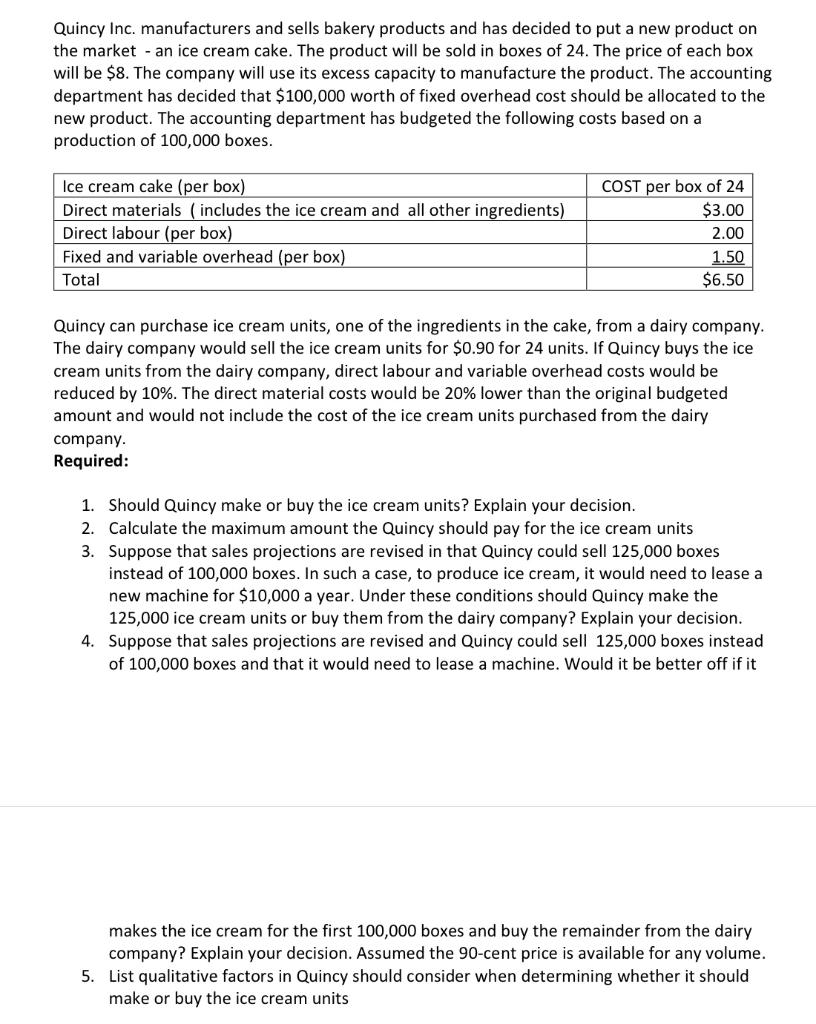

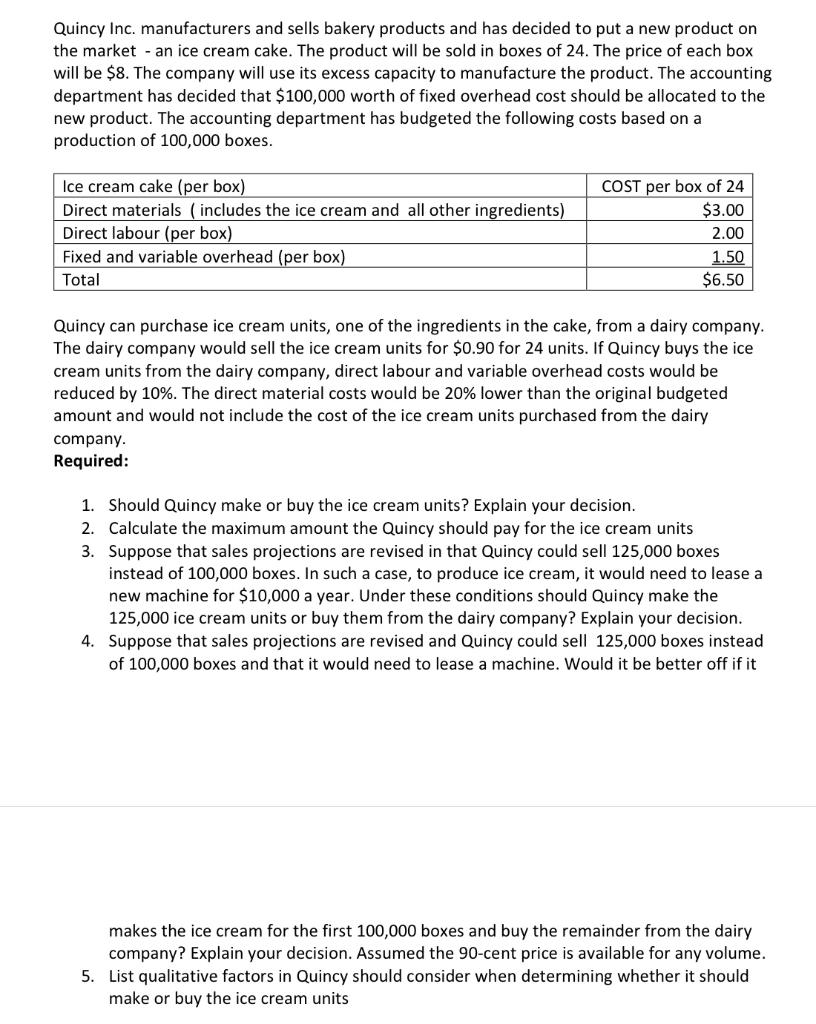

Quincy Inc. manufacturers and sells bakery products and has decided to put a new product on the market - an ice cream cake. The product will be sold in boxes of 24 . The price of each box will be $8. The company will use its excess capacity to manufacture the product. The accounting department has decided that $100,000 worth of fixed overhead cost should be allocated to the new product. The accounting department has budgeted the following costs based on a production of 100,000 boxes. Quincy can purchase ice cream units, one of the ingredients in the cake, from a dairy company. The dairy company would sell the ice cream units for $0.90 for 24 units. If Quincy buys the ice cream units from the dairy company, direct labour and variable overhead costs would be reduced by 10%. The direct material costs would be 20% lower than the original budgeted amount and would not include the cost of the ice cream units purchased from the dairy company. Required: 1. Should Quincy make or buy the ice cream units? Explain your decision. 2. Calculate the maximum amount the Quincy should pay for the ice cream units 3. Suppose that sales projections are revised in that Quincy could sell 125,000 boxes instead of 100,000 boxes. In such a case, to produce ice cream, it would need to lease a new machine for $10,000 a year. Under these conditions should Quincy make the 125,000 ice cream units or buy them from the dairy company? Explain your decision. 4. Suppose that sales projections are revised and Quincy could sell 125,000 boxes instead of 100,000 boxes and that it would need to lease a machine. Would it be better off if it makes the ice cream for the first 100,000 boxes and buy the remainder from the dairy company? Explain your decision. Assumed the 90 -cent price is available for any volume. 5. List qualitative factors in Quincy should consider when determining whether it should make or buy the ice cream units Quincy Inc. manufacturers and sells bakery products and has decided to put a new product on the market - an ice cream cake. The product will be sold in boxes of 24 . The price of each box will be $8. The company will use its excess capacity to manufacture the product. The accounting department has decided that $100,000 worth of fixed overhead cost should be allocated to the new product. The accounting department has budgeted the following costs based on a production of 100,000 boxes. Quincy can purchase ice cream units, one of the ingredients in the cake, from a dairy company. The dairy company would sell the ice cream units for $0.90 for 24 units. If Quincy buys the ice cream units from the dairy company, direct labour and variable overhead costs would be reduced by 10%. The direct material costs would be 20% lower than the original budgeted amount and would not include the cost of the ice cream units purchased from the dairy company. Required: 1. Should Quincy make or buy the ice cream units? Explain your decision. 2. Calculate the maximum amount the Quincy should pay for the ice cream units 3. Suppose that sales projections are revised in that Quincy could sell 125,000 boxes instead of 100,000 boxes. In such a case, to produce ice cream, it would need to lease a new machine for $10,000 a year. Under these conditions should Quincy make the 125,000 ice cream units or buy them from the dairy company? Explain your decision. 4. Suppose that sales projections are revised and Quincy could sell 125,000 boxes instead of 100,000 boxes and that it would need to lease a machine. Would it be better off if it makes the ice cream for the first 100,000 boxes and buy the remainder from the dairy company? Explain your decision. Assumed the 90 -cent price is available for any volume. 5. List qualitative factors in Quincy should consider when determining whether it should make or buy the ice cream units