Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Quiz Note: It is recommended that you save your response as you complete each question. Question 1 (30 points) Floozy Corporation had the following

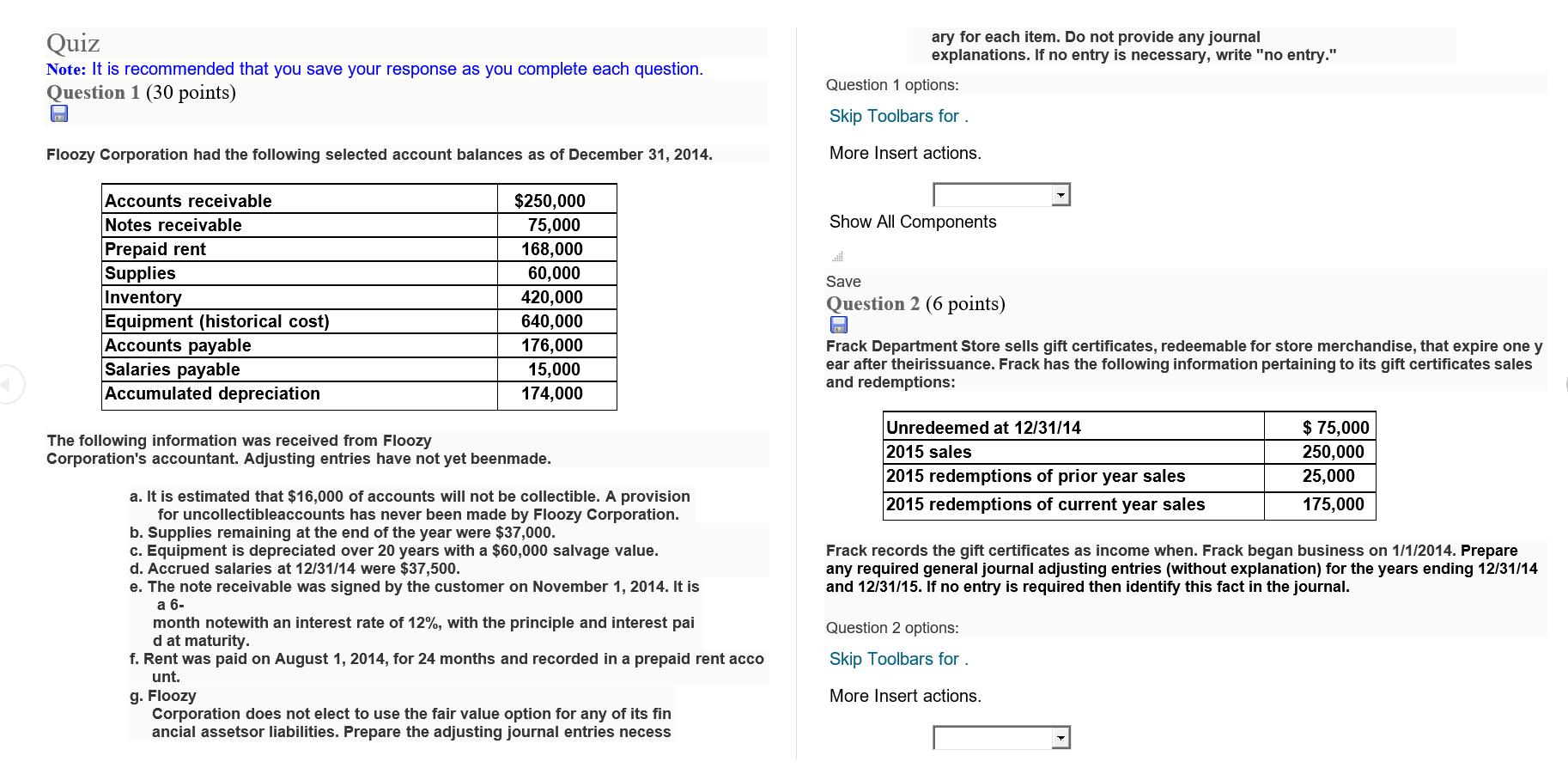

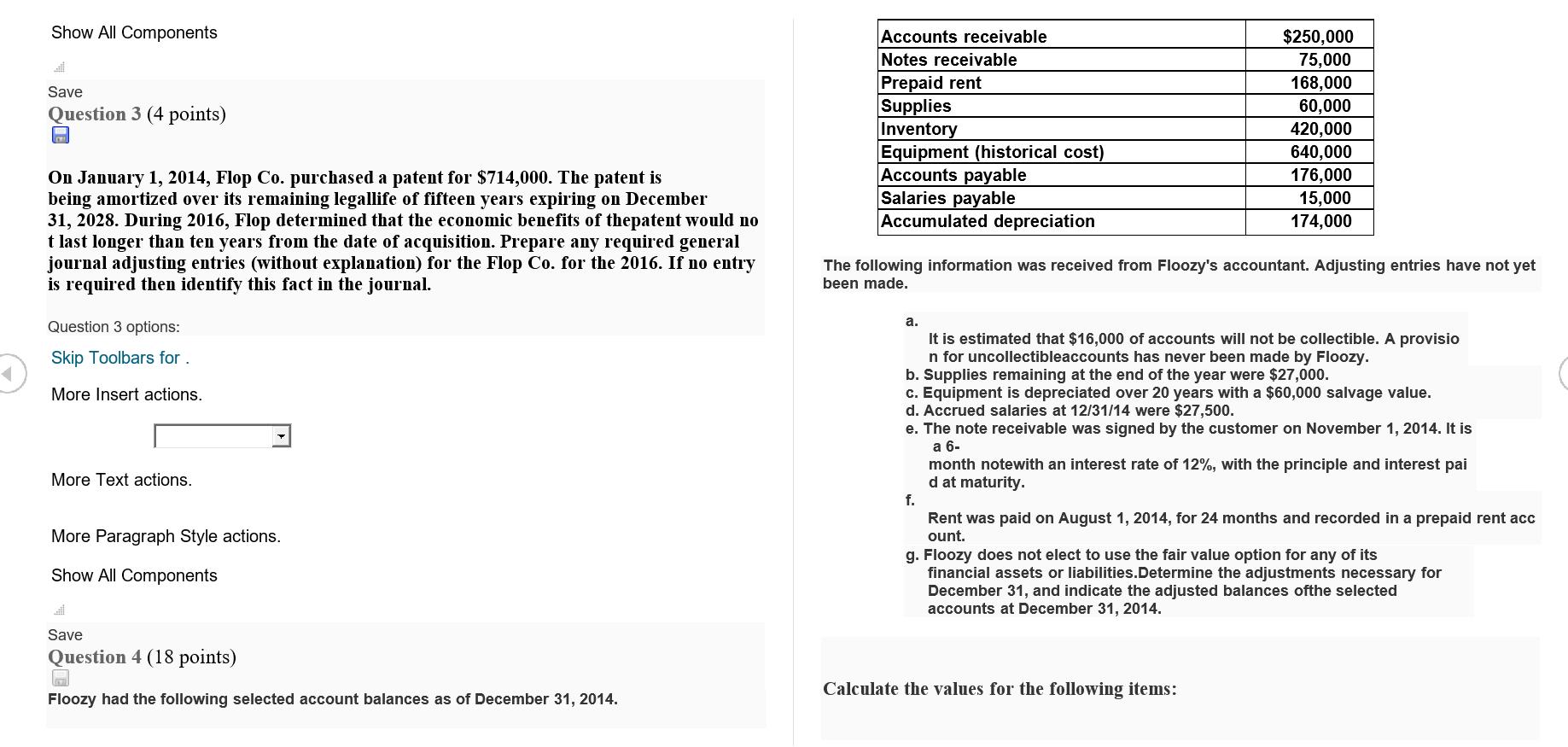

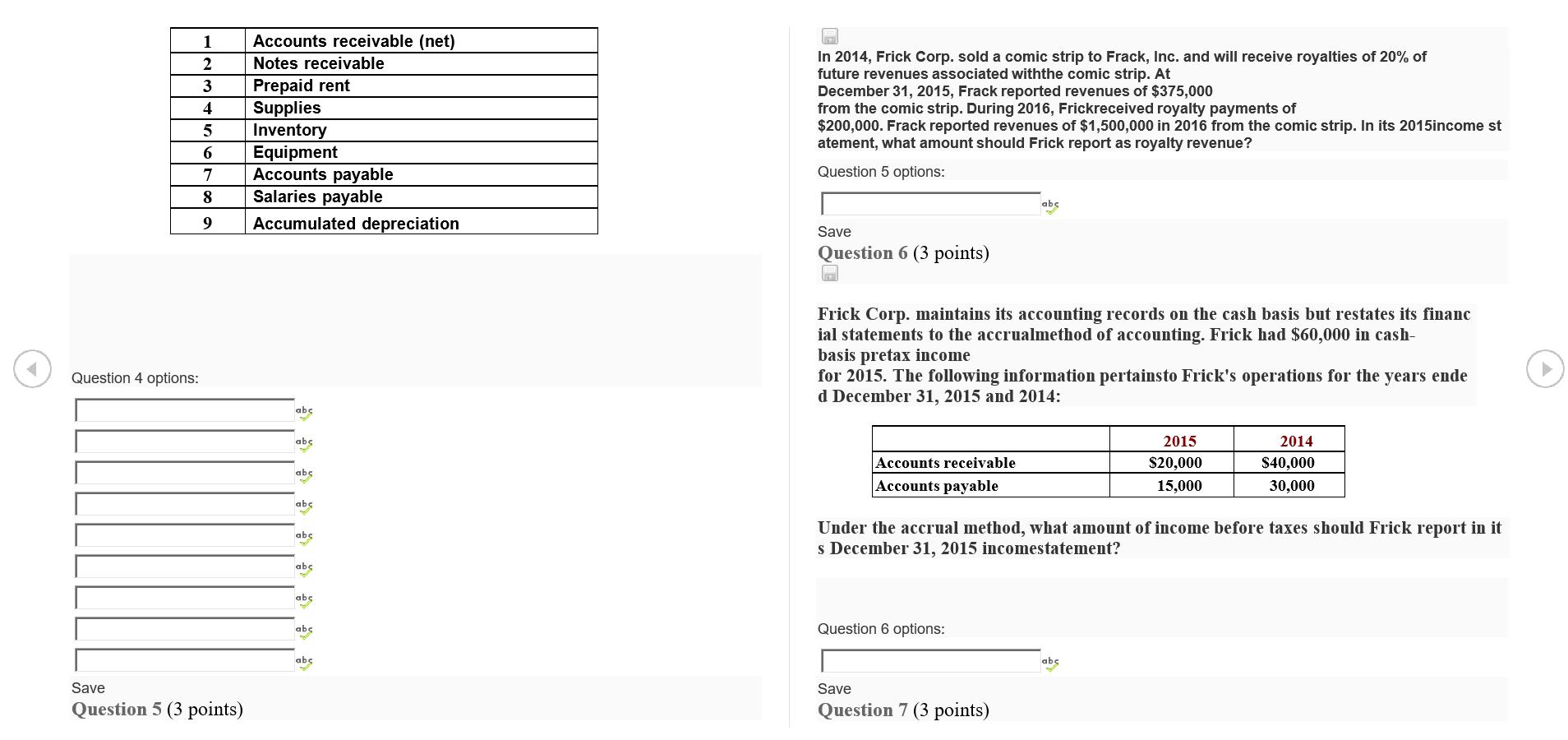

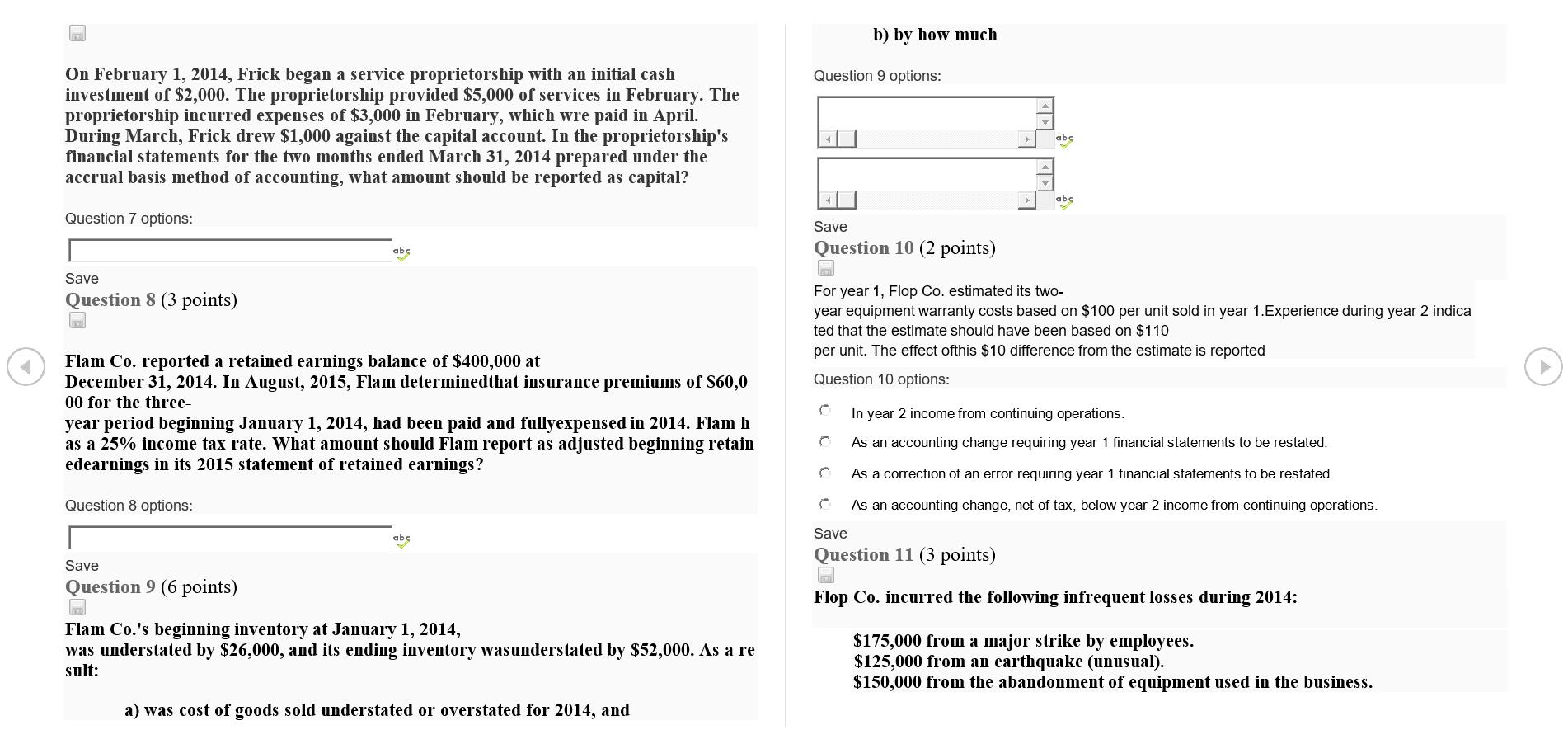

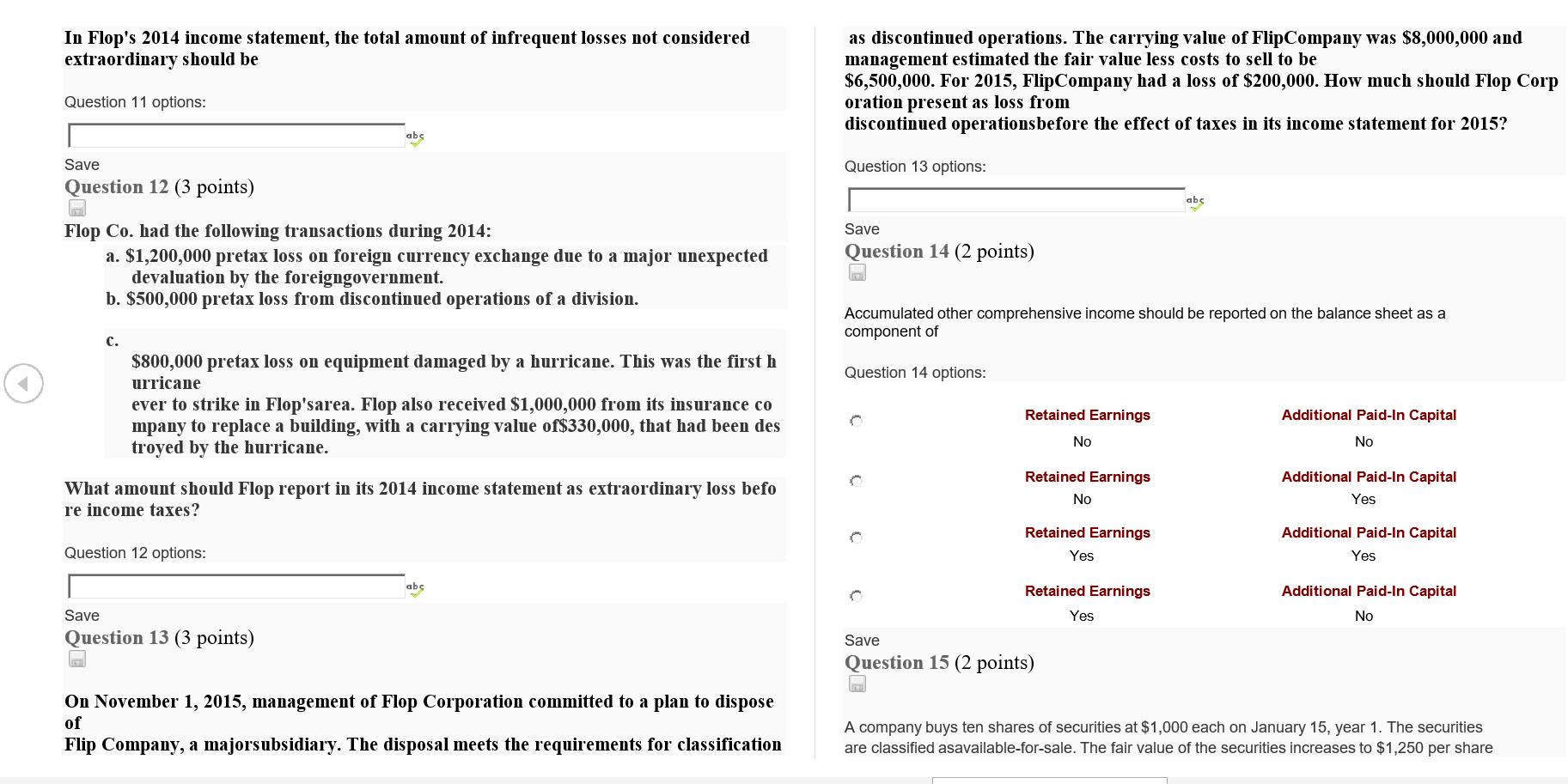

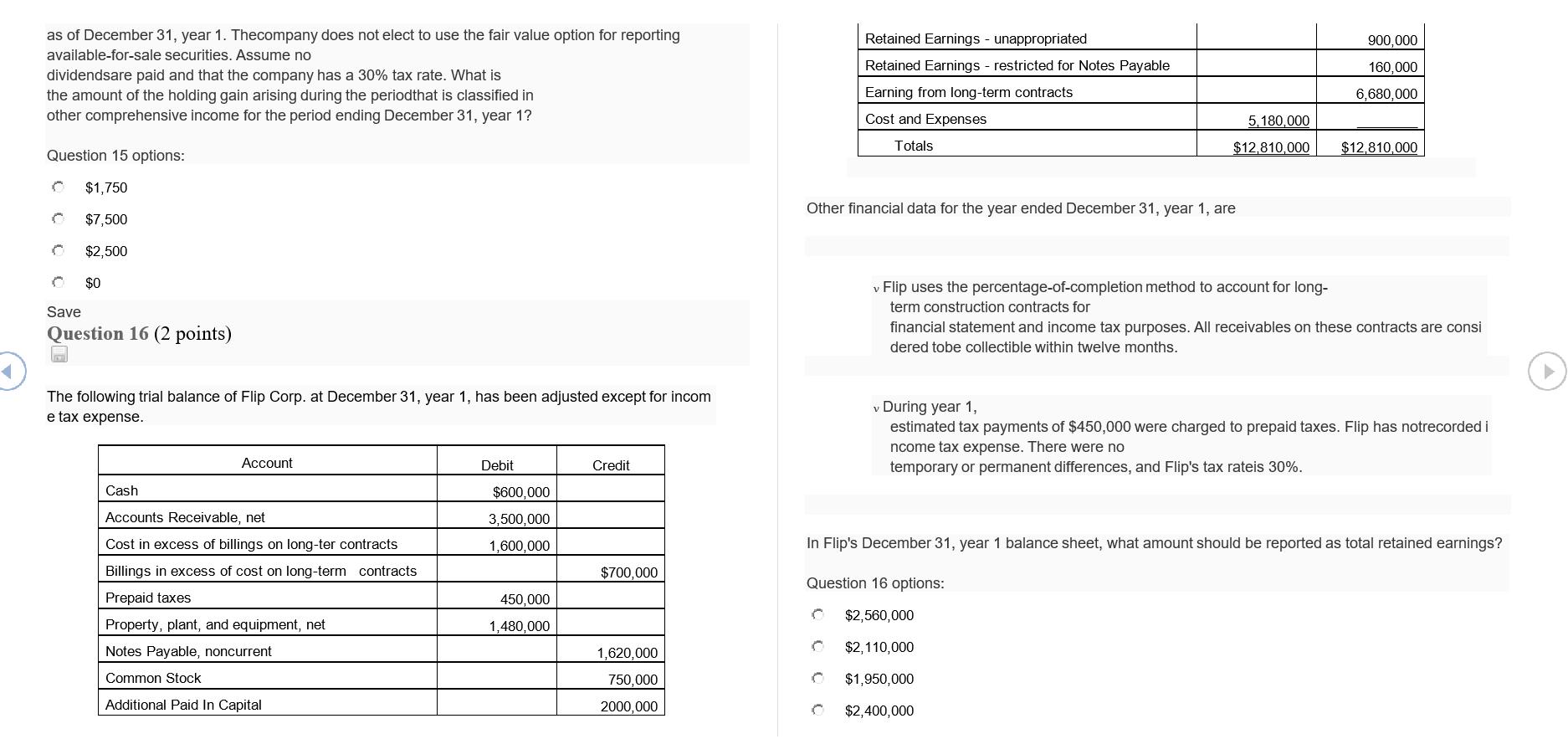

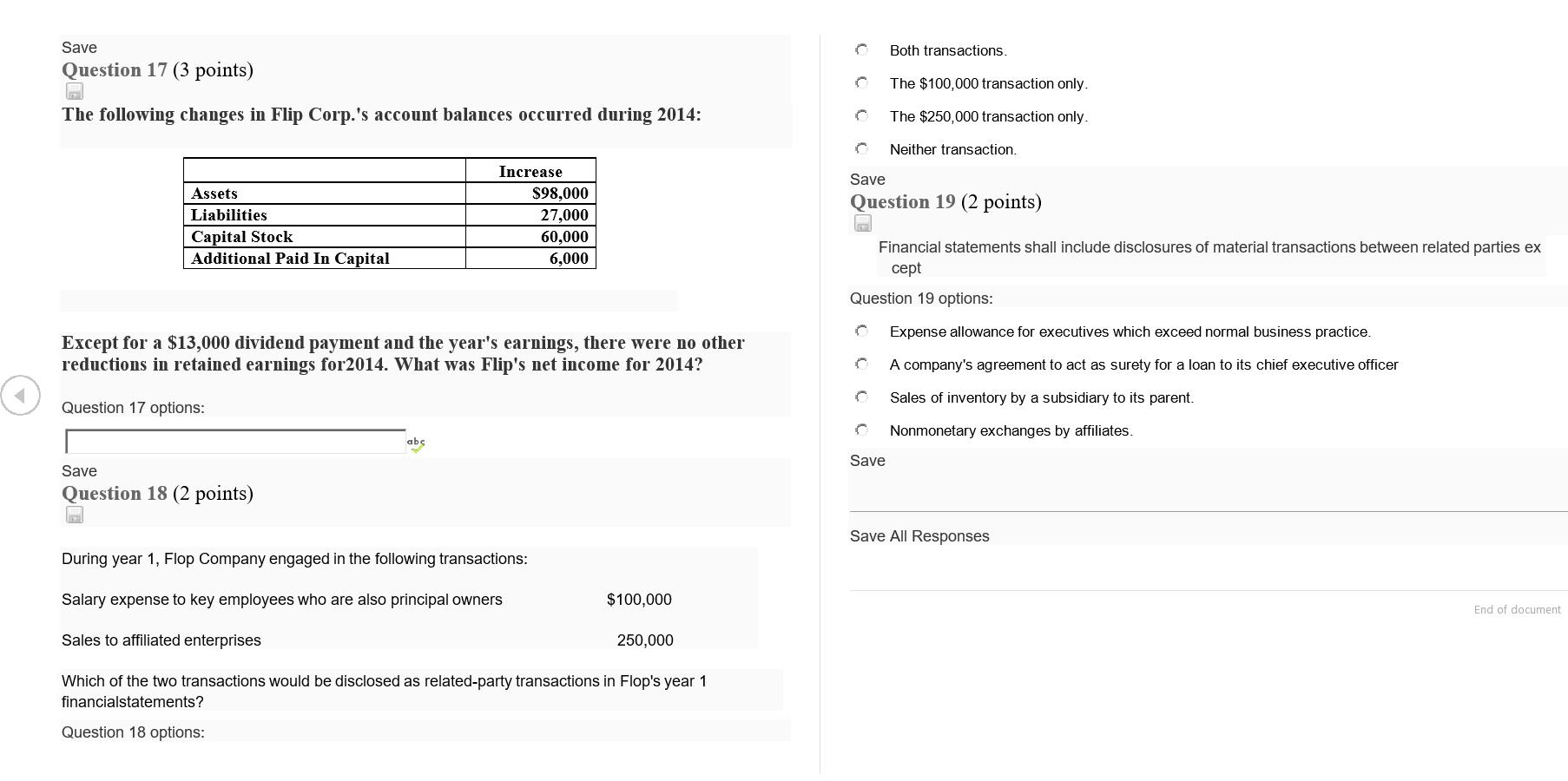

Quiz Note: It is recommended that you save your response as you complete each question. Question 1 (30 points) Floozy Corporation had the following selected account balances as of December 31, 2014. $250,000 75,000 168,000 60,000 420,000 640,000 176,000 15,000 174,000 Accounts receivable Notes receivable Prepaid rent Supplies Inventory Equipment (historical cost) Accounts payable Salaries payable Accumulated depreciation The following information was received from Floozy Corporation's accountant. Adjusting entries have not yet beenmade. a. It is estimated that $16,000 of accounts will not be collectible. A provision for uncollectibleaccounts has never been made by Floozy Corporation. b. Supplies remaining at the end of the year were $37,000. c. Equipment is depreciated over 20 years with a $60,000 salvage value. d. Accrued salaries at 12/31/14 were $37,500. e. The note receivable was signed by the customer on November 1, 2014. It is a 6- month notewith an interest rate of 12%, with the principle and interest pai d at maturity. f. Rent was paid on August 1, 2014, for 24 months and recorded in a prepaid rent acco unt. g. Floozy Corporation does not elect to use the fair value option for any of its fin ancial assetsor liabilities. Prepare the adjusting journal entries necess ary for each item. Do not provide any journal explanations. If no entry is necessary, write "no entry." Question 1 options: Skip Toolbars for . More Insert actions. Show All Components Save Question 2 (6 points) Frack Department Store sells gift certificates, redeemable for store merchandise, that expire one y ear after theirissuance. Frack has the following information pertaining to its gift certificates sales and redemptions: Unredeemed at 12/31/14 2015 sales 2015 redemptions of prior year sales 2015 redemptions of current year sales $ 75,000 250,000 25,000 175,000 Frack records the gift certificates as income when. Frack began business on 1/1/2014. Prepare any required general journal adjusting entries (without explanation) for the years ending 12/31/14 and 12/31/15. If no entry is required then identify this fact in the journal. Question 2 options: Skip Toolbars for . More Insert actions. Show All Components Save Question 3 (4 points) On January 1, 2014, Flop Co. purchased a patent for $714,000. The patent is being amortized over its remaining legallife of fifteen years expiring on December 31, 2028. During 2016, Flop determined that the economic benefits of thepatent would no t last longer than ten years from the date of acquisition. Prepare any required general journal adjusting entries (without explanation) for the Flop Co. for the 2016. If no entry is required then identify this fact in the journal. Question 3 options: Skip Toolbars for . More Insert acti More Text actions. More Paragraph Style actions. Show All Components Save Question 4 (18 points) 7 Floozy had the following selected account balances as of December 31, 2014. Accounts receivable Notes receivable Prepaid rent Supplies Inventory Equipment (historical cost) Accounts payable Salaries payable Accumulated depreciation The following information was received from Floozy's accountant. Adjusting entries have not yet been made. $250,000 75,000 168,000 60,000 420,000 640,000 176,000 15,000 174,000 a. It is estimated that $16,000 of accounts will not be collectible. A provisio n for uncollectibleaccounts has never been made by Floozy. b. Supplies remaining at the end of the year were $27,000. c. Equipment is depreciated over 20 years with a $60,000 salvage value. d. Accrued salaries at 12/31/14 were $27,500. e. The note receivable was signed by the customer on November 1, 2014. It is a 6- f. month notewith an interest rate of 12%, with the principle and interest pai d at maturity. Rent was paid on August 1, 2014, for 24 months and recorded in a prepaid rent acc ount. g. Floozy does not elect to use the fair value option for any of its financial assets or liabilities.Determine the adjustments necessary for December 31, and indicate the adjusted balances ofthe selected accounts at December 31, 2014. Calculate the values for the following items: Question 4 options: 1 2 3 Prepaid rent 4 Supplies 5 Inventory 6 Equipment 7 Accounts payable 8 Salaries payable 9 Accumulated depreciation Accounts receivable (net) Notes receivable Save Question 5 (3 points) abc abc abc abc abc abs abc abc abc G In 2014, Frick Corp. sold a comic strip to Frack, Inc. and will receive royalties of 20% of future revenues associated withthe comic strip. At December 31, 2015, Frack reported revenues of $375,000 from the comic strip. During 2016, Frickreceived royalty payments of $200,000. Frack reported revenues of $1,500,000 in 2016 from the comic strip. In its 2015income st atement, what amount should Frick report as royalty revenue? Question 5 options: Save Question 6 (3 points) Frick Corp. maintains its accounting records on the cash basis but restates its financ ial statements to the accrualmethod of accounting. Frick had $60,000 in cash- basis pretax income for 2015. The following information pertainsto Frick's operations for the years ende d December 31, 2015 and 2014: Accounts receivable Accounts payable abc Question 6 options: Save Question 7 (3 points) Under the accrual method, what amount of income before taxes should Frick report in it s December 31, 2015 incomestatement? 2015 $20,000 15,000 abc 2014 $40,000 30,000 On February 1, 2014, Frick began a service proprietorship with an initial cash investment of $2,000. The proprietorship provided $5,000 of services in February. The proprietorship incurred expenses of $3,000 in February, which wre paid in April. During March, Frick drew $1,000 against the capital account. In the proprietorship's financial statements for the two months ended March 31, 2014 prepared under the accrual basis method of accounting, what amount should be reported as capital? Question 7 options: Save Question 8 (3 points) LE abc Flam Co. reported a retained earnings balance of $400,000 at December 31, 2014. In August, 2015, Flam determined that insurance premiums of $60,0 00 for the three- year period beginning January 1, 2014, had been paid and fullyexpensed in 2014. Flam h as a 25% income tax rate. What amount should Flam report as adjusted beginning retain edearnings in its 2015 statement of retained earnings? Question 8 options: Save Question 9 (6 points) abc Flam Co.'s beginning inventory at January 1, 2014, was understated by $26,000, and its ending inventory was understated by $52,000. As a re sult: a) was cost of goods sold understated or overstated for 2014, and b) by how much Question 9 options: Save Question 10 (2 points) C abc For year 1, Flop Co. estimated its two- year equipment warranty costs based on $100 per unit sold in year 1.Experience during year 2 indica ted that the estimate should have been based on $110 per unit. The effect ofthis $10 difference from the estimate is reported Question 10 options: abc Save Question 11 (3 points) In year 2 income from continuing operations. As an accounting change requiring year 1 financial statements to be restated. As a correction of an error requiring year 1 financial statements to be restated. As an accounting change, net of tax, below year 2 income from continuing operations. F Flop Co. incurred the following infrequent losses during 2014: $175,000 from a major strike by employees. $125,000 from an earthquake (unusual). $150,000 from the abandonment of equipment used in the business. In Flop's 2014 income statement, the total amount of infrequent losses not considered extraordinary should be Question 11 options: Save Question 12 (3 points) Flop Co. had the following transactions during 2014: a. $1,200,000 pretax loss on foreign currency exchange due to a major unexpected devaluation by the foreigngovernment. b. $500,000 pretax loss from discontinued operations of a division. C. abc $800,000 pretax loss on equipment damaged by a hurricane. This was the first h urricane m ever to strike in Flop'sarea. Flop also received $1,000,000 from its insurance co mpany to replace a building, with a carrying value of $330,000, that had been des troyed by the hurricane. What amount should Flop report in its 2014 income statement as extraordinary loss befo re income taxes? Question 12 options: Save Question 13 (3 points) abc On November 1, 2015, management of Flop Corporation committed to a plan to dispose of Flip Company, a majorsubsidiary. The disposal meets the requirements for classification as discontinued operations. The carrying value of FlipCompany was $8,000,000 and management estimated the fair value less costs to sell to be $6,500,000. For 2015, FlipCompany had a loss of $200,000. How much should Flop Corp oration present as loss from discontinued operationsbefore the effect of taxes in its income statement for 2015? Question 13 options: Save Question 14 (2 points) Accumulated other comprehensive income should be reported on the balance sheet as a component of Question 14 options: C c C Retained Earnings H No Retained Earnings Save Question 15 (2 points) No Retained Earnings Yes Retained Earnings abc Yes Additional Paid-In Capital No Additional Paid-In Capital Yes Additional Paid-In Capital Yes Additional Paid-In Capital No A company buys ten shares of securities at $1,000 each on January 15, year 1. The securities are classified asavailable-for-sale. The fair value of the securities increases to $1,250 per share 1 as of December 31, year 1. Thecompany does not elect to use the fair value option for reporting available-for-sale securities. Assume no dividendsare paid and that the company has a 30% tax rate. What is the amount of the holding gain arising during the period that is classified in other comprehensive income for the period ending December 31, year 1? Question 15 options: $1,750 C $7,500 $2,500 $0 Save Question 16 (2 points) The following trial balance of Flip Corp. at December 31, year 1, has been adjusted except for incom e tax expense. Account Cash Accounts Receivable, net Cost in excess of billings on long-ter contracts Billings in excess of cost on long-term contracts Prepaid taxes Property, plant, and equipment, net Notes Payable, noncurrent Common Stock Additional Paid In Capital Debit $600,000 3,500,000 1,600,000 450,000 1,480,000 Credit $700,000 1,620,000 750,000 2000,000 Retained Earnings - unappropriated Retained Earnings - restricted for Notes Payable Earning from long-term contracts Cost and Expenses Totals 5,180,000 $12,810,000 Other financial data for the year ended December 31, year 1, are Flip uses the percentage-of-completion method to account for long- term construction contracts for 900,000 160,000 6,680,000 $12,810,000 financial statement and income tax purposes. All receivables on these contracts are consi dered tobe collectible within twelve months. v During year 1, estimated tax payments of $450,000 were charged to prepaid taxes. Flip has notrecorded i ncome tax expense. There were no temporary or permanent differences, and Flip's tax rateis 30%. In Flip's December 31, year 1 balance sheet, what amount should be reported as total retained earnings? Question 16 options: $2,560,000 $2,110,000 $1,950,000 $2,400,000 Save Question 17 (3 points) H The following changes in Flip Corp.'s account balances occurred during 2014: Assets Liabilities Capital Stock Additional Paid In Capital Save Question 18 (2 points) Increase Except for a $13,000 dividend payment and the year's earnings, there were no other reductions in retained earnings for 2014. What was Flip's net income for 2014? Question 17 options: abc $98,000 27,000 60,000 6,000 During year 1, Flop Company engaged in the following transactions: Salary expense to key employees who are also principal owners Sales to affiliated enterprises Which of the two transactions would be disclosed as related-party transactions in Flop's year 1 financialstatements? Question 18 options: $100,000 250,000 Save Question 19 (2 points) Both transactions. The $100,000 transaction only. The $250,000 transaction only. Neither transaction. Financial statements shall include disclosures of material transactions between related parties ex cept Question 19 options: C Save Expense allowance for executives which exceed normal business practice. A company's agreement to act as surety for a loan to its chief executive officer Sales of inventory by a subsidiary to its parent. Nonmonetary exchanges by affiliates. Save All Responses End of document

Step by Step Solution

★★★★★

3.33 Rating (180 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 a Accounts Receivable 250000 b Notes Receivable 75000 c Prepaid Rent 180000 d Supplies 60000 e Inventory 420000 f Equipment Historical Cost 640000 g Accounts Payable 176000 h Salaries Payab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started