Questions:

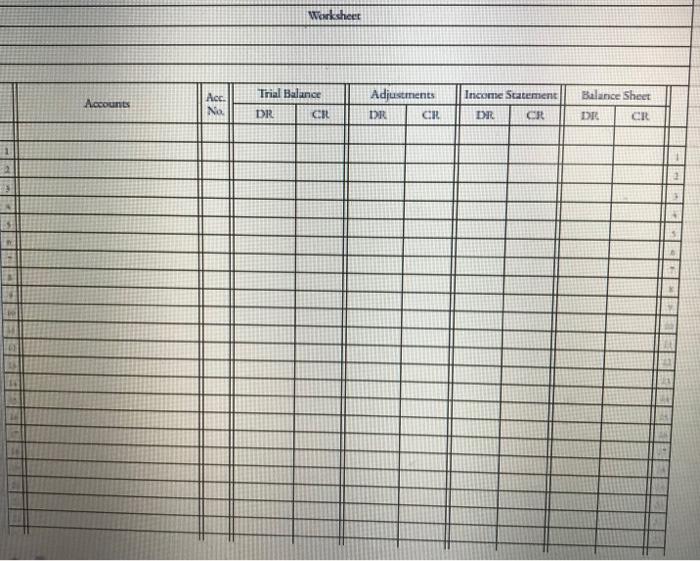

Worksheet Template:

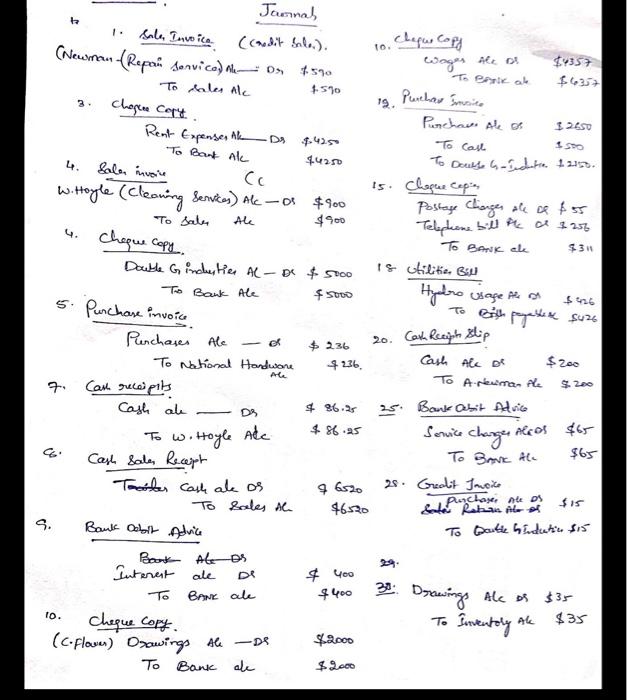

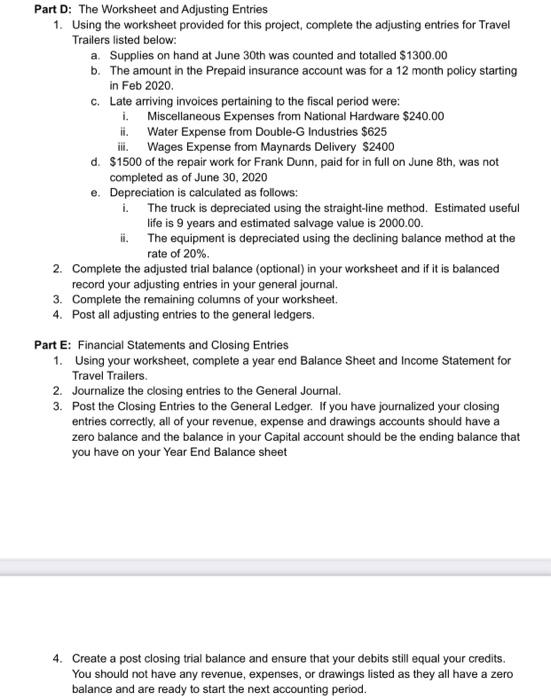

10. Chapus Copy Alt 126 DA L. 15 4. cheque copy, Journal 1. Sale, Convoice. (Credit Sal..). (NAM (@em anvico) - 02 4357 4590 To Propik at To sales Ale 510 19. Purches Smsice chogene Capt. Purchase the as Rent Expenses Al 4.42.50 To Cast To Bant al 14250 To Double 4-1 1215) Sale invoine Cc Chaque cepin W. Hoyle (Cleaning Services) Alc-os $900 Postage changes ale co $ 55 To saler the $900 Telephone bill me a 2256 To make Double Ginchester AL-D & 5000 Is Glitter Bu To Bank Ale $ some Hydro usage Ale on 5. Purchase invoice To with pastes $426 Purchases Ale $ 236 +236 Cash the be To National Handware $ 200 To A Newman the S. 200 7. Cash receipits Cash ale DS $ 86.25 25. Bank asit Advice $ 86.95 Service To BAVI Ale $65 Cash Sale, Recept Tociler cash ale os 4652 2s Grealit Tacice 1Purchases ne as $15 To Sales al $6520 Bank Dobit Advice To Double hindutin $15 Bank the Ds Interest ale De 30 BANK ale Drawings Ale as $35 To th $35 cheque copy. (c.flower) Drawings the De 42000 To Bank ale -2000 20. Cash Recipt slip Ale To w. Hoyle Ake Charger Alcos $65 S. $ 400 $400 10. Inventory ale Part D: The Worksheet and Adjusting Entries 1. Using the worksheet provided for this project, complete the adjusting entries for Travel Trailers listed below: a Supplies on hand at June 30th was counted and totalled $1300.00 b. The amount in the Prepaid insurance account was for a 12 month policy starting in Feb 2020. c. Late arriving invoices pertaining to the fiscal period were: i. Miscellaneous Expenses from National Hardware $240.00 i. Water Expense from Double-G Industries $625 iii. Wages Expense from Maynards Delivery $2400 d. $1500 of the repair work for Frank Dunn, paid for in full on June 8th, was not completed as of June 30, 2020 e. Depreciation is calculated as follows: i The truck is depreciated using the straight-line method. Estimated useful life is 9 years and estimated salvage value is 2000.00 ii. The equipment is depreciated using the declining balance method at the rate of 20% 2. Complete the adjusted trial balance (optional) in your worksheet and if it is balanced record your adjusting entries in your general journal. 3. Complete the remaining columns of your worksheet. 4. Post all adjusting entries to the general ledgers. Part E: Financial Statements and Closing Entries 1. Using your worksheet, complete a year end Balance Sheet and Income Statement for Travel Trailers 2. Journalize the closing entries to the General Journal. 3. Post the Closing Entries to the General Ledger. If you have journalized your closing entries correctly, all of your revenue, expense and drawings accounts should have a zero balance and the balance in your Cap account should be the ending balance that you have on your Year End Balance sheet 4. Create a post closing trial balance and ensure that your debits still equal your credits. You should not have any revenue, expenses, or drawings listed as they all have a zero balance and are ready to start the next accounting period. Work cheer Trial Balance Income Statement Accounts Acc. No. Adjustments DR CR Balance Sheet DR CR DR CR DR CR 1 2 10. Chapus Copy Alt 126 DA L. 15 4. cheque copy, Journal 1. Sale, Convoice. (Credit Sal..). (NAM (@em anvico) - 02 4357 4590 To Propik at To sales Ale 510 19. Purches Smsice chogene Capt. Purchase the as Rent Expenses Al 4.42.50 To Cast To Bant al 14250 To Double 4-1 1215) Sale invoine Cc Chaque cepin W. Hoyle (Cleaning Services) Alc-os $900 Postage changes ale co $ 55 To saler the $900 Telephone bill me a 2256 To make Double Ginchester AL-D & 5000 Is Glitter Bu To Bank Ale $ some Hydro usage Ale on 5. Purchase invoice To with pastes $426 Purchases Ale $ 236 +236 Cash the be To National Handware $ 200 To A Newman the S. 200 7. Cash receipits Cash ale DS $ 86.25 25. Bank asit Advice $ 86.95 Service To BAVI Ale $65 Cash Sale, Recept Tociler cash ale os 4652 2s Grealit Tacice 1Purchases ne as $15 To Sales al $6520 Bank Dobit Advice To Double hindutin $15 Bank the Ds Interest ale De 30 BANK ale Drawings Ale as $35 To th $35 cheque copy. (c.flower) Drawings the De 42000 To Bank ale -2000 20. Cash Recipt slip Ale To w. Hoyle Ake Charger Alcos $65 S. $ 400 $400 10. Inventory ale Part D: The Worksheet and Adjusting Entries 1. Using the worksheet provided for this project, complete the adjusting entries for Travel Trailers listed below: a Supplies on hand at June 30th was counted and totalled $1300.00 b. The amount in the Prepaid insurance account was for a 12 month policy starting in Feb 2020. c. Late arriving invoices pertaining to the fiscal period were: i. Miscellaneous Expenses from National Hardware $240.00 i. Water Expense from Double-G Industries $625 iii. Wages Expense from Maynards Delivery $2400 d. $1500 of the repair work for Frank Dunn, paid for in full on June 8th, was not completed as of June 30, 2020 e. Depreciation is calculated as follows: i The truck is depreciated using the straight-line method. Estimated useful life is 9 years and estimated salvage value is 2000.00 ii. The equipment is depreciated using the declining balance method at the rate of 20% 2. Complete the adjusted trial balance (optional) in your worksheet and if it is balanced record your adjusting entries in your general journal. 3. Complete the remaining columns of your worksheet. 4. Post all adjusting entries to the general ledgers. Part E: Financial Statements and Closing Entries 1. Using your worksheet, complete a year end Balance Sheet and Income Statement for Travel Trailers 2. Journalize the closing entries to the General Journal. 3. Post the Closing Entries to the General Ledger. If you have journalized your closing entries correctly, all of your revenue, expense and drawings accounts should have a zero balance and the balance in your Cap account should be the ending balance that you have on your Year End Balance sheet 4. Create a post closing trial balance and ensure that your debits still equal your credits. You should not have any revenue, expenses, or drawings listed as they all have a zero balance and are ready to start the next accounting period. Work cheer Trial Balance Income Statement Accounts Acc. No. Adjustments DR CR Balance Sheet DR CR DR CR DR CR 1 2