Answered step by step

Verified Expert Solution

Question

1 Approved Answer

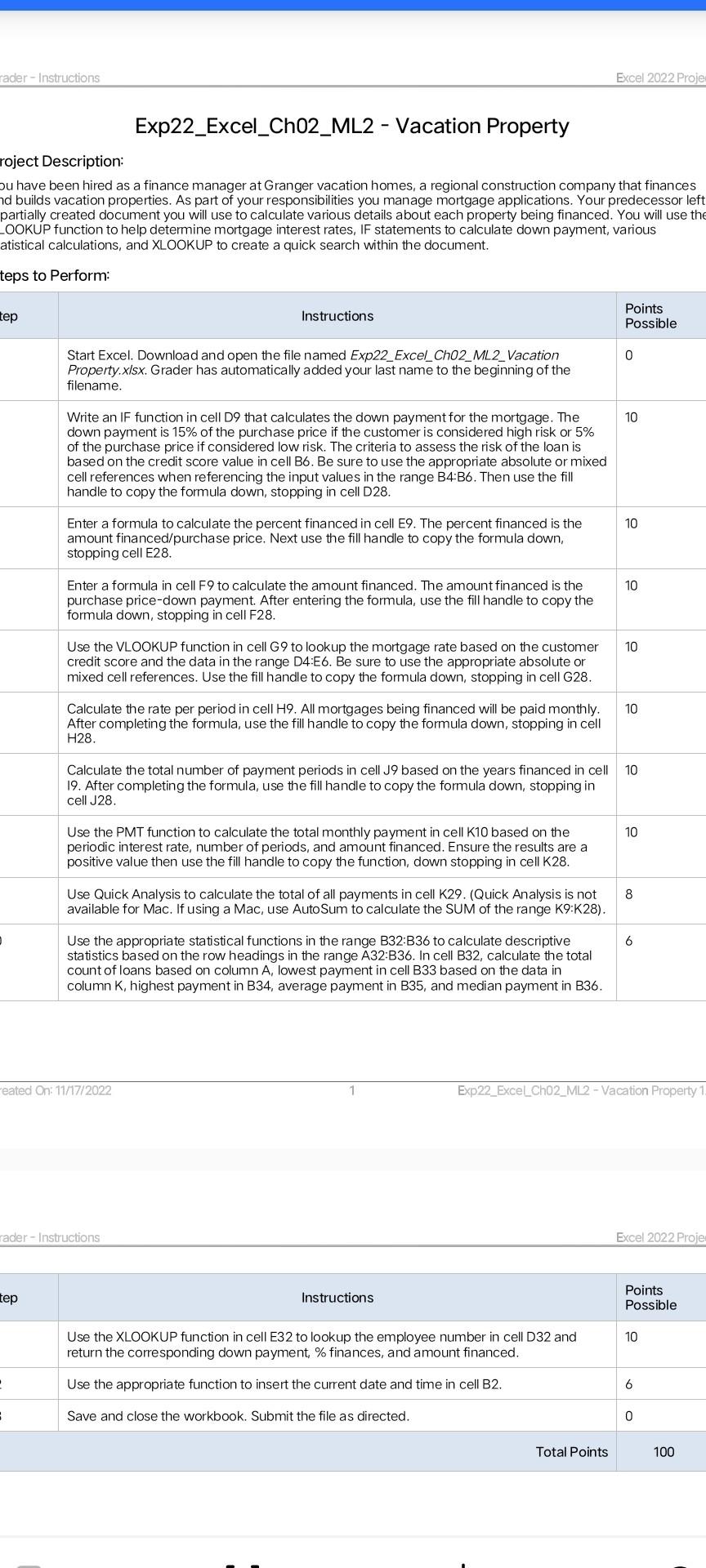

rader-Instructions tep roject Description: ou have been hired as a finance manager at Granger vacation homes, a regional construction company that finances nd builds

rader-Instructions tep roject Description: ou have been hired as a finance manager at Granger vacation homes, a regional construction company that finances nd builds vacation properties. As part of your responsibilities you manage mortgage applications. Your predecessor left partially created document you will use to calculate various details about each property being financed. You will use the LOOKUP function to help determine mortgage interest rates, IF statements to calculate down payment, various atistical calculations, and XLOOKUP to create a quick search within the document. teps to Perform: tep 2 Exp22_Excel_Ch02_ML2 - Vacation Property = Start Excel. Download and open the file named Exp22_Excel_Ch02_ML2_Vacation Property.xlsx. Grader has automatically added your last name to the beginning of the filename. Instructions Write an IF function in cell D9 that calculates the down payment for the mortgage. The down payment is 15% of the purchase price if the customer is considered high risk or 5% of the purchase price if considered low risk. The criteria to assess the risk of the loan is based on the credit score value in cell B6. Be sure to use the appropriate absolute or mixed cell references when referencing the input values in the range B4:B6. Then use the fill handle to copy the formula down, stopping in cell D28. Enter a formula to calculate the percent financed in cell E9. The percent financed is the amount financed/purchase price. Next use the fill handle to copy the formula down, stopping cell E28. Enter a formula in cell F9 to calculate the amount financed. The amount financed is the purchase price-down payment. After entering the formula, use the fill handle to copy the formula down, stopping in cell F28. Use the VLOOKUP function in cell G9 to lookup the mortgage rate based on the customer credit score and the data in the range D4:E6. Be sure to use the appropriate absolute or mixed cell references. Use the fill handle to copy the formula down, stopping in cell G28. Calculate the rate per period in cell H9. All mortgages being financed will be paid monthly. After completing the formula, use the fill handle to copy the formula down, stopping in cell H28. reated On: 11/17/2022 rader-Instructions Use the PMT function to calculate the total monthly payment in cell K10 based on the periodic interest rate, number of periods, and amount financed. Ensure the results are a positive value then use the fill handle to copy the function, down stopping in cell K28. Use Quick Analysis to calculate the total of all payments in cell K29. (Quick Analysis is not available for Mac. If using a Mac, use AutoSum to calculate the SUM of the range K9:K28). Use the appropriate statistical functions in the range B32:B36 to calculate descriptive statistics based on the row headings in the range A32:B36. In cell B32, calculate the total count of loans based on column A, lowest payment in cell B33 based on the data in column K, highest payment in B34, average payment in B35, and median payment in B36. 1 Instructions Excel 2022 Proje 10 Calculate the total number of payment periods in cell J9 based on the years financed in cell 19. After completing the formula, use the fill handle to copy the formula down, stopping in cell J28. Use the XLOOKUP function in cell E32 to lookup the employee number in cell D32 and return the corresponding down payment, % finances, and amount financed. Use the appropriate function to insert the current date and time in cell B2. Save and close the workbook. Submit the file as directed. Points Possible Total Points 0 10 10 10 10 10 10 8 Exp22_ExcelCh02_ML2-Vacation Property 1. 6 Excel 2022 Proje Points Possible 10 6 0 100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It seems like youre working on a finance project in Excel specifically dealing with mortgage calcula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started