Question

Questions: Should Marshall acquire Electro-Engineering, Inc. (EE)? What is the most important consideration? Even if the NPV of the acquisition is zero, should she still

Questions: Should Marshall acquire Electro-Engineering, Inc. (EE)? What is the most important consideration? Even if the NPV of the acquisition is zero, should she still proceed?

Does the acquisition allow EE to gain enough funding to invest in the purchase of thermowell machines?

Company Background

Burton was engaged primarily in the design and manufacturing of temperature sensors. Its products included a variety of highly accurate standard and customized thermocouple sensors, resistance temperature detectors (RTDs), and bearing temperature probes, as well as temperature transmitters. Its end users covered a wide range of industries, including oil and gas, petrochemicals, industrial machinery, automotive, food processing, medical, and aerospace.

While majoring in mechanical engineering, Marshall became interested in sensor technology. Shortly after her graduation in 2002, she founded AMI Labs with a loan from her family and began supplying temperature sensors to several local food processors. To meet growing demand, she acquired Burton Sensors in 2004 and adopted the target firm's name for the combined enterprise.

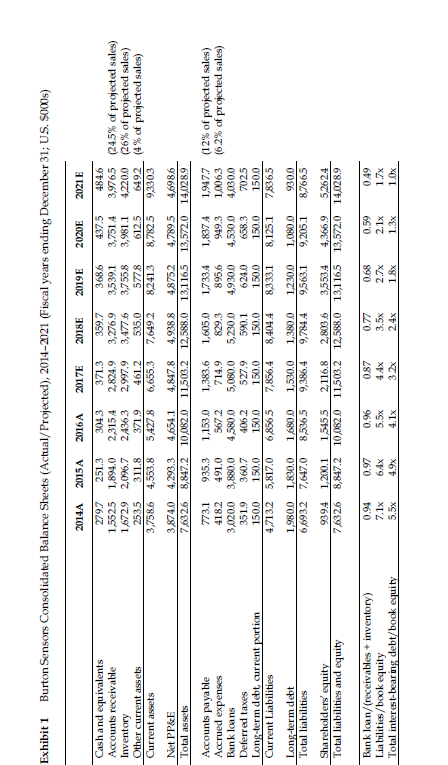

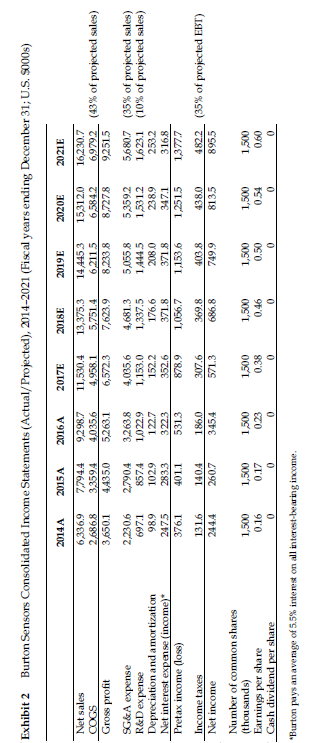

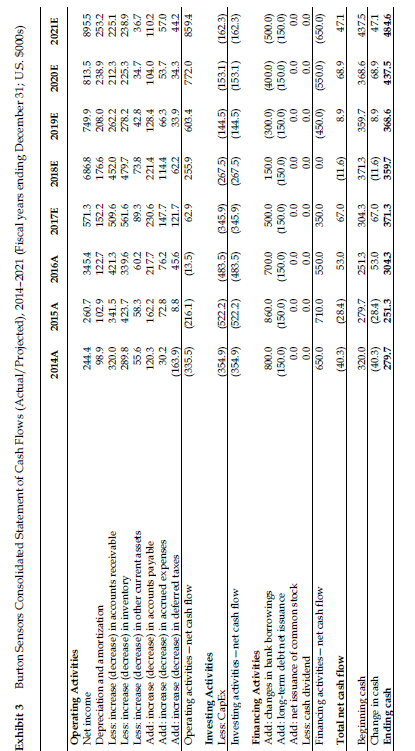

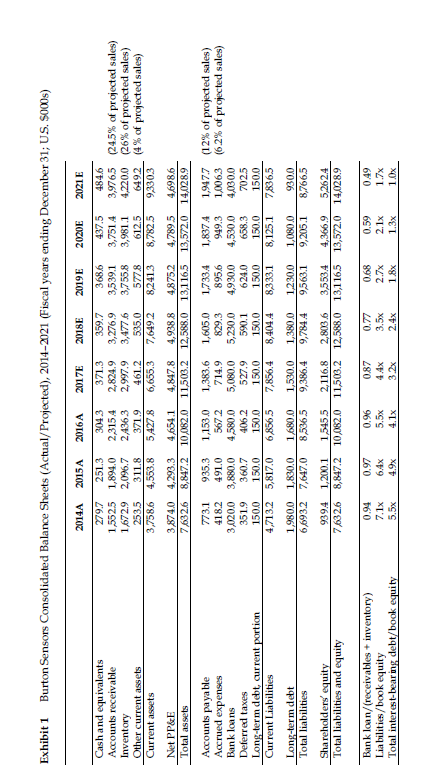

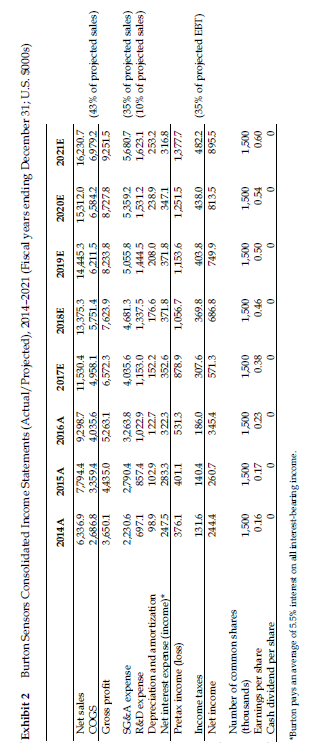

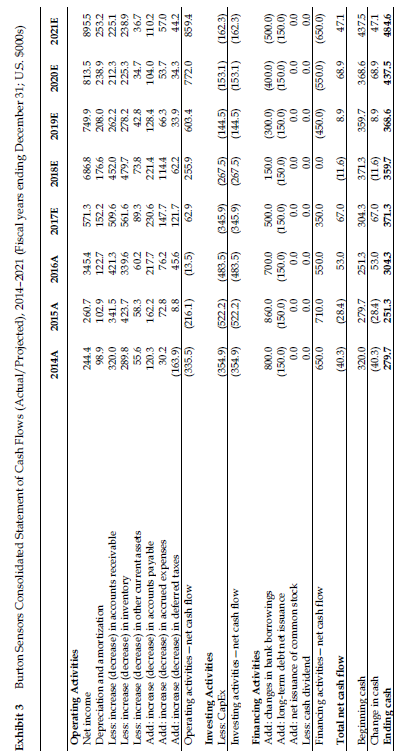

Initially, Burton financed its growth primarily through internally generated cash flows; however, Marshall saw that Burton needed more funds than it could generate internally to finance growth opportunities. Consequently, Burton had an initial public offering in 2011. Shortly after the equity issuance, Marshall realized that Burton needed yet more financing to expand even further. She approached her bank to request a substantial increase in Burton's line of credit in 2013. Exhibits 1, 2, and 3 show Burton's balance sheet, income statement, and statement of cash flows, respectively.

The Market for Sensors

Sensors were essential equipment in many industries.1 They provided vital information about crucial variables such as temperature, position, and pressure that affected products, processes, and systems. These variables had to be measured, tested, and monitored, and were often automated.2 Original equipment manufacturers (OEMs) manufactured many types of sensors.3 Among them, temperature sensors had the widest applications for industrial production because temperature affected every aspect of manufacturing; it was the most monitored parameter in various end-user applications, especially in critical and hazardous applications.

By product type, the temperature sensors market was classified into seven major segments: thermocouples, RTDs, thermistors, infrared temperature sensors, fiber-optic temperature sensors, bimetallic temperature sensors, and integrated circuit (IC) temperature sensors. Each segment had unique properties and end users. Traditional contact types such as RTDs and thermocouples dominated the market, but industry insiders expected the market for fiber-optic sensors, which were used primarily in low-volume niche applications, would grow more rapidly. Compared to traditional sensors, fiber-optic sensors had unique properties. They were immune to electromagnetic radiation and compatible with high-voltage, high-radio frequency, and high-magnetic field environments. These qualities made them ideal for applications in which traditional sensors would fail. In addition, they could be positioned in hard-to-reach or hard-to-view places and could withstand environments that were more corrosive.

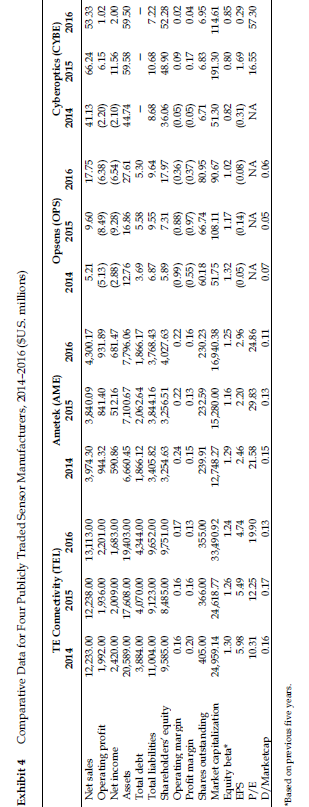

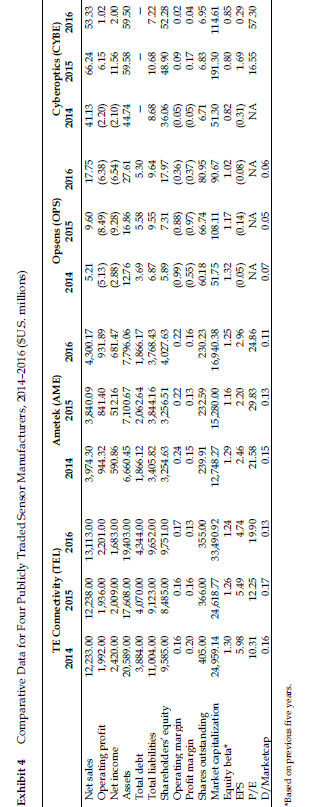

In the United States, the sensors industry was fragmented and competitive. In 2017, over 4,000 sensor OEMs served both the domestic and international markets in the United States. Three-quarters of these firms had annual sales of less than $10 million. Each type of sensor manufacturer faced distinct industry structures and competition. Over 200 OEMs produced temperature sensors. Most were privately held and family controlled. (Exhibit 4 provides financial data on four publicly-traded companies in the sensors industry.) Larger firms produced a diversified line of sensors and had more efficient distribution channels. To stay competitive, smaller companies like Burton needed to build close relationships with customers and design customized products that met specific customer needs. Smaller companies reviewed their distribution networks regularly to ensure that operating expenses were in line with industry norms. They also had to expand these networks to grow sales. Having experienced sales representatives was often the key to opening new markets. Many companies ran large inventory costs because they needed to keep stock for reorders.

The overall market was expected to grow at a cumulative annual growth rate (CAGR) of 4.5% between 2017 and 2023 and to reach $6.86 billion by 2023.4 The market for fiber-optic sensors was expected to have a 15% CAGR and reach $3.5 billion by 2024. The projected growth was attributed largely to high demand for accurate temperature measurement in harsh environments and heavy investment in research and development (R&D) by large semiconductor firms. The aerospace anddefense, chemical, semiconductor, utilities, metals, medical, construction, and consumer electronics industries had the greatest demand for fiber-optic sensors.

The Bank's Request

Burton's bank lender and suppliers supported the company's growth between 2013 and 2016. At the end of 2016, its revolving credit line was $4.58 million. It could also borrow at just 2% above the prime rate (3.5% as of February 2017). Nonetheless, Burton's lender had recently expressed concern about the extent to which the company was depending on short-term debt to finance its operations.

When Burton's bank initially agreed to finance Burton's expansion, it expected the industry would soon experience a shakeout, in which weaker competitors would exit and only stronger firms like Burton would remain. In turn, Burton expected to increase its operating cash flows once competition had decreased. Because Burton had covenanted in its loan agreement not to pay a dividend for several years, any increase in net income would go directly to its retained earnings and reduce the company's ratio of liabilities to equity.

However, Burton's sales growth outpaced its growth in cash flows. The company had to sustain high levels of working capital to support its growth. At the end of 2016, Burton's total liabilities were five times its net worth. Its outstanding bank loans were 96% of the total value of its accounts receivable and inventory, far in excess of industry norms. Burton's bank insisted that the company act to ensure that it would stay safely within the two restrictions that the bank planned to impose on future loans. These restrictions, which would apply as of the end of 2017, specified the following:

1. The outstanding bank loans at any time should not exceed 75% of the company's accounts receivable and inventory.

2. Total liabilities should not exceed three times the book value of equity.

Marshall had her own target leverage ratio in mind. She wanted to hold Burton's ratio of total interest-bearing debt to the book value of equity at approximately 1 to 1.

Purchasing New Thermowell Machines

The thermowell was a major part of the RTD. There were many advantages to installing a thermowell with the sensor. First, in providing a physical barrier between the production process and the sensing element, the thermowell protected production from corrosive processes, extremely high temperatures, and high pressure. Second, it allowed the RTD to be removed and serviced without interfering with the production process. Because the temperature had to travel through the metal of the thermowell before reaching the RTD, however, the RTD sensor's response time was reduced. The thermowell's quality and design thus affected the RTD's quality. Most thermowells were made from carbon steel, stainless steel, nickel, and brass. Other chemical compounds such as silicon carbide and silicon nitride were sometimes used to produce thermowells. The cost of thermowells was a major component of the production cost of sensors. Burton's thermowell equipment allowed it to fulfill only half of its production needs, so the company had to purchase the rest of the equipment from other manufacturers. During 2016, Burton spent $1.4 million to purchase thermowells.

Marshall contacted a large thermowell machinery manufacturer and learned that a purchase of four new thermowell machines for $600,000 would have enabled Burton to manufacture all the thermowells that it purchased in 2016. The equipment would have an economic life of seven years. Marshallestimated that Burton would need to hire two operators to run the new machines for $170,000 annually. Costs for buying additional materials and renting warehouse space were estimated at $780,000 annually. Marshall also estimated that if Burton started manufacturing additional thermowells, its average net working capital needs would increase immediately by $650,000 due to the increase in inventory arising from in-house production. The working capital would remain at that level during the equipment's life and would return to normal levels afterward.

Raising Capital by Issuing New Common Stock

Marshall knew that Burton had to raise additional equity capital to sustain its projected sales growth while satisfying the covenants of its bank loan. She felt that Burton would have difficulty retaining existing customers and attracting new ones if it did not have enough inventory to meet the potential increase in customer orders. She was also concerned that restrictions on accepting new orders would make key sales personnel lose confidence in the company's ability to grow, and they could leave to join competitors. Burton also needed capital to finance its ongoing R&D for new product development to stay competitive and make improvements to existing production facilities.

Burton's stock was traded on the over-the-counter (OTC) market. The average price in the first two months of 2017 had been $4.75. Given how thin the market was for its shares, the equity beta was challenging to estimate. Marshall and her family owned most of Burton's shares. The company's remaining equity was held primarily by its employees and other retail investors. Raising equity capital through stock issuance in the OTC market seemed unlikely.

After a private investor approached Marshall and offered to acquire 450,000 shares of the company at $3.50 per share, Marshall approached a friend at a large financial services firm for advice. She was told that it would be very difficult for Burton to sell enough stock directly to the market for more than $3.50 a share. It seemed that the only realistic prospect for raising new equity capital would be to accept the investor's offer. To close the deal, Marshall would also need to pay 50,000 shares to the consulting firm that would broker the deal.

Acquisition of Electro-Engineering, Inc.

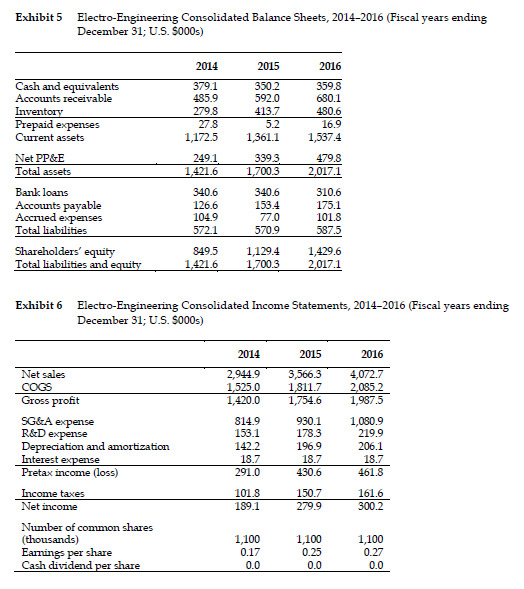

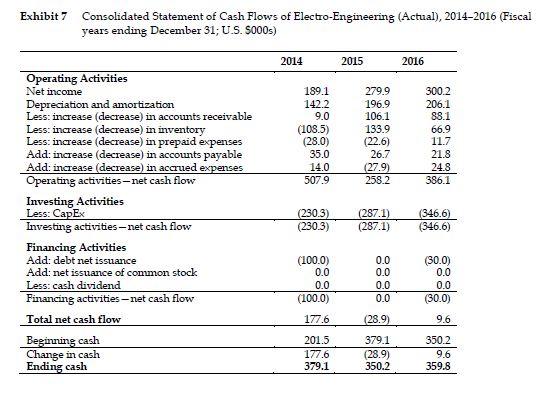

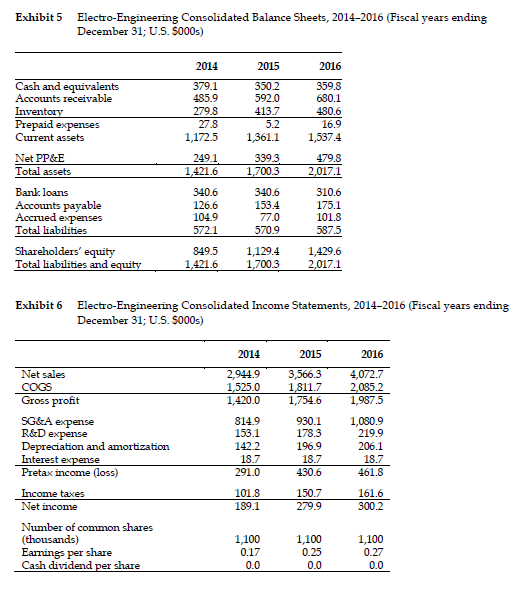

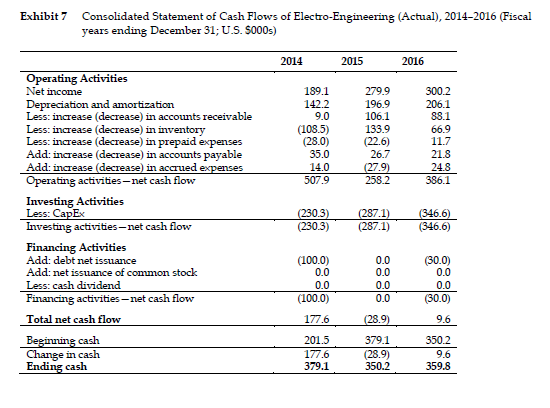

Marshall was also interested in expanding into the fiber-optic sensor segment. She was assessing whether to purchase Electro-Engineering (EE), a small manufacturer of fiber-optic sensors based in Gaithersburg, Maryland, that was privately owned. EE's unique technology enabled it to construct optical temperature probes from low-cost and high-strength materials. Its sensors were less expensive, more durable, and easier to install than were other competitive optical products. EE's financial reports indicated that it had total assets of $2 million and revenues of $4 million in 2016. (Exhibits 5, 6, and 7 show EE's balance sheet, income statement, and statement of cash flows, respectively.)

Marshall had investigated EE's operations and the compatibility of its business with Burton's operations. She found that, although EE's products were attractive, EE was not operated efficiently. She estimated that by giving EE access to Burton's distribution network, EE could reduce its selling, general, and administrative (SG&A) expenses from 26.54% to 23.86% annually. The combined company could also offer bundled products, which Marshall estimated would enable EE to grow its sales by 24% in 2017, 17.5% in 2018, 15% in 2019, 12% in 2020, and 10% in 2021. Further, by giving EE access to Burton's supply chain, she believed EE could immediately reduce its costs of goods sold from 51% to 49%. Finally, she felt that if EE were part of a bigger enterprise, its suppliers would provide better termsof trade credit than they did now. She estimated that accounts payable would increase to 4.5% of sales and remain at that level.

EE's strong balance sheet also attracted Marshall's attention. She knew that EE carried a large amount of unsecured debt capacity. Through her informal conversation with EE's owner, she learned that he was willing to sell his 100% equity holdings for 10 times 2016 earnings before interest, taxes, depreciation, and amortization in exchange for Burton's common stock, which he valued at $4.75 a share.

To facilitate the analysis, Marshall asked her assistant to gather the relevant information. The yield on the 10-year U.S. treasury note was 3%. The equity-risk premium was 5.8%. The yield on Baa-rated corporate bonds was 4.8%. Marshall assumed that EE would maintain its historical ratios of R&D expenses and depreciation and amortization as a percentage of sales.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started