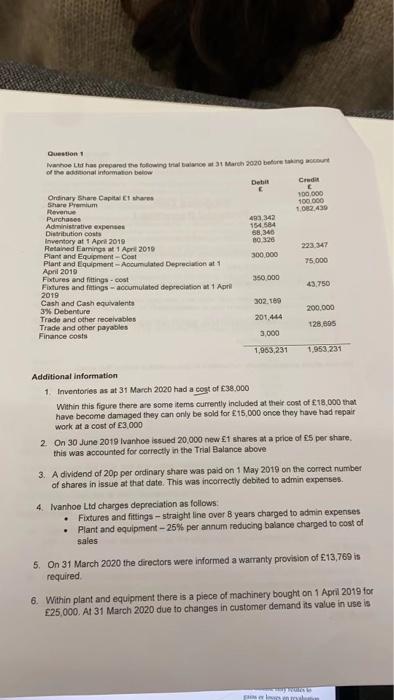

Questront 1 of the adsdisnat intomation beiow Additional information 1. Inventories as at 31 March 2020 had a cost of 238.000 Within this figure thare are some tems currently included at their cost of ,18,000 that heve become damaged they ean only be sold for 15,000 once they have had repair work at at cost of 3,000 2. On 30 June 2019 Ivanhce issued 20,000 new 1 shares at a price of 25 per share: this was accounted for correctly in the Trial Balance above 3. A dividend of 20p per ordinary share was paid on 1 May 2019 on the correct number of shares in issue at that date. This was incorrectily debited to admin expenses. 4. Wanhoe Ltd charges depreciation as follcis. - Fixtures and fittings - straight line over 8 years chatged to admin expenses - Plant and equipment - 25% per annum reducing baiance charged to cost of sales 5. On 31 March 2020 the drectors wete informed a warmanty provision of q13,769 is required. 6. Within plant and equigenent there is a piece of machinery bought on 1 April 2019 ior E25,000. At 31 March 2020 due to changes in customer demand ts value in use is E13,000, it could be disposed of for E.17,750 after disposal costs. Any impairment is to follow the same treatment as depreciation. 7. Interest for the debenture has se far only been accrued for the fist hax of the yeat. The loan note is repayable on 31 March 2022 8. The income tax charge for the year has been estimated as f,13,350. Rogquiforment a) Prepare a statement of profi or loss and other compreheriste ificomo, and a statement of changes in equity for franhoe Lto for the year ended 31 March 2020 and a statement of financial position as at 31 March 2020, in a form suitable for publeation. Notes to the financial statements are not required, expenses should be presented analysed by function and ignore the tax effocts of any adjustrnents. Questront 1 of the adsdisnat intomation beiow Additional information 1. Inventories as at 31 March 2020 had a cost of 238.000 Within this figure thare are some tems currently included at their cost of ,18,000 that heve become damaged they ean only be sold for 15,000 once they have had repair work at at cost of 3,000 2. On 30 June 2019 Ivanhce issued 20,000 new 1 shares at a price of 25 per share: this was accounted for correctly in the Trial Balance above 3. A dividend of 20p per ordinary share was paid on 1 May 2019 on the correct number of shares in issue at that date. This was incorrectily debited to admin expenses. 4. Wanhoe Ltd charges depreciation as follcis. - Fixtures and fittings - straight line over 8 years chatged to admin expenses - Plant and equipment - 25% per annum reducing baiance charged to cost of sales 5. On 31 March 2020 the drectors wete informed a warmanty provision of q13,769 is required. 6. Within plant and equigenent there is a piece of machinery bought on 1 April 2019 ior E25,000. At 31 March 2020 due to changes in customer demand ts value in use is E13,000, it could be disposed of for E.17,750 after disposal costs. Any impairment is to follow the same treatment as depreciation. 7. Interest for the debenture has se far only been accrued for the fist hax of the yeat. The loan note is repayable on 31 March 2022 8. The income tax charge for the year has been estimated as f,13,350. Rogquiforment a) Prepare a statement of profi or loss and other compreheriste ificomo, and a statement of changes in equity for franhoe Lto for the year ended 31 March 2020 and a statement of financial position as at 31 March 2020, in a form suitable for publeation. Notes to the financial statements are not required, expenses should be presented analysed by function and ignore the tax effocts of any adjustrnents