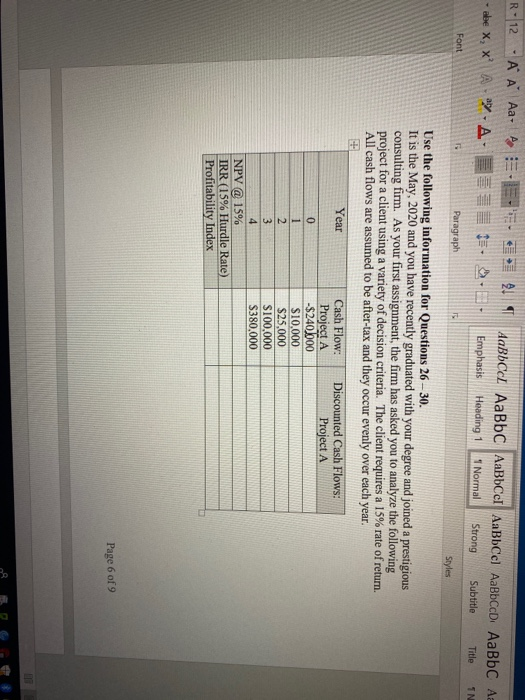

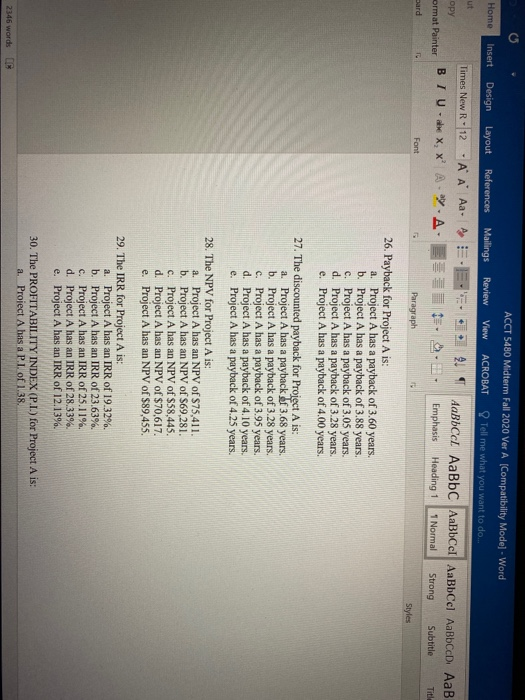

R-12 A A Aa : . . 2. | ) abe X, X? AYA-SE. Emphasis Heading 1 Normal Strong Subtitle Title IN Font Paragraph Styles Use the following information for Questions 26 - 30. It is the May, 2020 and you have recently graduated with your degree and joined a prestigious consulting firm. As your first assignment, the firm has asked you to analyze the following project for a client using a variety of decision criteria. The client requires a 15% rate of return. All cash flows are assumed to be after-tax and they occur evenly over each year. Year Discounted Cash Flows: Project A 0 1 2 3 4 NPV @ 15% IRR (15% Hurdle Rate) Profitability Index Cash Flow: Project A -$240.000 $10.000 $25,000 $100,000 S380,000 Page 6 of 9 ACCT 5480 Midterm Fall 2020 Ver A (Compatibility Mode] - Word View ACROBAT Tell me what you want to do... Home Insert Design Layout References Mailings Review ut Times New R 12 AA A A BIU - X, X' Aay.A. 2! opy el Emphasis Heading 1 1 Normal Strong Subtitle Title ormat Painter sard Font Paragraph Styles 26. Payback for Project A is: a. Project A has a payback of 3.60 years. b. Project A has a payback of 3.88 years. c. Project A has a payback of 3.05 years. d. Project A has a payback of 3.28 years. e. Project A has a payback of 4.00 years. 27. The discounted payback for Project A is: a. Project A has a payback of 3.68 years. b. Project A has a payback of 3.28 years. c. Project A has a payback of 3.95 years. d. Project A has a payback of 4.10 years. e. Project A has a payback of 4.25 years. 28. The NPV for Project A is: a. Project A has an NPV of $75,411. b. Project A has an NPV of $69.281. c. Project A has an NPV of $58,445. d. Project A has an NPV of $70,617. e. Project A has an NPV of $89,455. 29. The IRR for Project A is: a. Project A has an IRR of 19.32%. b. Project A has an IRR of 23.63%. c. Project A has an IRR of 25.11% d. Project A has an IRR of 28.33%. e. Project A has an IRR of 12.13% 30. The PROFITABILITY INDEX (P.I.) for Project A is: a. Proiect A has a P1 of 1.38. 2346 words HO View Paste Insert Design Layout References Mailings Review ACROBAT Tell me what you want to do X cut Times New R 12 A A A A 21 Copy AaBbcc AaBbc AaBbCel AaBbCel AaBbccd. BIU-X, X A.Y.A. Format Painter Emphasis Heading 1 1 Normal Strong Subtitle Clipboard Font Paragraph Styles 28. The NPV for Project A is: a. Project A has an NPV of $75,411. b. Project A has an NPV of S69,281, c. Project A has an NPV of $58,445. d. Project A has an NPV of S70,617. e. Project A has an NPV of $89,455 29. The IRR for Project A is: a. Project A has an IRR of 19.32% b. Project A has an IRR of 3.63%. c. Project A has an IRR of 25.11%. d. Project A has an IRR of 28.33%. e. Project A has an IRR of 12.13%. 30. The PROFITABILITY INDEX (P.L.) for Project A is: a. Project A has a P.I. of 1.38 b. Project A has a P.I. of 1.44 c. Project A has a P.I. of 1.65. d. Project A has a P.1 of 2.33. e. Project A has a P.I. of 1.29. Page 9 of 9 2346 words LE