Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Radar Company sells bikes for $530 each. The company currently sells 4,200 bikes per year and could make as many as 4,550 bikes per year.

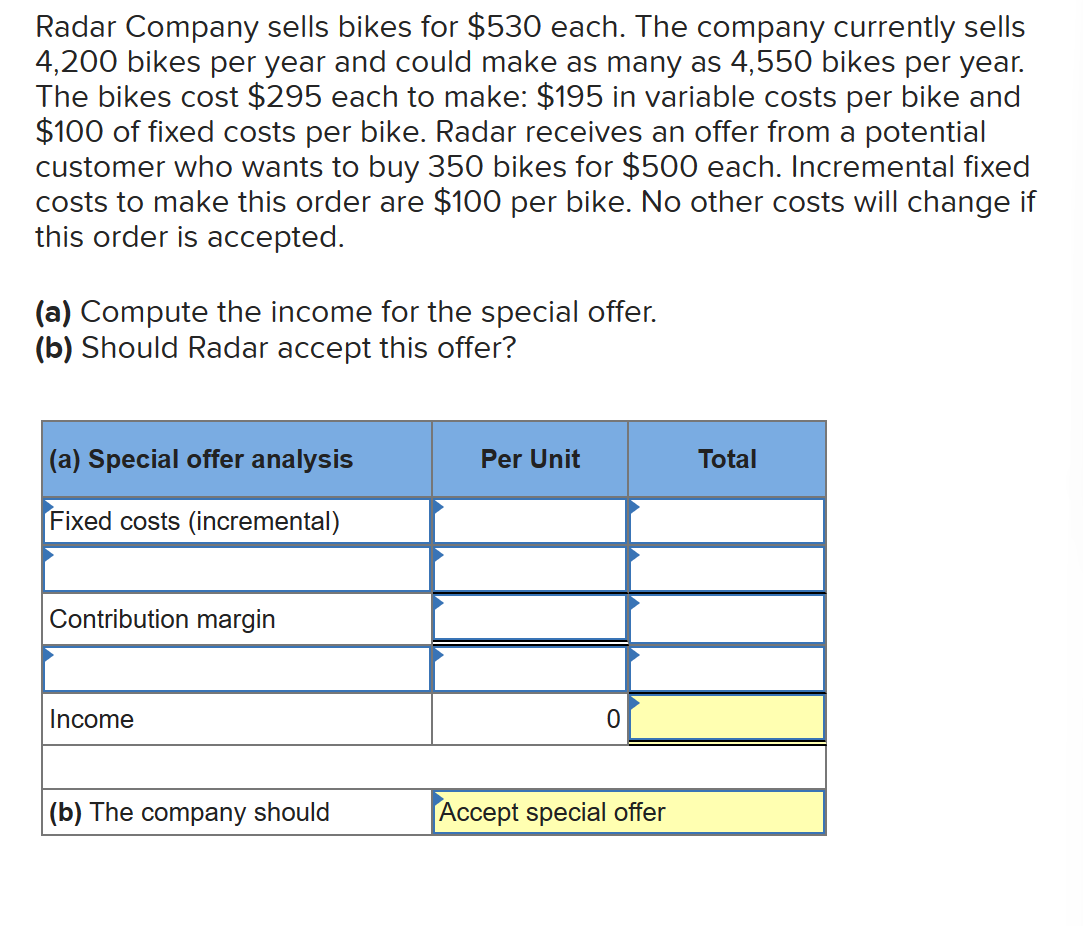

Radar Company sells bikes for $530 each. The company currently sells 4,200 bikes per year and could make as many as 4,550 bikes per year. The bikes cost $295 each to make: $195 in variable costs per bike and $100 of fixed costs per bike. Radar receives an offer from a potential customer who wants to buy 350 bikes for $500 each. Incremental fixed costs to make this order are $100 per bike. No other costs will change if this order is accepted. (a) Compute the income for the special offer. (b) Should Radar accept this offer?

Radar Company sells bikes for $530 each. The company currently sells 4,200 bikes per year and could make as many as 4,550 bikes per year. The bikes cost $295 each to make: $195 in variable costs per bike and $100 of fixed costs per bike. Radar receives an offer from a potential customer who wants to buy 350 bikes for $500 each. Incremental fixed costs to make this order are $100 per bike. No other costs will change if this order is accepted. (a) Compute the income for the special offer. (b) Should Radar accept this offer?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started