Answered step by step

Verified Expert Solution

Question

1 Approved Answer

R-Enterprise, a real estate dealer, has a Cash account in the general ledger showing a balance of $25,380 at December 31, 2020 (prior to

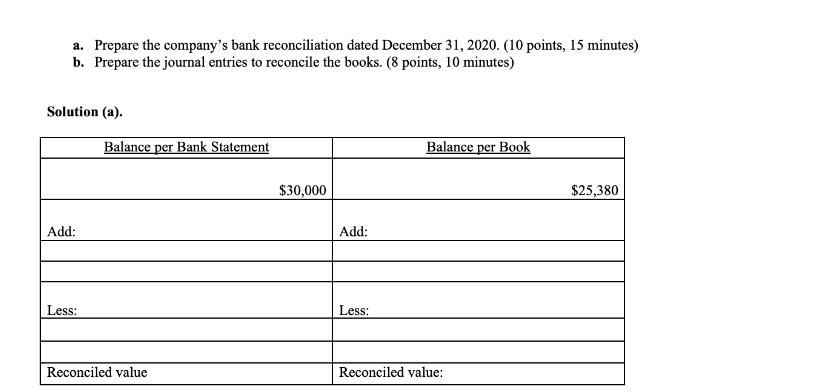

R-Enterprise, a real estate dealer, has a Cash account in the general ledger showing a balance of $25,380 at December 31, 2020 (prior to performing bank reconciliation). On the same date, the balance as per the company's bank statement is $30,000. A detailed review of the bank statement discloses the following: 1. Deposit in transit from November 30th bank reconciliation amounts to $3,000. 2. The deposit in transit on December 31st amount to $8,500. 3. Bank service charges total $450. 4. Outstanding checks amounting to $20,100 from November 30th bank reconciliation were cashed during December. 5. Outstanding checks on December 31st total $28,500. 6. The bank statement showed an NSF charge of $800 for a check issued by a customer to R-Enterprise's on account. 7. A cashed check (no. 108) written by the company in the amount of $3,260 for office supplies was incorrectly recorded in the cash ledger as a debit to supplies of $3,620, and a credit to Cash of $3,620. 8. Bank statement had a CM of $2,610. Required a. Prepare the company's bank reconciliation dated December 31, 2020. (10 points, 15 minutes) b. Prepare the journal entries to reconcile the books. (8 points, 10 minutes) Solution (a). Balance per Bank Statement Balance per Book $30,000 $25,380 Add: Less: Reconciled value Add: Less: Reconciled value:

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 2 Balance as per Bank statement Add Deposit in trans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started