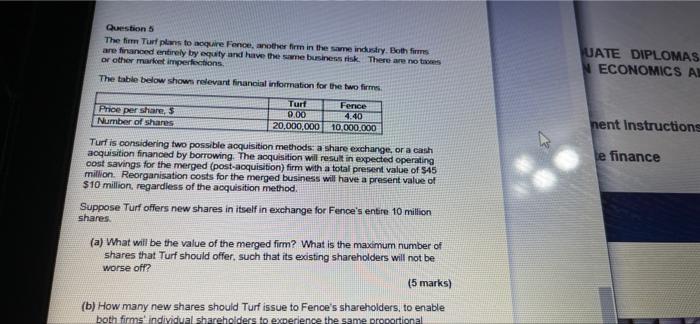

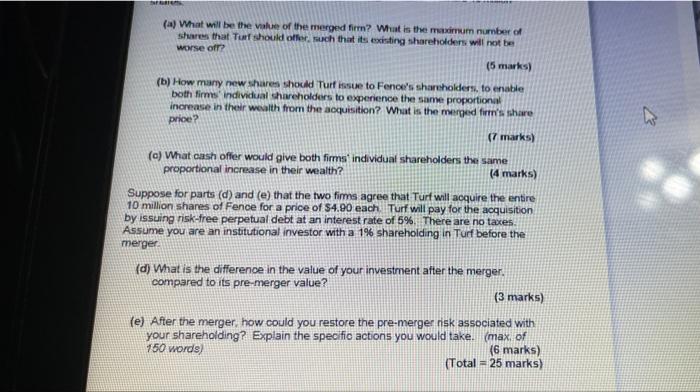

Questions The firm Turf plans to square Fence, another form in the same industry. Bothms are financed entirely by equity and have the same business risk. There are not or other market imperfections UATE DIPLOMAS ECONOMICS AL The table below shows relevant financial information for the two firme Price per share, Number of shares Turt 0.00 20.000.000 Ferice 4.40 10.000.000 nent Instructions le finance Turf is considering two possible acquisition methods a share exchange, or a cash acquisition financed by borrowing. The acquisition will result in expected operating cost savings for the merged (post-acquisition) firm with a total present value of $45 million. Reorganisation costs for the merged business will have a present value of $10 million regardless of the acquisition method. Suppose Turf offers new shares in itself in exchange for Fence's entire 10 million shares (a) What will be the value of the merged firm? What is the maximum number of shares that Turf should offer, such that its existing shareholders will not be worse off? (5 marks) (b) How many new shares should Turf issue to Fence's shareholders, to enable both firms individual shareholders to experience the same proportional (a) What will be the value of the merged firm? What is the maximum number of shares that Turf should offer much that its existing shareholders will not be worse of (5 marks) (b) How many new shares should Turf issue to Fence's shareholders, to enable both times individual shareholders to experience the same proportional increase in their wealth from the acquisition? What is the merged firm's share price? (7 marks) (a) What cash offer would give both firms individual shareholders the same proportional increase in their wealth? (4 marks) Suppose for parts (d) and (e) that the two fims agree that Turf will acquire the entire 10 million shares of Fence for a price of $4.90 each. Turf will pay for the acquisition by issuing risk-free perpetual debt at an interest rate of 5% There are no taxes Assume you are an institutional investor with a 1% shareholding in Turf before the merger (d) What is the difference in the value of your investment after the merger. compared to its pre-merger value? (3 marks) (e) After the merger, how could you restore the pre-merger nsk associated with your shareholding? Explain the specific actions you would take. (max. of 150 words) (6 marks) (Total = 25 marks) Questions The firm Turf plans to square Fence, another form in the same industry. Bothms are financed entirely by equity and have the same business risk. There are not or other market imperfections UATE DIPLOMAS ECONOMICS AL The table below shows relevant financial information for the two firme Price per share, Number of shares Turt 0.00 20.000.000 Ferice 4.40 10.000.000 nent Instructions le finance Turf is considering two possible acquisition methods a share exchange, or a cash acquisition financed by borrowing. The acquisition will result in expected operating cost savings for the merged (post-acquisition) firm with a total present value of $45 million. Reorganisation costs for the merged business will have a present value of $10 million regardless of the acquisition method. Suppose Turf offers new shares in itself in exchange for Fence's entire 10 million shares (a) What will be the value of the merged firm? What is the maximum number of shares that Turf should offer, such that its existing shareholders will not be worse off? (5 marks) (b) How many new shares should Turf issue to Fence's shareholders, to enable both firms individual shareholders to experience the same proportional (a) What will be the value of the merged firm? What is the maximum number of shares that Turf should offer much that its existing shareholders will not be worse of (5 marks) (b) How many new shares should Turf issue to Fence's shareholders, to enable both times individual shareholders to experience the same proportional increase in their wealth from the acquisition? What is the merged firm's share price? (7 marks) (a) What cash offer would give both firms individual shareholders the same proportional increase in their wealth? (4 marks) Suppose for parts (d) and (e) that the two fims agree that Turf will acquire the entire 10 million shares of Fence for a price of $4.90 each. Turf will pay for the acquisition by issuing risk-free perpetual debt at an interest rate of 5% There are no taxes Assume you are an institutional investor with a 1% shareholding in Turf before the merger (d) What is the difference in the value of your investment after the merger. compared to its pre-merger value? (3 marks) (e) After the merger, how could you restore the pre-merger nsk associated with your shareholding? Explain the specific actions you would take. (max. of 150 words) (6 marks) (Total = 25 marks)