Question: questions: Question 5 Two travelers returning home from a remote island discover that the identical antiques they bought have been smashed in transit. The airline

questions:

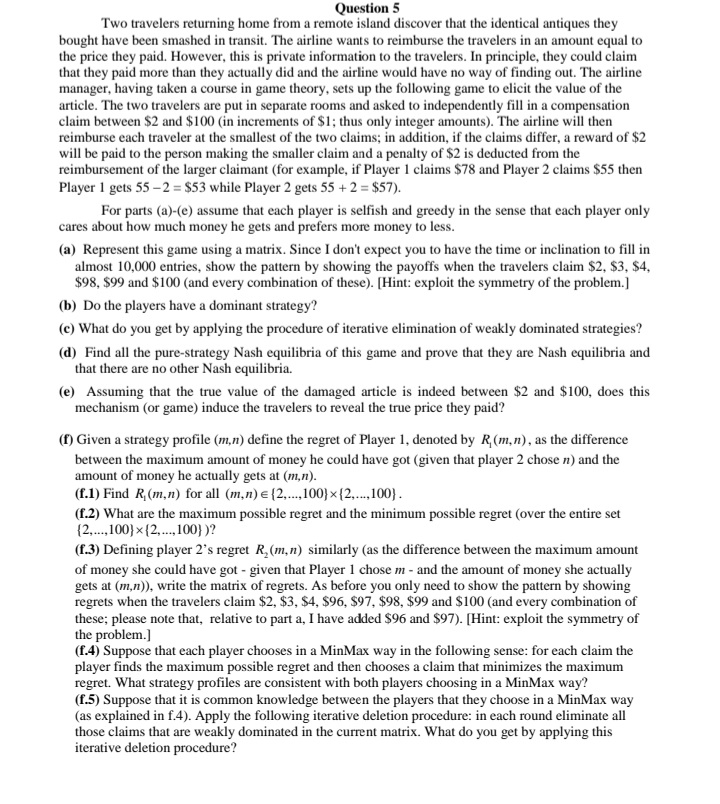

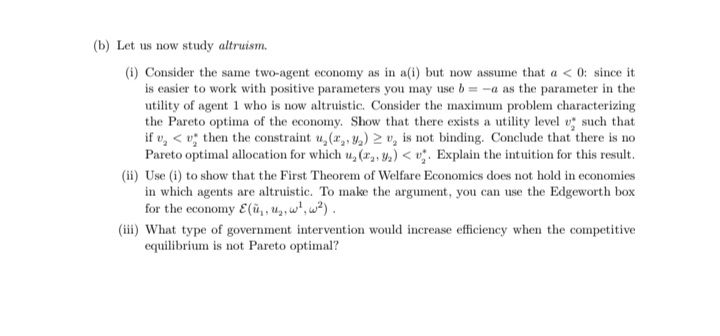

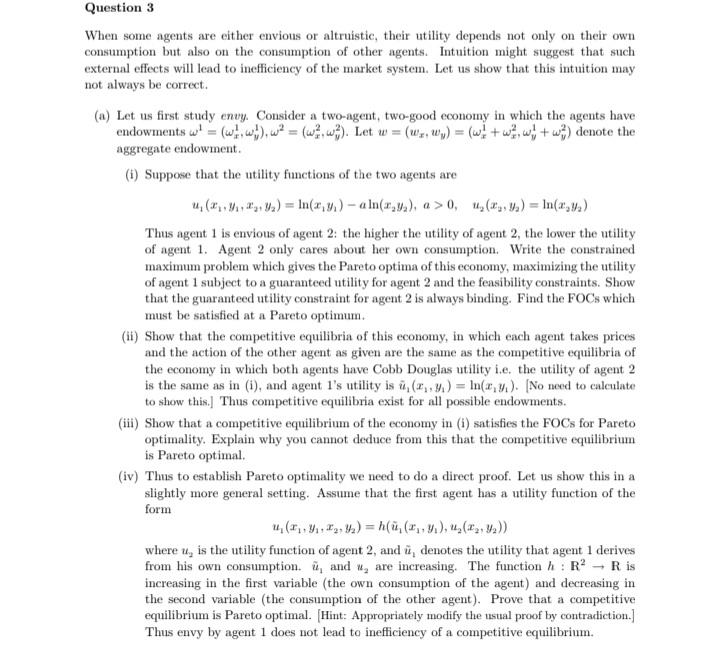

Question 5 Two travelers returning home from a remote island discover that the identical antiques they bought have been smashed in transit. The airline wants to reimburse the travelers in an amount equal to the price they paid. However, this is private information to the travelers. In principle, they could claim that they paid more than they actually did and the airline would have no way of finding out. The airline manager, having taken a course in game theory, sets up the following game to elicit the value of the article. The two travelers are put in separate rooms and asked to independently fill in a compensation claim between $2 and $100 (in increments of $1; thus only integer amounts). The airline will then reimburse each traveler at the smallest of the two claims; in addition, if the claims differ, a reward of $2 will be paid to the person making the smaller claim and a penalty of $2 is deducted from the reimbursement of the larger claimant (for example, if Player 1 claims $78 and Player 2 claims $55 then Player 1 gets 55 -2 = $53 while Player 2 gets 55 + 2 = $57). For parts (a)-(e) assume that each player is selfish and greedy in the sense that each player only cares about how much money he gets and prefers more money to less. (a) Represent this game using a matrix. Since I don't expect you to have the time or inclination to fill in almost 10,000 entries, show the pattern by showing the payoffs when the travelers claim $2, $3, $4, $98, $99 and $100 (and every combination of these). [Hint: exploit the symmetry of the problem.] (b) Do the players have a dominant strategy? (c) What do you get by applying the procedure of iterative elimination of weakly dominated strategies? (d) Find all the pure-strategy Nash equilibria of this game and prove that they are Nash equilibria and that there are no other Nash equilibria. (e) Assuming that the true value of the damaged article is indeed between $2 and $100, does this mechanism (or game) induce the travelers to reveal the true price they paid? (f) Given a strategy profile (m,n) define the regret of Player 1, denoted by R, (m, n) , as the difference between the maximum amount of money he could have got (given that player 2 chose n) and the amount of money he actually gets at (m,n). (f.1) Find R, (m,n) for all (m.n) c (2,...,100}x (2,...,100). (f.2) What are the maximum possible regret and the minimum possible regret (over the entire set (2,...,100}x (2,..,100} )? (f.3) Defining player 2's regret R, (m, n) similarly (as the difference between the maximum amount of money she could have got - given that Player 1 chose m - and the amount of money she actually gets at (m,n)), write the matrix of regrets. As before you only need to show the pattern by showing regrets when the travelers claim $2, $3, $4, $96, $97, $98, $99 and $100 (and every combination of these; please note that, relative to part a, I have added $96 and $97). [Hint: exploit the symmetry of the problem.] (f.4) Suppose that each player chooses in a MinMax way in the following sense: for each claim the player finds the maximum possible regret and then chooses a claim that minimizes the maximum regret. What strategy profiles are consistent with both players choosing in a MinMax way? (f.5) Suppose that it is common knowledge between the players that they choose in a MinMax way (as explained in f.4). Apply the following iterative deletion procedure: in each round eliminate all those claims that are weakly dominated in the current matrix. What do you get by applying this iterative deletion procedure?Question 4 Consider an economy with a private and a public good in which agents have different tastes for the public good: we study an example where the tastes give rise to an extreme form of the free-rider problem. To fix ideas suppose there are / 2 2 agents indexed by i = 1,...J. Each agent initially owns one unit of the private good. The private good can be transformed into a public good with a constant returns technology, one unit of private good producing one unit of public good. The preferences of the agents are given by 2(ri, yi) = 1 - -. i = ....I where r, is agent i's consumption of the private good and y is the quantity of the public good in the economy, and the preference parameters (@,); ) satisfy 0 )y". Compare this result with the outcome with voluntary contributions and comment.(b) Let us now study altruism. (i) Consider the same two-agent economy as in a(i) but now assume that a 0, u, (2,, 1) = In(1,y,) Thus agent 1 is envious of agent 2: the higher the utility of agent 2, the lower the utility of agent 1. Agent 2 only cares about her own consumption. Write the constrained maximum problem which gives the Pareto optima of this economy, maximizing the utility of agent 1 subject to a guaranteed utility for agent 2 and the feasibility constraints. Show that the guaranteed utility constraint for agent 2 is always binding. Find the FOCs which must be satisfied at a Pareto optimum. (ii) Show that the competitive equilibria of this economy, in which each agent takes prices and the action of the other agent as given are the same as the competitive equilibria of the economy in which both agents have Cobb Douglas utility i.e. the utility of agent 2 is the same as in (i), and agent I's utility is a, (2, , y, ) = In(2,y, ). (No need to calculate to show this.] Thus competitive equilibria exist for all possible endowments. (iii) Show that a competitive equilibrium of the economy in (i) satisfies the FOCs for Pareto optimality. Explain why you cannot deduce from this that the competitive equilibrium is Pareto optimal. (iv) Thus to establish Pareto optimality we need to do a direct proof. Let us show this in a slightly more general setting. Assume that the first agent has a utility function of the form where u, is the utility function of agent 2, and u, denotes the utility that agent 1 derives from his own consumption. a, and a, are increasing. The function h : R' - R is increasing in the first variable (the own consumption of the agent) and decreasing in the second variable (the consumption of the other agent). Prove that a competitive equilibrium is Pareto optimal. [Hint: Appropriately modify the usual proof by contradiction.] Thus envy by agent 1 does not lead to inefficiency of a competitive equilibrium.Question 2. Postulate the expected utility hypothesis, and assume the decision maker's von Neumann- Morgenstern-Bernoulli (VNMB) utility function is u :X- R:(x)=ba+* (2.1) where a, b and c are real numbers, c #0, satisfying b[1- c > o. (2.2) and the domain X is defined as X := (xeni., :a+=> 0). (2.3) 2.1. Argue that the decision maker is strictly risk-averse. 2.2. Show that the preferences described by the following vNMB utility functions are special cases of the ones defined by (2.1) (A). u" : X - R:1"(x)=,x=1.,n>0,n#1. 1 -n' (2.4) (B). u" : X - R:u" (x) =+k) ,X = (xeR., :x>-k),kex,n>0,n#1. (2.5) 1-n (C). u' : X - R:u'(x)=(g-x].X =(xex.:x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts