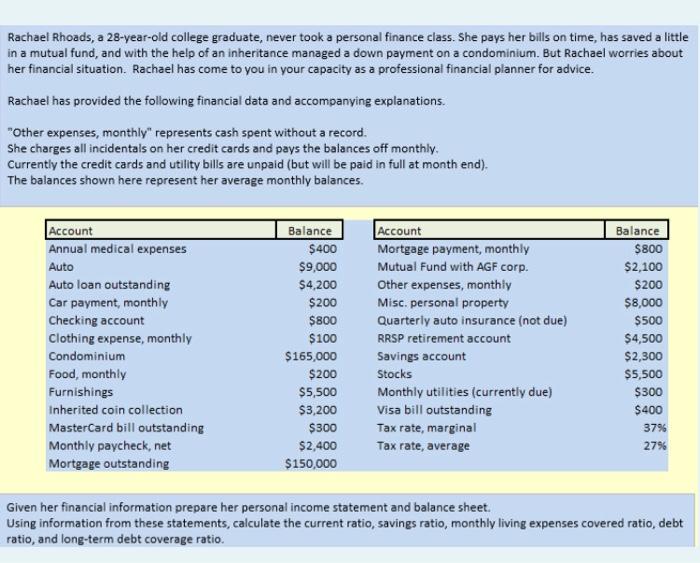

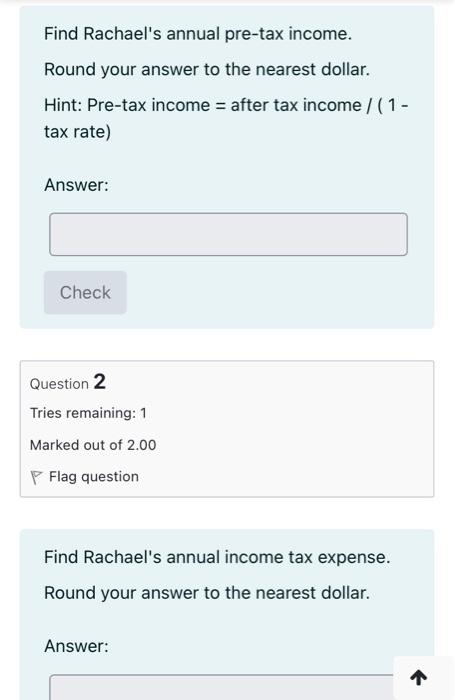

Rachael Rhoads, a 28-year-old college graduate, never took a personal finance class. She pays her bills on time, has saved a little in a mutual fund, and with the help of an inheritance managed a down payment on a condominium. But Rachael worries about her financial situation. Rachael has come to you in your capacity as a professional financial planner for advice. Rachael has provided the following financial data and accompanying explanations. "Other expenses, monthly" represents cash spent without a record. She charges all incidentals on her credit cards and pays the balances off monthly Currently the credit cards and utility bills are unpaid (but will be paid in full at month end). The balances shown here represent her average monthly balances. Account Annual medical expenses Auto Auto loan outstanding Car payment, monthly Checking account Clothing expense, monthly Condominium Food, monthly Furnishings Inherited coin collection MasterCard bill outstanding Monthly paycheck, net Mortgage outstanding Balance $400 $9,000 $4,200 $200 $800 $100 $165,000 $200 $5,500 $3,200 $300 $2,400 $150,000 Account Mortgage payment, monthly Mutual Fund with AGF corp. Other expenses, monthly Misc. personal property Quarterly auto insurance (not due) RRSP retirement account Savings account Stocks Monthly utilities (currently due) Visa bill outstanding Tax rate, marginal Tax rate, average Balance $800 $2,100 $200 $8,000 $500 $4,500 $2,300 $5,500 $300 $400 379 27% Given her financial information prepare her personal income statement and balance sheet. Using information from these statements, calculate the current ratio, savings ratio, monthly living expenses covered ratio, debt ratio, and long-term debt coverage ratio. Find Rachael's annual pre-tax income. Round your answer to the nearest dollar. Hint: Pre-tax income = after tax income /(1- tax rate) Answer: Check Question 2 Tries remaining: 1 Marked out of 2.00 Flag question Find Rachael's annual income tax expense. Round your answer to the nearest dollar. Answer: 1 Rachael Rhoads, a 28-year-old college graduate, never took a personal finance class. She pays her bills on time, has saved a little in a mutual fund, and with the help of an inheritance managed a down payment on a condominium. But Rachael worries about her financial situation. Rachael has come to you in your capacity as a professional financial planner for advice. Rachael has provided the following financial data and accompanying explanations. "Other expenses, monthly" represents cash spent without a record. She charges all incidentals on her credit cards and pays the balances off monthly Currently the credit cards and utility bills are unpaid (but will be paid in full at month end). The balances shown here represent her average monthly balances. Account Annual medical expenses Auto Auto loan outstanding Car payment, monthly Checking account Clothing expense, monthly Condominium Food, monthly Furnishings Inherited coin collection MasterCard bill outstanding Monthly paycheck, net Mortgage outstanding Balance $400 $9,000 $4,200 $200 $800 $100 $165,000 $200 $5,500 $3,200 $300 $2,400 $150,000 Account Mortgage payment, monthly Mutual Fund with AGF corp. Other expenses, monthly Misc. personal property Quarterly auto insurance (not due) RRSP retirement account Savings account Stocks Monthly utilities (currently due) Visa bill outstanding Tax rate, marginal Tax rate, average Balance $800 $2,100 $200 $8,000 $500 $4,500 $2,300 $5,500 $300 $400 379 27% Given her financial information prepare her personal income statement and balance sheet. Using information from these statements, calculate the current ratio, savings ratio, monthly living expenses covered ratio, debt ratio, and long-term debt coverage ratio. Find Rachael's annual pre-tax income. Round your answer to the nearest dollar. Hint: Pre-tax income = after tax income /(1- tax rate) Answer: Check Question 2 Tries remaining: 1 Marked out of 2.00 Flag question Find Rachael's annual income tax expense. Round your answer to the nearest dollar. Answer: 1