Answered step by step

Verified Expert Solution

Question

1 Approved Answer

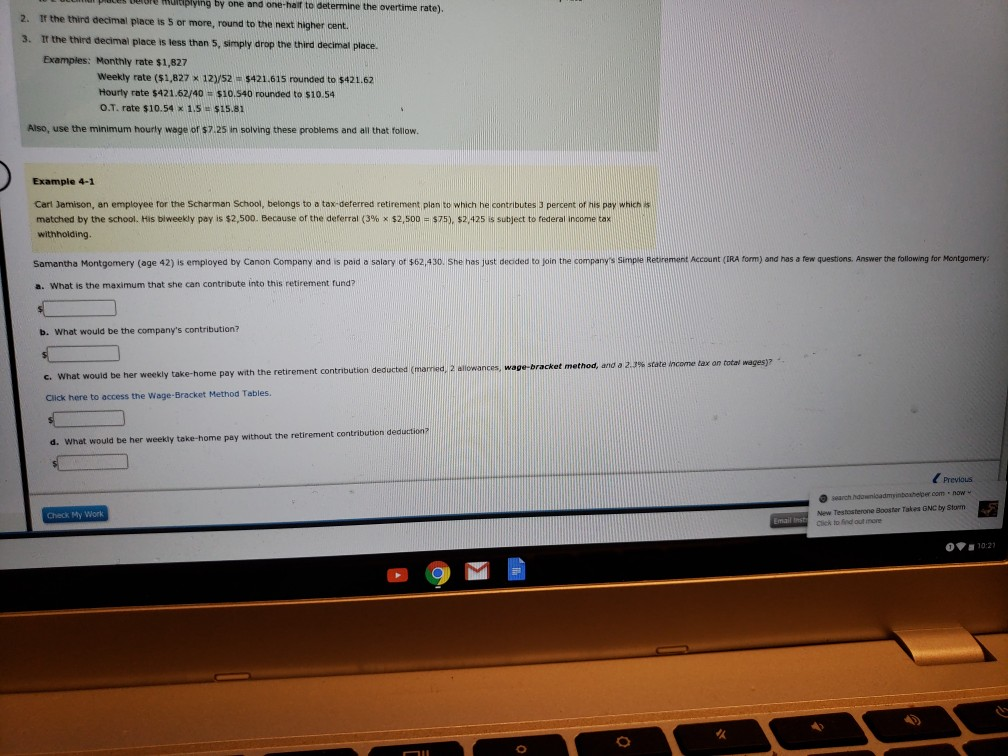

r hltplying by one and one-haif to determine the overtime rate) 2. If the third decimal place is 5 or more, round to the next

r hltplying by one and one-haif to determine the overtime rate) 2. If the third decimal place is 5 or more, round to the next higher cent. Tr the third decimal place is less than 5, simply drap the third decimal place. Examples: Monthly rate $1,827 3. Weekly rate ($1,827 * 12)/52 $421.615 rounded to $421.62 Hourty rate $421.62/40 $10.540 rounded to S10.54 O.T. rate $10.54 x 1.5 $15.81 Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow Example 4-1 Carl Jamison, an employee for the Scharman School, belongs to a tax-deferred retirement pian to which he contributes 3 percent of his pay which matched by the school. His biweekly pay is $2,500. Because or the deferral (3% x $2,500 S75), $2,425 s subject to federal income tax withholdinng Samantha Montgomery (age 42) is employed by Canon Company and is paid a salary of $62,430. She has just decided to join the company's Simpe Retrement Account (IRA form) and has a few questions. Answer the following for Montgomery a. What is the maximum that she can contribute into this retirement fund? b. What would be the company's contribution? wage-bracket method, and a 2.3% state income tax on total wages)? would be her weekly take-home pay with the retirement contribution deducted (marned., 2 ellowances Click here to access the Wage-Bracket Method Tables. d. What would be her weekly take-home pay without the retirement contribution deduction Previous now New Testosterone Boostar Takes GNC by Storm Click to ind out more Check My Work 10:2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started