Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Quickbooks exercise 10.3.3 E10-3-3 Ratios In addition to the QuickBooks reports you will be providing Mr. Castle, you decide that preparing ratio analysis for him

Quickbooks exercise 10.3.3

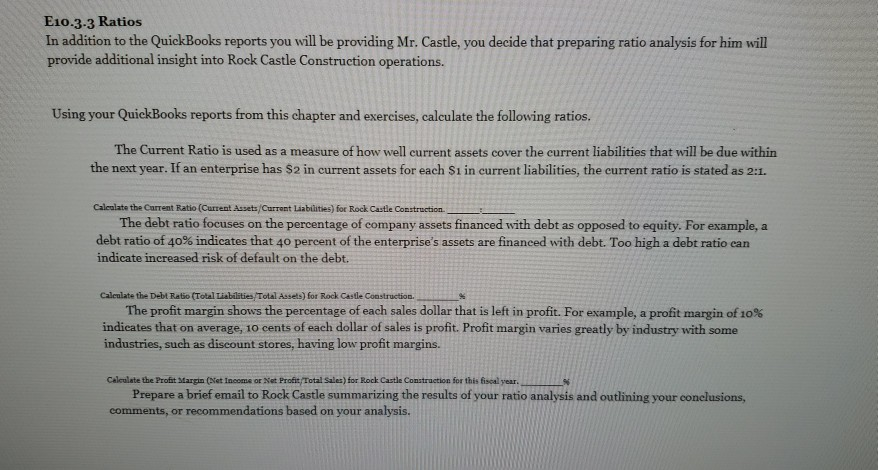

E10-3-3 Ratios In addition to the QuickBooks reports you will be providing Mr. Castle, you decide that preparing ratio analysis for him will provide additional insight into Rock Castle Construction operations. Using your QuickBooks reports from this chapter and exercises, calculate the following ratios. The Current Ratio is used as a measure of how well current assets cover the current liabilities that will be due within the next year. If an enterprise has $2 in current assets for each Si in current liabilities, the current ratio is stated as 2:1. Calealate the Current Ratio (Current Assets Current Liabilities) for Rock Castle Construction The debt ratio focuses on the percentage of company assets financed with debt as opposed to equity. For example, a debt ratio of 40% indicates that 40 percent of the enterprise's assets are financed with debt. Too high a debt ratio can indicate increased risk of default on the debt. Calenlate the Debt Ratio (Total Liabilities/Total Assets) for Rock Castle Construction The profit margin shows the percentage of each sales dollar that is left in profit. For example, a profit margin of 10% indicates that on average, 10 cents of each dollar of sales is profit. Profit margin varies greatly by industry with some industries, such as discount stores, having low profit margins. Calestate the Profit starrin (Net Income or Net Profit, Total Sales) for Rock Castle Construction for this fiscal year. Prepare a brief email to Rock Castle summarizing the results of your ratio analysis and outlining your conclusions, comments, or recommendations based on your analysis. E10-3-3 Ratios In addition to the QuickBooks reports you will be providing Mr. Castle, you decide that preparing ratio analysis for him will provide additional insight into Rock Castle Construction operations. Using your QuickBooks reports from this chapter and exercises, calculate the following ratios. The Current Ratio is used as a measure of how well current assets cover the current liabilities that will be due within the next year. If an enterprise has $2 in current assets for each Si in current liabilities, the current ratio is stated as 2:1. Calealate the Current Ratio (Current Assets Current Liabilities) for Rock Castle Construction The debt ratio focuses on the percentage of company assets financed with debt as opposed to equity. For example, a debt ratio of 40% indicates that 40 percent of the enterprise's assets are financed with debt. Too high a debt ratio can indicate increased risk of default on the debt. Calenlate the Debt Ratio (Total Liabilities/Total Assets) for Rock Castle Construction The profit margin shows the percentage of each sales dollar that is left in profit. For example, a profit margin of 10% indicates that on average, 10 cents of each dollar of sales is profit. Profit margin varies greatly by industry with some industries, such as discount stores, having low profit margins. Calestate the Profit starrin (Net Income or Net Profit, Total Sales) for Rock Castle Construction for this fiscal year. Prepare a brief email to Rock Castle summarizing the results of your ratio analysis and outlining your conclusions, comments, or recommendations based on your analysisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started