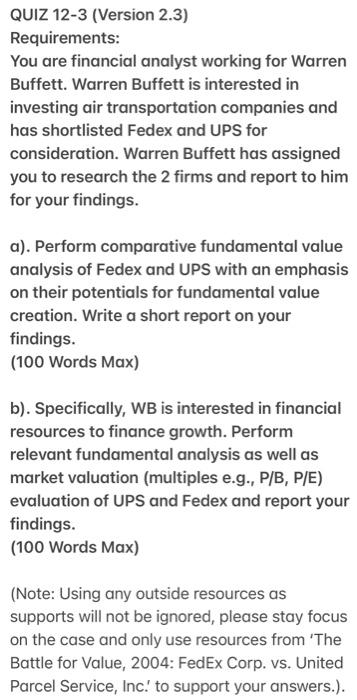

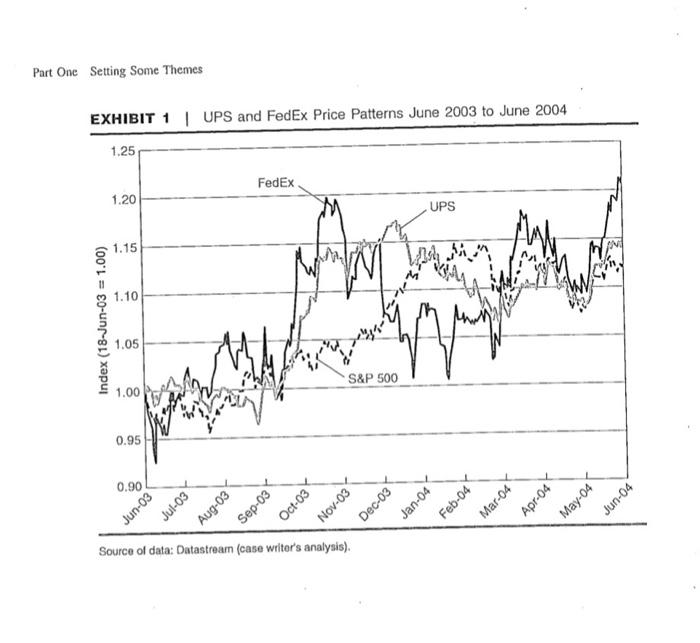

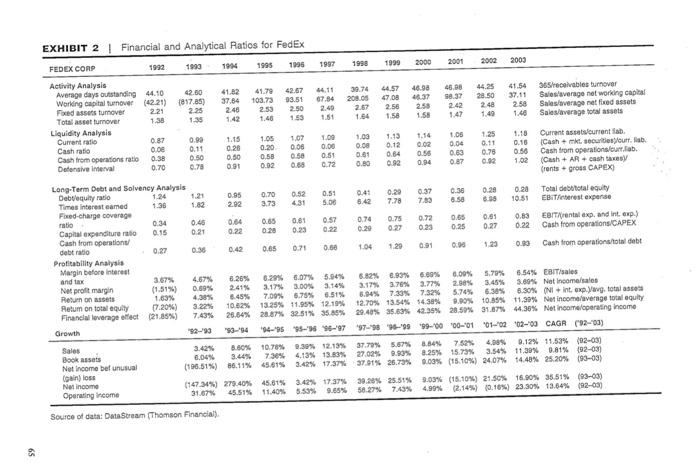

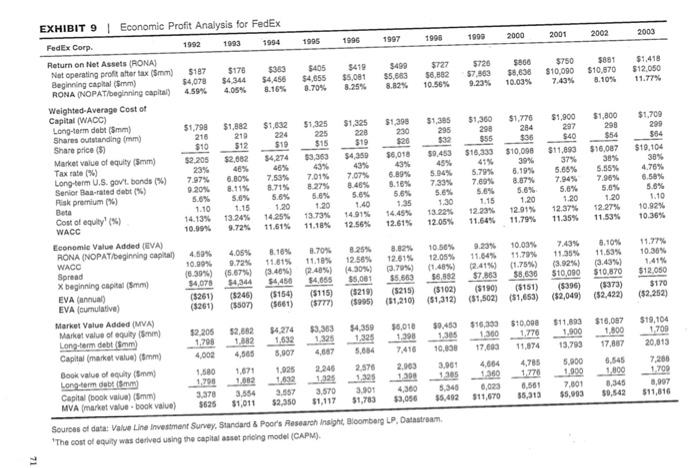

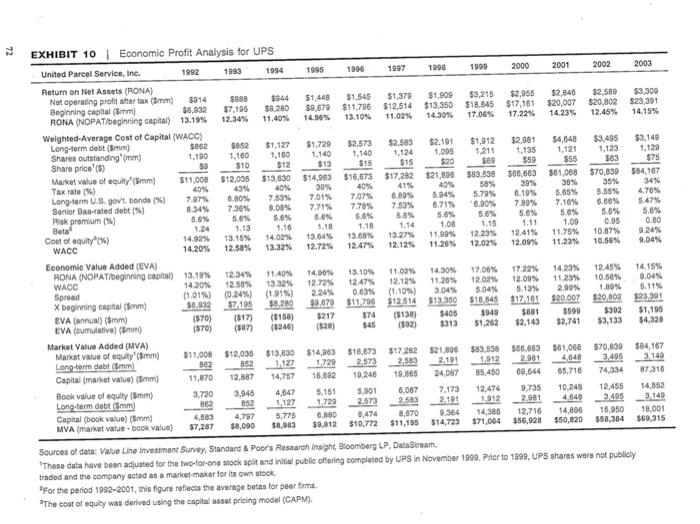

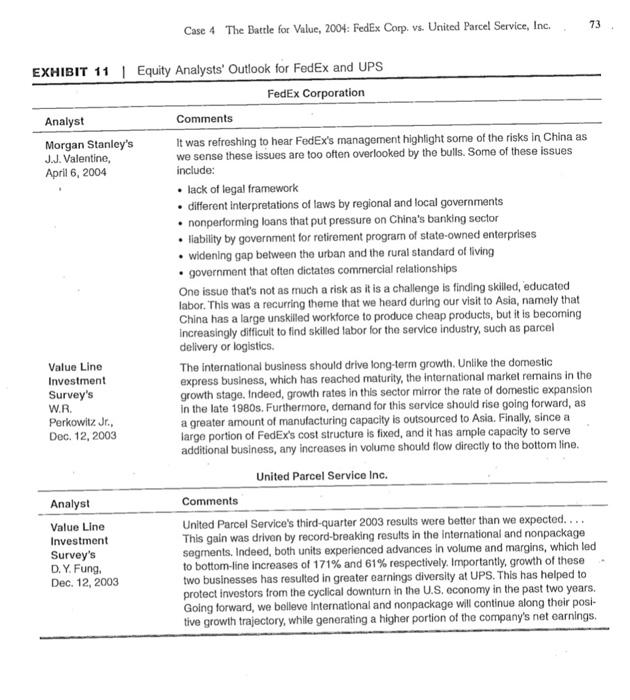

QUIZ 12-3 (Version 2.3) Requirements: You are financial analyst working for Warren Buffett. Warren Buffett is interested in investing air transportation companies and has shortlisted Fedex and UPS for consideration. Warren Buffett has assigned you to research the 2 firms and report to him for your findings. a). Perform comparative fundamental value analysis of Fedex and UPS with an emphasis on their potentials for fundamental value creation. Write a short report on your findings. . (100 Words Max) b). Specifically, WB is interested in financial resources to finance growth. Perform relevant fundamental analysis as well as market valuation (multiples e.g., P/B, P/E) evaluation of UPS and Fedex and report your findings. (100 Words Max) (Note: Using any outside resources as supports will not be ignored, please stay focus on the case and only use resources from 'The Battle for Value, 2004: FedEx Corp. vs. United Parcel Service, Inc. to support your answers.). Part One Setting Some Themes EXHIBIT 1 | UPS and FedEx Price Patterns June 2003 to June 2004 1.25 FedEx 1.20 UPS 1.15 1.10 Index (18-Jun-03 = 1.00) 1.05 S&P 500 1.00 0.95 0.90 Aug-03 Jul-03 Jun-03 Sep-03 Oct-03 Mar-04 Feb-04 Jan-04 Dec-03 Apr-04 May-04 Jun-04 Nov-03 Source of data: Dutastrearn (case welter's analysis). EXHIBIT 2 Financial and Analytical Ratios for FedEx 2.00 13.55 1:36 1.58 1.13 0.50 0.70 FEDEX CORP 1999 1914 1995 1998 1997 1998 1990 2000 2001 2000 2003 Activity Analysis Average days outstanding 44.10 11.02 41.79 42.67 4.11 39.74 44.57 46.00 48.00 44.25 41.54 Working capital turnover (42.21) 365/receivables burnover 1017.85) 37.04 103.73 67.34 2080 47.00 48.3 58.37 28.50 37.11 Fixed assets turnover Sales average not working capital 221 2.25 2.40 2.53 2.50 2.67 2.56 2.50 2.42 240 Total asset turnover 2.58 Sales/average reted assets 1.42 1.40 1.55 1.51 1.64 1.58 1.47 1.49 1.40 Sales/average total assets Liquidity Analysis Current ratio 0.87 0.90 1.15 1.05 1.07 1.00 1.00 1.16 1.06 1.25 Cash ratio 0.00 1.18 Current assets current fab 0.11 0.26 0.20 0.00 0.00 0.00 0.12 0.02 0.04 0.11 Cash from operationis ratio 0.18 Cash+mt securities four.lib. 0.38 0.50 0.50 0.50 0.51 0.61 0.54 0.56 0.63 0.56 Cash from operations.fb. Detersive Interval 0.70 0.70 0.91 0.02 0.66 0.72 0.80 0.92 0.94 0.87 0.92 102 (Cash + AR cash they Long-Term Debt and Solvency Analysis trents gross CAPEX) Debequity ratio 1.24 0.95 0.70 0.52 0.51 0.41 0.20 0:37 0.36 0.28 0.20 Times interesteemed Total debuttal equity 1.30 1.82 2.92 3.73 431 5.08 6.42 7.78 7.00 6.50 8.00 10.51 EB Test expense Fred-charge coverage ratio 0.34 0.40 0.64 0.65 057 0.74 0.75 0.72 0.01 0.83 Capital expenditure rato EBIT rental expand interp) 0.15 0.21 0.22 010 0.23 0.29 0.23 0.25 0.27 0.22 Cash from operation Cash from operations CAPEX debt ratio 0.27 0:36 0.42 0.65 0.71 0.60 1.04 0.00 123 0.00 Profitability Analysis Cash from operation total debt Margin before interest and tax 3.67% 4.67% 8.265 6.29% 0.07% 5.00 6.82% 8.83% 6.00% Net profit margin 0.00% 5.79% 6.54% EBITsales (1.51%) 0.89% 2.41% 3.173.00% 3.145 3.17% 3.76% 3.77% Return on 10 2.50% 3.45% 3.80% Net Income sales 6.45% 7.00% 5.75% 6.51% 8.94% 730% 7.32% Retum on total equily 5.74% 6.38% 6.30% (Niint. ex. avg. total asset 17.20%) 3.22% 10.62% 13.25% 11.95% 12.10% 2.70% 13.54% 54,38% 9.90% 10.88% 11,99% Net income average total equity Financial leverage offect (21.85%) 7.43% 26.64% 20.87% 32.51% 35.86% 29.40% 5.635 42.5% 28.50% 31.675 44.36% Net noomne operating income Growth 92-93 "93-94 04-95 95-96 96-97 97 98 96-99 99-0000-01 01-02 02-09 CAGR (920) Sales 8.60% 10.78% 9.30% 12.13% 37.7% 5.67% 0.84% 7524 Book assets 4.005 0.12% 11.53% 92-03) 6.00 3.44% 730% 4.13% 13.80% 27.025 0.00% 3.25% 15.73% 3.54% 11,39% 0.81% 92-03 Net Income bel unusual (196.51%) 66.11% 45.615 3.42% 17.37% 37.915 26.73% 0.03% (15.10%) 24.07% 4,40% 25.20% (90-03) gain lose Net income (147-30%) 279.40% 45.81% 3.42% 17.37% 30.28% 25.5% 3.03% (15.10%) 21.50% 16.00% 35.51% (03-08) Operating income 31.67% 45,51% 11.40% 5.53% 9.65% 58.27% 743% 4.90% 2.14%) (0.16%) 23.30% 13.64% (92-03) Source of data: DataStream (Thomson Financial) 1.20 1.63% 438% $1.00 4.16 1.19 0.00 6.94 12.17 EXHIBIT 3 Financial and Analytical Ratios for UPS UPS 1902 1980 1994 1995 1996 1990 1999 2000 2001 2000 2003 Activity Analysis Average days and 23.13 23.11 25.66 30.50 31 37. 300 . 53.16 5432 365ivables tumover Working over 207.78 474.29 101.70 30.03 20:30 20.01 14:51 2.30 11.3 10:33 9.82 Federer Salaverage networking 2.50 219 2.00 2.1 234 2.41 2.28 2.30 2.41 Total over Salaverage needs 100 1.75 1 141 13 1.10 Liquidity Analysis Sewerage to Current ratio 1.03 1.00 . 1.48 1.50 1.04 1.57 Cash rate Outral 0.56 012 0.00 GOT 0.14 1.50 04 0:35 0:54 0.72 Cash from operations Cash + miesto 0.00 O. 0.56 0.6 0.73 0.77 04 1.01 Defensive Wervel Cash from operation. 1.21 1.03 LAT 1:36 130 160 515 3.69 22 4.30 Cash Achary Contros CAPEX) Long-Term Det and solvency Analysis Dette 0.25 0.22 0.24 0.44 0.43 . 0.10 0.37 0.50 0.26 0:37 Times remed Total de quity 23.60 20.85 17.10 12.71 7.30 16.00 18.63 2315 30.41 Feed-charge coverage rate Treat expense 18. 13: 7.30 16.00 10:58 16.00 23.15 Cap expenditure 1.41 Erland in 0.25 0.21 010 0.22 0.10 041 0:33 Cashtro operation 167 Cash from CAPEX 2.04 1.13 0.74 0.04 1.10 0.00 Or 0.75 122 122 Cash from operations et Profitability Analysis Margin before 7.745 8.20 704 10.2007 7.569 1247 14.7% 15.104 Net prolt margin 12.00% 12.015 13.105 3.12% 45% 40% 5125 4.05% 70% 3.20 . Ruum 6:47% 0.10% 3.10% 2.2% 69 10.185 2.86% Net inom 7.10 11.15 14695 10.00 +2.73% 10.44% + int you total Ruum on tot equity 13.07% 20.59% 20.30% 20.259 142 14.305 427 7.005 0.14% Final vergeet 23.411 3.58% 19.515 Netingetot quity 3550 46.105 10:30 10:4116 0.10% 3.02% 0.705 39.72 107.00% 6151 56.55% 2.35 Nel competing income Growth 0001 01-02 02-03 CAGR 7,85% 100% 7.515 404 10:36 10. 25 7004 7. Books 02-03 5.09% 10.00% 19.00% 11.20% 0411 2018.015 15.00 13.7 60%. Net income nel vino 8.12% 02-03 5.82% 16,51% 10.57% 20.60 1.40.28%) 2009 (17) 34.10% (0.00%) 14254 10-05) Nel nome 56.00 16515 10574.000 1.50 4201 22:21 (18232.6459) 10.034 00 Opering income 14.00% 67% 30.2113 11.15 1.0 20.00% 4. 1011 10.01% 12.35% 0-0 Source of data: DataStream (Thoman Francia) 67 Case 4 The Battle for Value, 2004: FedEx Corp. vs. United Parcel Service, Inc. United Parcel Service, Inc. Establishes next-day air service EXHIBIT 4 Timeline of Competitive Developments FedEx Corp. Offers 10:30 A.M. delivery 1982 Acquires Gelco Express and launches 1984 oporations in Asia-Pacific Establishes European hub in Brussels 1985 Introduces handheld barcode scanner 1986 to capture detailed package information Offers warehouse services for IBM. 1987 National Semiconductor, Laura Ashley 1988 Begins Intercontinental air service between United States and Europe 1989 Acquires Tiger International to expand its International presence . Wins Malcolm Baldrige National Quality Award 1990 1991 Establishes UPS's first air fleet . Offers automated customs service Expands international air service to 180 countries Introduces 10:30 A.M. guarantee for next day air Begins Saturday delivery . Offers electronic-signature tracking Expands delivery to over 200 countries Provides supply-chain solutions through UPS Logistics Group Launches Web site for package tracking . Offers guaranteed 8 A.M. overnight delivery . Offers two-day delivery 1992 1993 . 1994 1995 1999 2000 Launches Web site for package tracking Acquires air routes serving China Establishes Latin American division Creates new hub at Roissy-Charles de Gaullo Airport in France Launches business-to-consumer home-delivery service Carries U.S. Postal Service packages Acquires American Freightways Corp. Expands home delivery to cover 100% of the U.S. population Acquires Kinko's retail franchise Establishes Chinese headquarters 2001 Makes UPS stock available through a public offering Acquires all-cargo air service in Latin America Acquires Mail Boxes Etc. retail franchise Begins direct flights to China Offers guaranteed next-day homo delivery Contracts with Yangtze River Express for package delivery within China Reduces domestic ground-delivery time 2002 2003 UPS 3.5% EXHIBIT 5 Summary of Announced List-Rate Increases 1998 1999 2000 2001 2002 2003 2004 Average Dato implemented 2/8/02 2/9/03 2/8/04 2/6/05 1/8/06 1/7/07 1/6/08 UPS ground 3.6% 2.5% 3.1% 3.1% 3.9% 1.9% 3.1% U.S. domestic air 3.3% 2.5% 3.5% 3.7% 4.0% 3.2% 2.9% 3.3% U.S. export 0.0% 0.0% 2.9% 2.9% 3.9% 2.9% 2.9% 2.2% Residential premium $1.00 $1.00 $1.00 $1.05 $1.10 $1.15 $1.40 Commercial premium NA NA NA NA N/A NA $1.00 FedEx 1998 1999 2000 2001 2002 2003 2004 Average Date Implemented 2/16/02 2/9/03 2/2/04 2/2/05 1/8/06 1/7/07 1/6/0B FedEx ground 3.6% 2.5% 3.1% 3.1% 3.5% 3.9% 1.9% 3.1% U.S. domestic air 3.5% 2.8% 0.0% 4.9% 3.5% 3.5% 2.5% 3.0% U.S. export 0.0% 0.0% 0.0% 2.9% 3.5% 3.5% 2.5% 1.8% Residential premium-expressa NA NA NA $1.35 $1.40 $1.75 Residential premium-ground NA NA NA $1.30 $1.35 $1.40 $1.75 Residential premium-home delivery? NA NA NA $1.05 $1.10 $1.15 $1.40 Commercial premium-express NA NA NA $1.50 $1.75 $1.00 Commercial premium ground NA NA NA NA NA $1.00 Sources of data: UPS, FedEx, and Morgan Stanley 'The residential premium was an additional charge for deliveries of express letters and packages to residential addresses, a price distinction UPS had applied to residential ground deliveries for the previous 10 years to offset the higher cost of providing service to them. The commercial premium was applied to products shipped to remote locations andor select zip codes. NA NA NA EXHIBIT 6 Cumulative Capital Expenditures for FedEx and UPS $25.0 $20.0 FedEx Corp $15.0 Billions (USS) United Parcel Service $10.0 $5.0 $ 0.0 1992 1993 1994 1995 1996 266 1998 1999 2000 2001 2002 2003 Sources of data Company regulatory flings 2003 EXHIBIT 7 Geographic Segment Information values in millions of U.S. dollars) FedEx Corp. 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 U.S. domestic Revenue 5,195 5,668 5,195 6.839 7.466 8,322 9,665 12,910 13,805 14,858 15,968 17,277 Identifiable assets 3,941 4,433 4,884 5,322 5,449 6,123 6,873 6,506 7,224 8,637 8,627 9,908 International Revenue 2.355 2,140 2.280 2.553 2,807 3,198 3,589 3,863 4,452 4,771 4,639 5,210 Identifiable assets 1.522 1,360 1,109 1,112 1.250 1,503 1,503 1,001 1,018 1,254 1,520 1,536 Consolidated Revenue 7,550 7,808 7,474 9,392 10,274 11,520 13,255 16,773 18,257 19,629 20,607 22,487 Identifiable assets 5.463 5,793 5,992 6,433 6,699 7.625 8,376 7,507 B.242 9,891 10.147 11.444 United Parcel Service Inc. 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 U.S. domestic Revenue 14,722 15,823 17,298 18,243 20,108 20,238 22,252 24,093 26,325 26,163 26,284 26,968 Identifiable assets 7,873 8,539 9,902 11,157 9,376 10.063 9,832 10,725 12,477 13,717 14,129 14,915 International Revenue 1.797 1,960 2,278 2,802 2,260 2.220 2,536 2,959 3,446 4,158 4,988 6,517 Identifiable assets 1,164 1,214 1.280 1.488 1.323 1,372 1.810 2,111 2,061 3,050 2,874 3,567 Consolidated Revenue 16,519 17,782 19,576 21.045 22,368 22,458 24.788 27,052 29,771 30,321 31,272 33,485 Identifiable assets 9,038 9,754 11,182 12,845 10,609 11,435 11,642 12,836 14,538 16,767 17,003 18,482 Sources of data: Company regulatory filings *FASB Statement No. 131 (Disclosures about Segments of an Enterprise and Related information), established the standard to be used by enterprises to identity and report Information about operating segments and for related disclosures about products and services, geographic areas, and major customers. 2003 1994 1995 1988 30.00 $2.79 nm EXHIBIT 8 | Equity Prices and Returns for FedEx and UPS United Parcel Service, Inc. 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 Stock price, December 31 59.25 $10.30 $11.75 $18.13 $14.83 $15.38 $20.00 $69.00 $58.75 $54.50 $63.00 $74.55 Dividends per share 30.25 50.25 $0.28 30.32 50.34 50.35 50.58 5022 $0.76 $0.58 EPS, basic incl. $0.92 $0.76 extra items! 30.44 $0.70 $0.83 $0.92 $1.00 30.82 $1.50 $0.70 $2.54 $2.13 5284 $2.57 P/E multiple 21.26 14.82 1434 14.55 18.34 12.58 8734 23.13 25.50 20.01 22.21 Capital appreciation 12.16% 13.25% 11.70% 11.43% 5.13% 30.08% 245.00% (14.86%) (7.23%) 16.74% 18.18% Cumul compound annual return 12.16% 27.03% 41.89% 58.11% 58.22% 116.22% 545.95% 535.14% 489.19% 581.95% 705.05% FedEx Corp. 1992 1993 1996 1997 1999 2000 2001 2002 2003 Stock price, December 31 $10.19 $12.25 $19.13 314,97 $19.10 $26.10 $32.00 $54,81 $35.50 $40.00 3539 Dividends per share $63.90 $0.00 $0.00 $0.00 50.00 $0.00 $0.00 $0.00 50.00 $0.00 $0.00 $0.20 EPS, basic incl. extra items (50.53) $0.25 $0.91 $132 $135 $1.56 $1.72 $2.13 5230 $2.02 $2.30 P/E multiple 50.00 20.00 11.36 14.22 16.79 18.70 25.73 15.04 19.30 22.67 22.99 Capital appreciation 20.25% 56.12 121.739) 27.97% 36.70% 22.43% 70.96% (35.23%) 12.58% 34.68% 18.59% Cumul compound annual return 20.25% 87.73% 48.93% 38.04% 157.00% 214.72% 43804% 248.47% 292.64% 428.57% 528.02% Standard & Poor's 500 Index 1992 1993 1994 1905 1996 1990 1999 2001 2002 2003 Index level 435.71 488.45 450.27 615 93 740.74 970.43 1.229.23 1.489 25 1.320.28 1.148.09 1.111.92 679.82 Annual retum 7.06% (1.54%) 34.115 20.26% 31.01% 20.67% 19.53% (10.14% (13.04%) (23.37%) 26.38% Cumul compound annual return 7.00% 5.41% 41.36% 70.01% 122.22% 182.12% 237 21% 203.02% 163.50% 101.93% 155-20% Cumul. Market Adjusted Returns 1993 1994 1995 1996 1007 1990 1999 2000 2001 2002 2003 UPS 5.11% 21.52% 0.53% (11.00%) 56.5156) (65.90%) 400.74% 332.12% 325.60% 480.02% 550.75% FedEx 13.19% 82.32% 5.57% 18.09% 34.33% 12.00% 200.83% 45.45% 120.14% 327.64% 372.33% Source of data: Standard & Poor's Research Insight annual reports These data have been adjusted for the two foros stock split and initial public ofering completed by UPS in November 1990. Prior to 1990, UPS shares were not publicly traded and the company acted as a markomaker for its own stock Compound annual return callation Current your price-Beginning your priceyleginning year price 2000 1997 2001 2002 2003 1992 $750 $10,090 7.49% $881 $10,870 8.10% $1,418 $12,050 11.77% 210 30% $1,900 297 $40 $11,090 37% 5.66% 7.94% 5.6% 1.20 12,37% 11.35% $1,800 298 $54 $16.087 38% 5.55% 7.98% 5.8% 1.20 12.27% 11.53% $1,700 299 554 $19,104 30% 4.76% 6.58% 5.6% 1.10 10.92% 10.36% EXHIBIT 9 | Economic Profit Analysis for FedEx FedEx Corp. 1993 1994 1995 1995 1997 1996 1999 2000 Return on Net Assets (RONA) Not operating profit after tax (mm) 5187 $175 5303 $405 $419 $490 $727 5720 5800 Beginning capital (m) 54,078 $4,344 $4,456 $4,655 $5.081 $5,683 56,882 57.363 $5,636 RONA (NOPAT/beginning capital) 4.59% 4.05% 8.16% 8.70% 8.25% 8.82% 10.56% 9.23% 10.03% Weighted Average Cost of Capital (WACC) Long-term debt (mm) $1,799 $1,882 $1,832 $1,325 $1,325 $1,398 31,385 51.360 $1,770 Share outstanding (mm) 216 224 225 230 295 298 284 Share price ($) $10 312 $19 $15 $10 520 $32 555 $36 Market value of equity (mm) $2.205 $2,082 54,274 53.369 $4,350 $6,018 59.453 $16,330 $10,000 Tax rate(%) 23% 40% 48% 434 45% Long-term U.S.govt. bonds (%) 7.97% 6,60% 7.53% 7,01% 7.07% 6.89% 5.94% 5.79% 6.19% Senior Brated debt (%) 9.20% 8.11% 8.71% 8.27% 8.46% 3.18% 7335 7.69% 8.87% Risk premium (%) 5.6% 5.6% 5.6% 5.6% 5.6% 5.6% 5.6% 5.6% Beta 1.10 1.15 1.20 1.20 1:40 1.35 1.30 1.15 1,20 Cost of equity' (%) 14.13% 13.24% 14.25% 13.73% 14.91% 14.45% 13.22% 12.23% 12.01% WACC 10.99% 9.72% 11.61% 11.18% 12.56% 12.615 12.05% 11.64% 11.79% Economie Value Added (EVA) RONA (NOPAT/beginning capital) 4.59% 4.05% 8.18% 8.70% 8.25% 8.82% 10.50% 10.03% WACC 10,90% 9.72% 11.81% 11.10% 12.56% 12.61% 12.05% 11.64% 11.79% Spread (6.30%) (5.67%) (3.40%) 2.40%) 14.30%) 3.70%) (1.4) (2.41% (1.75%) X beginning capital) $4,078 $4,346 $4,665 $5,001 $5.663 56,582 $7.563 $8,630 EVA (annual) (5261) (5246) (5154) (5115) (5210) (S215) ($190) (5151) EVA (cumulative) (261) (5507) (5661) (5777) ($995) (51,210) (1,312) ($1,502) ($1,653) Market Value Added (MVA) Market value of equity) 52 205 52.82 34.274 $3.363 34,359 30.010 39.455 $16,30 $10.000 Long-term debt (mm 1.200 1.882 1.632 1325 1.398 1.305 1.300 1.770 Capital market value) (mm) 4,002 4,565 5,907 4,667 5.654 7,410 10.000 17,600 11,874 Book value of equity (m) 1.500 1.671 1.025 2.240 2.576 2.003 3.000 4,664 4785 Long-term debem 1.700 1082 16:22 1325 1309 1960 1.770 Capital (book value) (mm) 3,878 3.554 3.557 3.570 3.901 4,300 5.340 0,023 6.561 MVA market value-book value) 5625 $1,011 52,350 $1,117 51.783 $3,056 $5,492 $11,670 35,313 Sources of data: Value Line Investment Survey, Standard & Poor's Research Insight, Bloomberg LP. Dataram 'The cost of equity was derived using the capital asset pricing model (CAPM) 7.43% 11.35% (3.92%) $10,000 (5396) (52,049) 8.10% 11.53% (3.43%) $10,870 (373) (52,422) 11.77% 10.36% 1.41% $12,050 $170 (52.252) 14.458 ($102) 1.325 $11.693 1.900 13,793 5.000 1990 7,001 $5,003 $18,097 1.300 17,867 5.545 1.800 0,345 50,542 $19,104 1.709 20,013 7,200 1.700 3,907 $11,816 3305 71 72 5.0 1.14 EXHIBIT 10 Economic Profit Analysis for UPS United Parcel Service, Inc. 1992 1993 1994 1995 1996 1997 1908 1999 2000 2001 2002 2003 Return on Net Assets (RONA) Not operating profit after tax (mm) 5914 $588 5944 $1,448 $1,545 $1,379 $1,909 $3,215 $2,955 $2,845 $2,589 $3.300 Beginning capital (mm) $5,832 $7.195 $8,280 $9,670 $11.796 $12,514 $13,350 $18.845 $17,161 $20,007 520,802 $23,391 RONA (NOPAT/beginning capital) 13.19% 12.34% 11.40% 14.96% 13.10% 11.02% 14.30% 17.06% 17.22% 14.23% 12.45% 14.15% Weighted Average Cost of Capital (WACC) Long-term debt (mm) 5862 3052 $1,127 $1,720 $2,573 $2,583 $2.191 $1,912 $2,981 $4,648 $3.495 $3,149 Shares outstanding Imm) 1.190 5,160 1.100 1.149 1,140 1,124 1.00 1.211 1.135 1.121 1,123 1.120 Share price (5) SO $10 $12 $13 $15 $15 $20 $80 $59 $55 563 $75 Market value of equity (mm) $11,000 $12,055 $13,630 $14,963 $16,673 $17,262 $21,898 $83,538 $66.663 $61,068 Tax rato (9) $84.167 $70,839 40% 40% 30% 40% 40% 58% 39% 30% 35% 34% Long-term U.S.govt bonds (%) 7.97% 8.00% 7.53% 7.01% 7.07% 8.80% 5.94% 5.79% 6.19% 5,65% 5.85% 4.76% Senior Datated debt (%) 8.34% 7.30% B.00% 7.71% 7.78% 7.53% 6.71% *8.90% 7.99% 7.16% 6.60% 5.47% Risk premium (96) 5.6% 50% 5.8% 5.6% 5.6% 5.6% 5.6% 5.6% 5.6% Beta 1.24 1.13 1.10 1.10 1.18 1.00 1.15 1.11 1.00 0.95 0.00 Cost of equity) 14.925 13.15% 14.02% 13.64% 13.68% 13.27% 11.00% 12.23% 12.41% 11.75% 0.07% 9.24% WACC 14.20% 12.58% 13.32% 12.72% 12.47% 12.12% 11.26% 12.02% 12.09% 11.23% 10.56% 9,04% Economie Value Added (EVA) RONA (NOPAT/beginning capital) 13.18% 12.34% 11.40% 14.00% 13.104 11.02 14.50% 17.06% 17.22% 14,23% 12.45% 14,15% WACC 14,20% 12.50% 13 32% 12.72% 12A7% 12.12% 11.26% 12.02% 12.00% 11.23 10.50% 0.04% Spread (1,01%) (024%) (1.1%) 2.24% 0.63% (1.10%) 3,04% 5,04% 5.13% 2.99% 1.00% 5.11% X beginning Capital (mm) $6,032 2105 5820 $9.670 $11.706 $12,514 $13.50 518.845 312101 $20.007 $20.000 $23 391 EVA (annual) (mm) (570) (8150) 5217 574 (5130) 5405 5949 $681 $590 $392 $1,195 EVA (cumulative) (mm) (570) (507) (5246) (520) (592) 3313 51.262 $2,143 52,741 $3,133 $4,320 Market Value Added (MVA) Market value of equity (mm) $11,000 $12,035 513,630 $14,963 $18,673 317.282 $21,800 383.530 $66.663 561,068 $70,839 584,167 Long term debt (mm) B62 1.122 1.720 2.573 2.589 2.11 1912 2001 4540 3.495 3140 Capital market value) (mm) 11,870 12,687 14,757 16,692 19,246 10.065 24.087 85.450 19,644 65,716 74,334 87316 Book value of equity (mm) 3,720 3.945 4,647 5.151 3.001 6,087 7.173 12.474 9.735 10.245 12,455 14,652 Long-term dobtam 362 852 1,722 2572 2,583 2.191 1.912 2981 4048 3.495 3.149 Capital (book value) (mm) 4,583 4,797 5,775 6.880 8,474 8,670 9,364 14,385 12,710 14,896 15,950 18.001 MVA (market value-book value) 37,287 $8,000 $8.983 $0,012 $10,772 $11,195 $14,723 $71,064 $56,920 $50,820 $58,384 569,315 (517) 1,127 Sources of data: Value Line Investment Survey, Standard & Poor's Research Insight, Bloomberg LP. DataStream 'These data have been adjusted for the two-for-one stock split and initial public offering completed by UPS in November 1909. Prior to 1999, UPS shares were not publicly traded and the company acted as a market-maker for its own stock *For the period 1992-2001, this figure reflects the average betas for peer is The cost of equity was derived using the capital asset pricing model (CAPM). 73 Case 4 The Battle for Value, 2004: FedEx Corp. vs. United Parcel Service, Inc. EXHIBIT 11 | Equity Analysts' Outlook for FedEx and UPS FedEx Corporation Analyst Comments Morgan Stanley's It was refreshing to hear FedEx's management highlight some of the risks in China as J.J. Valentine, we sense these issues are too often overlooked by the bulls. Some of these issues April 6, 2004 include: lack of legal framework different interpretations of laws by regional and local governments . nonperforming loans that put pressure on China's banking sector liability by government for retirement program of state-owned enterprises widening gap between the urban and the rural standard of living government that often dictates commercial relationships One issue that's not as much a risk as it is a challenge is finding skilled, educated labor. This was a recurring theme that we heard during our visit to Asia, namely that China has a large unskilled workforce to produce cheap products, but it is becoming Increasingly difficult to find skilled labor for the service industry, such as parcel delivery or logistics Value Line The international business should drive long-term growth. Unlike the domestic Investment express business, which has reached maturity, the international market remains in the Survey's growth stage. Indeed, growth rates in this sector mirror the rate of domestic expansion W.R. in the late 1980s. Furthermore, demand for this service should rise going forward, as Perkowitz Jr., a greater amount of manufacturing capacity is outsourced to Asia. Finally, since a Dec. 12, 2003 large portion of FedEx's cost structure is fixed, and it has ample capacity to serve additional business, any increases in volume should flow directly to the bottom line, United Parcel Service Inc. Analyst Comments Value Line United Parcel Service's third-quarter 2003 results were better than we expected.... Investment This gain was driven by record-breaking results in the International and nonpackage Survey's segments. Indeed, both units experienced advances in volume and margins, which led D. Y. Fung. to bottom-line increases of 171% and 61% respectively. Importantly, growth of these Dec. 12, 2003 two businesses has resulted in greater earnings diversity at UPS. This has helped to protect investors from the cyclical downturn in the U.S. economy in the past two years. Going forward, we believe International and nonpackage will continue along their posi- tive growth trajectory, while generating a higher portion of the company's net earnings, QUIZ 12-3 (Version 2.3) Requirements: You are financial analyst working for Warren Buffett. Warren Buffett is interested in investing air transportation companies and has shortlisted Fedex and UPS for consideration. Warren Buffett has assigned you to research the 2 firms and report to him for your findings. a). Perform comparative fundamental value analysis of Fedex and UPS with an emphasis on their potentials for fundamental value creation. Write a short report on your findings. . (100 Words Max) b). Specifically, WB is interested in financial resources to finance growth. Perform relevant fundamental analysis as well as market valuation (multiples e.g., P/B, P/E) evaluation of UPS and Fedex and report your findings. (100 Words Max) (Note: Using any outside resources as supports will not be ignored, please stay focus on the case and only use resources from 'The Battle for Value, 2004: FedEx Corp. vs. United Parcel Service, Inc. to support your answers.). Part One Setting Some Themes EXHIBIT 1 | UPS and FedEx Price Patterns June 2003 to June 2004 1.25 FedEx 1.20 UPS 1.15 1.10 Index (18-Jun-03 = 1.00) 1.05 S&P 500 1.00 0.95 0.90 Aug-03 Jul-03 Jun-03 Sep-03 Oct-03 Mar-04 Feb-04 Jan-04 Dec-03 Apr-04 May-04 Jun-04 Nov-03 Source of data: Dutastrearn (case welter's analysis). EXHIBIT 2 Financial and Analytical Ratios for FedEx 2.00 13.55 1:36 1.58 1.13 0.50 0.70 FEDEX CORP 1999 1914 1995 1998 1997 1998 1990 2000 2001 2000 2003 Activity Analysis Average days outstanding 44.10 11.02 41.79 42.67 4.11 39.74 44.57 46.00 48.00 44.25 41.54 Working capital turnover (42.21) 365/receivables burnover 1017.85) 37.04 103.73 67.34 2080 47.00 48.3 58.37 28.50 37.11 Fixed assets turnover Sales average not working capital 221 2.25 2.40 2.53 2.50 2.67 2.56 2.50 2.42 240 Total asset turnover 2.58 Sales/average reted assets 1.42 1.40 1.55 1.51 1.64 1.58 1.47 1.49 1.40 Sales/average total assets Liquidity Analysis Current ratio 0.87 0.90 1.15 1.05 1.07 1.00 1.00 1.16 1.06 1.25 Cash ratio 0.00 1.18 Current assets current fab 0.11 0.26 0.20 0.00 0.00 0.00 0.12 0.02 0.04 0.11 Cash from operationis ratio 0.18 Cash+mt securities four.lib. 0.38 0.50 0.50 0.50 0.51 0.61 0.54 0.56 0.63 0.56 Cash from operations.fb. Detersive Interval 0.70 0.70 0.91 0.02 0.66 0.72 0.80 0.92 0.94 0.87 0.92 102 (Cash + AR cash they Long-Term Debt and Solvency Analysis trents gross CAPEX) Debequity ratio 1.24 0.95 0.70 0.52 0.51 0.41 0.20 0:37 0.36 0.28 0.20 Times interesteemed Total debuttal equity 1.30 1.82 2.92 3.73 431 5.08 6.42 7.78 7.00 6.50 8.00 10.51 EB Test expense Fred-charge coverage ratio 0.34 0.40 0.64 0.65 057 0.74 0.75 0.72 0.01 0.83 Capital expenditure rato EBIT rental expand interp) 0.15 0.21 0.22 010 0.23 0.29 0.23 0.25 0.27 0.22 Cash from operation Cash from operations CAPEX debt ratio 0.27 0:36 0.42 0.65 0.71 0.60 1.04 0.00 123 0.00 Profitability Analysis Cash from operation total debt Margin before interest and tax 3.67% 4.67% 8.265 6.29% 0.07% 5.00 6.82% 8.83% 6.00% Net profit margin 0.00% 5.79% 6.54% EBITsales (1.51%) 0.89% 2.41% 3.173.00% 3.145 3.17% 3.76% 3.77% Return on 10 2.50% 3.45% 3.80% Net Income sales 6.45% 7.00% 5.75% 6.51% 8.94% 730% 7.32% Retum on total equily 5.74% 6.38% 6.30% (Niint. ex. avg. total asset 17.20%) 3.22% 10.62% 13.25% 11.95% 12.10% 2.70% 13.54% 54,38% 9.90% 10.88% 11,99% Net income average total equity Financial leverage offect (21.85%) 7.43% 26.64% 20.87% 32.51% 35.86% 29.40% 5.635 42.5% 28.50% 31.675 44.36% Net noomne operating income Growth 92-93 "93-94 04-95 95-96 96-97 97 98 96-99 99-0000-01 01-02 02-09 CAGR (920) Sales 8.60% 10.78% 9.30% 12.13% 37.7% 5.67% 0.84% 7524 Book assets 4.005 0.12% 11.53% 92-03) 6.00 3.44% 730% 4.13% 13.80% 27.025 0.00% 3.25% 15.73% 3.54% 11,39% 0.81% 92-03 Net Income bel unusual (196.51%) 66.11% 45.615 3.42% 17.37% 37.915 26.73% 0.03% (15.10%) 24.07% 4,40% 25.20% (90-03) gain lose Net income (147-30%) 279.40% 45.81% 3.42% 17.37% 30.28% 25.5% 3.03% (15.10%) 21.50% 16.00% 35.51% (03-08) Operating income 31.67% 45,51% 11.40% 5.53% 9.65% 58.27% 743% 4.90% 2.14%) (0.16%) 23.30% 13.64% (92-03) Source of data: DataStream (Thomson Financial) 1.20 1.63% 438% $1.00 4.16 1.19 0.00 6.94 12.17 EXHIBIT 3 Financial and Analytical Ratios for UPS UPS 1902 1980 1994 1995 1996 1990 1999 2000 2001 2000 2003 Activity Analysis Average days and 23.13 23.11 25.66 30.50 31 37. 300 . 53.16 5432 365ivables tumover Working over 207.78 474.29 101.70 30.03 20:30 20.01 14:51 2.30 11.3 10:33 9.82 Federer Salaverage networking 2.50 219 2.00 2.1 234 2.41 2.28 2.30 2.41 Total over Salaverage needs 100 1.75 1 141 13 1.10 Liquidity Analysis Sewerage to Current ratio 1.03 1.00 . 1.48 1.50 1.04 1.57 Cash rate Outral 0.56 012 0.00 GOT 0.14 1.50 04 0:35 0:54 0.72 Cash from operations Cash + miesto 0.00 O. 0.56 0.6 0.73 0.77 04 1.01 Defensive Wervel Cash from operation. 1.21 1.03 LAT 1:36 130 160 515 3.69 22 4.30 Cash Achary Contros CAPEX) Long-Term Det and solvency Analysis Dette 0.25 0.22 0.24 0.44 0.43 . 0.10 0.37 0.50 0.26 0:37 Times remed Total de quity 23.60 20.85 17.10 12.71 7.30 16.00 18.63 2315 30.41 Feed-charge coverage rate Treat expense 18. 13: 7.30 16.00 10:58 16.00 23.15 Cap expenditure 1.41 Erland in 0.25 0.21 010 0.22 0.10 041 0:33 Cashtro operation 167 Cash from CAPEX 2.04 1.13 0.74 0.04 1.10 0.00 Or 0.75 122 122 Cash from operations et Profitability Analysis Margin before 7.745 8.20 704 10.2007 7.569 1247 14.7% 15.104 Net prolt margin 12.00% 12.015 13.105 3.12% 45% 40% 5125 4.05% 70% 3.20 . Ruum 6:47% 0.10% 3.10% 2.2% 69 10.185 2.86% Net inom 7.10 11.15 14695 10.00 +2.73% 10.44% + int you total Ruum on tot equity 13.07% 20.59% 20.30% 20.259 142 14.305 427 7.005 0.14% Final vergeet 23.411 3.58% 19.515 Netingetot quity 3550 46.105 10:30 10:4116 0.10% 3.02% 0.705 39.72 107.00% 6151 56.55% 2.35 Nel competing income Growth 0001 01-02 02-03 CAGR 7,85% 100% 7.515 404 10:36 10. 25 7004 7. Books 02-03 5.09% 10.00% 19.00% 11.20% 0411 2018.015 15.00 13.7 60%. Net income nel vino 8.12% 02-03 5.82% 16,51% 10.57% 20.60 1.40.28%) 2009 (17) 34.10% (0.00%) 14254 10-05) Nel nome 56.00 16515 10574.000 1.50 4201 22:21 (18232.6459) 10.034 00 Opering income 14.00% 67% 30.2113 11.15 1.0 20.00% 4. 1011 10.01% 12.35% 0-0 Source of data: DataStream (Thoman Francia) 67 Case 4 The Battle for Value, 2004: FedEx Corp. vs. United Parcel Service, Inc. United Parcel Service, Inc. Establishes next-day air service EXHIBIT 4 Timeline of Competitive Developments FedEx Corp. Offers 10:30 A.M. delivery 1982 Acquires Gelco Express and launches 1984 oporations in Asia-Pacific Establishes European hub in Brussels 1985 Introduces handheld barcode scanner 1986 to capture detailed package information Offers warehouse services for IBM. 1987 National Semiconductor, Laura Ashley 1988 Begins Intercontinental air service between United States and Europe 1989 Acquires Tiger International to expand its International presence . Wins Malcolm Baldrige National Quality Award 1990 1991 Establishes UPS's first air fleet . Offers automated customs service Expands international air service to 180 countries Introduces 10:30 A.M. guarantee for next day air Begins Saturday delivery . Offers electronic-signature tracking Expands delivery to over 200 countries Provides supply-chain solutions through UPS Logistics Group Launches Web site for package tracking . Offers guaranteed 8 A.M. overnight delivery . Offers two-day delivery 1992 1993 . 1994 1995 1999 2000 Launches Web site for package tracking Acquires air routes serving China Establishes Latin American division Creates new hub at Roissy-Charles de Gaullo Airport in France Launches business-to-consumer home-delivery service Carries U.S. Postal Service packages Acquires American Freightways Corp. Expands home delivery to cover 100% of the U.S. population Acquires Kinko's retail franchise Establishes Chinese headquarters 2001 Makes UPS stock available through a public offering Acquires all-cargo air service in Latin America Acquires Mail Boxes Etc. retail franchise Begins direct flights to China Offers guaranteed next-day homo delivery Contracts with Yangtze River Express for package delivery within China Reduces domestic ground-delivery time 2002 2003 UPS 3.5% EXHIBIT 5 Summary of Announced List-Rate Increases 1998 1999 2000 2001 2002 2003 2004 Average Dato implemented 2/8/02 2/9/03 2/8/04 2/6/05 1/8/06 1/7/07 1/6/08 UPS ground 3.6% 2.5% 3.1% 3.1% 3.9% 1.9% 3.1% U.S. domestic air 3.3% 2.5% 3.5% 3.7% 4.0% 3.2% 2.9% 3.3% U.S. export 0.0% 0.0% 2.9% 2.9% 3.9% 2.9% 2.9% 2.2% Residential premium $1.00 $1.00 $1.00 $1.05 $1.10 $1.15 $1.40 Commercial premium NA NA NA NA N/A NA $1.00 FedEx 1998 1999 2000 2001 2002 2003 2004 Average Date Implemented 2/16/02 2/9/03 2/2/04 2/2/05 1/8/06 1/7/07 1/6/0B FedEx ground 3.6% 2.5% 3.1% 3.1% 3.5% 3.9% 1.9% 3.1% U.S. domestic air 3.5% 2.8% 0.0% 4.9% 3.5% 3.5% 2.5% 3.0% U.S. export 0.0% 0.0% 0.0% 2.9% 3.5% 3.5% 2.5% 1.8% Residential premium-expressa NA NA NA $1.35 $1.40 $1.75 Residential premium-ground NA NA NA $1.30 $1.35 $1.40 $1.75 Residential premium-home delivery? NA NA NA $1.05 $1.10 $1.15 $1.40 Commercial premium-express NA NA NA $1.50 $1.75 $1.00 Commercial premium ground NA NA NA NA NA $1.00 Sources of data: UPS, FedEx, and Morgan Stanley 'The residential premium was an additional charge for deliveries of express letters and packages to residential addresses, a price distinction UPS had applied to residential ground deliveries for the previous 10 years to offset the higher cost of providing service to them. The commercial premium was applied to products shipped to remote locations andor select zip codes. NA NA NA EXHIBIT 6 Cumulative Capital Expenditures for FedEx and UPS $25.0 $20.0 FedEx Corp $15.0 Billions (USS) United Parcel Service $10.0 $5.0 $ 0.0 1992 1993 1994 1995 1996 266 1998 1999 2000 2001 2002 2003 Sources of data Company regulatory flings 2003 EXHIBIT 7 Geographic Segment Information values in millions of U.S. dollars) FedEx Corp. 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 U.S. domestic Revenue 5,195 5,668 5,195 6.839 7.466 8,322 9,665 12,910 13,805 14,858 15,968 17,277 Identifiable assets 3,941 4,433 4,884 5,322 5,449 6,123 6,873 6,506 7,224 8,637 8,627 9,908 International Revenue 2.355 2,140 2.280 2.553 2,807 3,198 3,589 3,863 4,452 4,771 4,639 5,210 Identifiable assets 1.522 1,360 1,109 1,112 1.250 1,503 1,503 1,001 1,018 1,254 1,520 1,536 Consolidated Revenue 7,550 7,808 7,474 9,392 10,274 11,520 13,255 16,773 18,257 19,629 20,607 22,487 Identifiable assets 5.463 5,793 5,992 6,433 6,699 7.625 8,376 7,507 B.242 9,891 10.147 11.444 United Parcel Service Inc. 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 U.S. domestic Revenue 14,722 15,823 17,298 18,243 20,108 20,238 22,252 24,093 26,325 26,163 26,284 26,968 Identifiable assets 7,873 8,539 9,902 11,157 9,376 10.063 9,832 10,725 12,477 13,717 14,129 14,915 International Revenue 1.797 1,960 2,278 2,802 2,260 2.220 2,536 2,959 3,446 4,158 4,988 6,517 Identifiable assets 1,164 1,214 1.280 1.488 1.323 1,372 1.810 2,111 2,061 3,050 2,874 3,567 Consolidated Revenue 16,519 17,782 19,576 21.045 22,368 22,458 24.788 27,052 29,771 30,321 31,272 33,485 Identifiable assets 9,038 9,754 11,182 12,845 10,609 11,435 11,642 12,836 14,538 16,767 17,003 18,482 Sources of data: Company regulatory filings *FASB Statement No. 131 (Disclosures about Segments of an Enterprise and Related information), established the standard to be used by enterprises to identity and report Information about operating segments and for related disclosures about products and services, geographic areas, and major customers. 2003 1994 1995 1988 30.00 $2.79 nm EXHIBIT 8 | Equity Prices and Returns for FedEx and UPS United Parcel Service, Inc. 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 Stock price, December 31 59.25 $10.30 $11.75 $18.13 $14.83 $15.38 $20.00 $69.00 $58.75 $54.50 $63.00 $74.55 Dividends per share 30.25 50.25 $0.28 30.32 50.34 50.35 50.58 5022 $0.76 $0.58 EPS, basic incl. $0.92 $0.76 extra items! 30.44 $0.70 $0.83 $0.92 $1.00 30.82 $1.50 $0.70 $2.54 $2.13 5284 $2.57 P/E multiple 21.26 14.82 1434 14.55 18.34 12.58 8734 23.13 25.50 20.01 22.21 Capital appreciation 12.16% 13.25% 11.70% 11.43% 5.13% 30.08% 245.00% (14.86%) (7.23%) 16.74% 18.18% Cumul compound annual return 12.16% 27.03% 41.89% 58.11% 58.22% 116.22% 545.95% 535.14% 489.19% 581.95% 705.05% FedEx Corp. 1992 1993 1996 1997 1999 2000 2001 2002 2003 Stock price, December 31 $10.19 $12.25 $19.13 314,97 $19.10 $26.10 $32.00 $54,81 $35.50 $40.00 3539 Dividends per share $63.90 $0.00 $0.00 $0.00 50.00 $0.00 $0.00 $0.00 50.00 $0.00 $0.00 $0.20 EPS, basic incl. extra items (50.53) $0.25 $0.91 $132 $135 $1.56 $1.72 $2.13 5230 $2.02 $2.30 P/E multiple 50.00 20.00 11.36 14.22 16.79 18.70 25.73 15.04 19.30 22.67 22.99 Capital appreciation 20.25% 56.12 121.739) 27.97% 36.70% 22.43% 70.96% (35.23%) 12.58% 34.68% 18.59% Cumul compound annual return 20.25% 87.73% 48.93% 38.04% 157.00% 214.72% 43804% 248.47% 292.64% 428.57% 528.02% Standard & Poor's 500 Index 1992 1993 1994 1905 1996 1990 1999 2001 2002 2003 Index level 435.71 488.45 450.27 615 93 740.74 970.43 1.229.23 1.489 25 1.320.28 1.148.09 1.111.92 679.82 Annual retum 7.06% (1.54%) 34.115 20.26% 31.01% 20.67% 19.53% (10.14% (13.04%) (23.37%) 26.38% Cumul compound annual return 7.00% 5.41% 41.36% 70.01% 122.22% 182.12% 237 21% 203.02% 163.50% 101.93% 155-20% Cumul. Market Adjusted Returns 1993 1994 1995 1996 1007 1990 1999 2000 2001 2002 2003 UPS 5.11% 21.52% 0.53% (11.00%) 56.5156) (65.90%) 400.74% 332.12% 325.60% 480.02% 550.75% FedEx 13.19% 82.32% 5.57% 18.09% 34.33% 12.00% 200.83% 45.45% 120.14% 327.64% 372.33% Source of data: Standard & Poor's Research Insight annual reports These data have been adjusted for the two foros stock split and initial public ofering completed by UPS in November 1990. Prior to 1990, UPS shares were not publicly traded and the company acted as a markomaker for its own stock Compound annual return callation Current your price-Beginning your priceyleginning year price 2000 1997 2001 2002 2003 1992 $750 $10,090 7.49% $881 $10,870 8.10% $1,418 $12,050 11.77% 210 30% $1,900 297 $40 $11,090 37% 5.66% 7.94% 5.6% 1.20 12,37% 11.35% $1,800 298 $54 $16.087 38% 5.55% 7.98% 5.8% 1.20 12.27% 11.53% $1,700 299 554 $19,104 30% 4.76% 6.58% 5.6% 1.10 10.92% 10.36% EXHIBIT 9 | Economic Profit Analysis for FedEx FedEx Corp. 1993 1994 1995 1995 1997 1996 1999 2000 Return on Net Assets (RONA) Not operating profit after tax (mm) 5187 $175 5303 $405 $419 $490 $727 5720 5800 Beginning capital (m) 54,078 $4,344 $4,456 $4,655 $5.081 $5,683 56,882 57.363 $5,636 RONA (NOPAT/beginning capital) 4.59% 4.05% 8.16% 8.70% 8.25% 8.82% 10.56% 9.23% 10.03% Weighted Average Cost of Capital (WACC) Long-term debt (mm) $1,799 $1,882 $1,832 $1,325 $1,325 $1,398 31,385 51.360 $1,770 Share outstanding (mm) 216 224 225 230 295 298 284 Share price ($) $10 312 $19 $15 $10 520 $32 555 $36 Market value of equity (mm) $2.205 $2,082 54,274 53.369 $4,350 $6,018 59.453 $16,330 $10,000 Tax rate(%) 23% 40% 48% 434 45% Long-term U.S.govt. bonds (%) 7.97% 6,60% 7.53% 7,01% 7.07% 6.89% 5.94% 5.79% 6.19% Senior Brated debt (%) 9.20% 8.11% 8.71% 8.27% 8.46% 3.18% 7335 7.69% 8.87% Risk premium (%) 5.6% 5.6% 5.6% 5.6% 5.6% 5.6% 5.6% 5.6% Beta 1.10 1.15 1.20 1.20 1:40 1.35 1.30 1.15 1,20 Cost of equity' (%) 14.13% 13.24% 14.25% 13.73% 14.91% 14.45% 13.22% 12.23% 12.01% WACC 10.99% 9.72% 11.61% 11.18% 12.56% 12.615 12.05% 11.64% 11.79% Economie Value Added (EVA) RONA (NOPAT/beginning capital) 4.59% 4.05% 8.18% 8.70% 8.25% 8.82% 10.50% 10.03% WACC 10,90% 9.72% 11.81% 11.10% 12.56% 12.61% 12.05% 11.64% 11.79% Spread (6.30%) (5.67%) (3.40%) 2.40%) 14.30%) 3.70%) (1.4) (2.41% (1.75%) X beginning capital) $4,078 $4,346 $4,665 $5,001 $5.663 56,582 $7.563 $8,630 EVA (annual) (5261) (5246) (5154) (5115) (5210) (S215) ($190) (5151) EVA (cumulative) (261) (5507) (5661) (5777) ($995) (51,210) (1,312) ($1,502) ($1,653) Market Value Added (MVA) Market value of equity) 52 205 52.82 34.274 $3.363 34,359 30.010 39.455 $16,30 $10.000 Long-term debt (mm 1.200 1.882 1.632 1325 1.398 1.305 1.300 1.770 Capital market value) (mm) 4,002 4,565 5,907 4,667 5.654 7,410 10.000 17,600 11,874 Book value of equity (m) 1.500 1.671 1.025 2.240 2.576 2.003 3.000 4,664 4785 Long-term debem 1.700 1082 16:22 1325 1309 1960 1.770 Capital (book value) (mm) 3,878 3.554 3.557 3.570 3.901 4,300 5.340 0,023 6.561 MVA market value-book value) 5625 $1,011 52,350 $1,117 51.783 $3,056 $5,492 $11,670 35,313 Sources of data: Value Line Investment Survey, Standard & Poor's Research Insight, Bloomberg LP. Dataram 'The cost of equity was derived using the capital asset pricing model (CAPM) 7.43% 11.35% (3.92%) $10,000 (5396) (52,049) 8.10% 11.53% (3.43%) $10,870 (373) (52,422) 11.77% 10.36% 1.41% $12,050 $170 (52.252) 14.458 ($102) 1.325 $11.693 1.900 13,793 5.000 1990 7,001 $5,003 $18,097 1.300 17,867 5.545 1.800 0,345 50,542 $19,104 1.709 20,013 7,200 1.700 3,907 $11,816 3305 71 72 5.0 1.14 EXHIBIT 10 Economic Profit Analysis for UPS United Parcel Service, Inc. 1992 1993 1994 1995 1996 1997 1908 1999 2000 2001 2002 2003 Return on Net Assets (RONA) Not operating profit after tax (mm) 5914 $588 5944 $1,448 $1,545 $1,379 $1,909 $3,215 $2,955 $2,845 $2,589 $3.300 Beginning capital (mm) $5,832 $7.195 $8,280 $9,670 $11.796 $12,514 $13,350 $18.845 $17,161 $20,007 520,802 $23,391 RONA (NOPAT/beginning capital) 13.19% 12.34% 11.40% 14.96% 13.10% 11.02% 14.30% 17.06% 17.22% 14.23% 12.45% 14.15% Weighted Average Cost of Capital (WACC) Long-term debt (mm) 5862 3052 $1,127 $1,720 $2,573 $2,583 $2.191 $1,912 $2,981 $4,648 $3.495 $3,149 Shares outstanding Imm) 1.190 5,160 1.100 1.149 1,140 1,124 1.00 1.211 1.135 1.121 1,123 1.120 Share price (5) SO $10 $12 $13 $15 $15 $20 $80 $59 $55 563 $75 Market value of equity (mm) $11,000 $12,055 $13,630 $14,963 $16,673 $17,262 $21,898 $83,538 $66.663 $61,068 Tax rato (9) $84.167 $70,839 40% 40% 30% 40% 40% 58% 39% 30% 35% 34% Long-term U.S.govt bonds (%) 7.97% 8.00% 7.53% 7.01% 7.07% 8.80% 5.94% 5.79% 6.19% 5,65% 5.85% 4.76% Senior Datated debt (%) 8.34% 7.30% B.00% 7.71% 7.78% 7.53% 6.71% *8.90% 7.99% 7.16% 6.60% 5.47% Risk premium (96) 5.6% 50% 5.8% 5.6% 5.6% 5.6% 5.6% 5.6% 5.6% Beta 1.24 1.13 1.10 1.10 1.18 1.00 1.15 1.11 1.00 0.95 0.00 Cost of equity) 14.925 13.15% 14.02% 13.64% 13.68% 13.27% 11.00% 12.23% 12.41% 11.75% 0.07% 9.24% WACC 14.20% 12.58% 13.32% 12.72% 12.47% 12.12% 11.26% 12.02% 12.09% 11.23% 10.56% 9,04% Economie Value Added (EVA) RONA (NOPAT/beginning capital) 13.18% 12.34% 11.40% 14.00% 13.104 11.02 14.50% 17.06% 17.22% 14,23% 12.45% 14,15% WACC 14,20% 12.50% 13 32% 12.72% 12A7% 12.12% 11.26% 12.02% 12.00% 11.23 10.50% 0.04% Spread (1,01%) (024%) (1.1%) 2.24% 0.63% (1.10%) 3,04% 5,04% 5.13% 2.99% 1.00% 5.11% X beginning Capital (mm) $6,032 2105 5820 $9.670 $11.706 $12,514 $13.50 518.845 312101 $20.007 $20.000 $23 391 EVA (annual) (mm) (570) (8150) 5217 574 (5130) 5405 5949 $681 $590 $392 $1,195 EVA (cumulative) (mm) (570) (507) (5246) (520) (592) 3313 51.262 $2,143 52,741 $3,133 $4,320 Market Value Added (MVA) Market value of equity (mm) $11,000 $12,035 513,630 $14,963 $18,673 317.282 $21,800 383.530 $66.663 561,068 $70,839 584,167 Long term debt (mm) B62 1.122 1.720 2.573 2.589 2.11 1912 2001 4540 3.495 3140 Capital market value) (mm) 11,870 12,687 14,757 16,692 19,246 10.065 24.087 85.450 19,644 65,716 74,334 87316 Book value of equity (mm) 3,720 3.945 4,647 5.151 3.001 6,087 7.173 12.474 9.735 10.245 12,455 14,652 Long-term dobtam 362 852 1,722 2572 2,583 2.191 1.912 2981 4048 3.495 3.149 Capital (book value) (mm) 4,583 4,797 5,775 6.880 8,474 8,670 9,364 14,385 12,710 14,896 15,950 18.001 MVA (market value-book value) 37,287 $8,000 $8.983 $0,012 $10,772 $11,195 $14,723 $71,064 $56,920 $50,820 $58,384 569,315 (517) 1,127 Sources of data: Value Line Investment Survey, Standard & Poor's Research Insight, Bloomberg LP. DataStream 'These data have been adjusted for the two-for-one stock split and initial public offering completed by UPS in November 1909. Prior to 1999, UPS shares were not publicly traded and the company acted as a market-maker for its own stock *For the period 1992-2001, this figure reflects the average betas for peer is The cost of equity was derived using the capital asset pricing model (CAPM). 73 Case 4 The Battle for Value, 2004: FedEx Corp. vs. United Parcel Service, Inc. EXHIBIT 11 | Equity Analysts' Outlook for FedEx and UPS FedEx Corporation Analyst Comments Morgan Stanley's It was refreshing to hear FedEx's management highlight some of the risks in China as J.J. Valentine, we sense these issues are too often overlooked by the bulls. Some of these issues April 6, 2004 include: lack of legal framework different interpretations of laws by regional and local governments . nonperforming loans that put pressure on China's banking sector liability by government for retirement program of state-owned enterprises widening gap between the urban and the rural standard of living government that often dictates commercial relationships One issue that's not as much a risk as it is a challenge is finding skilled, educated labor. This was a recurring theme that we heard during our visit to Asia, namely that China has a large unskilled workforce to produce cheap products, but it is becoming Increasingly difficult to find skilled labor for the service industry, such as parcel delivery or logistics Value Line The international business should drive long-term growth. Unlike the domestic Investment express business, which has reached maturity, the international market remains in the Survey's growth stage. Indeed, growth rates in this sector mirror the rate of domestic expansion W.R. in the late 1980s. Furthermore, demand for this service should rise going forward, as Perkowitz Jr., a greater amount of manufacturing capacity is outsourced to Asia. Finally, since a Dec. 12, 2003 large portion of FedEx's cost structure is fixed, and it has ample capacity to serve additional business, any increases in volume should flow directly to the bottom line, United Parcel Service Inc. Analyst Comments Value Line United Parcel Service's third-quarter 2003 results were better than we expected.... Investment This gain was driven by record-breaking results in the International and nonpackage Survey's segments. Indeed, both units experienced advances in volume and margins, which led D. Y. Fung. to bottom-line increases of 171% and 61% respectively. Importantly, growth of these Dec. 12, 2003 two businesses has resulted in greater earnings diversity at UPS. This has helped to protect investors from the cyclical downturn in the U.S. economy in the past two years. Going forward, we believe International and nonpackage will continue along their posi- tive growth trajectory, while generating a higher portion of the company's net earnings