Question: QUESTIONS Using your own words based on the journal article above of Efficiency, Effectiveness and Risk in Australian Banking Industry by Amir Moradi-Motlagh, Ali Salman

QUESTIONS

Using your own words based on the journal article above of "Efficiency, Effectiveness and Risk in Australian Banking Industry" by Amir Moradi-Motlagh, Ali Salman Saleh, Amir Abdekhodaee and Mehran Ektesabi (2011),

a) State and elaborate on the problem statement in the journal article.

b) State the research questions and objectives based on the journal article.

c) What are the research design used in the research study? Explain it.

Hope the experts may answers my questions above.

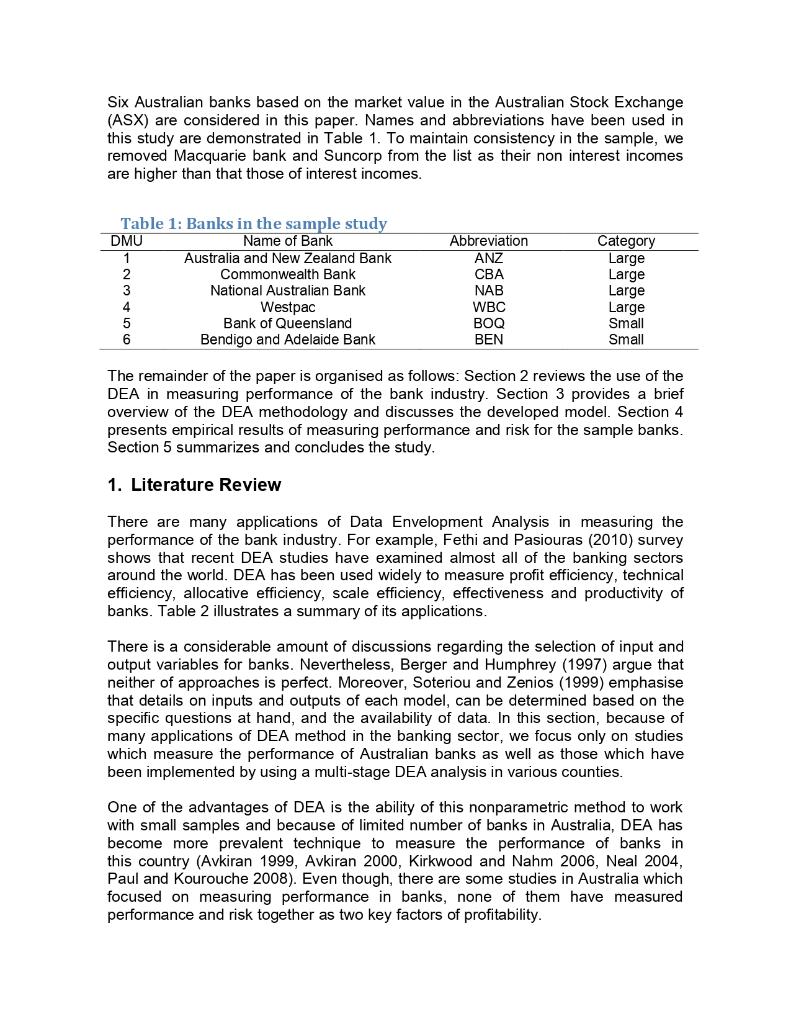

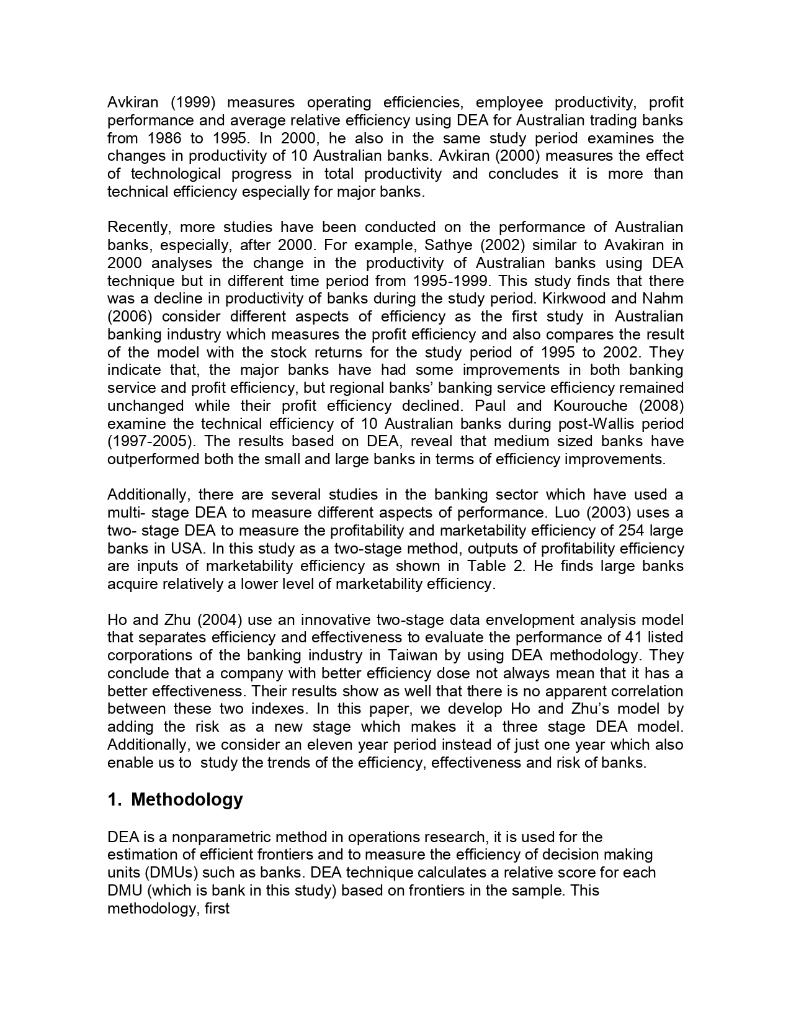

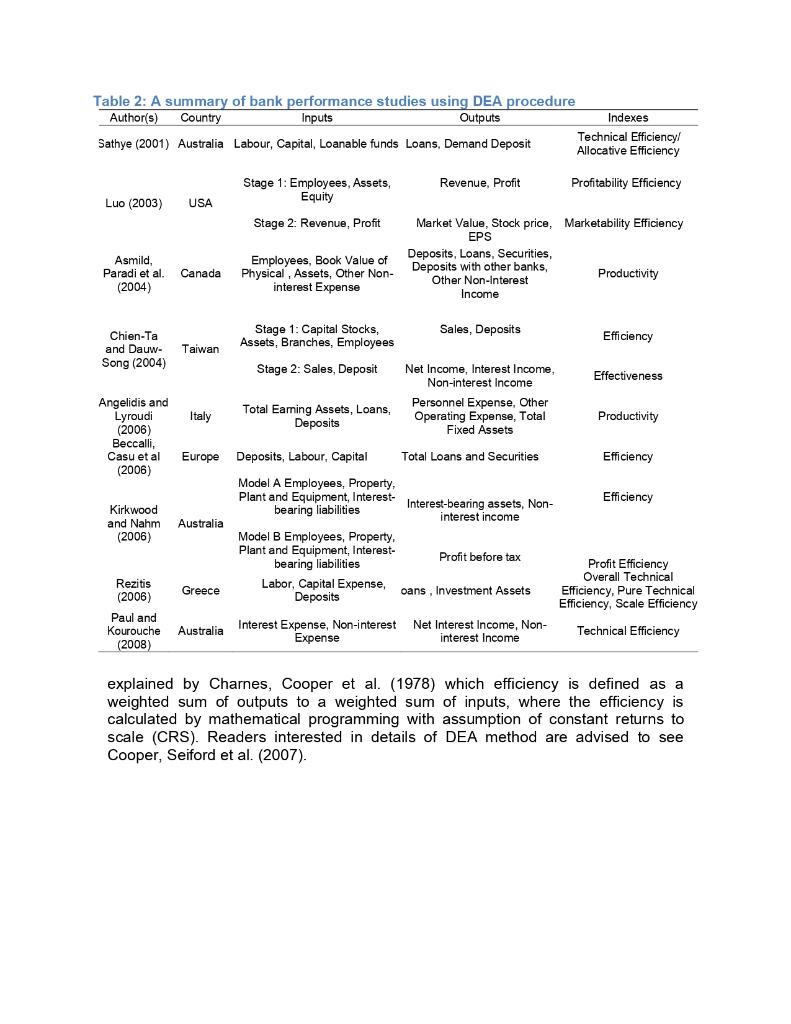

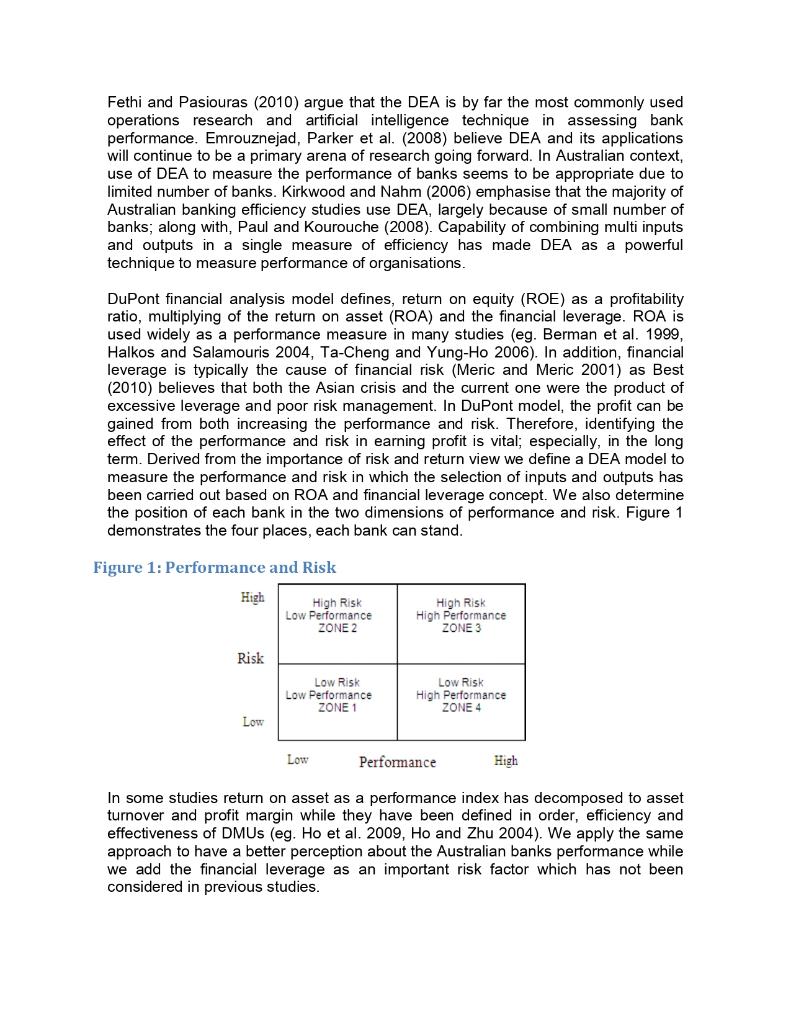

Deficiency Efficiency, Effectiveness and Risk in Australian Banking Industry Amir Moradi-Motlagh*, Ali Salman Saleh**, Amir Abdekhodaee*** and Mehran Ektesabi**** This paper analyses three aspects of profitability of banking industry in Australia over the period from 2000 to 2010. Using a three-stage Data Envelopment analysis (DEA) technique, we measure sources of profitability, which are risk, efficiency and effectiveness. This study utilizes a DuPont financial ratio analysis method to determine inputs and outputs variables of the DEA model. We break the and effectiveness. By doing so, this decomposition enhances our understanding about the sources of the profitability. Results from the DEA model indicate that the effectiveness of the large banks is greater than the small sized banks. On the contrary, the small sized banks are able to achieve higher efficiency scores. In addition, some banks gain their profit due to taking higher risk rather than others which might not be sustainable in the longer term. The results demonstrate as well that the averages of the risk scores of the small banks greater than large banks during the study period. Field of Research: Banking, Data Envelopment Analysis, Efficiency, Effectiveness, Risk 1. Introduction There is no doubt that banking industry plays a central role in the economy. For instance, in Australia, in June 2010, the financial sector has had the most market capitalisation among the other sectors with 35 per cent of the whole capital in the market. Due to this key position, measuring banks performance has been an issue of major interest for academics, managers, policy makers and stockholders. Therefore, many studies have recently focused for review of 196 studies in assessing bank performance). Most bank performance studies focus only on different aspect of performance, neglecting the effect of risk in their analyses (eg, Sathy 2001, Luo 2003, Kirkwood and Nahm 2006, Paul and Kourouche 2008). A study of banks performance regarding to the risk is significant due to the effect of risk factors in the long term profit. Raise in the profit can be achieved with a high risk, thus it is interesting to detect the source of profit. Given the above issues, this paper attempts to extend the current performance literature in banking industry by evaluating the trend of Australian banks profitability in term of performance and risk by using Data Envelopment Analysis (DEA) method which is a mathematical programming technique to measure the performance of organizations in compare to frontiers in the sample. This study is unique due to the study period and also, it is the first study in Australian banking industry which measures three factors of the profitability (risk, efficiency and effectiveness) using a nonparametric technique. Six Australian banks based on the market value in the Australian Stock Exchange (ASX) are considered in this paper. Names and abbreviations have been used in this study are demonstrated in Table 1. To maintain consistency in the sample, we removed Macquarie bank and Suncorp from the as their non interest incomes are higher than that those of interest incomes. Table 1: Banks in the sample study DMU Name of Bank 1 Australia and New Zealand Bank Commonwealth Bank 3 National Australian Bank 4 Westpac 5 Bank of Queensland 6 Bendigo and Adelaide Bank Abbreviation ANZ NAB WBC BOQ BEN Category Large Large Large Large Small Small The remainder of the paper is organised as follows: Section 2 reviews the use of the DEA in measuring performance of the bank industry. Section 3 provides a brief overview of the DEA methodology and discusses the developed model. Section 4 presents empirical results of measuring performance and risk for the sample banks. Section 5 summarizes and concludes the study. 1. Literature Review There are many applications of Data Envelopment Analysis in measuring the performance of the bank industry. For example, Fethi and Pasiouras (2010) survey shows that recent DEA studies have examined almost all of the banking sectors around the world. DEA has been used widely to measure profit efficiency, technical efficiency, allocative efficiency, scale efficiency, effectiveness and productivity of banks. Table 2 illustrates a summary of its applications. There is a considerable amount of discussions regarding the selection of input and output variables for banks. Nevertheless, Berger and Humphrey (1997) argue that neither of approaches is perfect. Moreover, Soteriou and Zenios (1999) emphasise that details on inputs and outputs of each model, can be determined based on the specific questions at hand, and the availability of data. In this section, because of many applications of DEA method in the banking sector, we focus only on studies which measure the performance of Australian banks as well as those which have been implemented by using a multi-stage DEA analysis in various counties. One of the advantages of DEA is the ability of this nonparametric method to work with small samples and because of limited number of banks in Australia, DEA has become more prevalent technique to measure the performance of banks in this country (Avkiran 1999, Avkiran 2000, Kirkwood and Nahm 2006, Neal 2004, Paul and Kourouche 2008). Even though, there are some studies in Australia which focused on measuring performance in banks, none of them have measured performance and risk together as two key factors of profitability. Avkiran (1999) measures operating efficiencies, employee productivity, profit performance and average relative efficiency using DEA for Australian trading banks from 1986 to 1995. In 2000, he also in the same study period examines the changes in productivity of 10 Australian banks. Avkiran (2000) measures the effect of technological progress in total productivity and concludes it is more than technical efficiency especially for major banks. Recently, more studies have been conducted on the performance of Australian banks, especially, after 2000. For example, Sathye (2002) similar to Avakiran in 2000 analyses the change in the productivity of Australian banks using DEA technique but in different time period from 1995-1999. This study finds that there was a decline in productivity of banks during the study period. Kirkwood and Nahm (2006) consider different aspects of efficiency as the first study in Australian banking industry which measures the profit efficiency and also compares the result of the model with the stock returns for the study period of 1995 to 2002. They indicate that, the major banks have had some improvements in both banking service and profit efficiency, but regional banks' banking service efficiency remained unchanged while their profit efficiency declined. Paul and Kourouche (2008) examine the technical efficiency of 10 Australian banks during post-Wallis period (1997-2005). The results based on DEA, reveal that medium sized banks have outperformed both the small and large banks in terms of efficiency improvements. Additionally, there are several studies in the banking sector which have used a multi- stage DEA to measure different aspects of performance. Luo (2003) uses a two-stage DEA to measure the profitability and marketability efficiency of 254 large banks in USA. In this study as a two-stage method, outputs of profitability efficiency are inputs of marketability efficiency as shown in Table 2. He finds large banks acquire relatively a lower level of marketability efficiency. Ho and Zhu (2004) use an innovative two-stage data envelopment analysis model that separates efficiency and effectiveness to evaluate the performance of 41 listed corporations of the banking industry in Taiwan by using DEA methodology. They conclude that a company with better efficiency dose not always mean that it has a better effectiveness. Their results show as well that there is no apparent correlation between these two indexes. In this paper, we develop Ho and Zhu's model by adding the risk as a new stage which makes it a three stage DEA model. Additionally, we consider an eleven year period instead of just one year which also enable us to study the trends of the efficiency, effectiveness and risk of banks. 1. Methodology DEA is a nonparametric method in operations research, it is used for the estimation of efficient frontiers and to measure the efficiency of decision making units (DMUS) such as banks. DEA technique calculates a relative score for each DMU (which is bank in this study) based on frontiers in the sample. This methodology, first Table 2: A summary of bank performance studies using DEA procedure Author(s) Country Inputs Outputs Indexes Sathye (2001) Australia Labour, Capital, Loanable funds Loans, Demand Deposit Technical Efficiency/ Allocative Efficiency Stage 1: Employees, Assets, Equity Revenue. Profit Profitability Efficiency Luo (2003) USA Stage 2: Revenue, Profit Asmild. Paradi et al. (2004) Market Value, Stock price, Marketability Efficiency EPS Deposits, Loans, Securities, Deposits with other banks, Productivity Other Non-Interest Income Employees, Book Value of Physical, Assets, Other Non- interest Expense Canada Sales, Deposits Efficiency Chien-Ta and Dauw- Song (2004) Taiwan Stage 1: Capital Stocks, Assets, Branches, Employees Stage 2: Sales, Deposit Effectiveness Net Income, Interest Income, Non-interest Income Personnel Expense, Other Operating Expense, Total Fixed Assets Italy Total Eaming Assets, Loans, Deposits Angelidis and Lyroudi (2006) Beccalli, Casu et al (2006) Productivity Europe Efficiency Efficiency Kirkwood and Nahm (2006) Australia Deposits, Labour, Capital Total Loans and Securities Model A Employees, Property, Plant and Equipment, Interest Interest-bearing assets, Non- bearing liabilities interest income Model B Employees, Property, Plant and Equipment, Interest- Profit before tax bearing liabilities Labor, Capital Expense, oans, Investment Assets Deposits Greece Rezitis (2006) Paul and Kourouche Profit Efficiency Overall Technical Efficiency, Pure Technical Efficiency, Scale Efficiency Australia Interest Expense, Non-interest Expense Net Interest Income, Non- interest Income Technical Efficiency (2008) explained by Charnes, Cooper et al. (1978) which efficiency is defined as a weighted sum of outputs to a weighted sum of inputs, where the efficiency is calculated by mathematical programming with assumption of constant returns to scale (CRS). Readers interested in details of DEA method are advised to see Cooper, Seiford et al. (2007). Fethi and Pasiouras (2010) argue that the DEA is by far the most commonly used operations research and artificial intelligence technique in assessing bank performance. Emrouznejad, Parker et al. (2008) believe DEA and its applications will continue to be a primary arena of research going forward. In Australian context, use of DEA to measure the performance of banks seems to be appropriate due to limited number of banks. Kirkwood and Nahm (2006) emphasise that the majority of Australian banking efficiency studies use DEA, largely because of small number of banks, along with, Paul and Kourouche (2008). Capability of combining multi inputs and outputs in a single measure of efficiency has made DEA as a powerful technique to measure performance of organisations. DuPont financial analysis model defines, return on equity (ROE) as a profitability ratio, multiplying of the return on asset (ROA) and the financial leverage. ROA is used widely as a performance measure in many studies (eg. Berman et al. 1999, Halkos and Salamouris 2004, Ta-Cheng and Yung-Ho 2006). In addition, financial leverage is typically the cause of financial risk (Meric and Meric 2001) as Best (2010) believes that both the Asian crisis and the current one were the product of excessive leverage and poor risk management. In DuPont model, the profit can be gained from both increasing the performance and risk. Therefore, identifying the effect of the performance and risk in earning profit is vital; especially, in the long term. Derived from the importance of risk and return view we define a DEA model to measure the performance and risk in which the selection of inputs and outputs has been carried out based on ROA and financial leverage concept. We also determine the position of each bank in the two dimensions of performance and risk. Figure 1 demonstrates the four places, each bank can stand. Figure 1: Performance and Risk High High Risk Low Performance ZONE 2 High Risk High Performance ZONE 3 Risk Low Risk Low Performance ZONE 1 Low Risk High Performance ZONE 4 Low Low Performance High In some studies return on asset as a performance index has decomposed to asset turnover and profit margin while they have been defined in order, efficiency and effectiveness of DMUs (eg. Ho et al. 2009, Ho and Zhu 2004). We apply the same approach to have a better perception about the Australian banks performance while we add the financial leverage as an important risk factor which has not been considered in previous studies. In our three-stage DEA model, the first stage addresses the risk, the degree to which a bank is utilizing borrowed money. The second stage measures efficiency, the ability of a bank to generate income from assets and resources and the last stage, effectiveness measures the ability of a bank to generate profit from its incomes. Figure 2 indicates the stages and the input and output variables of each stage. Stage 1 Figure 2: The inputs and outputs of the stages Stage 2 Risk Efficiency -Assets -Interest Income Equity Employees -Non Interest Income -Deposits Stage 3 Effectiveness Profit The DEA model employed in this study is the CCR model also DEA output-oriented model is chosen in the present study according to Charnes, Cooper et al. (1978) as follows: Max 0 ; m=1, 2... M {}-12; xjms Kjom {}-14; Vin 2 Oyjon ; n=1, 2... N ; 20 ; j=1,2... Where: O=1/0 O = the efficiency score bounded between 0 and 1 Xjm = the mth input of the th bank Yjn = the nth output of the th bank Aj = the ith bank weight value In this method, the score of each bank is a number between 0 to1 and the most risky, efficient and effective banks attain a score of 1, while other banks in the sample gain a score less than 1. Deficiency Efficiency, Effectiveness and Risk in Australian Banking Industry Amir Moradi-Motlagh*, Ali Salman Saleh**, Amir Abdekhodaee*** and Mehran Ektesabi**** This paper analyses three aspects of profitability of banking industry in Australia over the period from 2000 to 2010. Using a three-stage Data Envelopment analysis (DEA) technique, we measure sources of profitability, which are risk, efficiency and effectiveness. This study utilizes a DuPont financial ratio analysis method to determine inputs and outputs variables of the DEA model. We break the and effectiveness. By doing so, this decomposition enhances our understanding about the sources of the profitability. Results from the DEA model indicate that the effectiveness of the large banks is greater than the small sized banks. On the contrary, the small sized banks are able to achieve higher efficiency scores. In addition, some banks gain their profit due to taking higher risk rather than others which might not be sustainable in the longer term. The results demonstrate as well that the averages of the risk scores of the small banks greater than large banks during the study period. Field of Research: Banking, Data Envelopment Analysis, Efficiency, Effectiveness, Risk 1. Introduction There is no doubt that banking industry plays a central role in the economy. For instance, in Australia, in June 2010, the financial sector has had the most market capitalisation among the other sectors with 35 per cent of the whole capital in the market. Due to this key position, measuring banks performance has been an issue of major interest for academics, managers, policy makers and stockholders. Therefore, many studies have recently focused for review of 196 studies in assessing bank performance). Most bank performance studies focus only on different aspect of performance, neglecting the effect of risk in their analyses (eg, Sathy 2001, Luo 2003, Kirkwood and Nahm 2006, Paul and Kourouche 2008). A study of banks performance regarding to the risk is significant due to the effect of risk factors in the long term profit. Raise in the profit can be achieved with a high risk, thus it is interesting to detect the source of profit. Given the above issues, this paper attempts to extend the current performance literature in banking industry by evaluating the trend of Australian banks profitability in term of performance and risk by using Data Envelopment Analysis (DEA) method which is a mathematical programming technique to measure the performance of organizations in compare to frontiers in the sample. This study is unique due to the study period and also, it is the first study in Australian banking industry which measures three factors of the profitability (risk, efficiency and effectiveness) using a nonparametric technique. Six Australian banks based on the market value in the Australian Stock Exchange (ASX) are considered in this paper. Names and abbreviations have been used in this study are demonstrated in Table 1. To maintain consistency in the sample, we removed Macquarie bank and Suncorp from the as their non interest incomes are higher than that those of interest incomes. Table 1: Banks in the sample study DMU Name of Bank 1 Australia and New Zealand Bank Commonwealth Bank 3 National Australian Bank 4 Westpac 5 Bank of Queensland 6 Bendigo and Adelaide Bank Abbreviation ANZ NAB WBC BOQ BEN Category Large Large Large Large Small Small The remainder of the paper is organised as follows: Section 2 reviews the use of the DEA in measuring performance of the bank industry. Section 3 provides a brief overview of the DEA methodology and discusses the developed model. Section 4 presents empirical results of measuring performance and risk for the sample banks. Section 5 summarizes and concludes the study. 1. Literature Review There are many applications of Data Envelopment Analysis in measuring the performance of the bank industry. For example, Fethi and Pasiouras (2010) survey shows that recent DEA studies have examined almost all of the banking sectors around the world. DEA has been used widely to measure profit efficiency, technical efficiency, allocative efficiency, scale efficiency, effectiveness and productivity of banks. Table 2 illustrates a summary of its applications. There is a considerable amount of discussions regarding the selection of input and output variables for banks. Nevertheless, Berger and Humphrey (1997) argue that neither of approaches is perfect. Moreover, Soteriou and Zenios (1999) emphasise that details on inputs and outputs of each model, can be determined based on the specific questions at hand, and the availability of data. In this section, because of many applications of DEA method in the banking sector, we focus only on studies which measure the performance of Australian banks as well as those which have been implemented by using a multi-stage DEA analysis in various counties. One of the advantages of DEA is the ability of this nonparametric method to work with small samples and because of limited number of banks in Australia, DEA has become more prevalent technique to measure the performance of banks in this country (Avkiran 1999, Avkiran 2000, Kirkwood and Nahm 2006, Neal 2004, Paul and Kourouche 2008). Even though, there are some studies in Australia which focused on measuring performance in banks, none of them have measured performance and risk together as two key factors of profitability. Avkiran (1999) measures operating efficiencies, employee productivity, profit performance and average relative efficiency using DEA for Australian trading banks from 1986 to 1995. In 2000, he also in the same study period examines the changes in productivity of 10 Australian banks. Avkiran (2000) measures the effect of technological progress in total productivity and concludes it is more than technical efficiency especially for major banks. Recently, more studies have been conducted on the performance of Australian banks, especially, after 2000. For example, Sathye (2002) similar to Avakiran in 2000 analyses the change in the productivity of Australian banks using DEA technique but in different time period from 1995-1999. This study finds that there was a decline in productivity of banks during the study period. Kirkwood and Nahm (2006) consider different aspects of efficiency as the first study in Australian banking industry which measures the profit efficiency and also compares the result of the model with the stock returns for the study period of 1995 to 2002. They indicate that, the major banks have had some improvements in both banking service and profit efficiency, but regional banks' banking service efficiency remained unchanged while their profit efficiency declined. Paul and Kourouche (2008) examine the technical efficiency of 10 Australian banks during post-Wallis period (1997-2005). The results based on DEA, reveal that medium sized banks have outperformed both the small and large banks in terms of efficiency improvements. Additionally, there are several studies in the banking sector which have used a multi- stage DEA to measure different aspects of performance. Luo (2003) uses a two-stage DEA to measure the profitability and marketability efficiency of 254 large banks in USA. In this study as a two-stage method, outputs of profitability efficiency are inputs of marketability efficiency as shown in Table 2. He finds large banks acquire relatively a lower level of marketability efficiency. Ho and Zhu (2004) use an innovative two-stage data envelopment analysis model that separates efficiency and effectiveness to evaluate the performance of 41 listed corporations of the banking industry in Taiwan by using DEA methodology. They conclude that a company with better efficiency dose not always mean that it has a better effectiveness. Their results show as well that there is no apparent correlation between these two indexes. In this paper, we develop Ho and Zhu's model by adding the risk as a new stage which makes it a three stage DEA model. Additionally, we consider an eleven year period instead of just one year which also enable us to study the trends of the efficiency, effectiveness and risk of banks. 1. Methodology DEA is a nonparametric method in operations research, it is used for the estimation of efficient frontiers and to measure the efficiency of decision making units (DMUS) such as banks. DEA technique calculates a relative score for each DMU (which is bank in this study) based on frontiers in the sample. This methodology, first Table 2: A summary of bank performance studies using DEA procedure Author(s) Country Inputs Outputs Indexes Sathye (2001) Australia Labour, Capital, Loanable funds Loans, Demand Deposit Technical Efficiency/ Allocative Efficiency Stage 1: Employees, Assets, Equity Revenue. Profit Profitability Efficiency Luo (2003) USA Stage 2: Revenue, Profit Asmild. Paradi et al. (2004) Market Value, Stock price, Marketability Efficiency EPS Deposits, Loans, Securities, Deposits with other banks, Productivity Other Non-Interest Income Employees, Book Value of Physical, Assets, Other Non- interest Expense Canada Sales, Deposits Efficiency Chien-Ta and Dauw- Song (2004) Taiwan Stage 1: Capital Stocks, Assets, Branches, Employees Stage 2: Sales, Deposit Effectiveness Net Income, Interest Income, Non-interest Income Personnel Expense, Other Operating Expense, Total Fixed Assets Italy Total Eaming Assets, Loans, Deposits Angelidis and Lyroudi (2006) Beccalli, Casu et al (2006) Productivity Europe Efficiency Efficiency Kirkwood and Nahm (2006) Australia Deposits, Labour, Capital Total Loans and Securities Model A Employees, Property, Plant and Equipment, Interest Interest-bearing assets, Non- bearing liabilities interest income Model B Employees, Property, Plant and Equipment, Interest- Profit before tax bearing liabilities Labor, Capital Expense, oans, Investment Assets Deposits Greece Rezitis (2006) Paul and Kourouche Profit Efficiency Overall Technical Efficiency, Pure Technical Efficiency, Scale Efficiency Australia Interest Expense, Non-interest Expense Net Interest Income, Non- interest Income Technical Efficiency (2008) explained by Charnes, Cooper et al. (1978) which efficiency is defined as a weighted sum of outputs to a weighted sum of inputs, where the efficiency is calculated by mathematical programming with assumption of constant returns to scale (CRS). Readers interested in details of DEA method are advised to see Cooper, Seiford et al. (2007). Fethi and Pasiouras (2010) argue that the DEA is by far the most commonly used operations research and artificial intelligence technique in assessing bank performance. Emrouznejad, Parker et al. (2008) believe DEA and its applications will continue to be a primary arena of research going forward. In Australian context, use of DEA to measure the performance of banks seems to be appropriate due to limited number of banks. Kirkwood and Nahm (2006) emphasise that the majority of Australian banking efficiency studies use DEA, largely because of small number of banks, along with, Paul and Kourouche (2008). Capability of combining multi inputs and outputs in a single measure of efficiency has made DEA as a powerful technique to measure performance of organisations. DuPont financial analysis model defines, return on equity (ROE) as a profitability ratio, multiplying of the return on asset (ROA) and the financial leverage. ROA is used widely as a performance measure in many studies (eg. Berman et al. 1999, Halkos and Salamouris 2004, Ta-Cheng and Yung-Ho 2006). In addition, financial leverage is typically the cause of financial risk (Meric and Meric 2001) as Best (2010) believes that both the Asian crisis and the current one were the product of excessive leverage and poor risk management. In DuPont model, the profit can be gained from both increasing the performance and risk. Therefore, identifying the effect of the performance and risk in earning profit is vital; especially, in the long term. Derived from the importance of risk and return view we define a DEA model to measure the performance and risk in which the selection of inputs and outputs has been carried out based on ROA and financial leverage concept. We also determine the position of each bank in the two dimensions of performance and risk. Figure 1 demonstrates the four places, each bank can stand. Figure 1: Performance and Risk High High Risk Low Performance ZONE 2 High Risk High Performance ZONE 3 Risk Low Risk Low Performance ZONE 1 Low Risk High Performance ZONE 4 Low Low Performance High In some studies return on asset as a performance index has decomposed to asset turnover and profit margin while they have been defined in order, efficiency and effectiveness of DMUs (eg. Ho et al. 2009, Ho and Zhu 2004). We apply the same approach to have a better perception about the Australian banks performance while we add the financial leverage as an important risk factor which has not been considered in previous studies. In our three-stage DEA model, the first stage addresses the risk, the degree to which a bank is utilizing borrowed money. The second stage measures efficiency, the ability of a bank to generate income from assets and resources and the last stage, effectiveness measures the ability of a bank to generate profit from its incomes. Figure 2 indicates the stages and the input and output variables of each stage. Stage 1 Figure 2: The inputs and outputs of the stages Stage 2 Risk Efficiency -Assets -Interest Income Equity Employees -Non Interest Income -Deposits Stage 3 Effectiveness Profit The DEA model employed in this study is the CCR model also DEA output-oriented model is chosen in the present study according to Charnes, Cooper et al. (1978) as follows: Max 0 ; m=1, 2... M {}-12; xjms Kjom {}-14; Vin 2 Oyjon ; n=1, 2... N ; 20 ; j=1,2... Where: O=1/0 O = the efficiency score bounded between 0 and 1 Xjm = the mth input of the th bank Yjn = the nth output of the th bank Aj = the ith bank weight value In this method, the score of each bank is a number between 0 to1 and the most risky, efficient and effective banks attain a score of 1, while other banks in the sample gain a score less than 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts