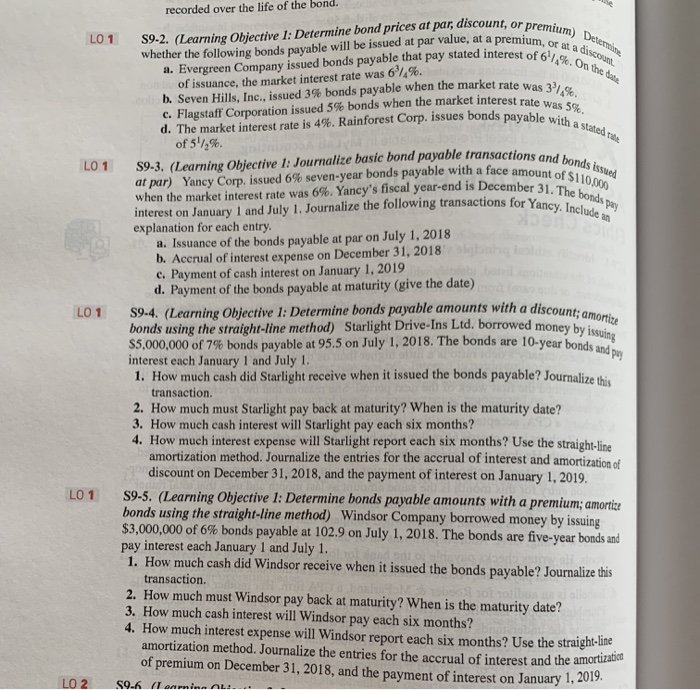

r premium) Detet um, or at a discoun of 61%. On the de was 31% terest rate was 5%. ble with a stated the tions and bonds issued amount of $110.000 ber 31. The bonds Day for Yancy. Include an recorded over the life of the bond. LO1 S92. (Learning Obiective 1: Determine bond prices ar par, discount, or... whether the following bonds payable will be issued at par value, at a premium a. Evergreen Company issued bonds payable that pay stated interest of 61 of issuance, the market interest rate was 6/4%. b. Seven Hills, Inc., issued 3% bonds payable when the market rate was 2 c. Flagstaff Corporation issued 5% bonds when the market interest rate, d. The market interest rate is 4%. Rainforest Corp. issues bonds payable w of 57,%. LO 1 59-3. (Learning Objective 1: Journalize basic bond payable transactions an at par) Yancy Corp. issued 6% seven-year bonds payable with a face amount when the market interest rate was 6%. Yancy's fiscal year-end is December 31 interest on January 1 and July 1. Journalize the following transactions for Yancy explanation for each entry. a. Issuance of the bonds payable at par on July 1, 2018 b. Accrual of interest expense on December 31, 2018 c. Payment of cash interest on January 1, 2019 d. Payment of the bonds payable at maturity (give the date) LO 1 S9-4. (Learning Objective 1: Determine bonds payable amounts with a discount bonds using the straight-line method) Starlight Drive-Ins Ltd, borrowed money he $5,000,000 of 7% bonds payable at 95.5 on July 1, 2018. The bonds are 10-year bond interest each January 1 and July 1. 1. How much cash did Starlight receive when it issued the bonds payable? Journalize thi transaction. 2. How much must Starlight pay back at maturity? When is the maturity date? 3. How much cash interest will Starlight pay each six months? 4. How much interest expense will Starlight report each six months? Use the straight-line amortization method. Journalize the entries for the accrual of interest and amortization of discount on December 31, 2018, and the payment of interest on January 1, 2019. S9-5. (Learning Objective 1: Determine bonds payable amounts with a premium; amortize bonds using the straight-line method) Windsor Company borrowed money by issuing $3,000,000 of 6% bonds payable at 102.9 on July 1, 2018. The bonds are five-year bonds and pay interest each January 1 and July 1. a discount; amortize owed money by issuing 0-year bonds and po LO 1 1. How much cash did Windsor receive when it issued the bonds payable? Journalize this transaction. 2. How much must Windsor pay back at maturity? When is the maturity date? 3. How much cash interest will Windsor pay each six months? 4. How much interest expense will Windsor report each six months? Use the straigniew amortization method. Journalize the entries for the accrual of interest and the amor of premium on December 31, 2018, and the payment of interest on January 1, 2017 S9.6 (Tamina A.... LO 2