Answered step by step

Verified Expert Solution

Question

1 Approved Answer

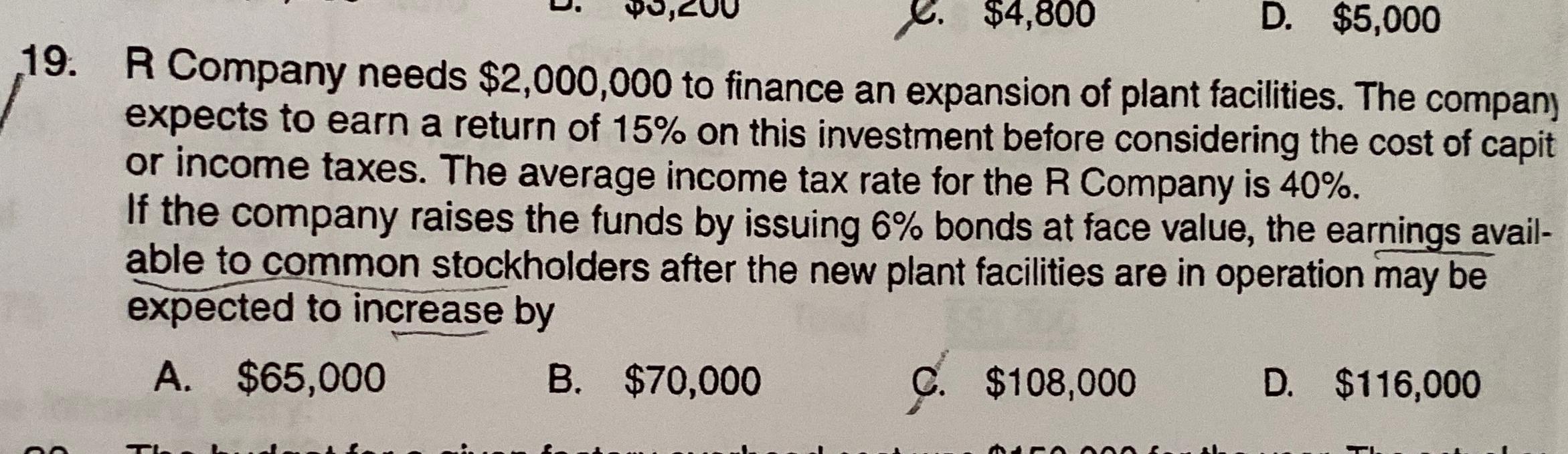

R Company needs $ 2 , 0 0 0 , 0 0 0 to finance an expansion of plant facilities. The compans expects to earn

R Company needs $ to finance an expansion of plant facilities. The compans expects to earn a return of on this investment before considering the cost of capit or income taxes. The average income tax rate for the R Company is If the company raises the funds by issuing bonds at face value, the earnings available to common stockholders after the new plant facilities are in operation may be expected to increase by

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started