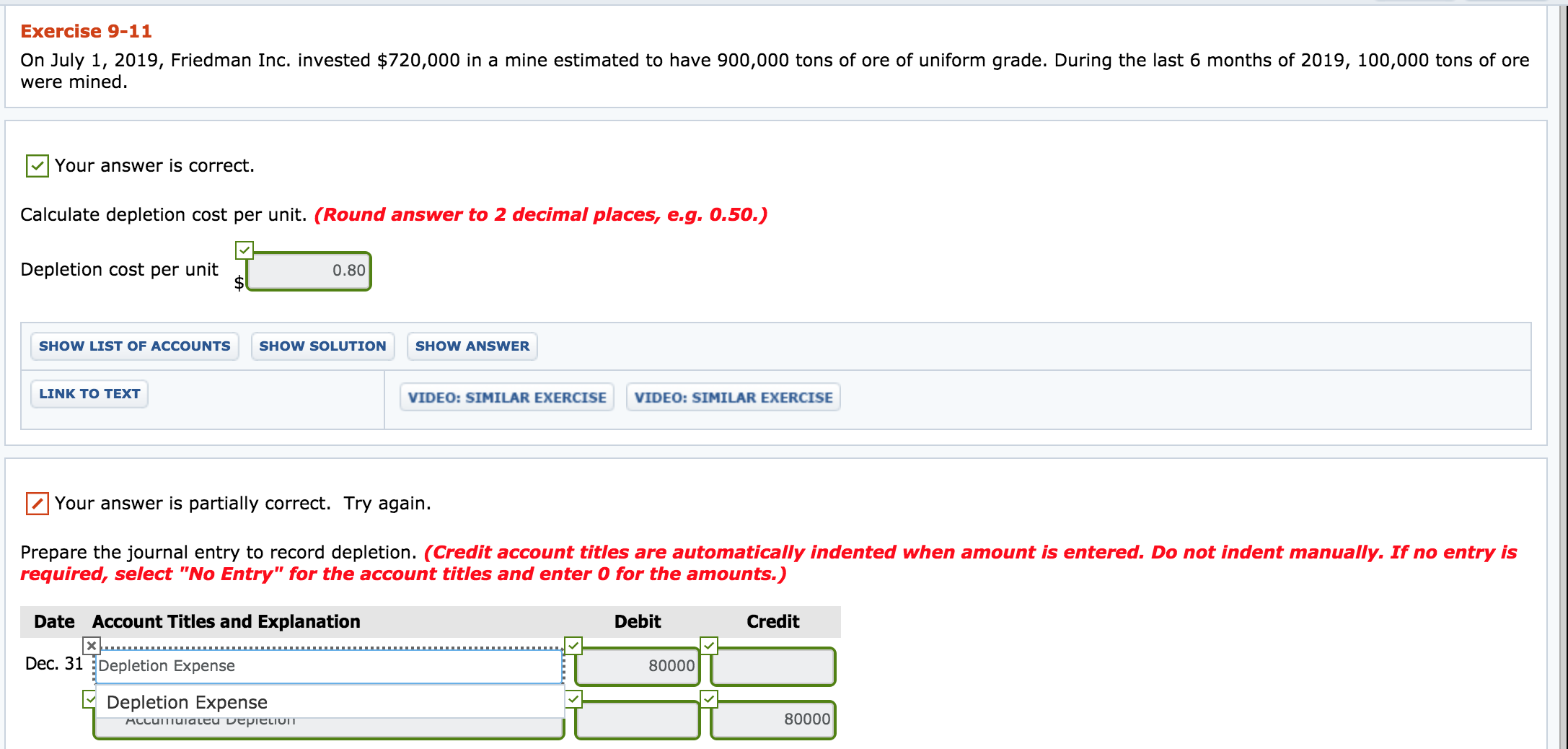

quick! I need help with these homework problems. thank you. for exercise 9-11, I need help with the dotted line box that isn't in green - I tried "Depletion Expense " and it said it wasn't right.

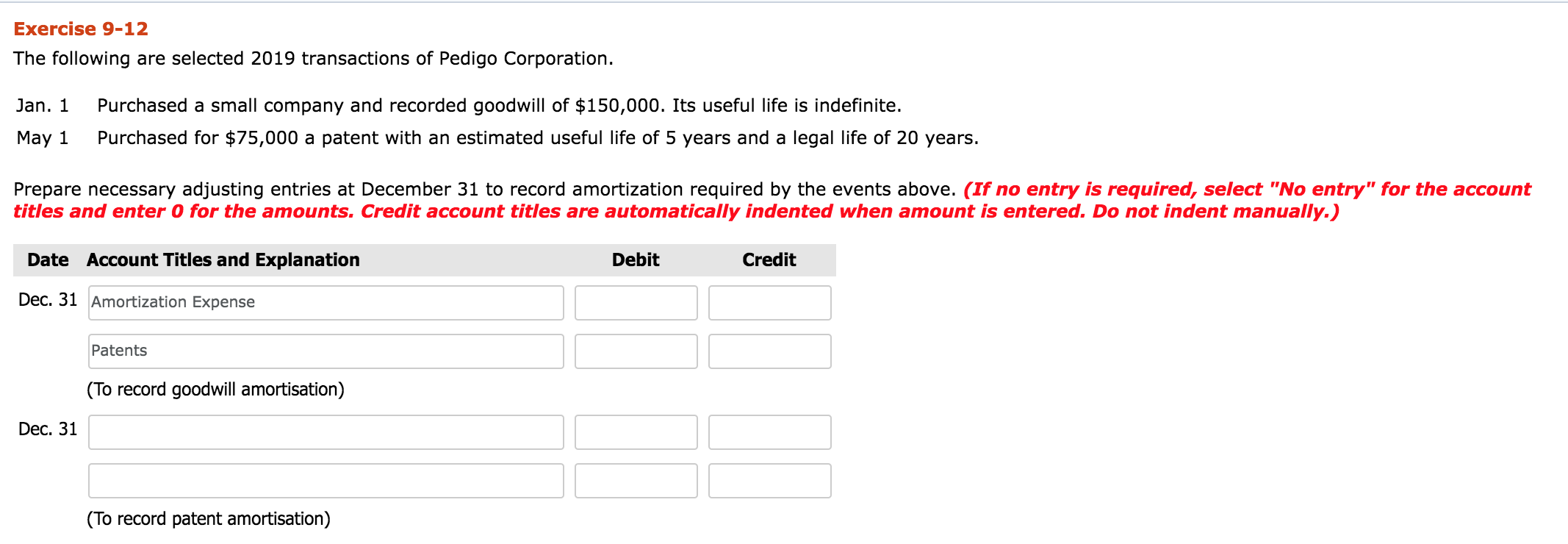

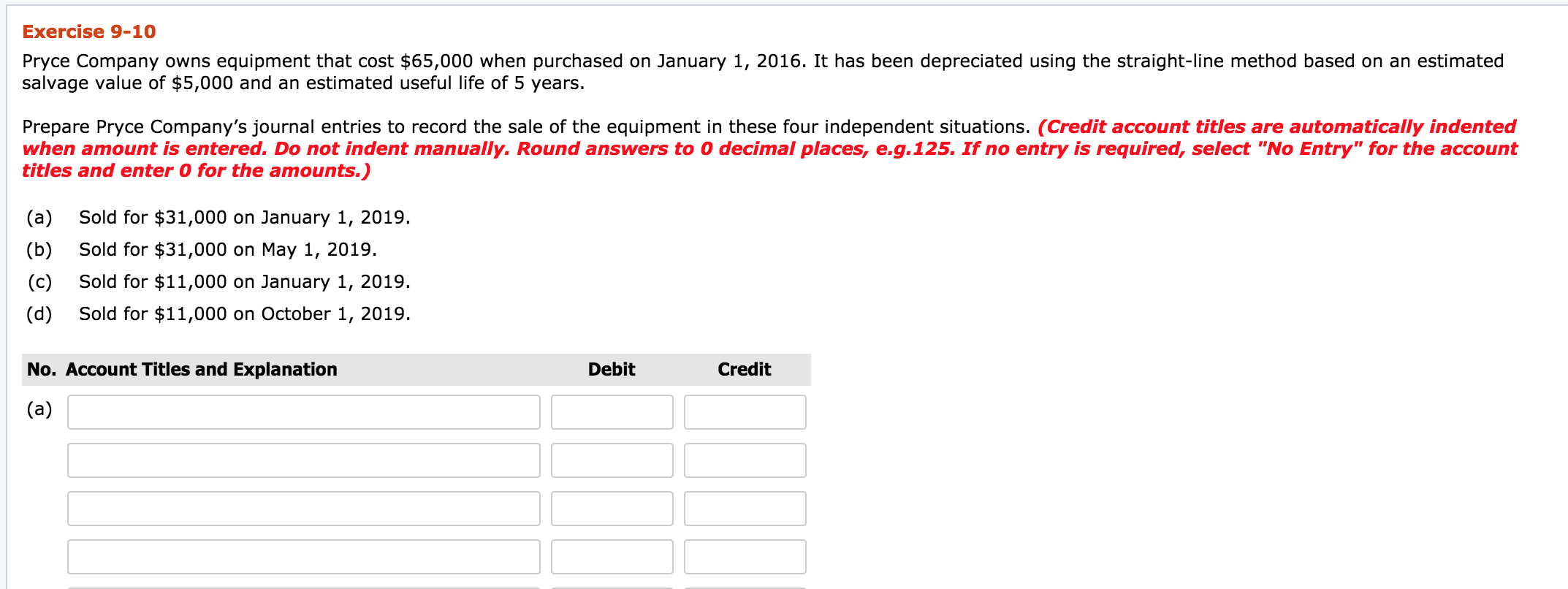

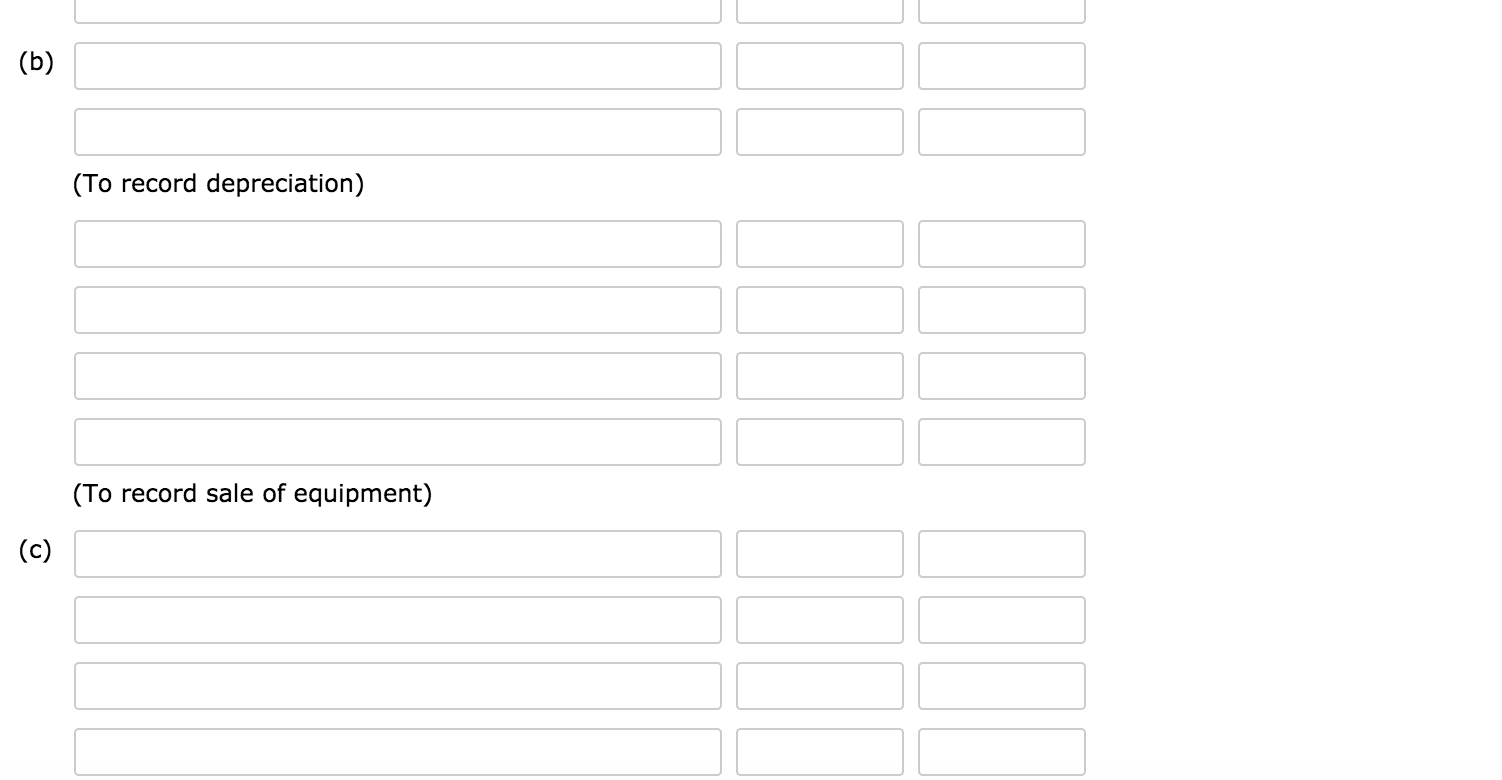

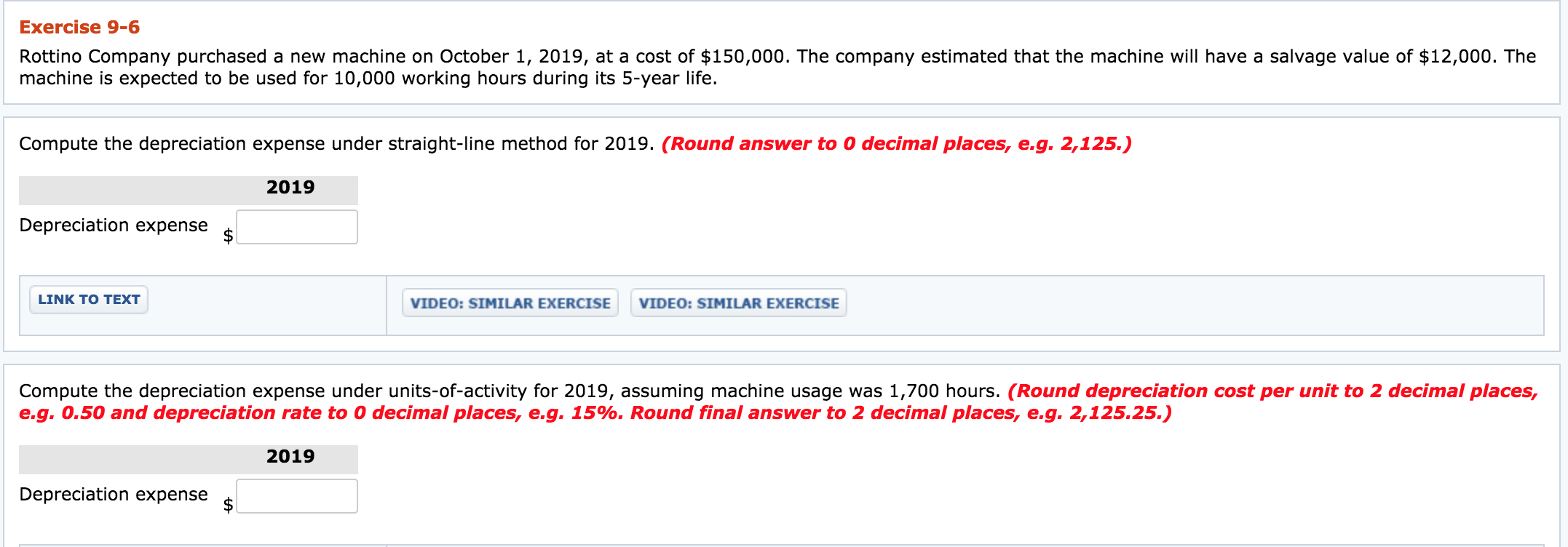

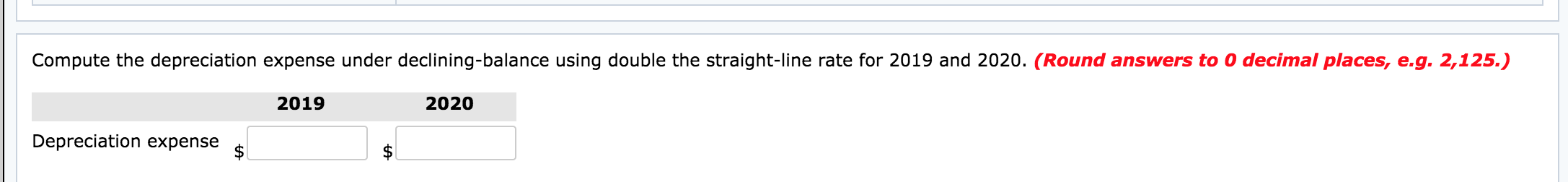

Exercise 9-11 On July 1, 2019, Friedman Inc. invested $720,000 in a mine estimated to have 900,000 tons of ore of uniform grade. During the last 6 months of 2019, 100,000 tons of ore were mined. Your answer is correct. Calculate depletion cost per unit. (Round answer to 2 decimal places, e.g. 0.50.) Depletion cost per unit 0.80 $ lrsuow LIST OF Accoun'rsl 'VSHOW sownourl lrsnow ANSWERV' lVLINK'ro TEXTVl lVIDEO: snuunmasEl lvmso: 51:quth Your answer is partially correct. Try again. Prepare the journal entry to record depletion. ( Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Ties and Explanation Debit Credit Depletion Expense Depletion Expense Dec. 31 Exercise 9-12 The following are selected 2019 transactions of Pedigo Corporation. Jan. 1 Purchased a small company and recorded goodwill of $150,000. Its useful life is indenite. May 1 Purchased for $75,000 a patent with an estimated useful life of 5 years and a legal life of 20 years. Prepare necessary adjusting entries at December 31 to record amortization required by the events above. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Tides and Explanation Debit Credit Dec. 31 'Amortization Expense I I I I I IPatents I I I I I Cl'o record goodwill amortisation) DEC-\"l ll H l Cl'o record patent amortisation) Exercise 9-10 Pryce Company owns equipment that cost $65,000 when purchased on January 1, 2016. It has been depreciated using the straight-line method based on an estimated salvage value of $5,000 and an estimated useful life of 5 years. Prepare Pryce Company's journal entries to record the sale of the equipment in these four independent situations. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g.125. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) Sold for $31,000 on January 1, 2019. (b) Sold for $31,000 on May 1, 2019. (c) Sold for $11,000 on January 1, 2019. (d) Sold for $11,000 on October 1, 2019. No. Account Tides and Explanation Debit Credit (a) l ll ll lJlJlJ w>:ll:ll:l :ICICI Cl'o record depreciation) :ll:ll:l :ICICI :H:H:l :ll:ll:l (T 0 record sale of equipment) (\">:Il:ll:l :ICICI :JCJCJ :H:H:l \fExercise 9-6 Rottino Company purchased a new machine on October 1, 2019, at a cost of $150,000. The company estimated that the machine will have a salvage value of $12,000. The machine is expected to be used for 10,000 working hours during its 5-year life. Compute the depreciation expense under straightline method for 2019. (Round answer to 0 decimal places, e.g. 2,125.) 2019 Depreciation expense $|:] lrl-INKTOTEXTVl l unto: mmml l unto: snuuul l Compute the depreciation expense under units-ofactivity for 2019, assuming machine usage was 1,700 hours. (Round depreciation cost per unit to 2 decimal places, e.g. 0.50 and depreciation rate to 0 decimal places, e.g. 15%. Round final answer to 2 decimal places, e.g. 2,125.25.) 2019 Depreciation expense $|:] Compute the depreciation expense under declining-balance using double the straight-line rate for 2019 and 2020. (Round answers to 0 decimal places, e.g. 2,125.) 2019 2020