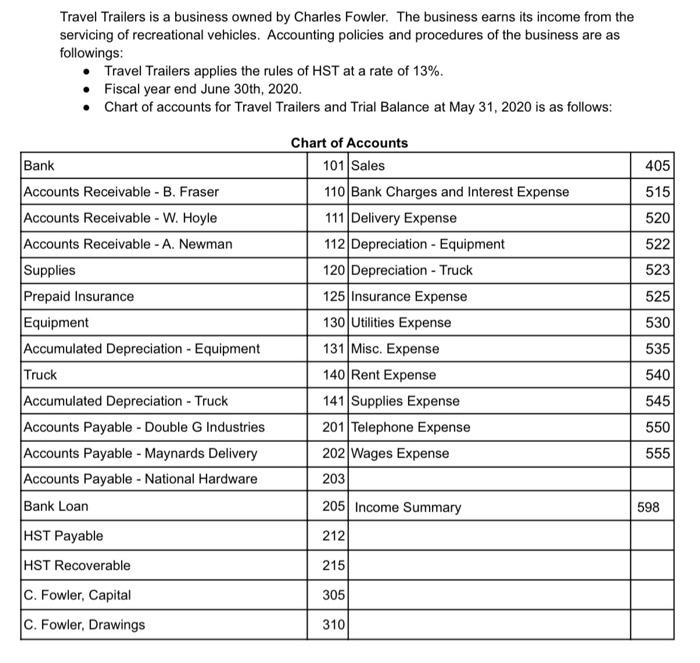

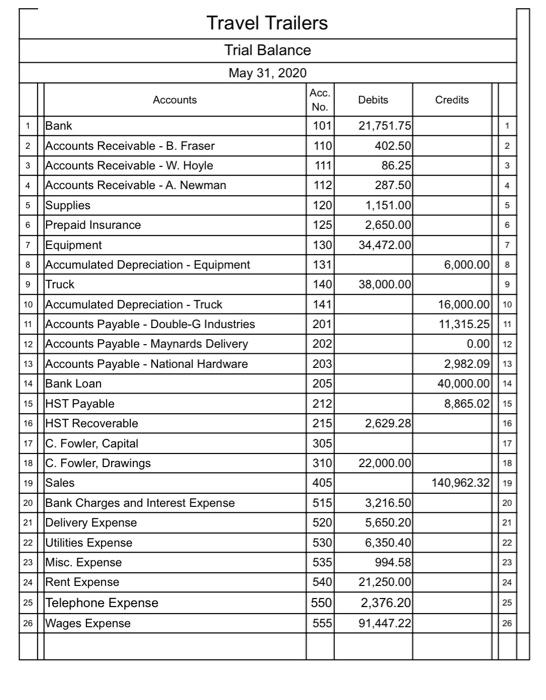

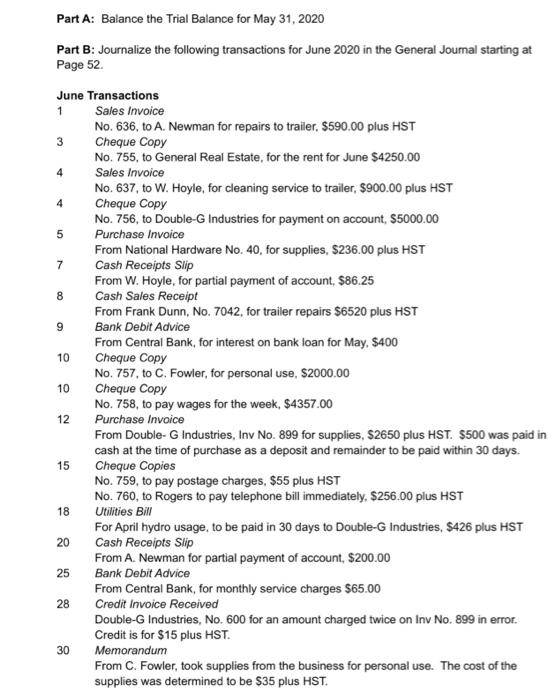

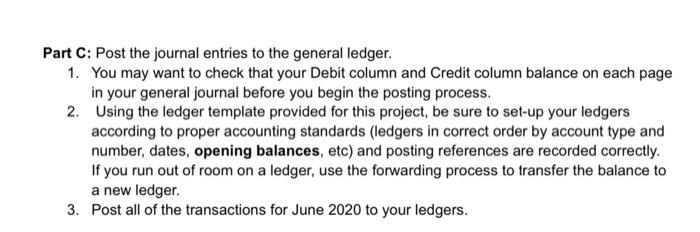

Travel Trailers is a business owned by Charles Fowler. The business earns its income from the servicing of recreational vehicles. Accounting policies and procedures of the business are as followings: Travel Trailers applies the rules of HST at a rate of 13%. Fiscal year end June 30th, 2020. Chart of accounts for Travel Trailers and Trial Balance at May 31, 2020 is as follows: 405 515 520 522 523 525 530 Chart of Accounts 101 Sales 110 Bank Charges and Interest Expense 111 Delivery Expense 112 Depreciation - Equipment 120 Depreciation - Truck 125 Insurance Expense 130 Utilities Expense 131 Misc. Expense 140 Rent Expense 141 Supplies Expense 201 Telephone Expense 202 Wages Expense 203 205 Income Summary 212 Bank Accounts Receivable - B. Fraser Accounts Receivable - W. Hoyle Accounts Receivable - A. Newman Supplies Prepaid Insurance Equipment Accumulated Depreciation - Equipment Truck Accumulated Depreciation - Truck Accounts Payable - Double G Industries Accounts Payable - Maynards Delivery Accounts Payable - National Hardware Bank Loan HST Payable HST Recoverable C. Fowler, Capital 535 540 545 550 555 598 215 305 C. Fowler, Drawings 310 Debits Credits 1 2 2 3 " 4 21,751.75 402.50 86.25 287.50 1,151.00 2,650.00 34,472.00 5 6 7 6,000.00 8 9 38,000.00 9 Travel Trailers Trial Balance May 31, 2020 Acc. Accounts No. Bank 101 Accounts Receivable - B. Fraser 110 Accounts Receivable - W. Hoyle 111 Accounts Receivable - A. Newman 112 5 Supplies 120 6 Prepaid Insurance 125 Equipment 130 8 Accumulated Depreciation - Equipment 131 Truck 140 10 Accumulated Depreciation - Truck 141 11 | Accounts Payable - Double-G Industries 201 12 Accounts Payable - Maynards Delivery 202 13 Accounts Payable - National Hardware 203 14 | Bank Loan 205 15 HST Payable 212 16 HST Recoverable 215 17|c. Fowler, Capital 305 18. Fowler, Drawings 310 Sales 405 20 Bank Charges and Interest Expense 515 21 Delivery Expense 520 22 Utilities Expense 530 23 Misc. Expense 535 24 Rent Expense 540 25 Telephone Expense 550 26 Wages Expense 555 16,000.00 10 11,315.2511 0.00112 2,982.09 13 40,000.00|| 14 8,865.02.15 16 2,629.28 17 22,000.00 18 19 140,962.3219 20 21 22 3,216.50 5,650.20 6,350.40 994.58 21,250.00 2,376.20 91,447.22 24 25 26 Part A: Balance the Trial Balance for May 31, 2020 Part B: Journalize the following transactions for June 2020 in the General Journal starting at Page 52 4 4 8 9 10 June Transactions 1 Sales Invoice No. 636, to A. Newman for repairs to trailer. $590.00 plus HST 3 Cheque Copy No. 755, to General Real Estate, for the rent for June $4250.00 Sales Invoice No. 637, to W. Hoyle, for cleaning service to trailer, $900.00 plus HST Cheque Copy No. 756, to Double-G Industries for payment on account, $5000.00 5 Purchase Invoice From National Hardware No. 40, for supplies, $236.00 plus HST 7 Cash Receipts Slip From W. Hoyle, for partial payment of account, $86.25 Cash Sales Receipt From Frank Dunn, No. 7042, for trailer repairs $6520 plus HST Bank Debit Advice From Central Bank, for interest on bank loan for May, $400 Cheque Copy No. 757, to C. Fowler, for personal use, $2000.00 Cheque Copy No. 758, to pay wages for the week, $4357.00 Purchase Invoice From Double-G Industries, Inv No. 899 for supplies, S2650 plus HST. $500 was paid in cash at the time of purchase as a deposit and remainder to be paid within 30 days. Cheque Copies No. 759, to pay postage charges, $55 plus HST No. 760, to Rogers to pay telephone bill immediately, $256.00 plus HST Utilities Bill For April hydro usage, to be paid in 30 days to Double-G Industries, S426 plus HST Cash Receipts Slip From A. Newman for partial payment of account, $200.00 Bank Debit Advice From Central Bank, for monthly service charges $65.00 Credit Invoice Received Double-G Industries, No. 600 for an amount charged twice on Inv No. 899 in error. Credit is for $15 plus HST. Memorandum From C. Fowler, took supplies from the business for personal use. The cost of the supplies was determined to be $35 plus HST. 10 12 15 18 20 25 28 30 Part C: Post the journal entries to the general ledger. 1. You may want to check that your Debit column and Credit column balance on each page in your general journal before you begin the posting process. 2. Using the ledger template provided for this project, be sure to set-up your ledgers according to proper accounting standards (ledgers in correct order by account type and number, dates, opening balances, etc) and posting references are recorded correctly. If you run out of room on a ledger, use the forwarding process to transfer the balance to a new ledger 3. Post all of the transactions for June 2020 to your ledgers