Answered step by step

Verified Expert Solution

Question

1 Approved Answer

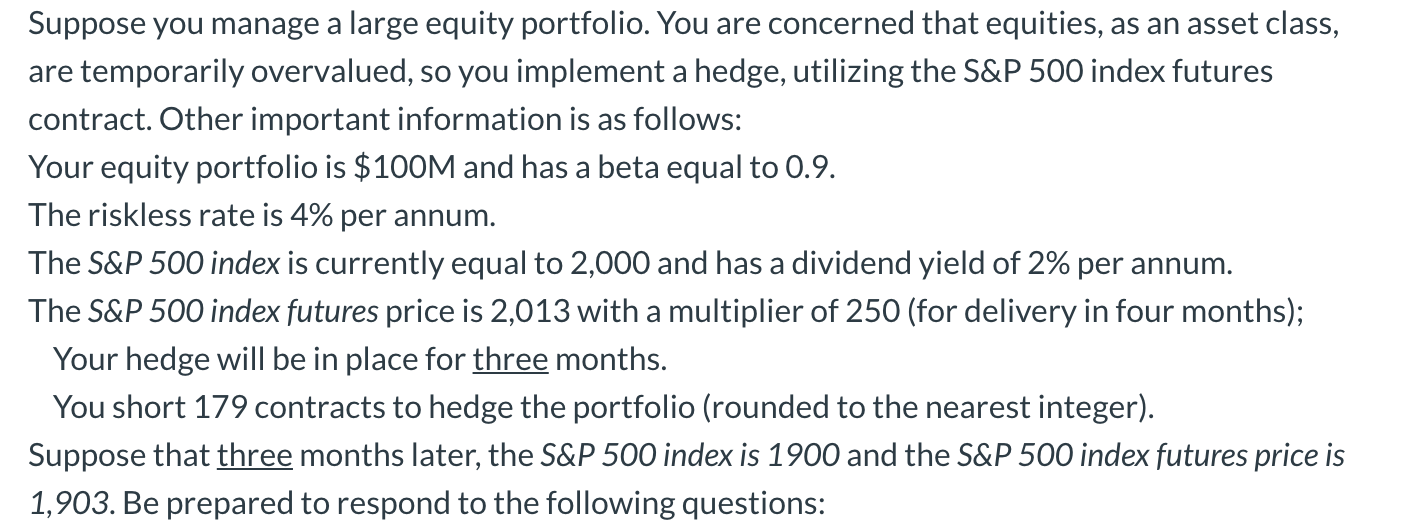

QUESTIONS: What is the cash flow associated with the futures position (also indicate positive or negative)? What is the percent return on the S&P500 market

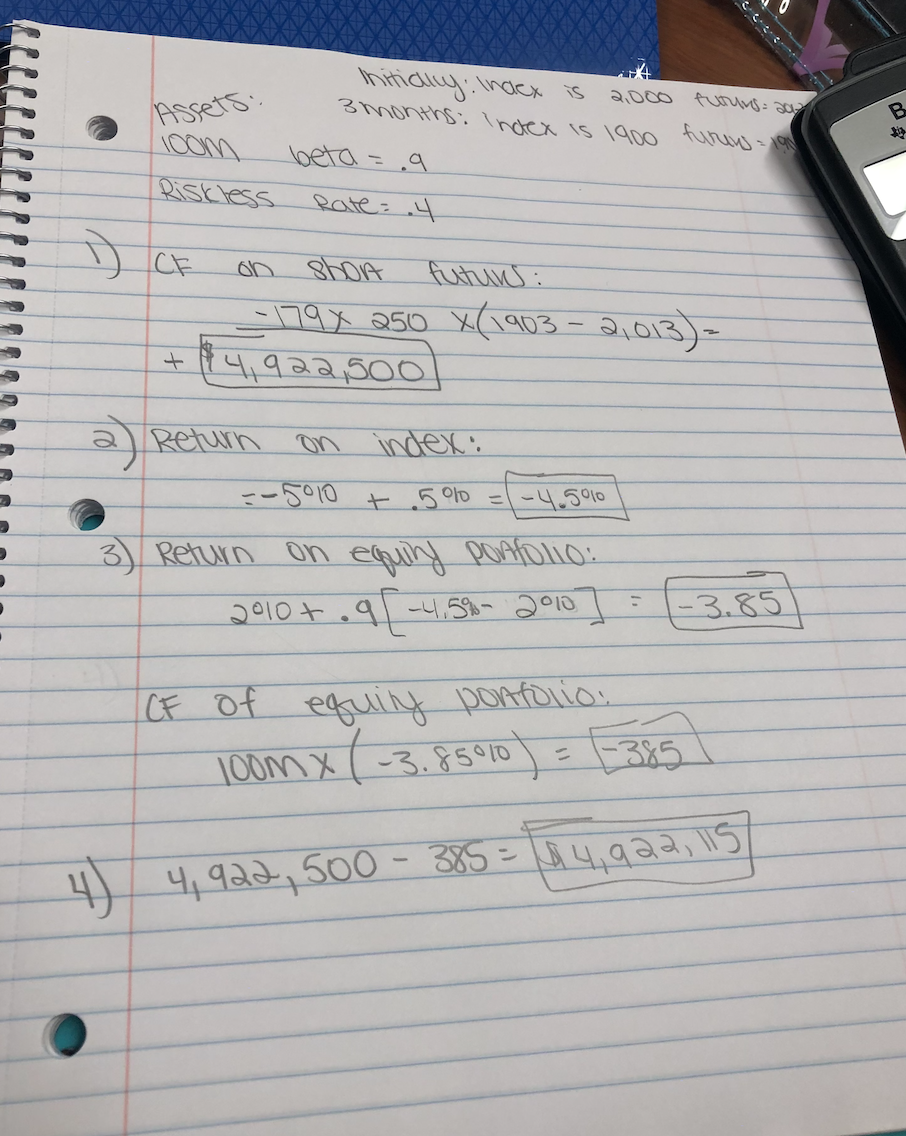

QUESTIONS: What is the cash flow associated with the futures position (also indicate positive or negative)?

QUESTIONS: What is the cash flow associated with the futures position (also indicate positive or negative)?

What is the percent return on the S&P500 market index (including dividends)?

What is the predicted percent return on the equity portfolio, as forecasted by CAPM?

What percent return (approx.) would you expect to earn on the hedged equity portfolio?

Attached are the numbers I got- checking to see if they are correct:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started