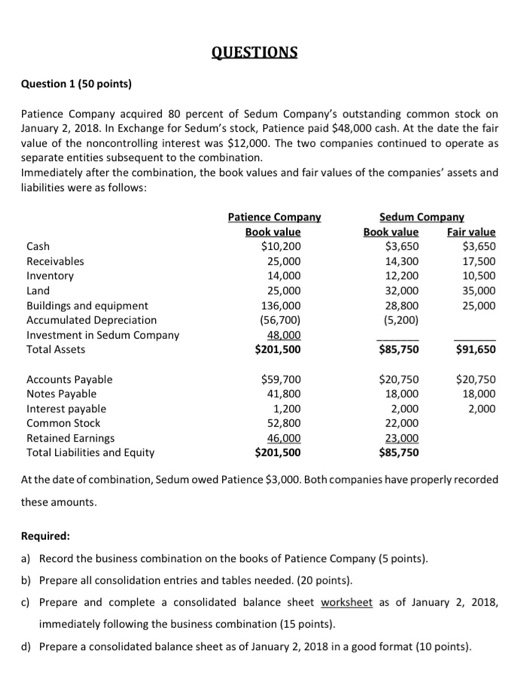

QUESTIONS Question 1 (50 points) Patience Company acquired 80 percent of Sedum Company's outstanding common stock on January 2, 2018. In Exchange for Sedum's stock, Patience paid $48,000 cash. At the date the fair value of the noncontrolling interest was $12,000. The two companies continued to operate as separate entities subsequent to the combination. Immediately after the combination, the book values and fair values of the companies' assets and liabilities were as follows: Patience Company Sedum Company Book value Book value Fair value Cash $10,200 $3,650 $3,650 Receivables 25,000 14,300 17,500 Inventory 14,000 12,200 10,500 Land 25,000 32,000 35,000 Buildings and equipment 136,000 28,800 25,000 Accumulated Depreciation (56,700) (5,200) Investment in Sedum Company 48.000 Total Assets $201,500 $85,750 $91,650 Accounts Payable $59,700 $20,750 $20,750 Notes Payable 41,800 18,000 18,000 Interest payable 1,200 2,000 2,000 Common Stock 52,800 22,000 Retained Earnings 46,000 23,000 Total Liabilities and Equity $201,500 $85,750 At the date of combination, Sedum owed Patience $3,000. Both companies have properly recorded these amounts. Required: a) Record the business combination on the books of Patience Company (5 points) b) Prepare all consolidation entries and tables needed. (20 points). c) Prepare and complete a consolidated balance sheet worksheet as of January 2, 2018, immediately following the business combination (15 points). d) Prepare a consolidated balance sheet as of January 2, 2018 in a good format (10 points). QUESTIONS Question 1 (50 points) Patience Company acquired 80 percent of Sedum Company's outstanding common stock on January 2, 2018. In Exchange for Sedum's stock, Patience paid $48,000 cash. At the date the fair value of the noncontrolling interest was $12,000. The two companies continued to operate as separate entities subsequent to the combination. Immediately after the combination, the book values and fair values of the companies' assets and liabilities were as follows: Patience Company Sedum Company Book value Book value Fair value Cash $10,200 $3,650 $3,650 Receivables 25,000 14,300 17,500 Inventory 14,000 12,200 10,500 Land 25,000 32,000 35,000 Buildings and equipment 136,000 28,800 25,000 Accumulated Depreciation (56,700) (5,200) Investment in Sedum Company 48.000 Total Assets $201,500 $85,750 $91,650 Accounts Payable $59,700 $20,750 $20,750 Notes Payable 41,800 18,000 18,000 Interest payable 1,200 2,000 2,000 Common Stock 52,800 22,000 Retained Earnings 46,000 23,000 Total Liabilities and Equity $201,500 $85,750 At the date of combination, Sedum owed Patience $3,000. Both companies have properly recorded these amounts. Required: a) Record the business combination on the books of Patience Company (5 points) b) Prepare all consolidation entries and tables needed. (20 points). c) Prepare and complete a consolidated balance sheet worksheet as of January 2, 2018, immediately following the business combination (15 points). d) Prepare a consolidated balance sheet as of January 2, 2018 in a good format (10 points)