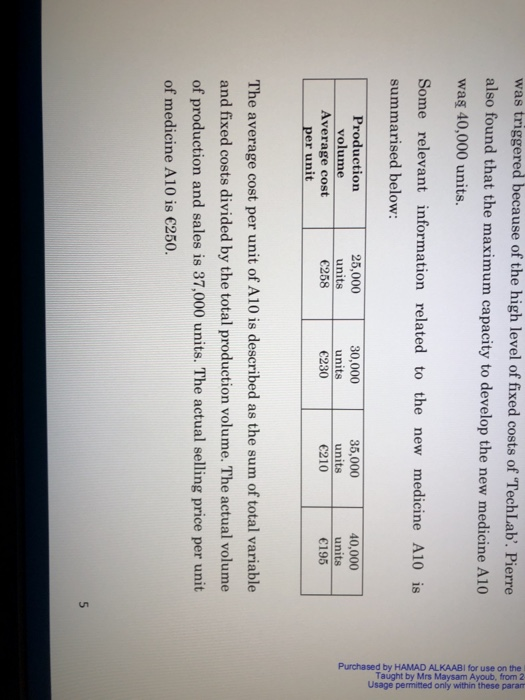

Questions: Question 1. Answer the following questions in relation to the earlier information presented by Pierre to Etienne, the bank manager of Bank XL, described in the section 'The Business Plan: a) Calculate the break-even point for each of the three price lists: 570$, 625$, and 675$. b) Based on the opinion of the bank manager that the clinic would only treat 700 patients regardless of the price list selected, what is the profit/loss for each of the three price lists:570$,625$, and 675$? c) Based on the opinion of Pierre that during the first year the clinic would generate the following profit: 70,000$ if the price list was 570$, 90,000$ if the price list was 625$, and 115,000$ if the price list was 675$; what is total revenue in $ for each of the three price lists? d) Based on the suggestion made by the bank manager in which the total fixed costs could be reduced by 25% and the possibility to lease the equipment at a cost of 35$ per patient treated, do you believe that this suggestion will facilitate to achieve the break-even point faster compared to the original situation? was triggered because of the high level of fixed costs of TechLab'. Pierre also found that the maximum capacity to develop the new medicine A10 wa 40,000 units. Some relevant information related to the new medicine A10 is summarised below: Production volume Average cost 25,000 units 258 30,000 units 230 35,000 units 210 40,000 units 195 per unit Purchased by HAMAD ALKAABI for use on the permitted only within these parar caught by Mrs Maysam Ayoub from The average cost per unit of A10 is described as the sum of total variable and fixed costs divided by the total production volume. The actual volume of production and sales is 37,000 units. The actual selling price per unit of medicine A10 is 250. 5 120-0023-1 In a recent meeting between Pierre and two founders of "Tech Lab', the start-up founders stressed the need to manufacture as much as possible to achieve the maximum capacity level of 40,000 units. Pierre mentioned that Luc Petit had the opportunity of signing a special order for an extra 3,000 units but, due to the fierce market competition, the selling price would only be 190. One of the founders of TechLab', Gabriel Deneuville, was against this proposal. He argued that this special price was under the average cost per unit at maximum production volume and as a result profitability would be reduced. However, Gabriel agreed to accept, only for this particular occasion, to sell the medicine A10 at 195 if the order was increased to 5,000 units. Pierre was not convinced about Gabriel's strategy. Luc had only a few hours to close his initial deal and a quick decision needed to be done... he Managerial Accounting, at American University in Dubai. n 2-Aug-2020 to 4-Aug-2020. Order ref F387570 rameters otherwise contact info@thecasecentre.org Questions: Question 1. Answer the following questions in relation to the earlier information presented by Pierre to Etienne, the bank manager of Bank XL, described in the section 'The Business Plan: a) Calculate the break-even point for each of the three price lists: 570$, 625$, and 675$. b) Based on the opinion of the bank manager that the clinic would only treat 700 patients regardless of the price list selected, what is the profit/loss for each of the three price lists:570$,625$, and 675$? c) Based on the opinion of Pierre that during the first year the clinic would generate the following profit: 70,000$ if the price list was 570$, 90,000$ if the price list was 625$, and 115,000$ if the price list was 675$; what is total revenue in $ for each of the three price lists? d) Based on the suggestion made by the bank manager in which the total fixed costs could be reduced by 25% and the possibility to lease the equipment at a cost of 35$ per patient treated, do you believe that this suggestion will facilitate to achieve the break-even point faster compared to the original situation? was triggered because of the high level of fixed costs of TechLab'. Pierre also found that the maximum capacity to develop the new medicine A10 wa 40,000 units. Some relevant information related to the new medicine A10 is summarised below: Production volume Average cost 25,000 units 258 30,000 units 230 35,000 units 210 40,000 units 195 per unit Purchased by HAMAD ALKAABI for use on the permitted only within these parar caught by Mrs Maysam Ayoub from The average cost per unit of A10 is described as the sum of total variable and fixed costs divided by the total production volume. The actual volume of production and sales is 37,000 units. The actual selling price per unit of medicine A10 is 250. 5 120-0023-1 In a recent meeting between Pierre and two founders of "Tech Lab', the start-up founders stressed the need to manufacture as much as possible to achieve the maximum capacity level of 40,000 units. Pierre mentioned that Luc Petit had the opportunity of signing a special order for an extra 3,000 units but, due to the fierce market competition, the selling price would only be 190. One of the founders of TechLab', Gabriel Deneuville, was against this proposal. He argued that this special price was under the average cost per unit at maximum production volume and as a result profitability would be reduced. However, Gabriel agreed to accept, only for this particular occasion, to sell the medicine A10 at 195 if the order was increased to 5,000 units. Pierre was not convinced about Gabriel's strategy. Luc had only a few hours to close his initial deal and a quick decision needed to be done... he Managerial Accounting, at American University in Dubai. n 2-Aug-2020 to 4-Aug-2020. Order ref F387570 rameters otherwise contact info@thecasecentre.org