Quick answer please!

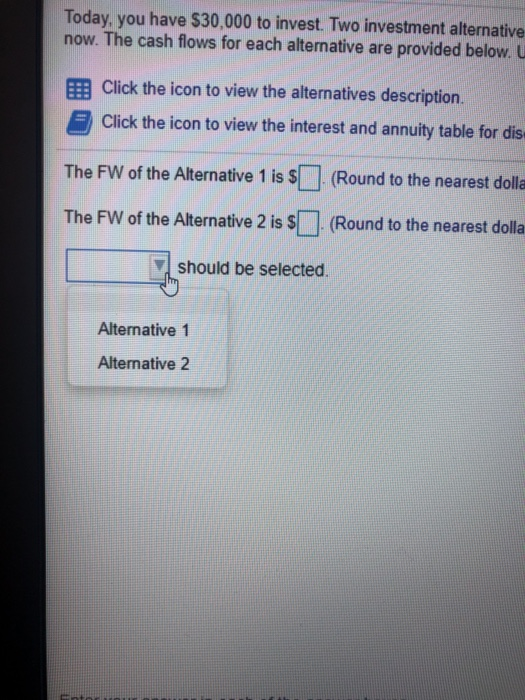

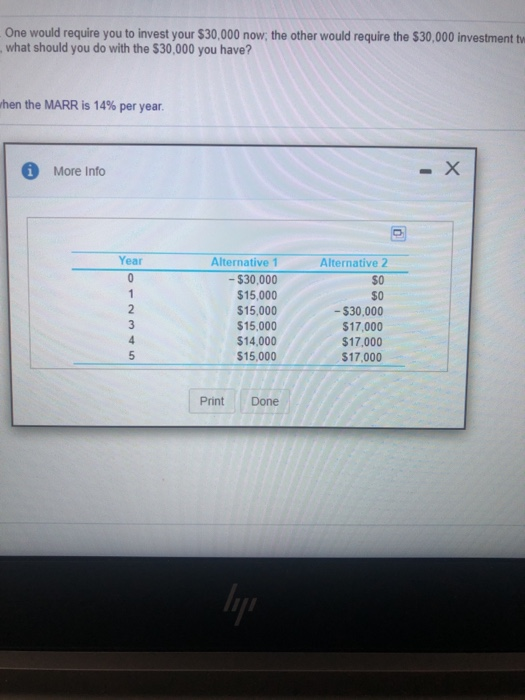

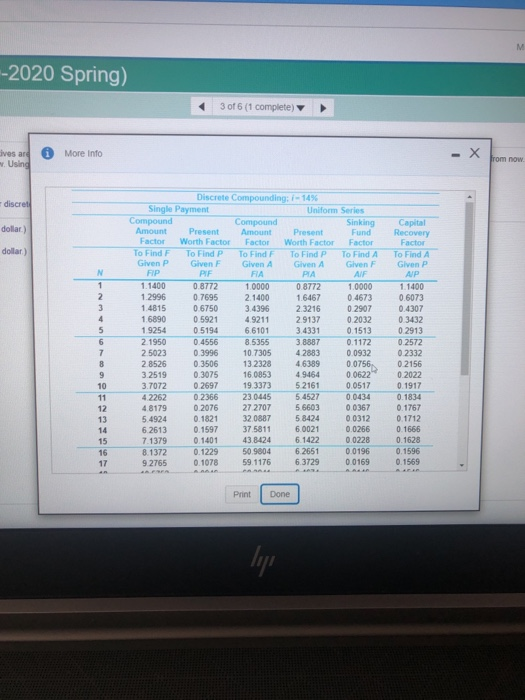

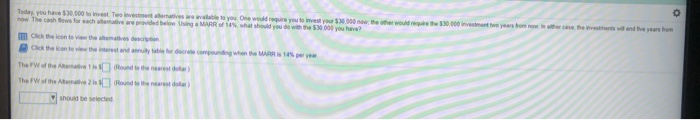

Today you have $30.000 tons Two inventives are avait you one would require you to invest your 30.000 w.the other worth $30.000 invent two years from now can then and the years from how The cash Bows for each teatere provided below Using a MARR of what should you do with the 50.000 you have The con to the imatives de The Wof the sound to the nearest der The Wof the terrace Hound to the rest otor) should be selected Today, you have $30,000 to invest. Two investment alternative now. The cash flows for each alternative are provided below. U B Click the icon to view the alternatives description. Click the icon to view the interest and annuity table for dis The FW of the Alternative 1 is $ (Round to the nearest dolla The FW of the Alternative 2 is $ (Round to the nearest dolla should be selected. Alternative 1 Alternative 2 One would require you to invest your $30,000 now, the other would require the $30,000 investment what should you do with the $30,000 you have? when the MARR is 14% per year. More Info .X 0 Year 1 2 3 4 5 Alternative 1 - $30,000 $15,000 $15,000 $15,000 $14,000 $15,000 Alternative 2 $0 $0 - $30,000 $17,000 $17,000 $17,000 Print Done ly M -2020 Spring) 3 of 6 (1 complete) More Info ives and w. Using - X from now. discret dollar) dollar) N FIA 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Discrete Compounding: 1-14% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find To Find P To Find A Given P Given Given A Given A Glven FIP PF PA 1.1400 0.8772 1.0000 08772 1.0000 1.2996 0.7695 2.1400 1.6467 0.4673 1.4815 06750 3.4396 2.3216 0.2907 1.6890 05921 4.9211 2.9137 0.2032 1.9254 0.5194 6.6101 3.4331 0.1513 2. 1950 0.4556 8.5355 3.8887 0.1172 2.5023 0.3996 10.7305 42883 0.0932 2.8526 0.3506 13.2328 4.6389 0.0756 3.2519 0.3075 16.0853 4.9464 0.0622 3.7072 0.2697 19.3373 52161 0.0517 4.2262 0.2366 23.0445 5.4527 0.0434 48179 0.2076 27.2707 5 6603 0.0367 5.4924 0.1821 32.0887 5 8424 0.0312 6.2613 0.1597 37.5811 6.0021 0.0266 7.1379 0.1401 43.8424 6.1422 0.0228 8.1372 0.1229 50.9804 6.2651 0.0196 92765 0.1078 59. 1176 6.3729 0.0169 Capital Recovery Factor To Find A Given P AP 1.1400 0.6073 0.4307 0.3432 0.2913 0.2572 0.2332 0.2156 0.2022 0.1917 0.1834 0.1767 0.1712 0.1666 0.1628 0.1596 0.1569 Print Done lije