Answered step by step

Verified Expert Solution

Question

1 Approved Answer

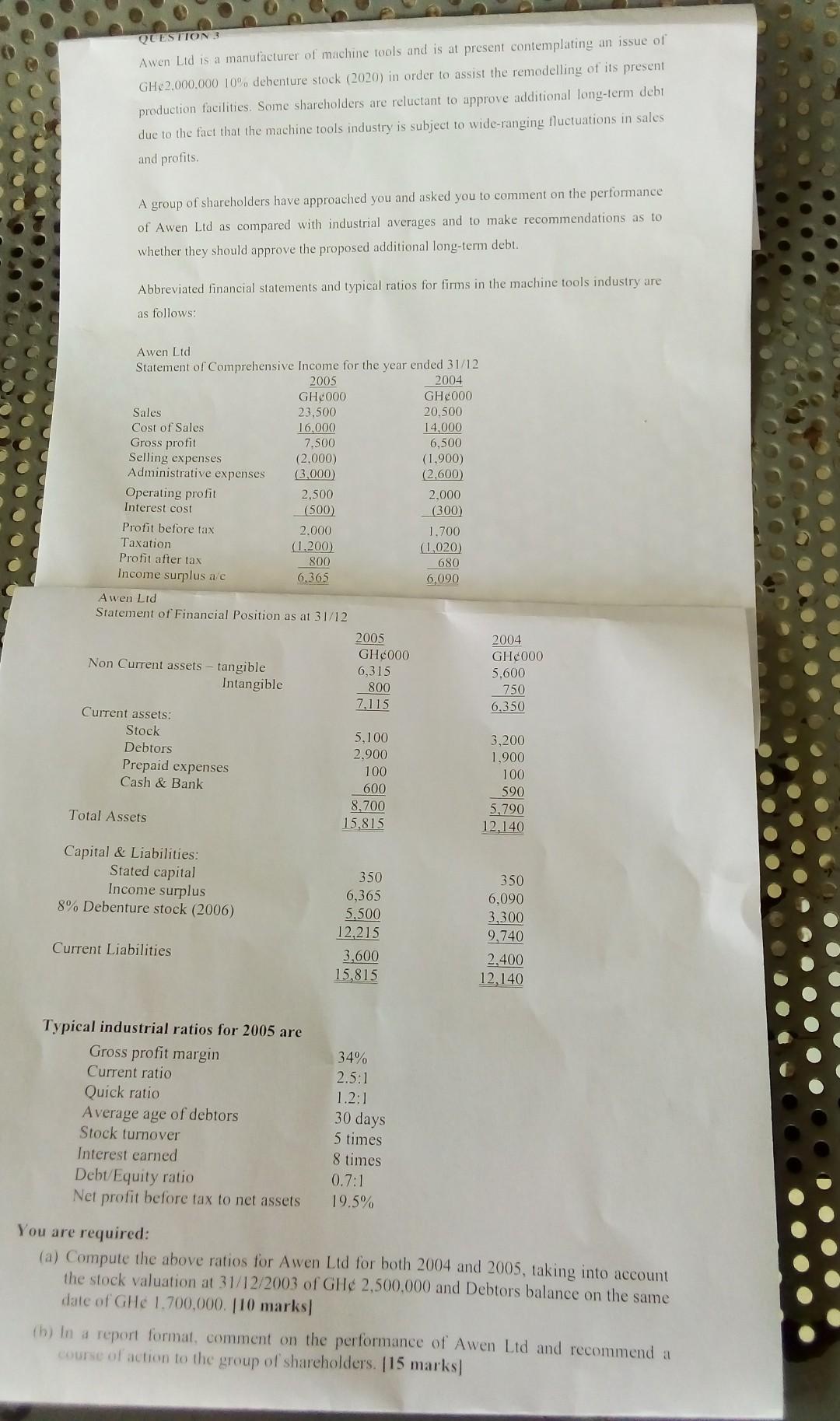

QUESTTON 3 Awen Ltd is a manufacturer of machine tools and is at present contemplating an issue of GH 2.000.000 10% debenture stock (2020) in

QUESTTON 3 Awen Ltd is a manufacturer of machine tools and is at present contemplating an issue of GH 2.000.000 10% debenture stock (2020) in order to assist the remodelling of its present production facilities. Some shareholders are reluctant to approve additional long-term debi due to the fact that the machine tools industry is subject to wide-ranging fluctuations in sales and profits. A group of shareholders have approached you and asked you to comment on the performance of Awen Ltd as compared with industrial averages and to make recommendations as to whether they should approve the proposed additional long-term debu Abbreviated financial statements and typical ratios for firms in the machine tools industry are as follows: Awen Ltd Statement of Comprehensive Income for the year ended 31/12 2005 2004 GH2000 GH000 Sales 23.500 20.500 Cost of Sales 16.000 14,000 Gross profit 7.500 6,500 Selling expenses (2.000) (1,900) Administrative expenses (3.000) (2.600) Operating profit 2.500 2.000 Interest cost (500) (300) Profit before tax 2.000 1.700 Taxation (1.200) (1,020) Profit after tax 800 680 Income surplus ac 6.365 6,090 Awen Ltd Statement of Financial Position as at 31/12 2005 GH&000 Non Current assets - tangible 6,315 Intangible 800 7.115 Current assets: Stock 5.100 Debtors 2,900 Prepaid expenses Cash & Bank 600 8,700 Total Assets 15,815 2004 GH&000 5.600 750 6,350 100 3,200 1.900 100 590 5,790 12.140 Capital & Liabilities: Stated capital Income surplus 8% Debenture stock (2006) 350 6,365 5.500 12,215 3,600 15,815 350 6,090 3,300 2,740 2.400 12,140 Current Liabilities Typical industrial ratios for 2005 are Gross profit margin Current ratio Quick ratio Average age of debtors Stock turnover Interest earned Debt/Equity ratio Net profit before tax to net assets 34% 2.5:1 1.2:1 30 days 5 times 8 times 0.7:1 19.5% You are required: (a) Compute the above ratios for Awen Ltd for both 2004 and 2005, taking into account the stock valuation at 31/12/2003 of GH 2,500,000 and Debtors balance on the same date of GHe 1.700,000. [10 marks (h) In a report format, comment on the performance of Awen Ltd and recommend a course of action to the group of shareholders. [15 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started