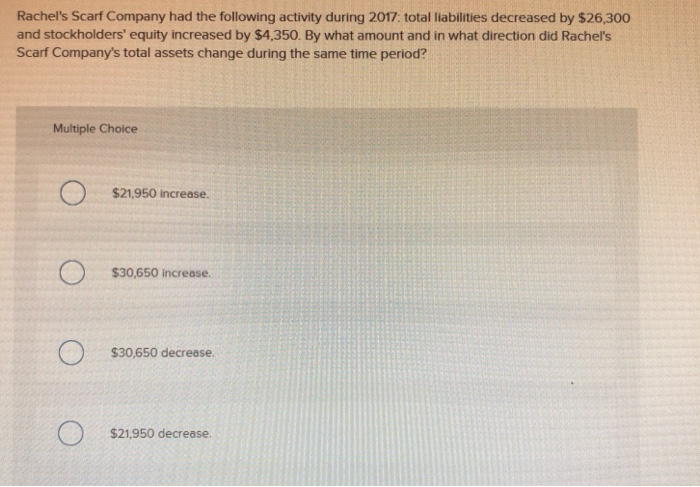

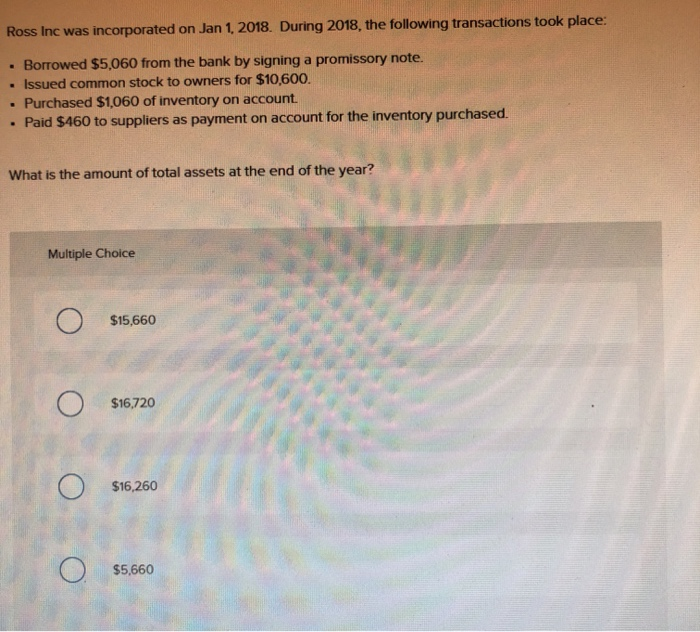

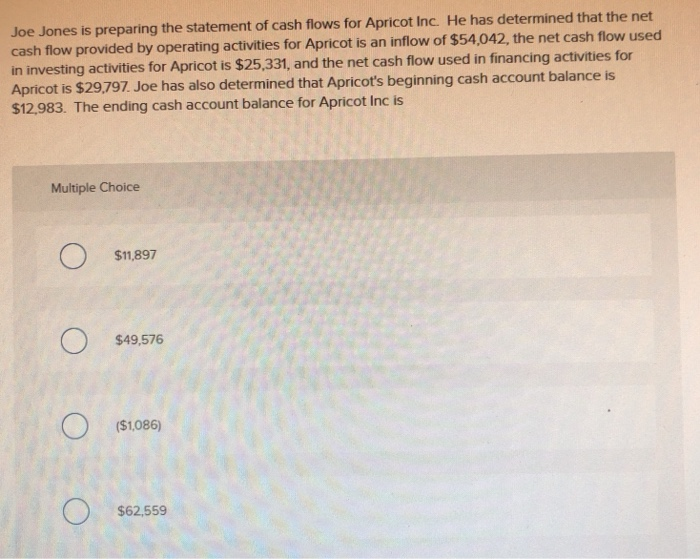

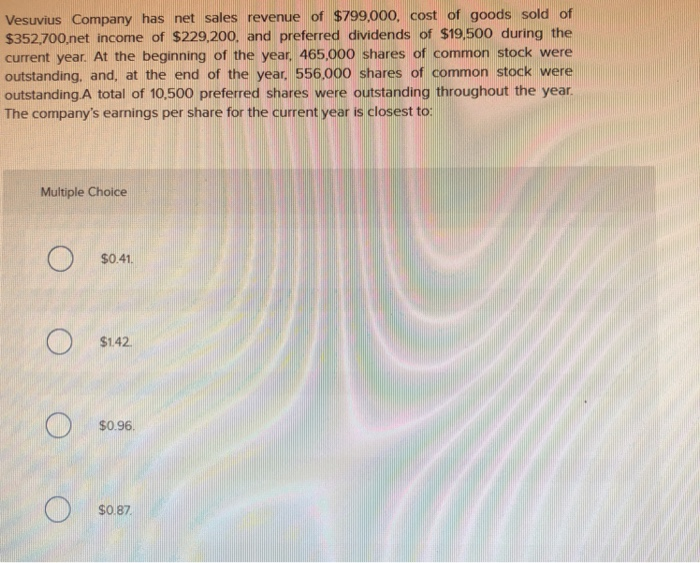

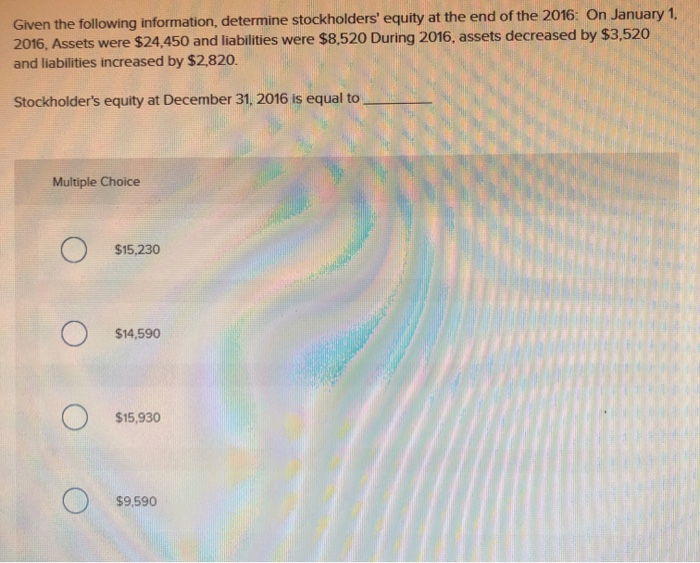

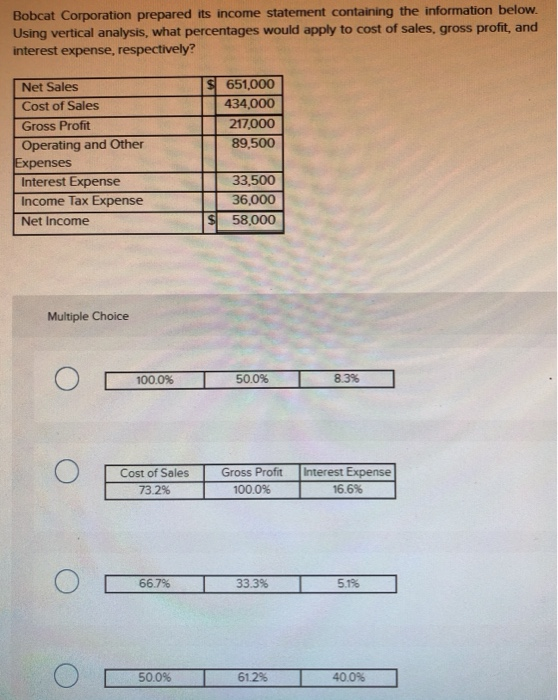

Rachel's Scarf Company had the following activity during 2017 total liabilities decreased by $26,300 and stockholders' equity increased by $4,350. By what amount and in what direction did Rachel's Scarf Company's total assets change during the same time period? Multiple Choice $21,950 increase $30,650 increase $30,650 decrease 0 $21,950 decrease. Ross Inc was incorporated on Jan 1, 2018. During 2018, the following transactions took place: Borrowed $5,060 from the bank by signing a promissory note. Issued common stock to owners for $10,600. Purchased $1,060 of inventory on account. Paid $460 to suppliers as payment on account for the inventory purchased. What is the amount of total assets at the end of the year? Multiple Choice $15,660 $16,720 $16,260 O $5,660 Joe Jones is preparing the statement of cash flows for Apricot Inc. He has determined that the net! cash flow provided by operating activities for Apricot is an inflow of $54,042, the net cash flow used in investing activities for Apricot is $25,331, and the net cash flow used in financing activities for Apricot is $29,797. Joe has also determined that Apricot's beginning cash account balance is $12,983. The ending cash account balance for Apricot Inc is Multiple Choice 1 0 $11,897 0 $49.576 0 ($1,086) 0 $62,559 Vesuvius Company has net sales revenue of $799,000, cost of goods sold of $352,700,net income of $229,200, and preferred dividends of $19,500 during the current year. At the beginning of the year, 465,000 shares of common stock were outstanding, and, at the end of the year, 556,000 shares of common stock were outstanding. A total of 10,500 preferred shares were outstanding throughout the year. The company's earnings per share for the current year is closest to: Multiple Choice $0.41 O $1.42 o $0.96 o $0.87 o Given the following information, determine stockholders' equity at the end of the 2016: On January 1, 2016, Assets were $24.450 and liabilities were $8,520 During 2016, assets decreased by $3,520 and liabilities increased by $2,820. Stockholder's equity at December 31, 2016 is equal to Multiple Choice $15, 230 $14,590 515,930 59.590 Bobcat Corporation prepared its income statement containing the information below. Using vertical analysis, what percentages would apply to cost of sales, gross profit, and interest expense, respectively? S651,000 I 434,000 217,000 89,500 Net Sales Cost of Sales Gross Profit Operating and Other Expenses Interest Expense Income Tax Expense Net Income 33,500 36,000 58,000 Multiple Choice O 1000% | 50.0% | 83% interest Expense Cost of Sales 73.2% Gross Profit 100.0% O 6676 | 333% 5 O 500% | 612% 400%