Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rabiya Corporation's Shareholder's equity for January 1, 2020: Issued shares 50,000 P15 Par value Share capital Share premium Retained earnings Total P750,000 500,000 1,250,000

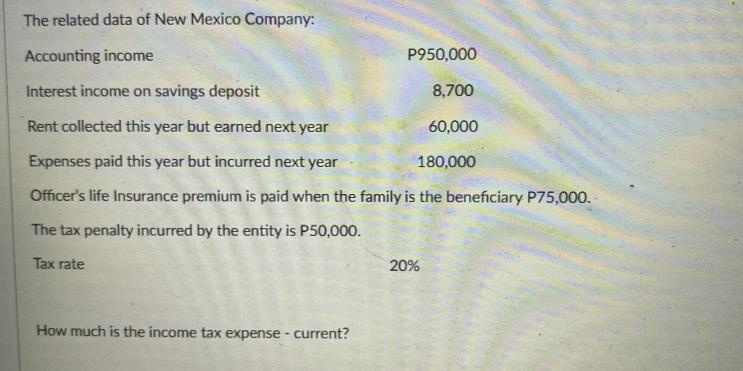

Rabiya Corporation's Shareholder's equity for January 1, 2020: Issued shares 50,000 P15 Par value Share capital Share premium Retained earnings Total P750,000 500,000 1,250,000 P2,500,000 During the year, the following transactions occur: 1. The entity acquired 10% of its own issued shares at P30 cost per share. 2. Reissued shares of 3,000 for an amount of P33 per share. 3. Retire 2,000 treasury shares. 4. Net income is P950,000. 5. Declared P12.50 cash dividends per share. How much is the contributed capital at year-end? On January 1, 2021, Milka Company leased property from Minorka Company: The related data: Annual payment in advance at the beginning of each lease year P1,500,000 Lease term in years Estimated useful life of equipment in years Guaranteed residual value by the lessee Incremental borrowing rate Implicit interest rate Initial direct cost paid by the lessee Lease incentive received P150,000 The lease bonus paid to the lessor before commencing the lease is P100,000. The property will revert back to the lessor at the end of the lease term. The entity used 2 decimal places for the PV factor. 8% 6 P250,000 10% 12 P120,000 How much is the Right-of-used asset on December 31, 2021 (round-off answer to the nearest peso value)? The related data of New Mexico Company: Accounting income Interest income on savings deposit Rent collected this year but earned next year Expenses paid this year but incurred next year Officer's life Insurance premium is paid when the family is the beneficiary P75,000. The tax penalty incurred by the entity is P50,000. Tax rate How much is the income tax expense - current? P950,000 8,700 60,000 180,000 20% Angeline Corporation's Shareholder's equity for January 1, 2020: Issued shares Par value 50,000 P20 Share capital Share premium Retained earnings Total During the year: 1. The entity reacquired its own shares of 4,500 at a cost per share of P31. 2. Reissue own shares of 2,500 for a P39.25 per share. 3. Net income is P980,000. 4. The BOD declared cash dividends of P15.75 per share. P1,000,000 1,750,000 2,850,500 P5,600.500 How much are the retained earnings - unappropriated at year-end? The related data of Gazini Company: Authorized 200,000 shares with a P25 par value. Issued 50,000 shares for cash at P32.5 per share. Issued 25,000 shares for a property. The fair value per share is P35 while the fair value of the property is P867,000. How much is the contributed capital at year-end? Question 35 The related data of Catriona Company: Authorized 100,000 shares with a P20 par value. Received 1st subscription with 50% down payment of 35,000 shares at P25 per share. Issued 15,000 shares for cash at P28.75 per share. Issued 10,000 shares for a property. The fair value per share is P29.5 at that time while the fair value of the property is P304,500. How much is the share premium?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the requested values step by step 1 Rabiya Corporations Contributed Capital at YearEnd Contributed Capital Share Capital Share Premium ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started