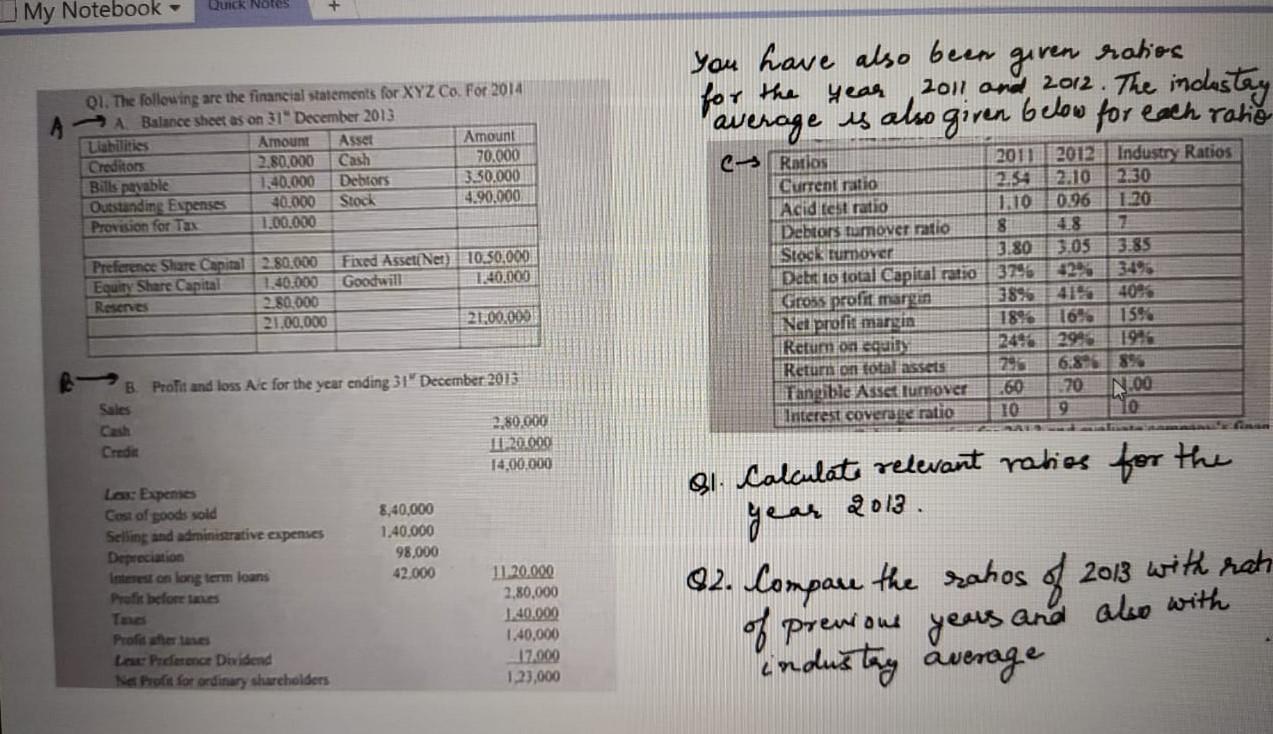

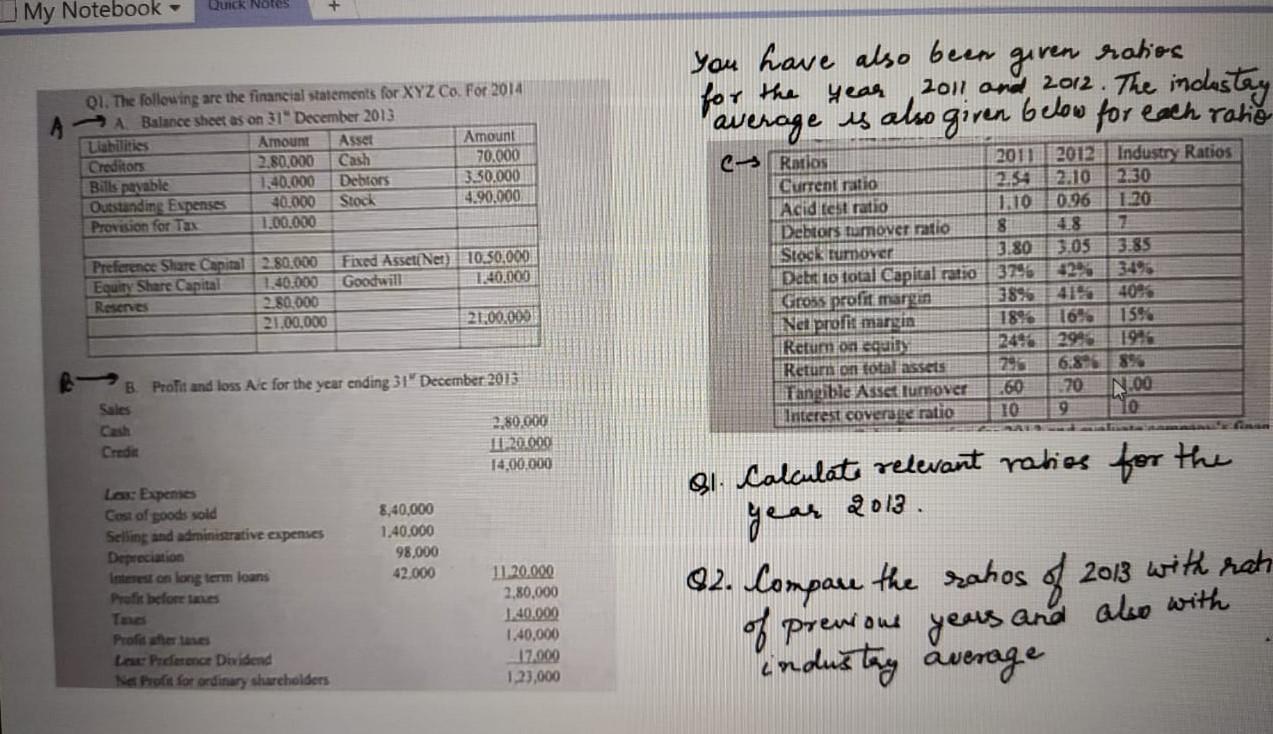

Quick Notes My Notebook- you have also been given ratios 2011 and 2012. The industry average is also given below for each ratio for the year 01. The following are the financial statements for XYZ Co. For 2014 A Balance sheet as on 31 December 2013 Llabilities Amount Asset Amount Creditors 2.80,000 70.000 Bills payable 140.000 Debtors 3.30.000 Outstanding Expenses 40.000 Stock 4.90,000 Provision for Tax 1.00.000 Cash 0.96 HELLER Fixed Asset Net) 10.30.000 Goodwill 1:40.000 Preference Share Capital 280.000 Eauiry Share Capital 1.40.000 Resenes 280.000 21.00.000 - Ratios 2011 2012 Industry Ratios Current ratio 2.10 2:30 Acid test ratio 1.10 1:20 Debtors turnover ratio 8 7 Stock turnover 3.80 3.05 3.85 Det to total Capital ratio 37% Gross profit margin 38% 41% 4095 Net profis margin 18% 16% 1593 Return on equity 24462996 1986 Return on total assets 293 6.89689 Tangible Asset turnover 660 70 Interest coverste ratio 10 10 21.00,000 IN.00 the 21. Calculat relevant rabies to B. Profit and loss Aic for the year ending 31 December 2015 Sales 2.80.000 Credit 120.000 14,00.000 tas: Eupem Cost of goods sold 8,40.000 Selling and administrative expenses 1,40.000 Depreciation 98,000 Interest on long term loans 42.000 11.20.000 Profit before 2,80,000 Tme 1.40.000 Profis here 1.40,000 La Presence Dividend 17.000 Netto it for ordinary shareholders 1.23,000 year 2013 . 22. Compare the rahos of 2013 with rats of previous years and also with industry average Quick Notes My Notebook- you have also been given ratios 2011 and 2012. The industry average is also given below for each ratio for the year 01. The following are the financial statements for XYZ Co. For 2014 A Balance sheet as on 31 December 2013 Llabilities Amount Asset Amount Creditors 2.80,000 70.000 Bills payable 140.000 Debtors 3.30.000 Outstanding Expenses 40.000 Stock 4.90,000 Provision for Tax 1.00.000 Cash 0.96 HELLER Fixed Asset Net) 10.30.000 Goodwill 1:40.000 Preference Share Capital 280.000 Eauiry Share Capital 1.40.000 Resenes 280.000 21.00.000 - Ratios 2011 2012 Industry Ratios Current ratio 2.10 2:30 Acid test ratio 1.10 1:20 Debtors turnover ratio 8 7 Stock turnover 3.80 3.05 3.85 Det to total Capital ratio 37% Gross profit margin 38% 41% 4095 Net profis margin 18% 16% 1593 Return on equity 24462996 1986 Return on total assets 293 6.89689 Tangible Asset turnover 660 70 Interest coverste ratio 10 10 21.00,000 IN.00 the 21. Calculat relevant rabies to B. Profit and loss Aic for the year ending 31 December 2015 Sales 2.80.000 Credit 120.000 14,00.000 tas: Eupem Cost of goods sold 8,40.000 Selling and administrative expenses 1,40.000 Depreciation 98,000 Interest on long term loans 42.000 11.20.000 Profit before 2,80,000 Tme 1.40.000 Profis here 1.40,000 La Presence Dividend 17.000 Netto it for ordinary shareholders 1.23,000 year 2013 . 22. Compare the rahos of 2013 with rats of previous years and also with industry average