Answered step by step

Verified Expert Solution

Question

1 Approved Answer

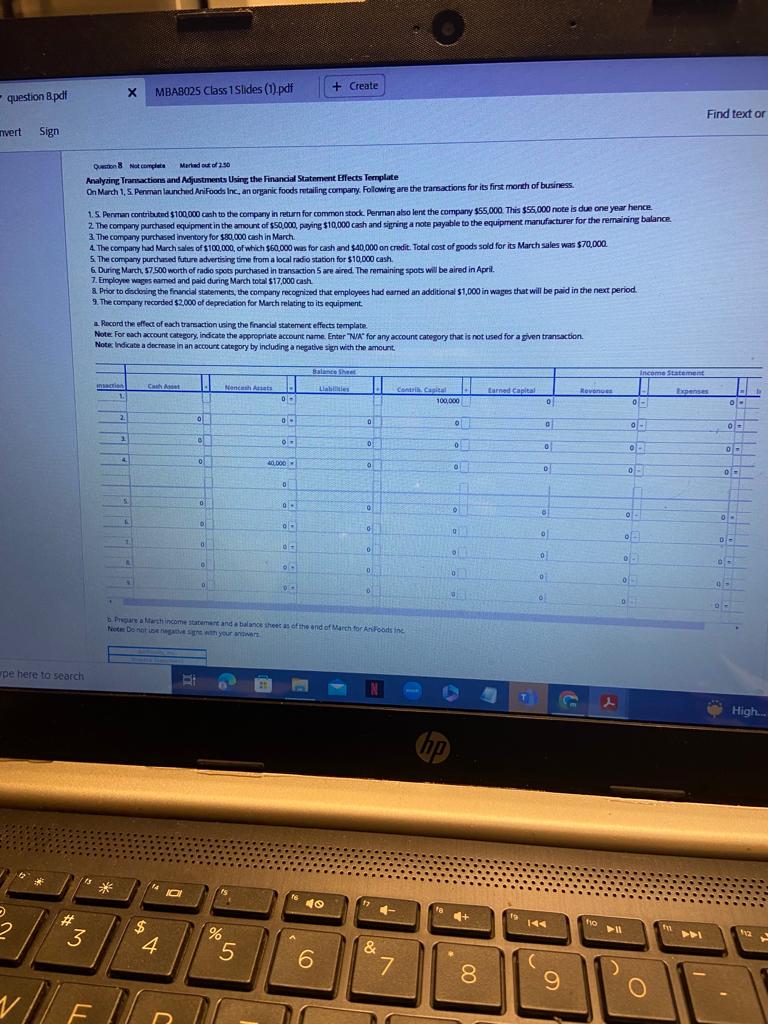

Qunation 8 Notcomplete Mentad out /250 Analyaing Transactions and Adjustments Using the Financial Statement Effects Teerplate On Mordh 1, 5 . Perman launched AniFoods lnc,

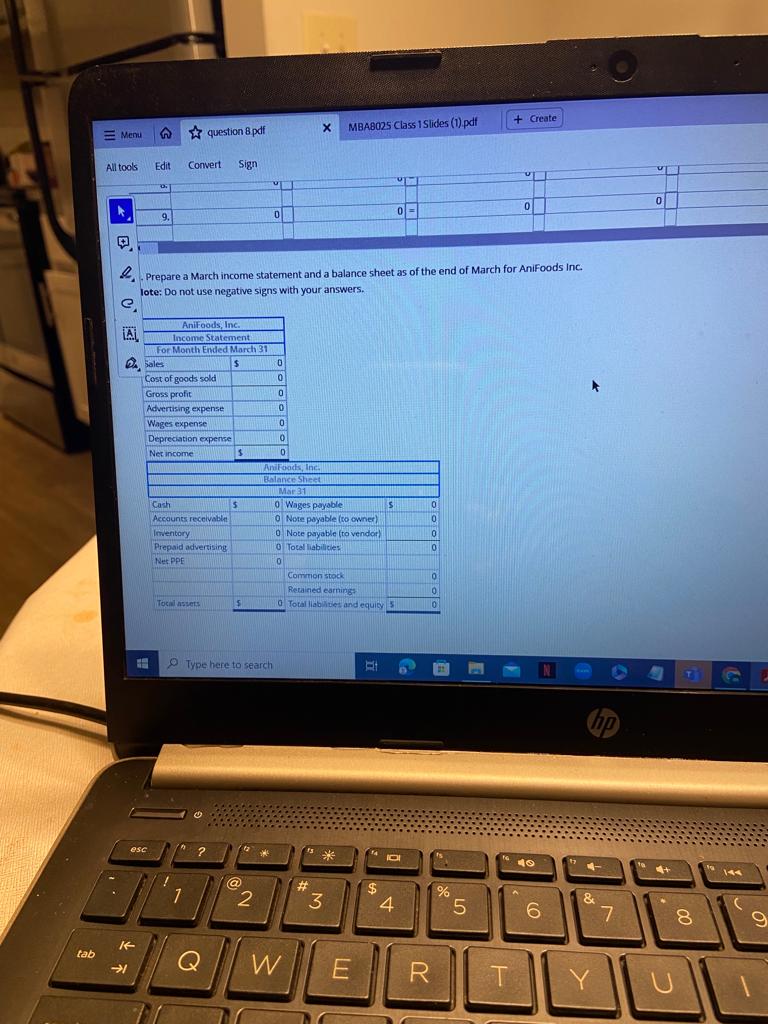

Qunation 8 Notcomplete Mentad out /250 Analyaing Transactions and Adjustments Using the Financial Statement Effects Teerplate On Mordh 1, 5 . Perman launched AniFoods lnc, an organic foods retailing company. Folowirg are the trarsactions for its first morah of business. 1.5. Penman contribatnd $100,000 cah to the company in return for common stock. Penman also lent the company $55,000. This $55,000 note is due one year hence. 2 The compary purchased equipment in the amount of $50,000, paging $10,000 cash and sigring a note payable to the equipment manufacturer for the remaining balance. 3 The company purchased inventory for $80,000 cash in March. 4. The company had March sales of $100,000, of which $60,000 was for cash and $40,000 on credit. Toeal cost of goods sold for its March sales was $70,000. 5. The compary purchased future achertisine time from a bcal radio station for $10,000cash. 6. During March, 57,500 worth of radio spots purchased in transaction 5 are aired. The remaining spots will be aired in April. 7. Employe wages named and paid during March total $17,000 cash. 8. Prioc to disdoning the finandal stabements, the company recognized that employees had eamed an additional $1,000 in wages that will be paid in the next period. 9. The compary recorded $2000 of depreciation for March relating to its equipment 1. Recond the effect of each transaction using the financial statemert effects template. Note. For esch account category, indicate the aporcpriate account name. Enter TNA for any account category that is not used for a given transaction. Note Indicate a docrease in an accourt category by including a negative sign with the amount. Prepare a March income statement and a balance sheet as of the end of March for Anifoods Inc. lote: Do not use negative signs with your answers. Qunation 8 Notcomplete Mentad out /250 Analyaing Transactions and Adjustments Using the Financial Statement Effects Teerplate On Mordh 1, 5 . Perman launched AniFoods lnc, an organic foods retailing company. Folowirg are the trarsactions for its first morah of business. 1.5. Penman contribatnd $100,000 cah to the company in return for common stock. Penman also lent the company $55,000. This $55,000 note is due one year hence. 2 The compary purchased equipment in the amount of $50,000, paging $10,000 cash and sigring a note payable to the equipment manufacturer for the remaining balance. 3 The company purchased inventory for $80,000 cash in March. 4. The company had March sales of $100,000, of which $60,000 was for cash and $40,000 on credit. Toeal cost of goods sold for its March sales was $70,000. 5. The compary purchased future achertisine time from a bcal radio station for $10,000cash. 6. During March, 57,500 worth of radio spots purchased in transaction 5 are aired. The remaining spots will be aired in April. 7. Employe wages named and paid during March total $17,000 cash. 8. Prioc to disdoning the finandal stabements, the company recognized that employees had eamed an additional $1,000 in wages that will be paid in the next period. 9. The compary recorded $2000 of depreciation for March relating to its equipment 1. Recond the effect of each transaction using the financial statemert effects template. Note. For esch account category, indicate the aporcpriate account name. Enter TNA for any account category that is not used for a given transaction. Note Indicate a docrease in an accourt category by including a negative sign with the amount. Prepare a March income statement and a balance sheet as of the end of March for Anifoods Inc. lote: Do not use negative signs with your answers

Qunation 8 Notcomplete Mentad out /250 Analyaing Transactions and Adjustments Using the Financial Statement Effects Teerplate On Mordh 1, 5 . Perman launched AniFoods lnc, an organic foods retailing company. Folowirg are the trarsactions for its first morah of business. 1.5. Penman contribatnd $100,000 cah to the company in return for common stock. Penman also lent the company $55,000. This $55,000 note is due one year hence. 2 The compary purchased equipment in the amount of $50,000, paging $10,000 cash and sigring a note payable to the equipment manufacturer for the remaining balance. 3 The company purchased inventory for $80,000 cash in March. 4. The company had March sales of $100,000, of which $60,000 was for cash and $40,000 on credit. Toeal cost of goods sold for its March sales was $70,000. 5. The compary purchased future achertisine time from a bcal radio station for $10,000cash. 6. During March, 57,500 worth of radio spots purchased in transaction 5 are aired. The remaining spots will be aired in April. 7. Employe wages named and paid during March total $17,000 cash. 8. Prioc to disdoning the finandal stabements, the company recognized that employees had eamed an additional $1,000 in wages that will be paid in the next period. 9. The compary recorded $2000 of depreciation for March relating to its equipment 1. Recond the effect of each transaction using the financial statemert effects template. Note. For esch account category, indicate the aporcpriate account name. Enter TNA for any account category that is not used for a given transaction. Note Indicate a docrease in an accourt category by including a negative sign with the amount. Prepare a March income statement and a balance sheet as of the end of March for Anifoods Inc. lote: Do not use negative signs with your answers. Qunation 8 Notcomplete Mentad out /250 Analyaing Transactions and Adjustments Using the Financial Statement Effects Teerplate On Mordh 1, 5 . Perman launched AniFoods lnc, an organic foods retailing company. Folowirg are the trarsactions for its first morah of business. 1.5. Penman contribatnd $100,000 cah to the company in return for common stock. Penman also lent the company $55,000. This $55,000 note is due one year hence. 2 The compary purchased equipment in the amount of $50,000, paging $10,000 cash and sigring a note payable to the equipment manufacturer for the remaining balance. 3 The company purchased inventory for $80,000 cash in March. 4. The company had March sales of $100,000, of which $60,000 was for cash and $40,000 on credit. Toeal cost of goods sold for its March sales was $70,000. 5. The compary purchased future achertisine time from a bcal radio station for $10,000cash. 6. During March, 57,500 worth of radio spots purchased in transaction 5 are aired. The remaining spots will be aired in April. 7. Employe wages named and paid during March total $17,000 cash. 8. Prioc to disdoning the finandal stabements, the company recognized that employees had eamed an additional $1,000 in wages that will be paid in the next period. 9. The compary recorded $2000 of depreciation for March relating to its equipment 1. Recond the effect of each transaction using the financial statemert effects template. Note. For esch account category, indicate the aporcpriate account name. Enter TNA for any account category that is not used for a given transaction. Note Indicate a docrease in an accourt category by including a negative sign with the amount. Prepare a March income statement and a balance sheet as of the end of March for Anifoods Inc. lote: Do not use negative signs with your answers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started