Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Quetion 1 as shown below. Please anwer this question. a7696/cuizzes/159059/take (AGM) of the company (this is the case for most investee companies undess explicitly seated

Quetion 1 as shown below. Please anwer this question.

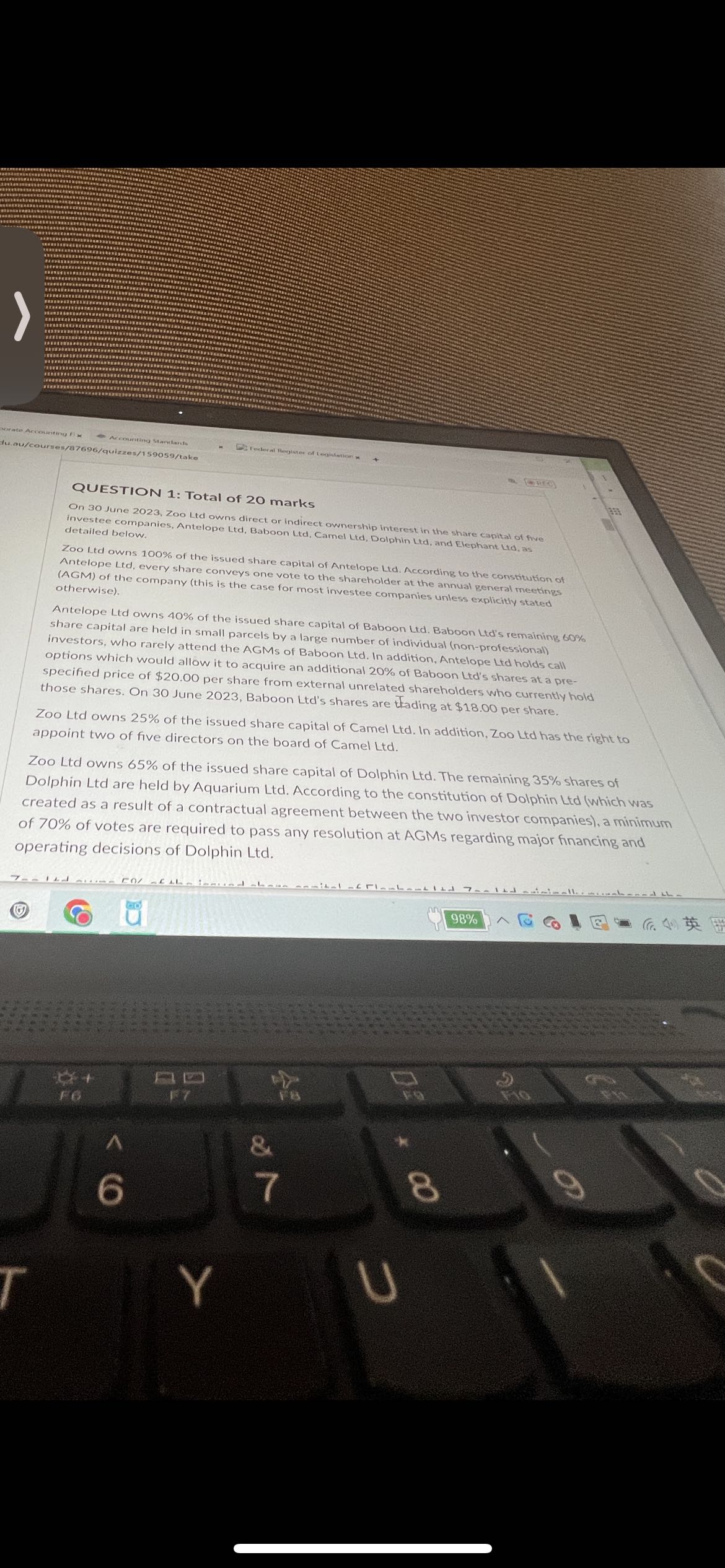

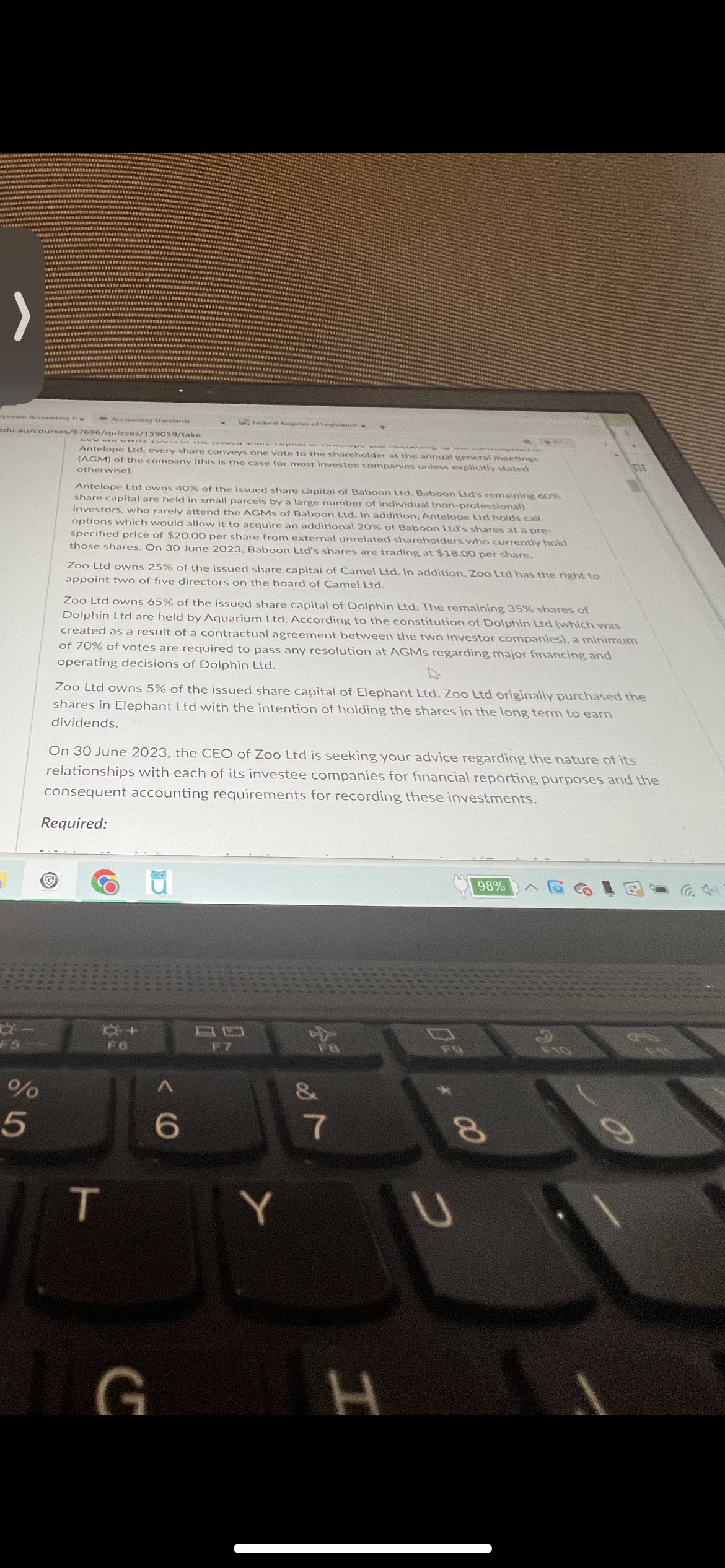

a7696/cuizzes/159059/take (AGM) of the company (this is the case for most investee companies undess explicitly seated otherwise). share capital are held in small parcels by a large number of individual (non-protessional) Zoo Ltd owns 25% of the issued share capital of Camel Ltd. In addition. Zoo Ltd has the right to appoint two of five directors on the board of Camel Ltd. Zoo Ltd owns 65% of the issued share capital of Dolphin Ltd. The remaining 35% shares of Dolphin Ltd are held by Aquarium Ltd. According to the constitution of Dolphin Ltd (which was created as a result of a contractual agreement between the two investor companies). a minimum of 70% of votes are required to pass any resolution at AGMs regarding major financing and operating decisions of Dolphin Ltd. Zoo Ltd owns 5% of the issued share capital of Elephant Ltd. Zoo Ltd originally purchased the shares in Elephant Ltd with the intention of holding the shares in the long term to earn dividends. On 30 June 2023, the CEO of Zoo Ltd is seeking your advice regarding the nature of its relationships with each of its investee companies for financial reporting purposes and the consequent accounting requirements for recording these investments. Required: QUESTION 1: Total of 20 marks On 30 June 2023, Zoo Ltd owns direct or indirect ownership interest in the share capital of five investee companies, Antelope Ltd, Baboon Ltd, Camel Ltd, Dolphin Ltd, and Elephant Ld, as detalled below. Zoo Ltd owns 100% of the issued share capital of Antelope Ltd. According to the constitution of Antelope Ltd, every share conveys one vote to the shareholder at the annual general meetings (AGM) of the company (this is the case for most investee companies unless explicitly stated otherwise). Antelope Ltd owns 40\% of the issued share capital of Baboon Ltd. Baboon Ltd's remaining 60% share capital are held in small parcels by a large number of individual (non-professional) investors, who rarely attend the AGMs of Baboon Ltd. In addition, Antelope Ltd holds call options which would allow it to acquire an additional 20% of Baboon Ltd's shares at a prespecified price of $20.00 per share from external unrelated shareholders who currently hold those shares. On 30 June 2023, Baboon Ltd's shares are Ifading at $18.00 per share. Zoo Ltd owns 25% of the issued share capital of Camel Ltd. In addition, Zoo Ltd has the right to appoint two of five directors on the board of Camel Ltd. Zoo Ltd owns 65% of the issued share capital of Dolphin Ltd. The remaining 35% shares of Dolphin Ltd are held by Aquarium Ltd. According to the constitution of Dolphin Ltd (which was created as a result of a contractual agreement between the two investor companies), a minimum of 70% of votes are required to pass any resolution at AGMs regarding major financing and operating decisions of Dolphin Ltd. 7696/quizzes/is9o59/take Zoo Ltd owns 5% of the issued share capital of Elephant Ltd. Zoo Lid originally purchased the shares in Elephant Ltd with the intention of holding the shares in the tong, term to earn dividends. On 30 June 2023 , the CEO of Zoo Ltd is seeking your advice regarding the nature of its relationships with each of its investee companies for financial reporting purposes and the consequent accounting requirements for recording these investrments. Required: [1] Identify which companies belong to the reporting entity of "Zoo Ltd Group" and explain what accounting method should be employed by the reporting entity. [2] Explain the nature of the relationship between Zoo Ltd and each of its investees, Antelope Ltd, Baboon Ltd, Camel Ltd, Dolphin Ltd, and Elephant Ltd. You must discuss the relationship with each investee in detail. Your answer must be justified with references to specific paragraphs in all relevant accounting standards. Your answer should address all relationships that are potentially relevant (e.g., control, significant influence, and any other that may be applicable). Your answer should address all of the relevant criteria in the AASB accounting standards for determining each relationship. Formatting requirements: Your answer should be divided into multiple sections and paragraphs should use section headings (e.g., for each sub-question and each investor-investee relations) clearly identify the structure of your essay. All answers must be provided in your own words

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started