Answered step by step

Verified Expert Solution

Question

1 Approved Answer

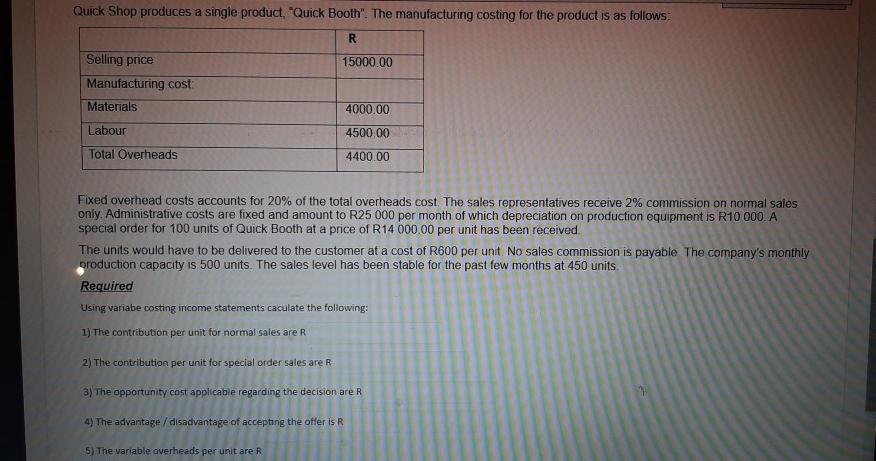

Quick Shop produces a single product, Quick Booth. The manufacturing costing for the product is as follows: R 15000.00 Selling price Manufacturing cost Materials 4000.00

Quick Shop produces a single product, Quick Booth". The manufacturing costing for the product is as follows: R 15000.00 Selling price Manufacturing cost Materials 4000.00 Labour 4500.00 Total Overheads 4400.00 Fixed overhead costs accounts for 20% of the total overheads cost. The sales representatives receive 2% commission on normal sales only. Administrative costs are fixed and amount to R25 000 per month of which depreciation on production equipment is R10 000 A special order for 100 units of Quick Booth at a price of R14 000.00 per unit has been received The units would have to be delivered to the customer at a cost of R600 per unit. No sales commission is payable The company's monthly production capacity is 500 units. The sales level has been stable for the past few months at 450 units Required Using variabe costing income statements caculate the following: 1) The contribution per unit for normal sales are R 2) The contribution per unit for special order sales are R 3) The opportunity cost applicable regarding the decision are R 4) The advantage / disadvantage of accepting the offer is R 5) The variable overheads per unit are R

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started