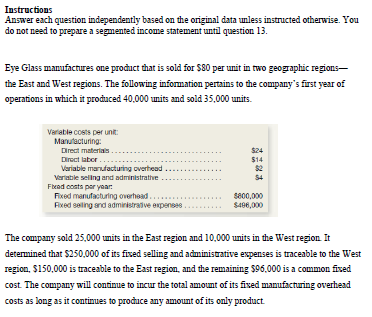

Questions to answer

Answer to question 1 to 4

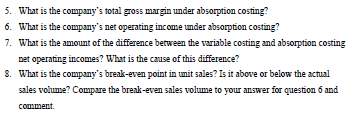

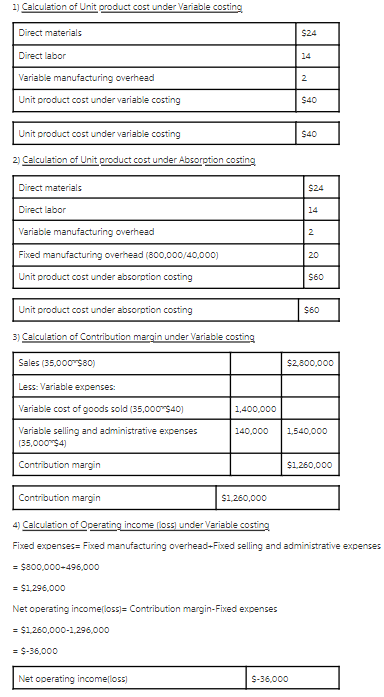

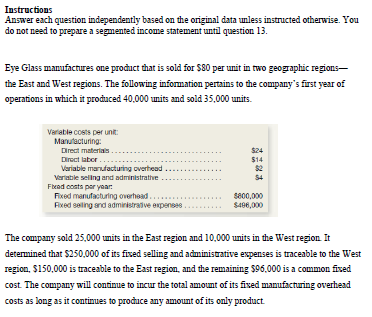

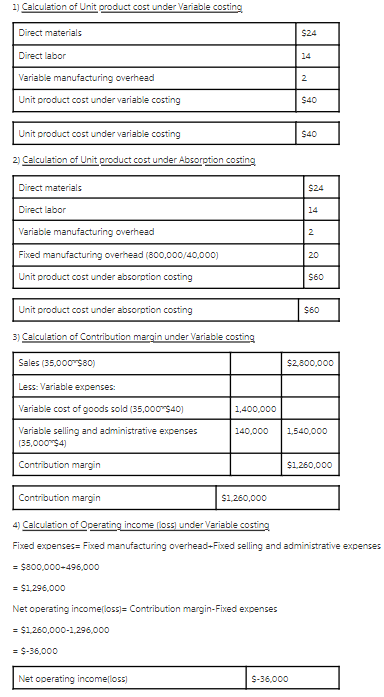

Instructions Answer each question independently based on the original data unless instructed otherwise. You do not need to prepare a segmented income statement until question 13. Eye Glass manufactures one product that is sold for $80 per unit in two geographic regions, the East and West regions. The following information pertains to the company's first year of operations in which it produced 40.000 units and sold 35,000 units. $24 $14 Verable costs per unit Manufacturing: Direct materias Direct labor Variable manufacturing overhead Variable selling and administrative Feed costs per year Fixed manufacturing overhead Fixed selling and administrative open 54 $800,000 $496,000 The company sold 25,000 umits in the East region and 10,000 units in the West region It determined that $250,000 of its fixed selling and acim.inistrative expenses is traceable to the West region, $150,000 is traceable to the East region, and the remaining $96.000 is a common fised cost. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product 5. What is the company's total gross margin under absorption costing? 6. What is the company's net operating income under absorption costing? 7. What is the amount of the difference between the variable costing and absorption costing net operating incomes? What is the cause of this difference? 8. What is the company's break-even point in unit sales? Is it above or below the actual sales volume? Compare the break-even sales volume to your answer for question 6 and comment 1) Calculation of Unit product cost under Variable costing Direct materials $24 Direct labor 14 Variable manufacturing overhead 2. Unit product cost under variable costing $40 Unit product cost under variable costing $40 2) Calculation of Unit product cost under Absorption costing Direct materials $24 Direct labor 14 Variable manufacturing overhead 2 Fixed manufacturing overhead (800,000/40,000) 20 Unit product cost under absorption costing $60 Unit product cost under absorption costing $60 3) Calculation of Contribution margin under Variable costing Sales (35,000 $80) $2.800,000 Less: Variable expenses: 1,400,000 Variable cost of goods sold (35,000 $40) Variable selling and administrative expenses (35,000 $4) 140,000 1.540,000 Contribution margin $1,260,000 Contribution margin SI 260,000 4) Calculation of Operating income (loss) under Variable costing Fixed expenses Fixed manufacturing overhead-Fixed selling and administrative expenses = $800,000-496,000 = $1.296,000 Net operating incomerlossj= Contribution margin-Fixed expenses = $1.260,000-1.296,000 = $-36.000 Net operating incomellose) S-36.000