Rachel Cook is very concerned. Until recently, she has always had the golden touch, having successfully launched two start- up companies that made her

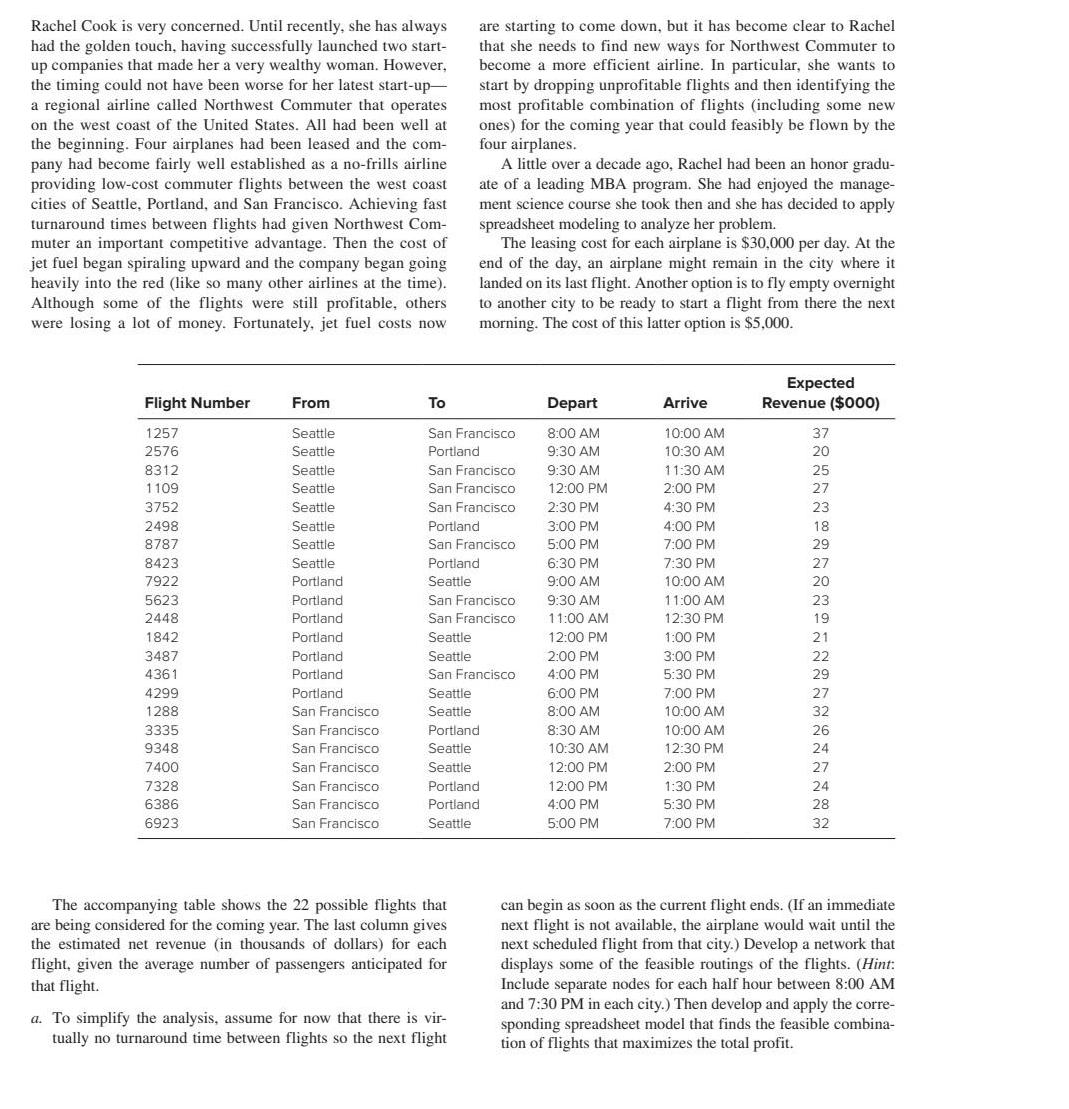

Rachel Cook is very concerned. Until recently, she has always had the golden touch, having successfully launched two start- up companies that made her a very wealthy woman. However, the timing could not have been worse for her latest start-up- a regional airline called Northwest Commuter that operates on the west coast of the United States. All had been well at the beginning. Four airplanes had been leased and the com- pany had become fairly well established as a no-frills airline providing low-cost commuter flights between the west coast cities of Seattle, Portland, and San Francisco. Achieving fast turnaround times between flights had given Northwest Com- muter an important competitive advantage. Then the cost of jet fuel began spiraling upward and the company began going heavily into the red (like so many other airlines at the time). Although some of the flights were still profitable, others were losing a lot of money. Fortunately, jet fuel costs now Flight Number 1257 2576 8312 1109 3752 2498 8787 8423 7922 5623 2448 1842 3487 4361 4299 1288 3335 9348 7400 7328 6386 6923 From Seattle Seattle Seattle Seattle Seattle Seattle Seattle Seattle Portland Portland Portland Portland Portland Portland Portland San Francisco San Francisco San Francisco San Francisco San Francisco San Francisco San Francisco are starting to come down, but it has become clear to Rachel that she needs to find new ways for Northwest Commuter to become a more efficient airline. In particular, she wants to start by dropping unprofitable flights and then identifying the most profitable combination of flights (including some new ones) for the coming year that could feasibly be flown by the four airplanes. To San Francisco Portland San Francisco San Francisco San Francisco A little over a decade ago, Rachel had been an honor gradu- ate of a leading MBA program. She had enjoyed the manage- ment science course she took then and she has decided to apply spreadsheet modeling to analyze her problem. The leasing cost for each airplane is $30,000 per day. At the end of the day, an airplane might remain in the city where it landed on its last flight. Another option is to fly empty overnight to another city to be ready to start a flight from there the next morning. The cost of this latter option is $5,000. Portland San Francisco Portland Seattle San Francisco San Francisco Seattle Seattle San Francisco Seattle Seattle The accompanying table shows the 22 possible flights that are being considered for the coming year. The last column gives the estimated net revenue (in thousands of dollars) for each flight, given the average number of passengers anticipated for that flight. Portland Seattle Seattle Portland Portland Seattle a. To simplify the analysis, assume for now that there is vir- tually no turnaround time between flights so the next flight Depart 8:00 AM 9:30 AM 9:30 AM 12:00 PM 2:30 PM 3:00 PM 5:00 PM 6:30 PM 9:00 AM 9:30 AM 11:00 AM 12:00 PM 2:00 PM 4:00 PM 6:00 PM 8:00 AM 8:30 AM 10:30 AM 12:00 PM 12:00 PM 4:00 PM 5:00 PM Arrive 10:00 AM 10:30 AM 11:30 AM 2:00 PM 4:30 PM 4:00 PM 7:00 PM 7:30 PM 10:00 AM 11:00 AM 12:30 PM 1:00 PM 3:00 PM 5:30 PM 7:00 PM 10:00 AM 10:00 AM 12:30 PM 2:00 PM 1:30 PM 5:30 PM 7:00 PM Expected Revenue ($000) 37 20 25 27 23 18 29 27 20 23 19 NNNNNNN 21 22 29 27 32 26 24 27 24 28 32 can begin as soon as the current flight ends. (If an immediate next flight is not available, the airplane would wait until the next scheduled flight from that city.) Develop a network that displays some of the feasible routings of the flights. (Hint: Include separate nodes for each half hour between 8:00 AM and 7:30 PM in each city.) Then develop and apply the corre- sponding spreadsheet model that finds the feasible combina- tion of flights that maximizes the total profit. b. Rachel is considering leasing additional airplanes to achieve economies of scale. The leasing cost of each one again would be $30,000 per day. Perform what-if analysis to determine whether it would be worthwhile to have 5, 6, or 7 airplanes instead of 4. c. Now repeat part a under the more realistic assumption that there is a minimum turnaround time of 30 minutes on the ground for unloading and loading passengers between the arrival of a flight and the departure of the next flight by the same airplane. (Most airlines use a considerably longer turnaround time.) Does this change the number of flights that can be flown? d. Rachel now is considering having each of the four airplanes carry freight instead of flying empty if it flies overnight to another city. Instead of a cost of $5,000, this would result in net revenue of $5,000. Adapt the spreadsheet model used in part c to find the feasible combination of flights that maxi- mizes the total profit. Does this change the number of air- planes that fly overnight to another city?

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To address Rachel Cooks concerns and aid in decisionmaking for Northwest Commuter we need to create a spreadsheet model that evaluates different possi...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started