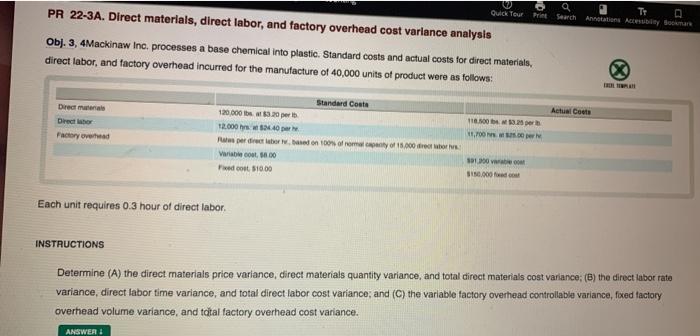

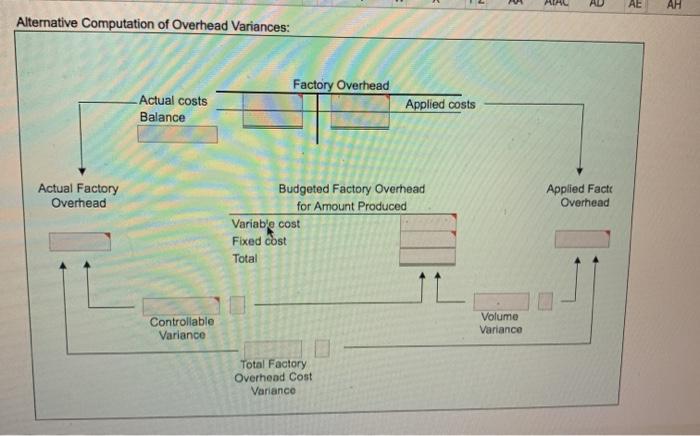

QuickTout Print Search Ano Ay Suman PR 22-3A. Direct materials, direct labor, and factory overhead cost variance analysis Obj. 3, 4Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 40,000 units of product were as follows: Actual Coets Direct Director Factory Overhead Standard Conta 120.000 5.20 12.000 SM.40 perdre bored on some of 15.000 Variable cost. 8.00 Fedot 10.00 116.0 Mb 1.FOONS 181 000 150.000 do Each unit requires 0.3 hour of direct labor. INSTRUCTIONS Determine (A) the direct materials price variance, direct materials quantity variance, and total direct materials cost varianco; (B) the direct labor rate variance, direct labor time variance, and total direct labor cost variance, and (C) the variable factory overhead controllable variance, foxed factory overhead volume variance, and total factory overhead cost variance. ANSWER: AE AH Alternative Computation of Overhead Variances: Factory Overhead Actual costs Balance Applied costs Actual Factory Overhead Budgeted Factory Overhead for Amount Produced Variable cost Applied Fact Overhead Fixed cost Total Controllable Variance Volume Variance Total Factory Overhead Cost Variance QuickTout Print Search Ano Ay Suman PR 22-3A. Direct materials, direct labor, and factory overhead cost variance analysis Obj. 3, 4Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 40,000 units of product were as follows: Actual Coets Direct Director Factory Overhead Standard Conta 120.000 5.20 12.000 SM.40 perdre bored on some of 15.000 Variable cost. 8.00 Fedot 10.00 116.0 Mb 1.FOONS 181 000 150.000 do Each unit requires 0.3 hour of direct labor. INSTRUCTIONS Determine (A) the direct materials price variance, direct materials quantity variance, and total direct materials cost varianco; (B) the direct labor rate variance, direct labor time variance, and total direct labor cost variance, and (C) the variable factory overhead controllable variance, foxed factory overhead volume variance, and total factory overhead cost variance. ANSWER: AE AH Alternative Computation of Overhead Variances: Factory Overhead Actual costs Balance Applied costs Actual Factory Overhead Budgeted Factory Overhead for Amount Produced Variable cost Applied Fact Overhead Fixed cost Total Controllable Variance Volume Variance Total Factory Overhead Cost Variance