Answered step by step

Verified Expert Solution

Question

1 Approved Answer

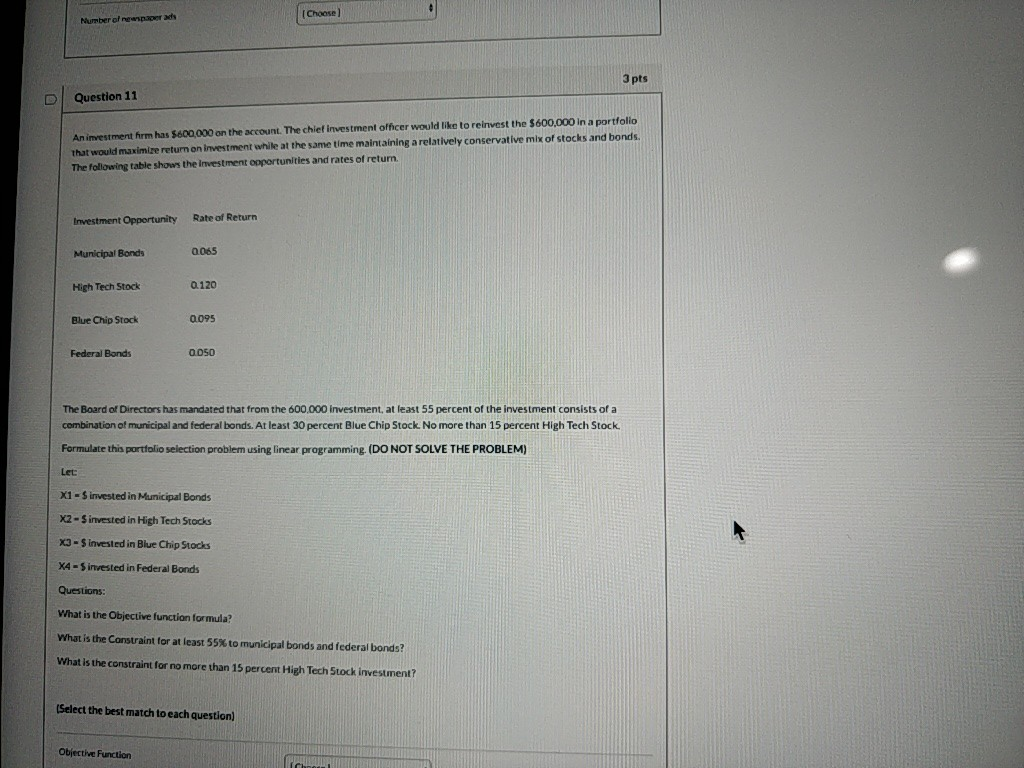

queston 1 find the objective function question 2 constrain for at least 55% to municipal bonds and federal bonds question 3 no more than 15%

queston 1 find the objective function

question 2 constrain for at least 55% to municipal bonds and federal bonds

question 3 no more than 15% high tech stock investment

Choose) Number of newspapers 3 pts D Question 11 An investment form has 5600,000 on the account. The chief investment ofhcer would like to reinvest the $600,000 in a portfolio That would maximize return on investment while at the same time maintaining a relatively conservative mix of stocks and bonds. The following table shows the investment opportunities and rates of return Investment Opportunity Rate of Return Municipal Bonds 0.065 High Tech Stock 0.120 Blue Chip Stock 0.095 Federal Bonds 0.050 The Board of Directors has mandated that from the 600.000 investment, at least 55 percent of the investment consists of a combination of municipal and federal bonds. At least 30 percent Blue Chip Stock. No more than 15 percent High Tech Stock Formulate this portfolio selection problem using linear programming. (DO NOT SOLVE THE PROBLEM) Let X1 - Sinvested in Municipal Bonds X2 - Sinvested in High Tech Stocks X3 - Sinvested in Blue Chip Stocks X4 - Sinvested in Federal Bonds Questions: What is the Objective function formula? What is the Constraint for at least 55% to municipal bonds and federal bonds? What is the constraint for no more than 15 percent High Tech Stock investment? (Select the best match to each question) Objective Function Choose) Number of newspapers 3 pts D Question 11 An investment form has 5600,000 on the account. The chief investment ofhcer would like to reinvest the $600,000 in a portfolio That would maximize return on investment while at the same time maintaining a relatively conservative mix of stocks and bonds. The following table shows the investment opportunities and rates of return Investment Opportunity Rate of Return Municipal Bonds 0.065 High Tech Stock 0.120 Blue Chip Stock 0.095 Federal Bonds 0.050 The Board of Directors has mandated that from the 600.000 investment, at least 55 percent of the investment consists of a combination of municipal and federal bonds. At least 30 percent Blue Chip Stock. No more than 15 percent High Tech Stock Formulate this portfolio selection problem using linear programming. (DO NOT SOLVE THE PROBLEM) Let X1 - Sinvested in Municipal Bonds X2 - Sinvested in High Tech Stocks X3 - Sinvested in Blue Chip Stocks X4 - Sinvested in Federal Bonds Questions: What is the Objective function formula? What is the Constraint for at least 55% to municipal bonds and federal bonds? What is the constraint for no more than 15 percent High Tech Stock investment? (Select the best match to each question) Objective FunctionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started