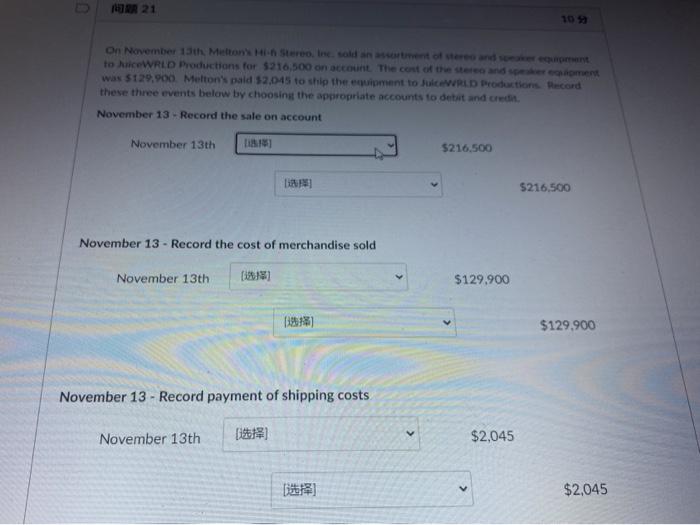

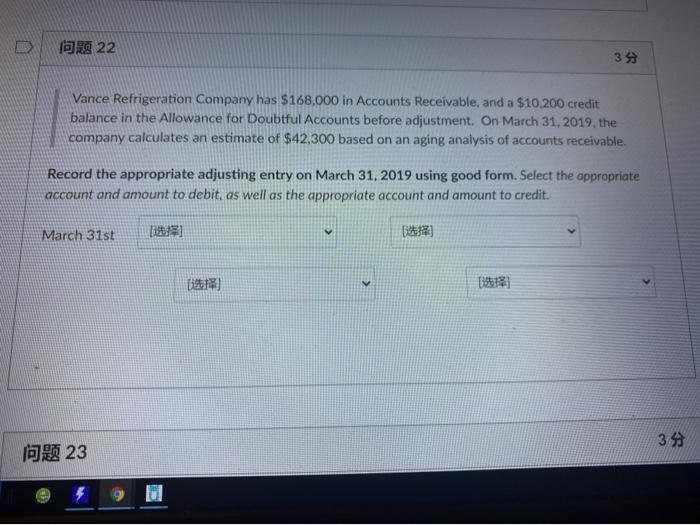

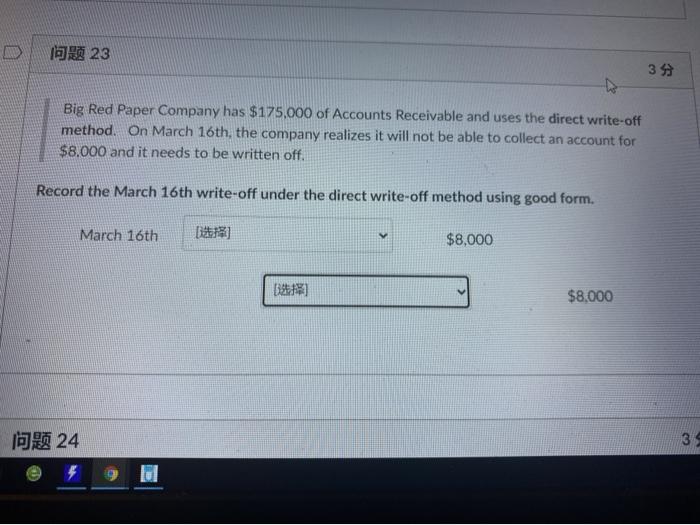

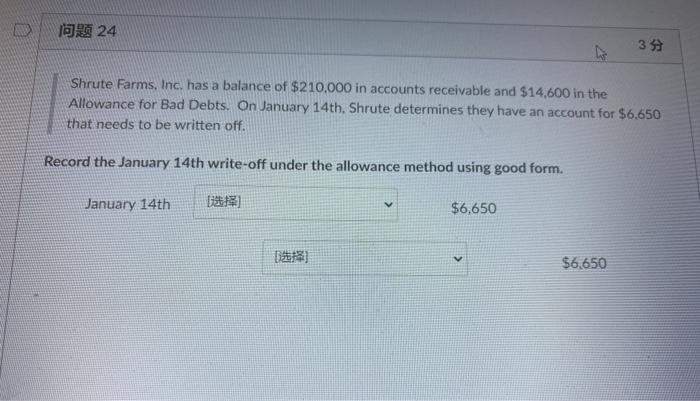

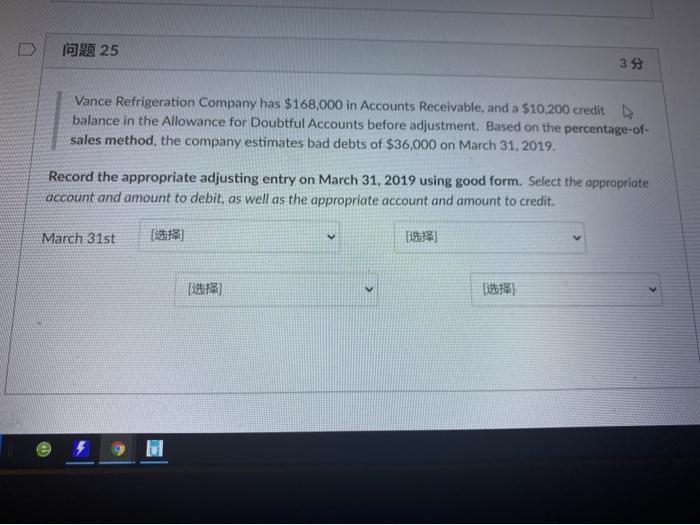

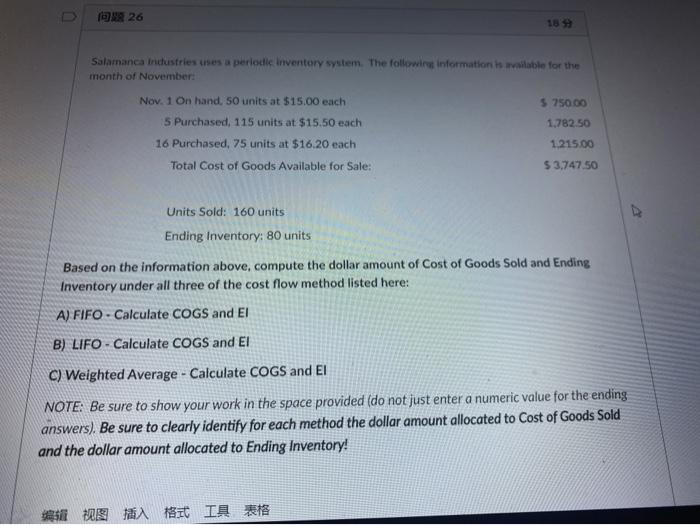

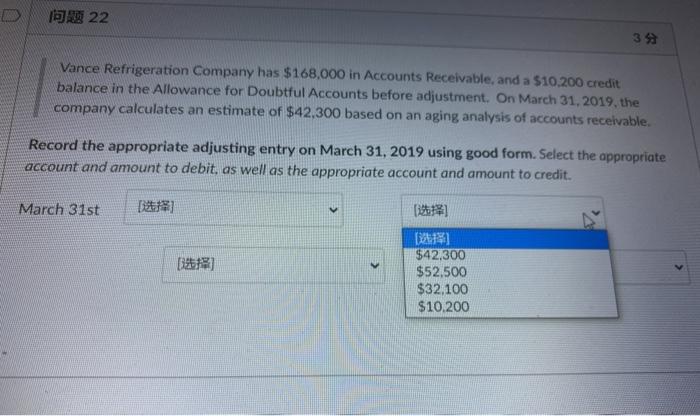

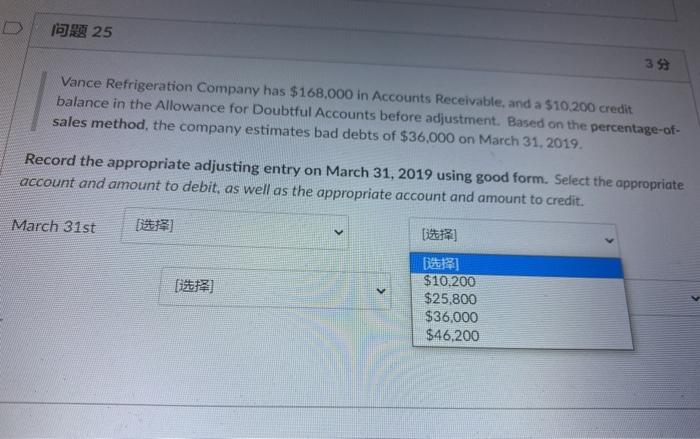

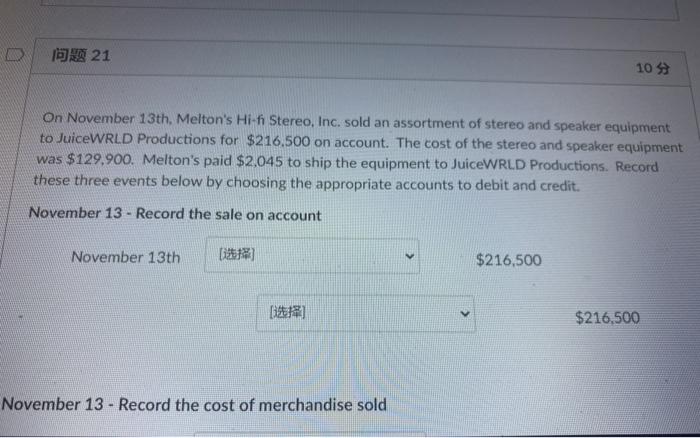

R 21 2013 On November 13th Melton's Stereo inesoldate of to WRLD Productions for 5216,500 on account the cost of the strandement was $129,900 Melton's paid $2,045 to ship the equipment to WRLD Production Record these three events below by choosing the appropriate accounts to detst and credit November 13 - Record the sale on account November 13th $216.500 $216,500 November 13 - Record the cost of merchandise sold November 13th $129,900 $129,900 November 13 - Record payment of shipping costs November 13th ) $2,045 $2.045 22 3 Vance Refrigeration Company has $168,000 in Accounts Receivable, and a $10.200 credit balance in the Allowance for Doubtful Accounts before adjustment. On March 31, 2019, the company calculates an estimate of $42.300 based on an aging analysis of accounts receivable. Record the appropriate adjusting entry on March 31, 2019 using good form. Select the appropriate account and amount to debit, as well as the appropriate account and amount to credit. March 31st 8 (1413) 3 23 23 35 Big Red Paper Company has $175,000 of Accounts Receivable and uses the direct write-off method On March 16th, the company realizes it will not be able to collect an account for $8,000 and it needs to be written off. Record the March 16th write-off under the direct write-off method using good form. March 16th $8,000 ) $8,000 24 3 39 lu 24 33 Shrute Farms, Inc. has a balance of $210,000 in accounts receivable and $14,600 in the Allowance for Bad Debts. On January 14th, Shrute determines they have an account for $6.650 that needs to be written off. Record the January 14th write-off under the allowance method using good form. January 14th $6,650 $6,650 25 39 Vance Refrigeration Company has $168,000 in Accounts Receivable, and a $10.200 credit balance in the Allowance for Doubtful Accounts before adjustment. Based on the percentage-of- sales method, the company estimates bad debts of $36,000 on March 31, 2019. Record the appropriate adjusting entry on March 31, 2019 using good form. Select the appropriate account and amount to debit, as well as the appropriate account and amount to credit. March 31st 16] 26 Salamanca Industries uses a periodic Inventory system. The following information is able for the month of November: Nov. 1 On hand. 50 units at $15.00 each $ 25000 5 Purchased, 115 units at $15.50 each 1,782.50 16 Purchased, 75 units at $16.20 each 1.215.00 Total Cost of Goods Available for Sale: $ 3.747.50 Units Sold: 160 units Ending Inventory: 80 units Based on the information above, compute the dollar amount of Cost of Goods Sold and Ending Inventory under all three of the cost flow method listed here: A) FIFO - Calculate COGS and El B) LIFO - Calculate COGS and El C) Weighted Average - Calculate COGS and El NOTE: Be sure to show your work in the space provided (do not just enter a numeric value for the ending answers). Be sure to clearly identify for each method the dollar amount allocated to Cost of Goods Sold and the dollar amount allocated to Ending Inventory! D 22 39 Vance Refrigeration Company has $168,000 in Accounts Receivable, and a $10.200 credit balance in the Allowance for Doubtful Accounts before adjustment. On March 31, 2019, the company calculates an estimate of $42,300 based on an aging analysis of accounts receivable. Record the appropriate adjusting entry on March 31, 2019 using good form. Select the appropriate account and amount to debit, as well as the appropriate account and amount to credit. March 31st ! ] ! $42,300 $52.500 $32.100 $10.200 25 353 Vance Refrigeration Company has $168,000 in Accounts Receivable, and a $10.200 credit balance in the Allowance for Doubtful Accounts before adjustment. Based on the percentage-of- sales method, the company estimates bad debts of $36,000 on March 31, 2019 Record the appropriate adjusting entry on March 31, 2019 using good form. Select the appropriate account and amount to debit, as well as the appropriate account and amount to credit. March 31st [1] ] $10.200 $25,800 $36,000 $46,200 21 10 On November 13th, Melton's Hi-fi Stereo, Inc. sold an assortment of stereo and speaker equipment to JuiceWRLD Productions for $216.500 on account. The cost of the stereo and speaker equipment was $129.900. Melton's paid $2,045 to ship the equipment to JuiceWRLD Productions. Record these three events below by choosing the appropriate accounts to debit and credit. November 13 - Record the sale on account November 13th ] $216,500 ) $216,500 November 13 - Record the cost of merchandise sold