Answered step by step

Verified Expert Solution

Question

1 Approved Answer

R.18 ((Please, I want a very fast solution. I need a solution in less than half an hour. Help me VIETA xa OS Remaining Time:

R.18 ((Please, I want a very fast solution. I need a solution in less than half an hour. Help me

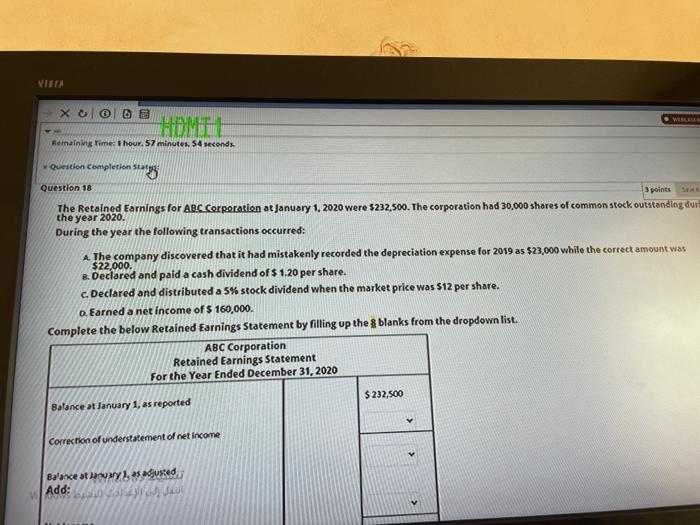

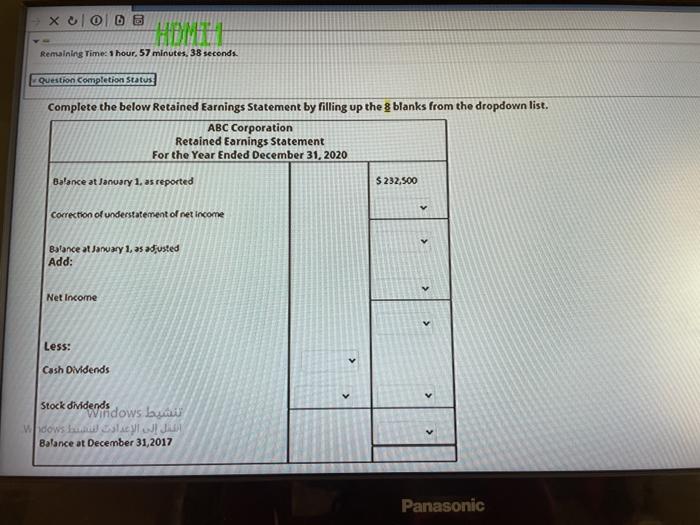

VIETA xa OS Remaining Time: 1 hour. 57 minutes, 54 seconds Question completion stat Question 18 3 points The Retained Earnings for ABC Corporation at January 1, 2020 were $232,500. The corporation had 30,000 shares of common stock outstanding dun the year 2020. During the year the following transactions occurred: A. The company discovered that it had mistakenly recorded the depreciation expense for 2019 as $23,000 while the correct amount was $22,000. 8. Declared and paid a cash dividend of $ 1.20 per share. c. Declared and distributed a 5% stock dividend when the market price was $12 per share. o Earned a net income of $ 160,000. Complete the below Retained Earnings Statement by filling up the 8 blanks from the dropdown list. ABC Corporation Retained Earnings Statement For the Year Ended December 31, 2020 $ 232,500 Balance at January 1, as reported v Correction of understatement of net income Balance at Annuary , as adjusted Add: XOOB Remaining Time: 1 hour, 57 minutes, 38 seconds. Question completion Status Complete the below Retained Earnings Statement by filling up the 8 blanks from the dropdown list. ABC Corporation Retained Earnings Statement For the Year Ended December 31, 2020 Balance at January 1, as reported $ 232,500 Correction of understatement of net income Balance at January 1, 35 $usted Add: Net Income > Less: Cash Dividends > Stock didends dows bumi I Balance at December 31, 2017 Panasonic

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started