Answered step by step

Verified Expert Solution

Question

1 Approved Answer

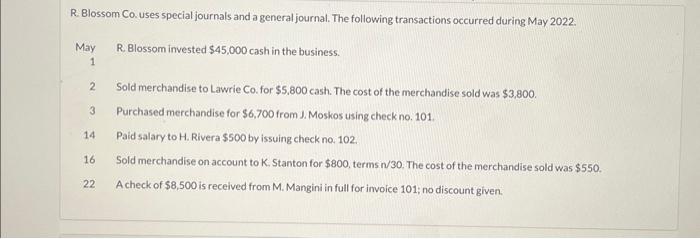

R. Blossom Co. uses special journals and a general journal. The following transactions occurred during May 2022. R. Blossom invested $45,000 cash in the

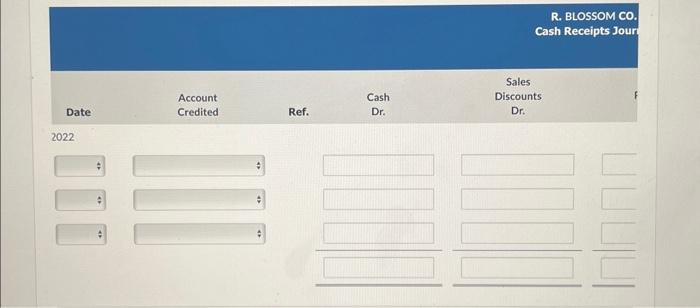

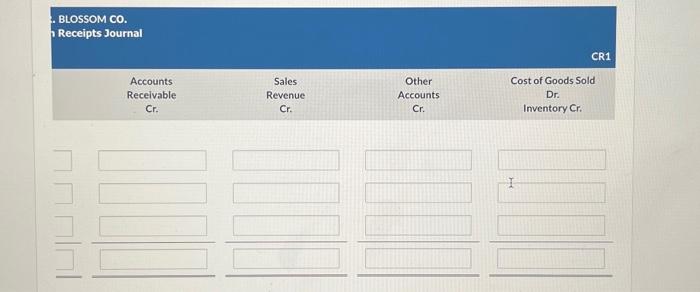

R. Blossom Co. uses special journals and a general journal. The following transactions occurred during May 2022. R. Blossom invested $45,000 cash in the business. May 1 2 3 14 16 22 Sold merchandise to Lawrie Co. for $5,800 cash. The cost of the merchandise sold was $3,800. Purchased merchandise for $6,700 from J. Moskos using check no. 101. Paid salary to H. Rivera $500 by issuing check no. 102. Sold merchandise on account to K. Stanton for $800, terms n/30. The cost of the merchandise sold was $550. A check of $8,500 is received from M. Mangini in full for invoice 101; no discount given. Date: 2022 # Account Credited Ref. Cash Dr. R. BLOSSOM CO. Cash Receipts Jour Sales Discounts Dr. 7000 E . BLOSSOM CO. Receipts Journal Accounts Receivable Cr. 11 Sales: Revenue Cr. Other Accounts Cr. CR1 Cost of Goods Sold Dr. Inventory Cr. I [1]

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

General Journal May 1 Debit Cash 45000 Credit Owners Equity or Capital 45000 May 2 Debit Cash 5800 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started