Question

Quick Fix-It Corporation was organized at the beginning of this year to operate several car repair businesses in a large metropolitan area. The charter issued

Quick Fix-It Corporation was organized at the beginning of this year to operate several car repair businesses in a large metropolitan area. The charter issued by the state authorized the following stock:

Common stock, $11 par value, 98,500 shares authorized

Preferred stock, $41 par value, 8 percent, 60,700 shares authorized

During January and February of this year, the following stock transactions were completed:

a. Sold 78,700 shares of common stock at $22 cash per share.

b. Sold 21,900 shares of preferred stock at $68 cash per share.

c. Bought 5,800 shares of common stock from a current stockholder for $14 cash per share.

Required:

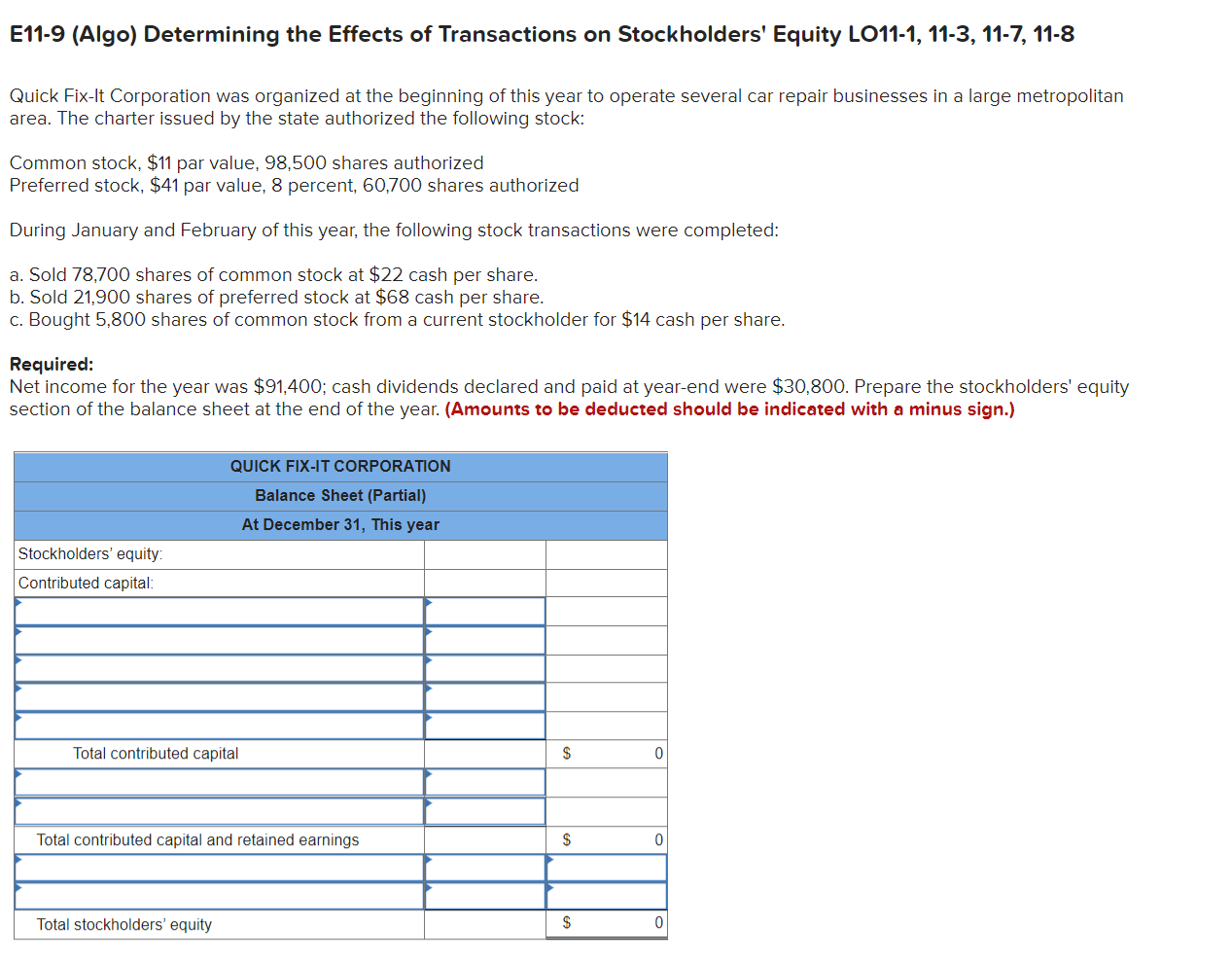

Net income for the year was $91,400; cash dividends declared and paid at year-end were $30,800. Prepare the stockholders' equity section of the balance sheet at the end of the year. (Amounts to be deducted should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started