Answered step by step

Verified Expert Solution

Question

1 Approved Answer

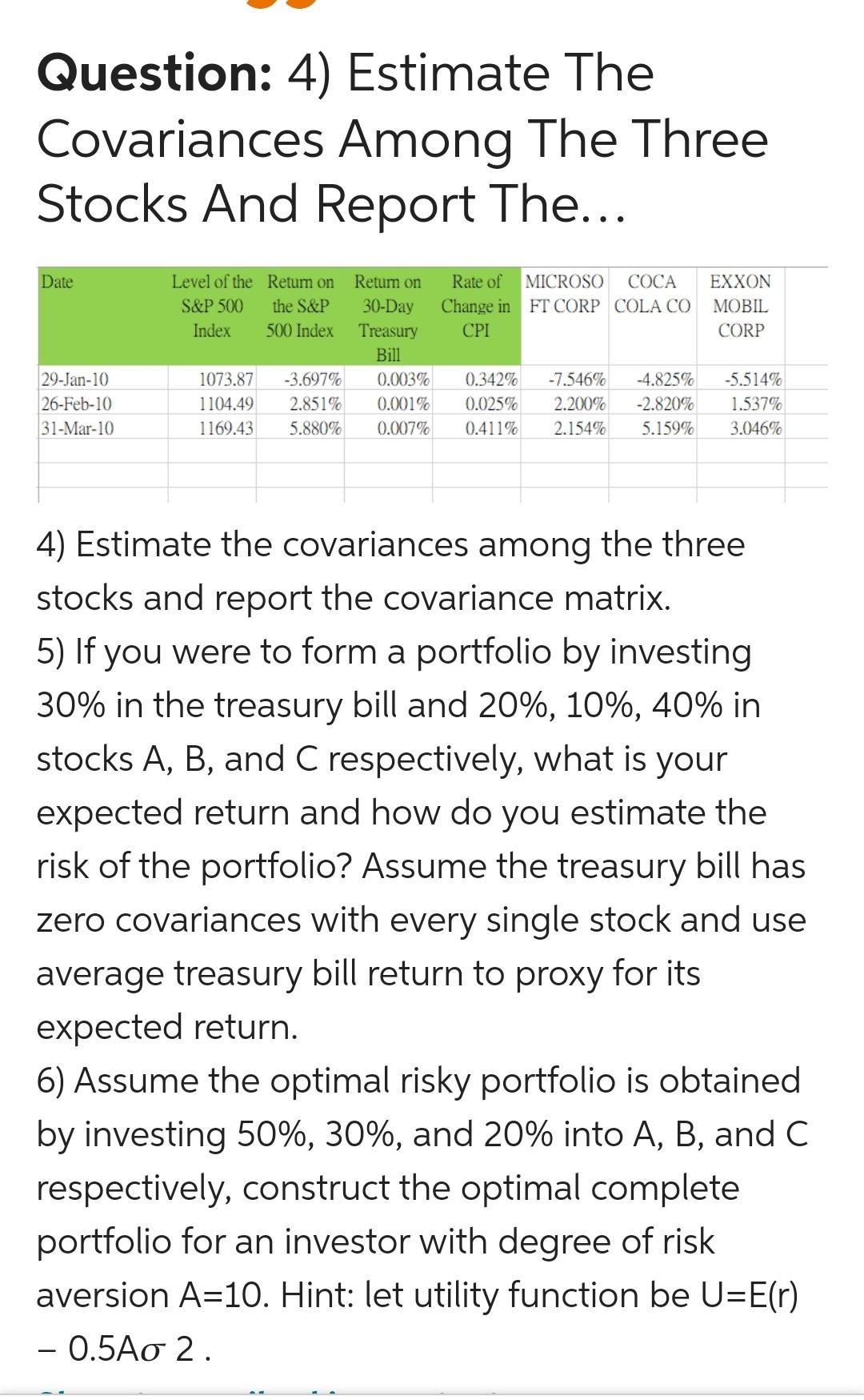

quick!!! I need the answer of Q5 Question: 4) Estimate The Covariances Among The Three Stocks And Report The... Date Level of the Return on

quick!!! I need the answer of Q5

Question: 4) Estimate The Covariances Among The Three Stocks And Report The... Date Level of the Return on S&P 500 the S&P Index 500 Index Rate of MICROSO COCA Change in FT CORP COLA CO CPI EXXON MOBIL CORP Return on 30-Day Treasury Bill 0.003% 0.001% 0.007% 29-Jan-10 26-Feb-10 31-Mar-10 1073.87 1104.49 1169.43 -3.697% 2.851% 5.880% 0.342% 0.025% 0.411% -7.546% 2.200% 2.154% -4.825% -2.820% 5.159% -5.514% 1.537% 3.046% 9 4) Estimate the covariances among the three stocks and report the covariance matrix. 5) If you were to form a portfolio by investing 30% in the treasury bill and 20%, 10%, 40% in stocks A, B, and C respectively, what is your expected return and how do you estimate the risk of the portfolio? Assume the treasury bill has zero covariances with every single stock and use average treasury bill return to proxy for its expected return. 6) Assume the optimal risky portfolio is obtained by investing 50%, 30%, and 20% into A, B, and C respectively, construct the optimal complete portfolio for an investor with degree of risk aversion A=10. Hint: let utility function be U=E(r) - 0.5Ao 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started